As global markets navigate a landscape marked by rate adjustments and geopolitical tensions, investors are keenly observing the impacts on corporate earnings and sector performance. With U.S. stocks experiencing volatility amid AI competition concerns and mixed economic signals from Europe and Japan, dividend stocks remain an attractive option for those seeking steady income in uncertain times. A good dividend stock typically combines a strong track record of consistent payouts with the potential for capital appreciation, offering a buffer against market fluctuations highlighted in recent weeks.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Totech (TSE:9960) | 3.80% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 5.78% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.99% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.93% | ★★★★★★ |

Click here to see the full list of 1956 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

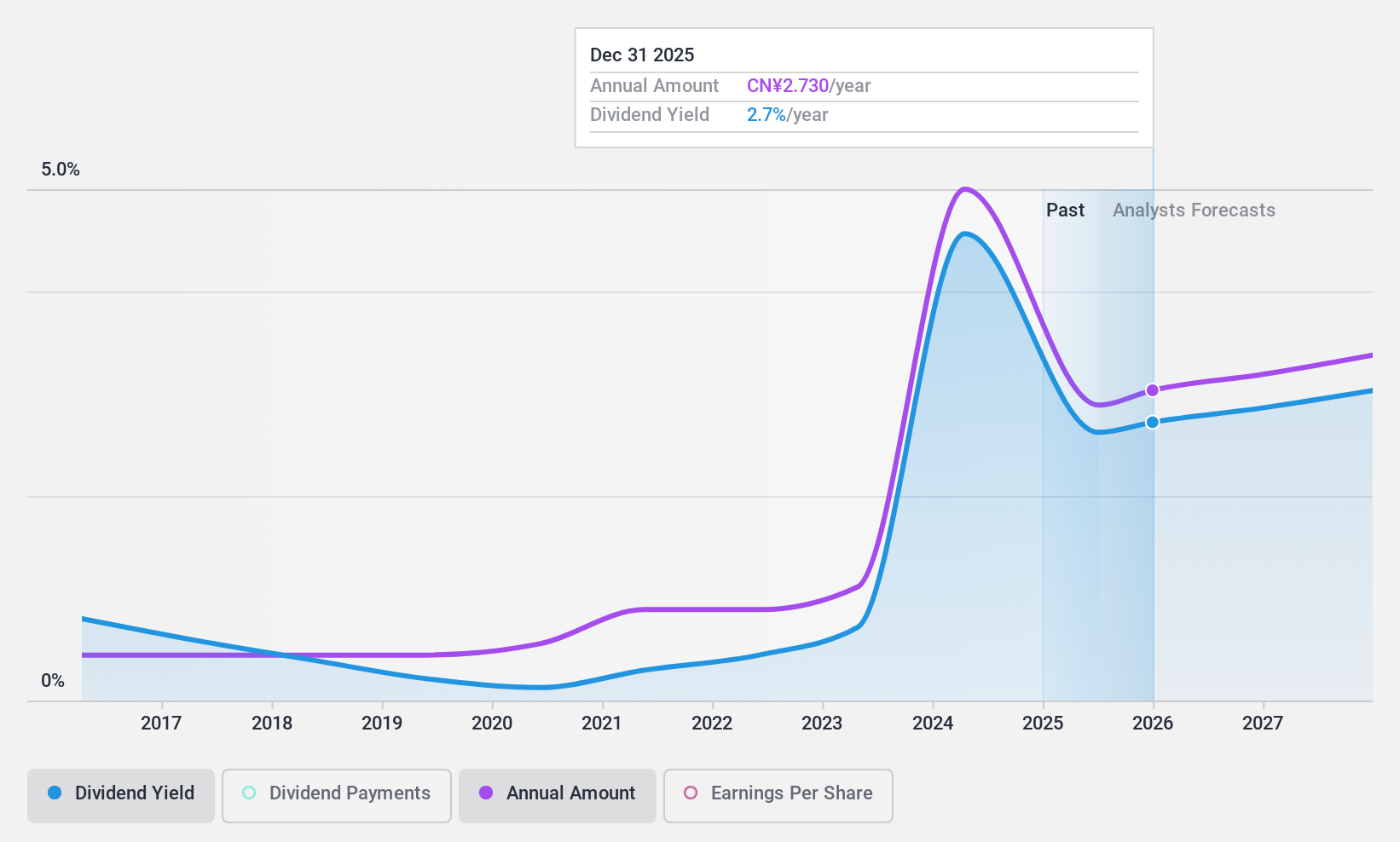

Changchun High-Tech Industry (Group) (SZSE:000661)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Changchun High-Tech Industry (Group) Co., Ltd. engages in the research, development, manufacturing, and sale of biopharmaceuticals and traditional Chinese medicine products in China, with a market cap of CN¥37.79 billion.

Operations: Changchun High-Tech Industry (Group) Co., Ltd. generates revenue primarily from its biopharmaceuticals and traditional Chinese medicine products in China.

Dividend Yield: 4.7%

Changchun High-Tech Industry (Group) offers a compelling dividend profile, with a yield of 4.73%, placing it in the top 25% of dividend payers in China. Its dividends have been stable and growing over the past decade, supported by earnings and cash flows with payout ratios at 49.1% and 82.2%, respectively. Recent share buybacks totaling ¥300 million also suggest a commitment to shareholder returns, though future capital adjustments are under consideration at an upcoming shareholders meeting.

- Delve into the full analysis dividend report here for a deeper understanding of Changchun High-Tech Industry (Group).

- Our valuation report here indicates Changchun High-Tech Industry (Group) may be undervalued.

