- Taiwan

- /

- Metals and Mining

- /

- TWSE:2015

Undiscovered Gems To Watch On None Exchange February 2025

Reviewed by Simply Wall St

Amidst geopolitical tensions and consumer spending concerns, global markets have experienced volatility, with the U.S. Services PMI entering contraction territory and major indices like the S&P 500 facing declines after reaching record highs earlier in the week. As investors navigate these uncertain waters, identifying promising small-cap stocks can offer opportunities for growth, especially those that demonstrate resilience to external pressures such as tariffs and inflationary trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Transnational Corporation of Nigeria | 45.51% | 31.42% | 58.48% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| NSIA Banque Société Anonyme | 10.33% | 13.42% | 31.75% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Invest Bank | 126.08% | 12.31% | 20.26% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

XGD (SZSE:300130)

Simply Wall St Value Rating: ★★★★★★

Overview: XGD Inc. is engaged in the research, development, manufacturing, sales, and servicing of payment terminals both in China and internationally with a market capitalization of CN¥13.05 billion.

Operations: XGD generates revenue primarily from the sale and servicing of payment terminals. The company's net profit margin has exhibited variability, reflecting fluctuations in operational efficiency and cost management.

XGD, a small cap in the electronics sector, has demonstrated impressive financial health with earnings growth of 71.8% over the past year, outpacing the industry’s 1.6%. Its debt-to-equity ratio improved significantly from 12.5% to 6% over five years, indicating prudent financial management. XGD is trading at a substantial discount of 57.6% below its estimated fair value, suggesting potential upside for investors seeking undervalued opportunities. With high-quality earnings and robust free cash flow generation (A$1 billion as of September), XGD seems well-positioned for continued profitability and growth in the coming years.

Shanghai YongLi Belting (SZSE:300230)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai YongLi Belting Co., Ltd specializes in the development, production, and sale of conveyor belts with a market capitalization of CN¥3.77 billion.

Operations: Shanghai YongLi Belting generates revenue primarily from the sale of conveyor belts. The company's financial performance is characterized by its gross profit margin, which was 27.5% in the most recent period observed.

YongLi Belting, a promising player in the belting industry, offers an attractive valuation with a price-to-earnings ratio of 10.5x compared to the broader CN market's 38.1x. The company has demonstrated robust earnings growth of 63.6% over the past year, significantly outpacing its industry's -0.06%. Despite this positive trajectory, a one-off gain of CN¥157 million has notably influenced its recent financial results through September 2024. While YongLi's debt-to-equity ratio rose from 10.7% to 15% over five years, it holds more cash than total debt and remains profitable with no concerns about covering interest payments or cash runway stability.

Feng Hsin Steel (TWSE:2015)

Simply Wall St Value Rating: ★★★★★★

Overview: Feng Hsin Steel Co., Ltd. is a Taiwanese company engaged in the manufacturing, processing, and trading of steel products with a market capitalization of NT$41.88 billion.

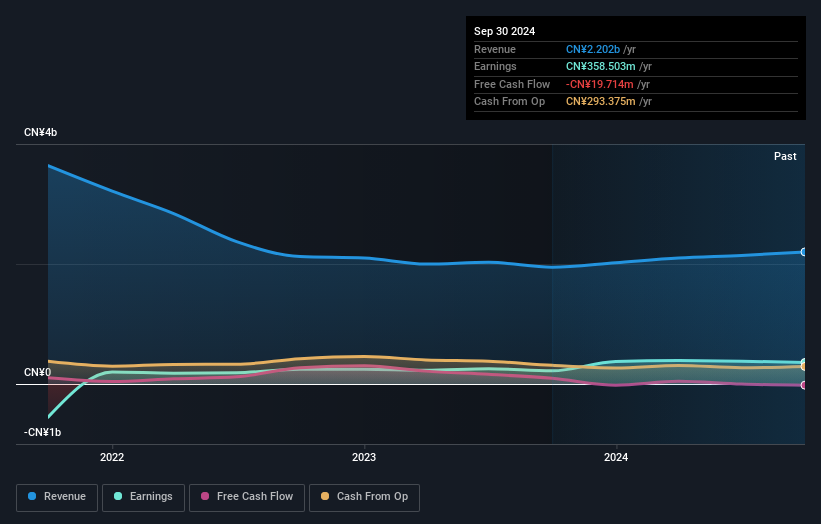

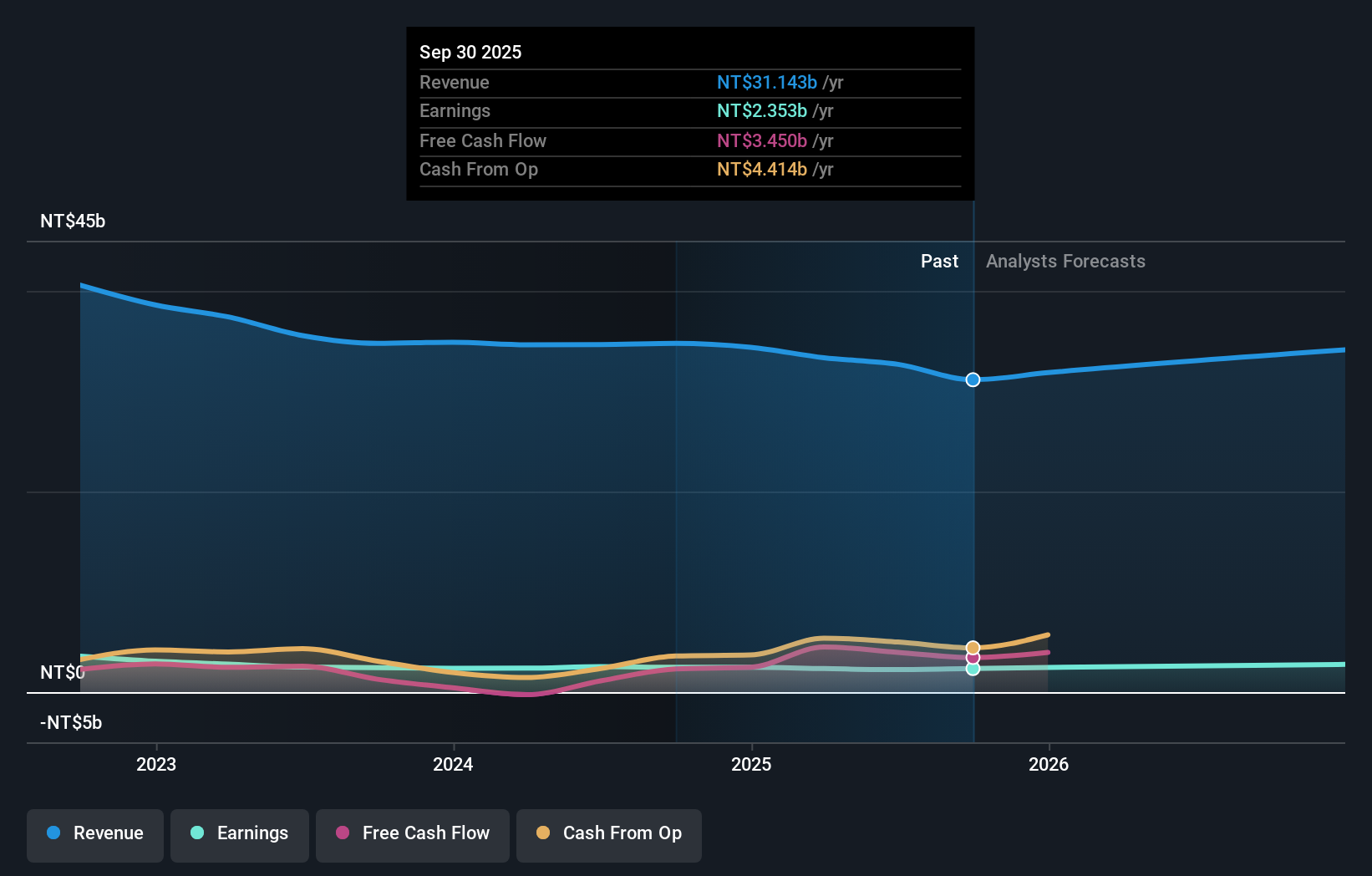

Operations: The primary revenue stream for Feng Hsin Steel comes from the manufacture and processing of various steel products, generating NT$34.77 billion. The company's financial performance can be further analyzed through its gross profit margin or net profit margin trends over time.

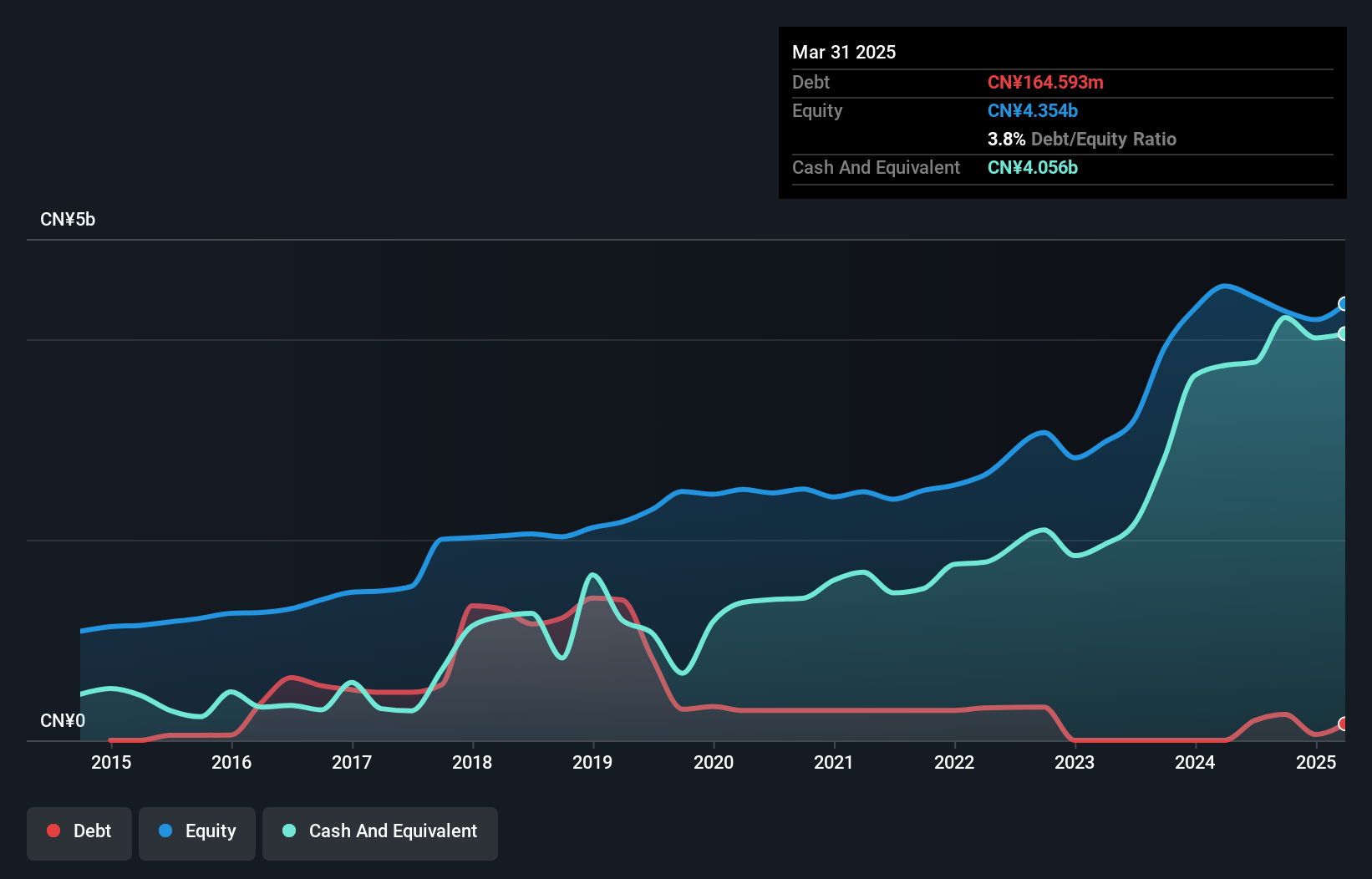

Feng Hsin Steel, a smaller player in the steel industry, has shown steady performance with earnings growing 2.6% annually over the last five years. Despite not outpacing the broader Metals and Mining sector's recent 12.3% growth, it remains profitable with a debt-to-equity ratio reduced from 7.9 to 5.5 over five years, suggesting improved financial health. The company trades at 1.8% below its estimated fair value and maintains high-quality earnings while covering interest payments comfortably due to more cash than total debt on hand. Earnings are projected to grow by 4.38% annually, indicating potential for future expansion.

- Navigate through the intricacies of Feng Hsin Steel with our comprehensive health report here.

Gain insights into Feng Hsin Steel's past trends and performance with our Past report.

Where To Now?

- Discover the full array of 4749 Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2015

Feng Hsin Steel

Manufactures, processes, and trades various steel products in Taiwan.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives