momo.com (TWSE:8454) Q3 Earnings Decline 7.3% as High P/E Ratio and Dividend Concerns Persist

Reviewed by Simply Wall St

Get an in-depth perspective on momo.com's performance by reading our analysis here.

Core Advantages Driving Sustained Success for momo.com

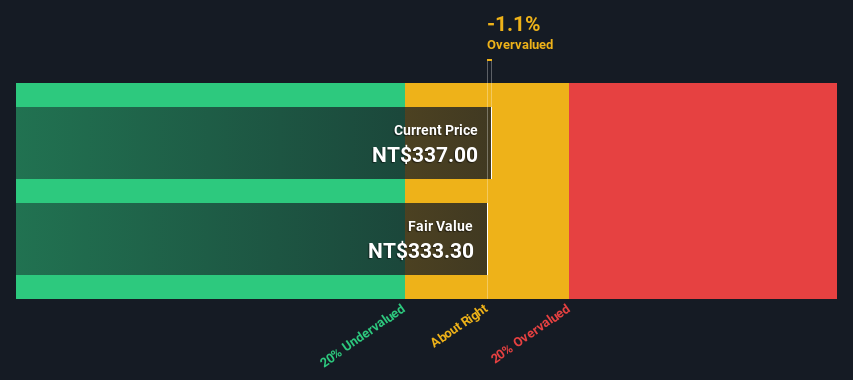

The company has consistently demonstrated high-quality earnings, with an 18.3% annual profit growth over the past five years. This growth is bolstered by a strong Return on Equity (ROE) of 38.7%, signaling efficient equity utilization. The management, with an average tenure of four years, has strategically steered the company towards maintaining a debt-free status, enhancing financial health. In the latest earnings call, Jeff Ku highlighted the advertising segment's unexpected strong performance, which diversifies revenue streams and reinforces financial stability. However, the company's valuation is considered expensive with a Price-To-Earnings Ratio of 26.8x, surpassing both peers and industry averages, indicating it is trading above the SWS fair ratio.

To dive deeper into how momo.com's valuation metrics are shaping its market position, check out our detailed analysis of momo.com's Valuation.Critical Issues Affecting the Performance of momo.com and Areas for Growth

Challenges arise as the company's earnings and revenue growth projections lag behind market averages, at 11.8% and 6.4% respectively. Recent earnings reports reveal a 7.3% decline in net income for the third quarter, reflecting ongoing margin pressures. Additionally, the high payout ratio of 99.5% suggests dividend payments are not well-covered by earnings, raising concerns about financial sustainability. The board's relatively short average tenure of 2.4 years may also impact strategic decision-making, potentially affecting long-term growth.

Learn about momo.com's dividend strategy and how it impacts shareholder returns and financial stability.Potential Strategies for Leveraging Growth and Competitive Advantage

Opportunities abound with projected earnings growth of 11.77% annually, supported by the company's debt-free flexibility to explore new ventures without interest burdens. Strategic alliances and product-related announcements, such as those discussed at the UBS Securities Taiwan Summit, could enhance market position and capitalize on emerging opportunities. This proactive approach to growth, coupled with evolving membership benefits, aims to boost customer engagement and retention, potentially increasing customer lifetime value.

To gain deeper insights into momo.com's historical performance, explore our detailed analysis of past performance.External Factors Threatening momo.com

Competitive pressures remain a significant threat, as indicated by management's cautious tone in recent discussions. The economic environment poses additional challenges, potentially impacting consumer spending and revenue across various segments. Furthermore, supply chain vulnerabilities, although not directly addressed, could affect product availability and costs, necessitating strategic adjustments to maintain operational stability and customer satisfaction.

See what the latest analyst reports say about momo.com's future prospects and potential market movements.Conclusion

momo.com has shown strong financial health with an 18.3% annual profit growth and a 38.7% Return on Equity, highlighting efficient management and a debt-free status that supports strategic expansion. However, the company's high Price-To-Earnings Ratio of 26.8x, which exceeds industry norms, suggests that its stock is priced above its estimated fair value, potentially limiting immediate investment appeal. Despite this, the company's strategic initiatives, such as exploring new ventures and enhancing customer engagement, offer promising avenues for future growth. Nevertheless, challenges like declining net income, high dividend payout ratios, and external pressures necessitate careful navigation to sustain long-term performance and shareholder value.

Where To Now?

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TWSE:8454

momo.com

Engages in the TV and radio production, radio and TV program distribution, radio and TV commercial, video program distribution, issuing of magazine, and retailing businesses in Taiwan.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives