Caliway Biopharmaceuticals (TWSE:6919): Assessing Valuation After a Significant Share Price Rally

Reviewed by Simply Wall St

If you have been keeping an eye on Caliway Biopharmaceuticals (TWSE:6919), the recent surge might have you wondering if something big is brewing. There has been no major event at the company this week, but the stock’s momentum could still catch investors by surprise. This raises the natural question of what is driving sentiment and whether it signals a shift in the story for Caliway. Sometimes, a sustained rally without an obvious headline deserves just as much attention.

Looking at the bigger picture, Caliway has seen its share price climb more than 371% over the past year, reflecting underlying optimism even without short-term catalysts. In the past month alone, the stock gained 94%, building on momentum that accelerated across three and twelve-month periods. Despite annual revenue growth of just 2% and continued losses, investors seem drawn by the company’s future potential rather than immediate fundamentals.

So with strong price gains and no clear event behind the move, should investors see this as a genuine buying opportunity, or is the market already pricing in all the growth Caliway might deliver?

Price-to-Book of 42.1x: Is it justified?

Based on the price-to-book ratio, Caliway Biopharmaceuticals trades at 42.1 times its book value. This is significantly higher than both the peer group average of 9.8x and the industry average of 2.5x. This suggests that, by this standard, the stock appears expensive compared to sector peers.

The price-to-book ratio measures how much investors are paying for each unit of a company's net assets. For biopharmaceutical companies, where tangible assets may be less indicative of future performance than pipeline prospects, this multiple can still signal market optimism or skepticism about underlying value.

At such a high multiple, investors may be pricing in expectations of outsized future growth or a major breakthrough. Whether recent gains can be justified against these benchmarks remains in question unless the company begins realizing the anticipated pipeline potential.

Result: Fair Value of $255 (OVERVALUED)

See our latest analysis for Caliway Biopharmaceuticals.However, ongoing losses and modest revenue growth leave Caliway vulnerable if anticipated breakthroughs or further progress in the pipeline do not materialize soon.

Find out about the key risks to this Caliway Biopharmaceuticals narrative.Another Perspective: What Does the DCF Model Suggest?

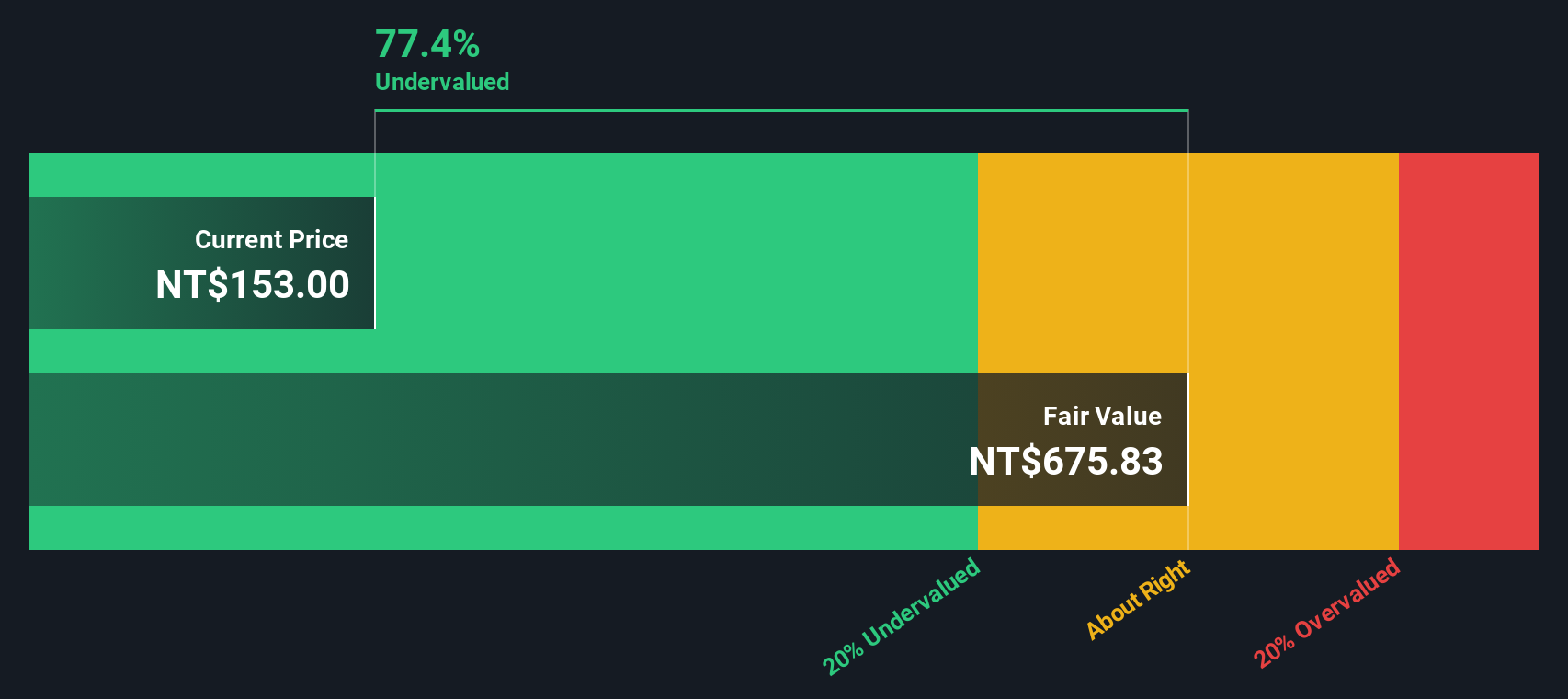

While the stock appears expensive compared to its assets, our DCF model considers a longer-term view of cash flows and values. This approach presents a much more optimistic picture, suggesting the company might actually be undervalued. Could market sentiment be overlooking something over the long term?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Caliway Biopharmaceuticals Narrative

If you see the story differently or want to uncover your own insights, it only takes a few minutes to craft a personal view. So why not Do it your way?

A great starting point for your Caliway Biopharmaceuticals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Make your next move count by seeking out stocks that match your strategy. With the Simply Wall Street Screener, you can quickly spot compelling opportunities tailored to your interests. Don’t let the market’s best ideas pass you by.

- Uncover fast-growing companies at attractive prices with undervalued stocks based on cash flows and capitalize on potential before others catch on.

- Target future-ready healthcare pioneers innovating with artificial intelligence by using healthcare AI stocks for your next breakthrough stock idea.

- Secure higher income streams from reliable businesses by checking dividend stocks with yields > 3% for companies offering attractive yields and stable performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TWSE:6919

Caliway Biopharmaceuticals

Engages in the development of drugs for aesthetic medicine and chronic inflammation.

Exceptional growth potential with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)