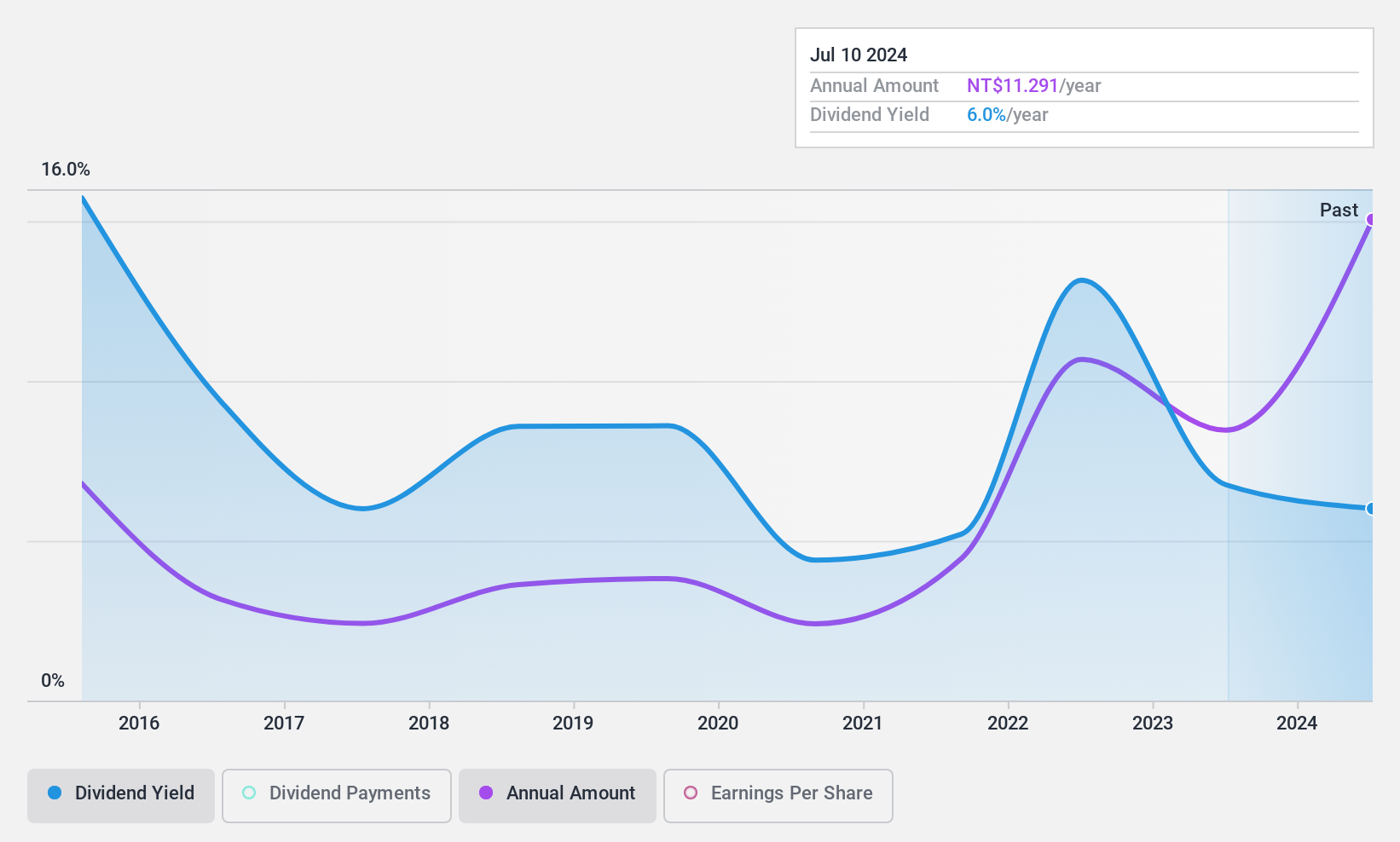

Yungshin Construction & DevelopmentLtd (TPEX:5508)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yungshin Construction & Development Co., Ltd. operates in the construction and development industry with a market capitalization of NT$27.61 billion.

Operations: Yungshin Construction & Development Co., Ltd. generates revenue from its Home Builders - Residential / Commercial segment, amounting to NT$12.55 billion.

Dividend Yield: 8.6%

Yungshin Construction & Development Ltd. provides a high dividend yield of 8.59%, ranking in the top 25% of Taiwanese dividend payers, yet its dividend history is marked by volatility over the past decade. Despite this instability, dividends are currently covered by earnings and cash flows with payout ratios of 56.7% and 47.8%, respectively. However, a high debt level may pose risks to financial stability, potentially impacting future dividend reliability and sustainability.

- Click here to discover the nuances of Yungshin Construction & DevelopmentLtd with our detailed analytical dividend report.

- Our valuation report unveils the possibility Yungshin Construction & DevelopmentLtd's shares may be trading at a discount.

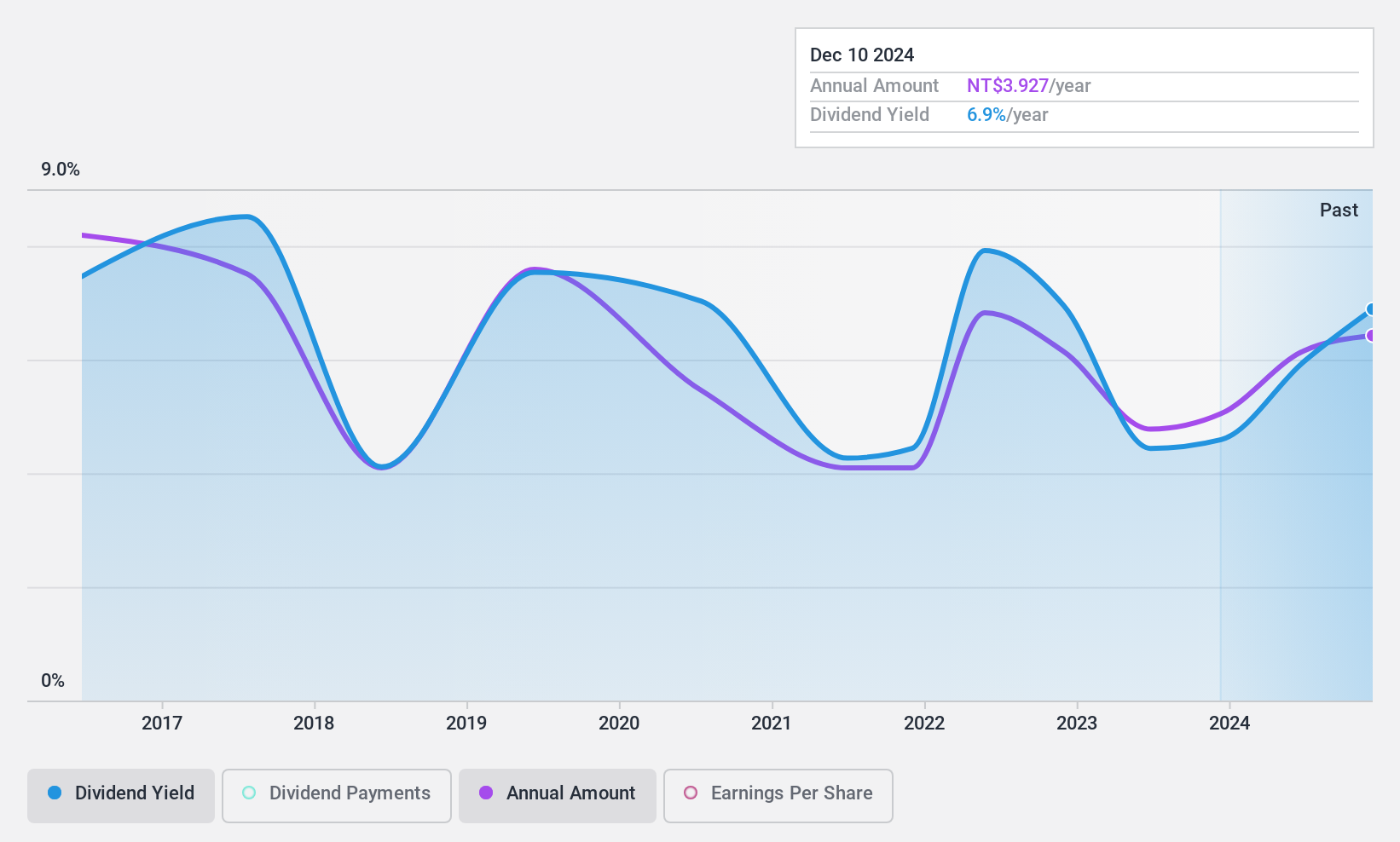

Xxentria Technology Materials (TPEX:8942)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xxentria Technology Materials Co., Ltd. manufactures and sells steel composite materials in the United States, Asia, and internationally, with a market cap of NT$11.29 billion.

Operations: Xxentria Technology Materials Co., Ltd. generates revenue primarily from its Composite board segment, contributing NT$3.43 billion, and its Surface Treatment segment, which adds NT$234.92 million.

Dividend Yield: 6.8%

Xxentria Technology Materials offers a dividend yield of 6.81%, placing it among the top 25% in Taiwan, but its dividends have been volatile over the past decade and are not well covered by earnings with a payout ratio of 92.3%. Despite this, cash flows do cover dividends at a cash payout ratio of 78.8%. Recent financials show declining revenue and net income, potentially impacting future dividend sustainability.

- Click here and access our complete dividend analysis report to understand the dynamics of Xxentria Technology Materials.

- Our valuation report here indicates Xxentria Technology Materials may be overvalued.

Taking Advantage

- Click here to access our complete index of 1956 Top Dividend Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000661

Changchun High-Tech Industry (Group)

Researches, develops, manufactures, and sells biopharmaceuticals and traditional Chinese medicines products in China.

Flawless balance sheet with moderate growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)