- South Korea

- /

- Oil and Gas

- /

- KOSE:A267250

HD Hyundai And 2 Other Growth Stocks With Strong Insider Confidence

Reviewed by Simply Wall St

As global markets navigate a period of economic uncertainty, with major indices experiencing mixed performances and central banks adjusting monetary policies, investors are increasingly focused on growth stocks that exhibit resilience. In this environment, companies with high insider ownership can be particularly appealing as they often signal strong internal confidence in the company's future prospects and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 27% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.9% | 37.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

HD Hyundai (KOSE:A267250)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HD Hyundai Co., Ltd., with a market cap of ₩5.63 trillion, operates in the oil refining sector both domestically in Korea and internationally through its subsidiaries.

Operations: The company's revenue segments include Ship Service (₩2.11 billion), Essential Oil (₩47.76 billion), Electrical/Electronic (₩4.28 billion), Construction Equipment (₩11.42 billion), and Shipbuilding & Marine Engineering (₩27.04 billion).

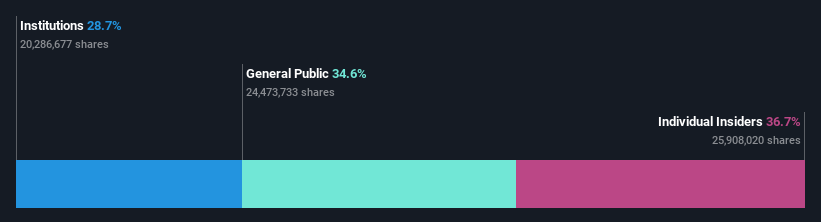

Insider Ownership: 36.7%

HD Hyundai faces challenges with a recent net loss of KRW 33.05 billion in Q3 2024, contrasting last year's profit. Despite this, its earnings are forecast to grow significantly at 62.66% annually, outpacing the Korean market's average growth rate of 12.6%. Trading well below estimated fair value and expected price targets suggest potential upside, though low profit margins and a dividend not covered by earnings present risks for investors considering insider ownership dynamics.

- Get an in-depth perspective on HD Hyundai's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility HD Hyundai's shares may be trading at a discount.

POYA International (TPEX:5904)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: POYA International Co., Ltd. operates a chain of retail stores in Taiwan and has a market cap of NT$50.99 billion.

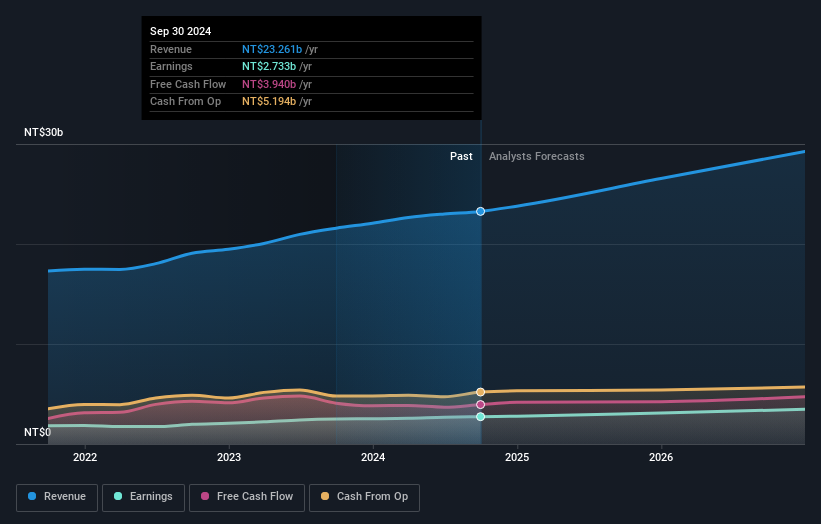

Operations: The company's revenue is primarily derived from its General Merchandise Retail Sales Department, amounting to NT$23.26 billion.

Insider Ownership: 11.4%

POYA International's earnings are forecast to grow at 10.9% annually, outpacing the Taiwan market's 6.6%, with revenue growth expected at 10.5%. The stock trades at a significant discount to its estimated fair value, suggesting potential upside, supported by high return on equity projections of over 50% in three years. Recent Q3 results show increased sales and net income year-over-year, although its dividend history remains unstable, posing a risk for investors valuing insider ownership stability.

- Unlock comprehensive insights into our analysis of POYA International stock in this growth report.

- The analysis detailed in our POYA International valuation report hints at an deflated share price compared to its estimated value.

Sansan (TSE:4443)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sansan, Inc. is a company that plans, develops, and sells cloud-based solutions in Japan, with a market capitalization of ¥305.81 billion.

Operations: The company's revenue primarily comes from its Sansan/Bill One Business, generating ¥31.79 billion, followed by the Eight Business, which contributes ¥3.80 billion.

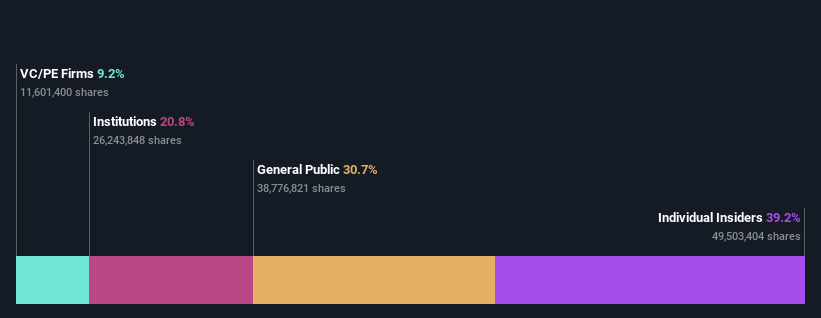

Insider Ownership: 39.3%

Sansan's earnings are projected to grow significantly at 40% annually, surpassing the JP market's 7.9%, with revenue growth expected at 16.3% per year. Despite a highly volatile share price recently, Sansan trades at a discount of 30.6% to its estimated fair value, indicating potential upside. Recent board discussions on issuance outline suggest strategic financial maneuvers ahead, although no substantial insider trading activity has been reported in the last three months.

- Click here and access our complete growth analysis report to understand the dynamics of Sansan.

- Upon reviewing our latest valuation report, Sansan's share price might be too pessimistic.

Summing It All Up

- Click this link to deep-dive into the 1568 companies within our Fast Growing Companies With High Insider Ownership screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if HD Hyundai might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A267250

HD Hyundai

Through its subsidiaries, engages in oil refining business in Korea and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives