- Saudi Arabia

- /

- Banks

- /

- SASE:1060

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate the complexities of cautious Federal Reserve commentary and political uncertainties, investors are keeping a close eye on economic indicators such as inflation rates and government spending. Amidst these developments, dividend stocks continue to attract attention for their potential to offer steady income streams in uncertain times. In this environment, selecting dividend stocks with strong fundamentals and a history of reliable payouts can be a prudent strategy for those seeking stability amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.30% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.98% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.56% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.53% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.76% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.26% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.05% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.74% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1962 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Saudi Awwal Bank (SASE:1060)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Saudi Awwal Bank, with a market cap of SAR66.16 billion, operates in the Kingdom of Saudi Arabia offering a range of banking and financial services through its subsidiaries.

Operations: Saudi Awwal Bank's revenue segments include Treasury (SAR1.91 billion), Capital Markets (SAR445.65 million), Wealth & Personal Banking (SAR3.70 billion), and Corporate and Institutional Banking (SAR7.02 billion).

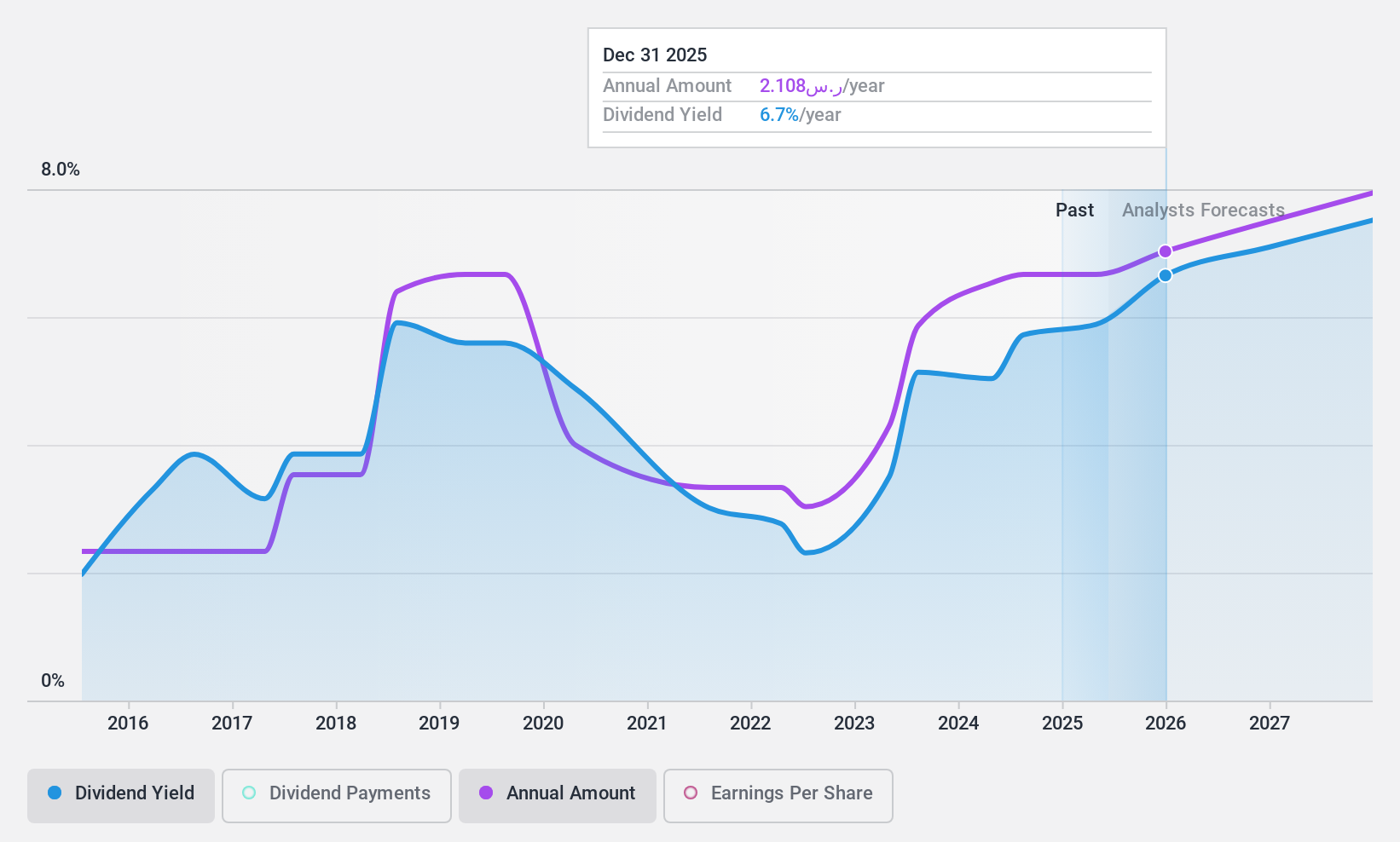

Dividend Yield: 6.1%

Saudi Awwal Bank's dividend yield is among the top 25% in the Saudi Arabian market, with a payout ratio of 53.7%, suggesting sustainable dividends. However, its dividend history has been volatile over the past decade. The bank's recent earnings showed growth, with net income rising to SAR 5.94 billion for nine months ending September 2024. Additionally, strategic alliances like those with Swvl Holdings aim to enhance employee commutes and urban mobility in Riyadh post-metro launch.

- Click to explore a detailed breakdown of our findings in Saudi Awwal Bank's dividend report.

- Our expertly prepared valuation report Saudi Awwal Bank implies its share price may be lower than expected.

Yungshin Construction & DevelopmentLtd (TPEX:5508)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yungshin Construction & Development Co., Ltd. operates in the construction and development industry with a market capitalization of NT$30.44 billion.

Operations: Yungshin Construction & Development Co., Ltd. generates revenue of NT$12.55 billion from its Home Builders - Residential / Commercial segment.

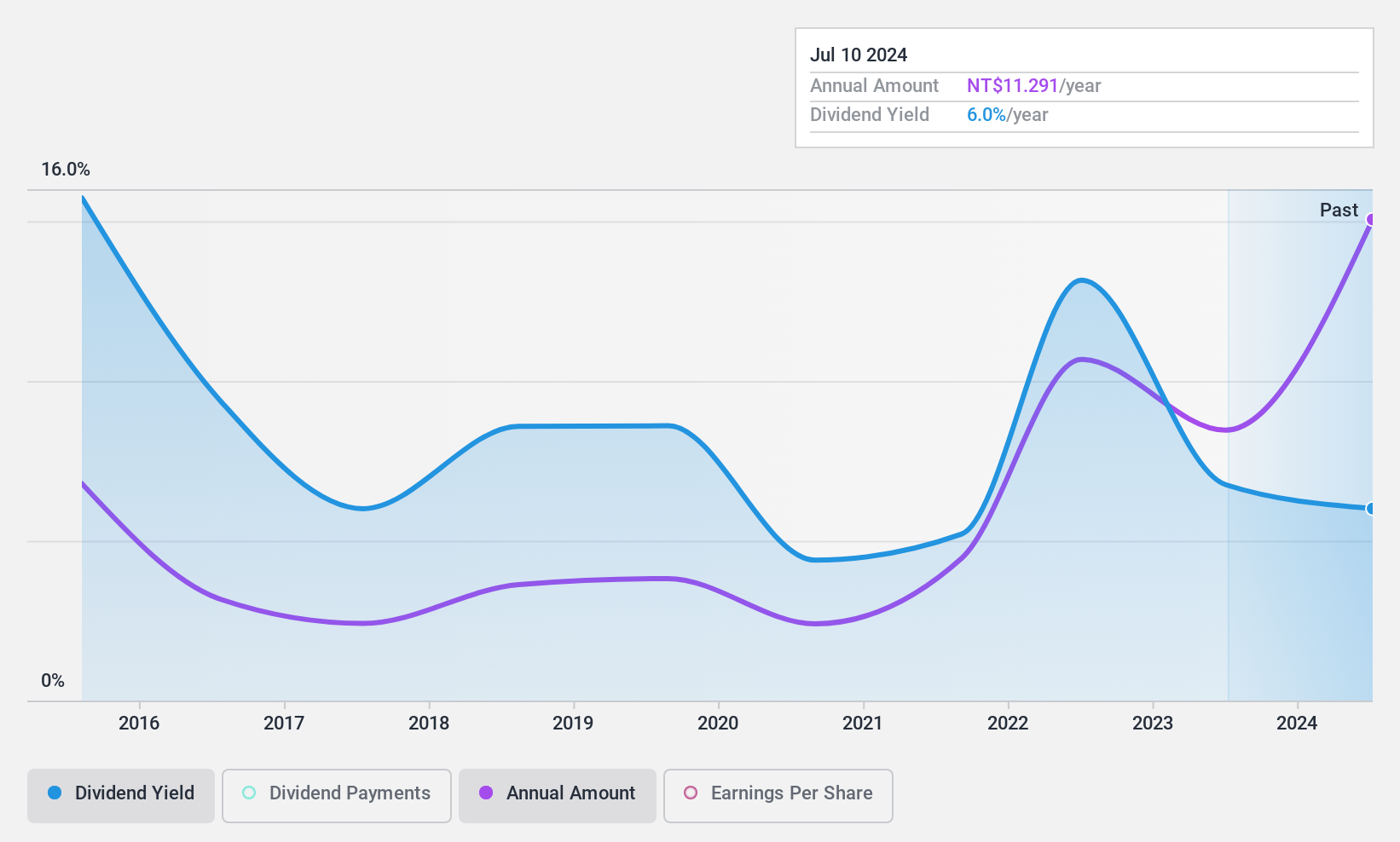

Dividend Yield: 7.9%

Yungshin Construction & Development Ltd. offers a dividend yield in the top 25% of the Taiwanese market, supported by a payout ratio of 56.7%, indicating coverage by earnings and cash flows. Despite this, its dividend history has been inconsistent over the past decade with volatility and instability noted. Recent financial results show strong earnings growth, with net income reaching NT$3.18 billion for nine months ending September 2024, doubling from NT$1.58 billion year-on-year.

- Get an in-depth perspective on Yungshin Construction & DevelopmentLtd's performance by reading our dividend report here.

- According our valuation report, there's an indication that Yungshin Construction & DevelopmentLtd's share price might be on the cheaper side.

Marketech International (TWSE:6196)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Marketech International Corp. operates in the manufacturing, sales, import, and trading of integrated circuits, semiconductors, electrical and computer equipment and materials, chemicals, gas, and components across Taiwan, China, the United States, and internationally with a market cap of NT$29.29 billion.

Operations: Marketech International Corp.'s revenue is primarily derived from its Factory System and Electromechanical System Service Business Segment at NT$44.83 billion, followed by the Customized Equipment Manufacturing Segment at NT$8.98 billion, and the Equipment Materials Agent Sales Business Segment at NT$8.06 billion.

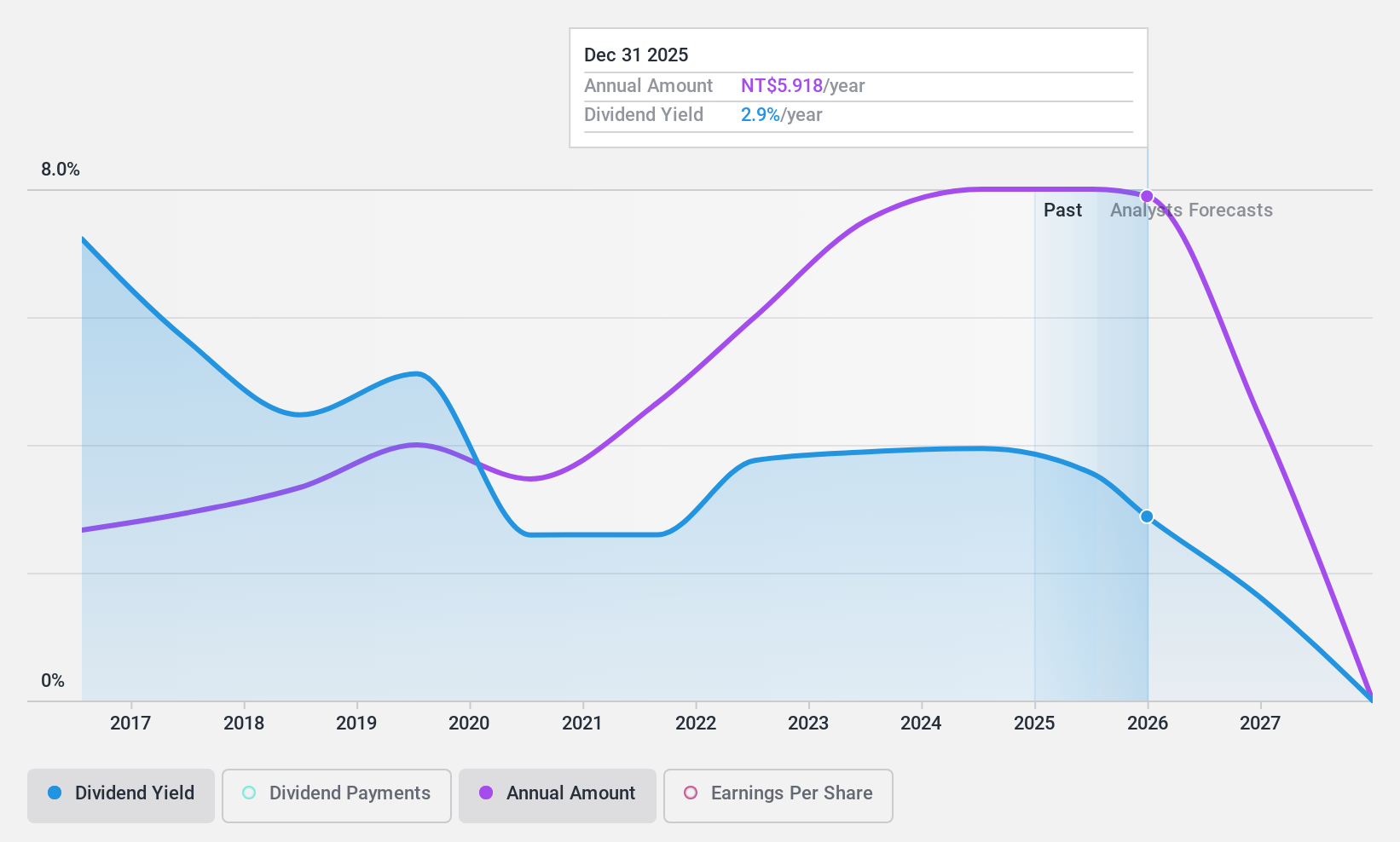

Dividend Yield: 4%

Marketech International offers a stable dividend, supported by a payout ratio of 70.6% and a cash payout ratio of 26.5%, indicating strong coverage by earnings and cash flows. Despite recent profit margin declines, dividends have grown steadily over the past decade with minimal volatility. The stock trades at a favorable price-to-earnings ratio of 17.8x compared to the TW market average, providing good relative value for investors seeking consistent dividend income in Taiwan's market environment.

- Delve into the full analysis dividend report here for a deeper understanding of Marketech International.

- Insights from our recent valuation report point to the potential undervaluation of Marketech International shares in the market.

Make It Happen

- Investigate our full lineup of 1962 Top Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:1060

Saudi Awwal Bank

Provides banking and financial services in the Kingdom of Saudi Arabia.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives