- Taiwan

- /

- Semiconductors

- /

- TPEX:4971

Does IntelliEPI Inc. (Cayman)'s (GTSM:4971) Weak Fundamentals Mean A Downturn In Its Stock Should Be Expected?

IntelliEPI (Cayman)'s (GTSM:4971) stock is up by 9.7% over the past three months. Given that the markets usually pay for the long-term financial health of a company, we wonder if the current momentum in the share price will keep up, given that the company's financials don't look very promising. Specifically, we decided to study IntelliEPI (Cayman)'s ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

See our latest analysis for IntelliEPI (Cayman)

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for IntelliEPI (Cayman) is:

2.3% = NT$31m ÷ NT$1.4b (Based on the trailing twelve months to September 2020).

The 'return' is the income the business earned over the last year. Another way to think of that is that for every NT$1 worth of equity, the company was able to earn NT$0.02 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of IntelliEPI (Cayman)'s Earnings Growth And 2.3% ROE

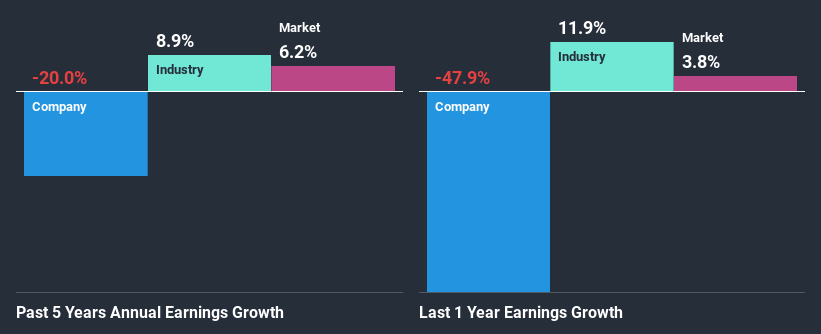

As you can see, IntelliEPI (Cayman)'s ROE looks pretty weak. Not just that, even compared to the industry average of 11%, the company's ROE is entirely unremarkable. Given the circumstances, the significant decline in net income by 20% seen by IntelliEPI (Cayman) over the last five years is not surprising. We reckon that there could also be other factors at play here. Such as - low earnings retention or poor allocation of capital.

However, when we compared IntelliEPI (Cayman)'s growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 8.9% in the same period. This is quite worrisome.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. Is IntelliEPI (Cayman) fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is IntelliEPI (Cayman) Efficiently Re-investing Its Profits?

With a high three-year median payout ratio of 67% (implying that 33% of the profits are retained), most of IntelliEPI (Cayman)'s profits are being paid to shareholders, which explains the company's shrinking earnings. With only a little being reinvested into the business, earnings growth would obviously be low or non-existent. Our risks dashboard should have the 3 risks we have identified for IntelliEPI (Cayman).

Additionally, IntelliEPI (Cayman) has paid dividends over a period of seven years, which means that the company's management is rather focused on keeping up its dividend payments, regardless of the shrinking earnings.

Conclusion

Overall, we would be extremely cautious before making any decision on IntelliEPI (Cayman). Because the company is not reinvesting much into the business, and given the low ROE, it's not surprising to see the lack or absence of growth in its earnings. Up till now, we've only made a short study of the company's growth data. So it may be worth checking this free detailed graph of IntelliEPI (Cayman)'s past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

If you decide to trade IntelliEPI (Cayman), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:4971

IntelliEPI (Cayman)

Produces and sells epitaxy wafers of compound semiconductor for use in wireless communications, data transmission and national defense in the United States, Germany, Korea, Japan, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion