- Taiwan

- /

- Semiconductors

- /

- TWSE:3150

Shareholders Shouldn’t Be Too Comfortable With Syncomm Technology's (GTSM:3150) Strong Earnings

Despite posting strong earnings, Syncomm Technology Corp.'s (GTSM:3150) stock didn't move much over the last week. We looked deeper into the numbers and found that shareholders might be concerned with some underlying weaknesses.

See our latest analysis for Syncomm Technology

Zooming In On Syncomm Technology's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

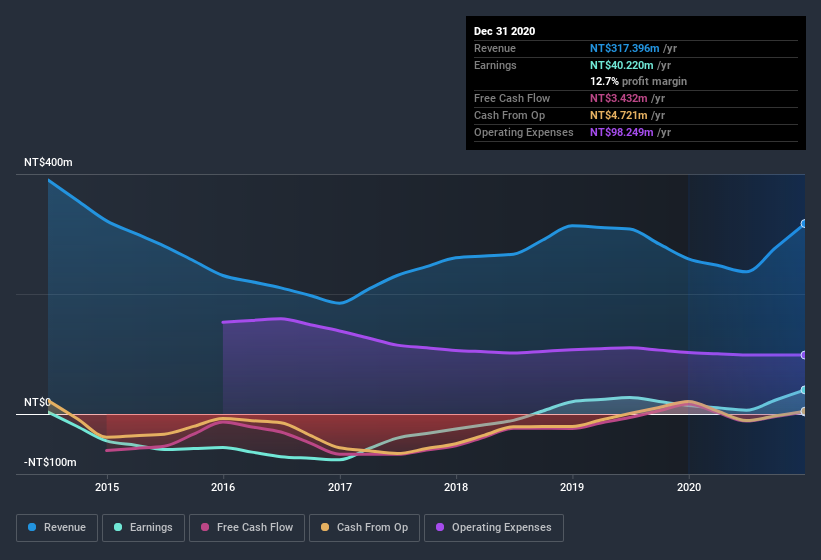

Over the twelve months to December 2020, Syncomm Technology recorded an accrual ratio of 1.16. That means it didn't generate anywhere near enough free cash flow to match its profit. As a general rule, that bodes poorly for future profitability. Indeed, in the last twelve months it reported free cash flow of NT$3.4m, which is significantly less than its profit of NT$40.2m. Syncomm Technology shareholders will no doubt be hoping that its free cash flow bounces back next year, since it was down over the last twelve months. Having said that, there is more to the story. The accrual ratio is reflecting the impact of unusual items on statutory profit, at least in part. One positive for Syncomm Technology shareholders is that it's accrual ratio was significantly better last year, providing reason to believe that it may return to stronger cash conversion in the future. Shareholders should look for improved cashflow relative to profit in the current year, if that is indeed the case.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Syncomm Technology.

The Impact Of Unusual Items On Profit

Given the accrual ratio, it's not overly surprising that Syncomm Technology's profit was boosted by unusual items worth NT$3.4m in the last twelve months. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Our Take On Syncomm Technology's Profit Performance

Summing up, Syncomm Technology received a nice boost to profit from unusual items, but could not match its paper profit with free cash flow. Considering all this we'd argue Syncomm Technology's profits probably give an overly generous impression of its sustainable level of profitability. So while earnings quality is important, it's equally important to consider the risks facing Syncomm Technology at this point in time. For example, we've found that Syncomm Technology has 3 warning signs (1 is significant!) that deserve your attention before going any further with your analysis.

Our examination of Syncomm Technology has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you’re looking to trade Syncomm Technology, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:3150

Syncomm Technology

Operates as a fabless semiconductor company worldwide.

Flawless balance sheet with moderate risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)