- Israel

- /

- Semiconductors

- /

- TASE:QLTU

Undiscovered Gems With Potential For January 2025

Reviewed by Simply Wall St

As global markets experience a rebound, driven by easing core U.S. inflation and strong bank earnings, small-cap stocks have shown resilience with the S&P MidCap 400 Index gaining 3.81% over the week. Amidst this backdrop of cautious optimism and potential rate cuts later in the year, identifying undiscovered gems in the stock market involves looking for companies that exhibit robust fundamentals and are well-positioned to capitalize on these evolving economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Qualitau (TASE:QLTU)

Simply Wall St Value Rating: ★★★★★★

Overview: Qualitau Ltd develops, manufactures, and sells test equipment and services for the semiconductor industry targeting European and Far-Eastern markets, with a market cap of ₪1.23 billion.

Operations: Qualitau generates revenue primarily from the sale of electronic components and parts, amounting to $43.87 million. The company's market cap stands at approximately ₪1.23 billion.

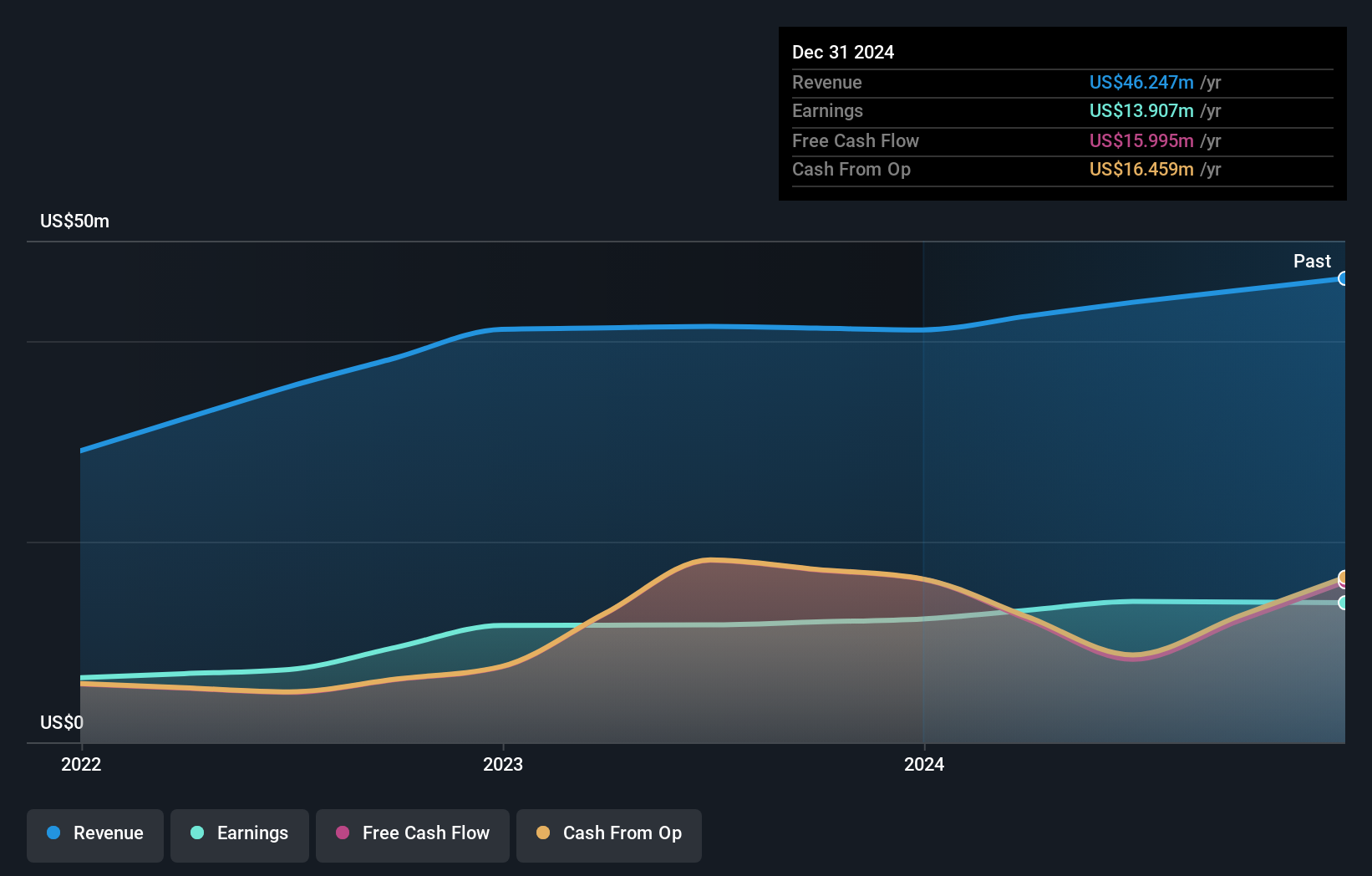

Qualitau, a notable player in the semiconductor space, stands out with its attractive price-to-earnings ratio of 24.5x, undercutting the industry average of 32x. The company boasts a robust earnings growth of 20.1% over the past year, surpassing the broader industry's 5.7%. With no debt on its books for five years and high-quality non-cash earnings, Qualitau seems well-positioned financially. However, potential investors should be cautious about its share price volatility observed over recent months. Despite these fluctuations, Qualitau's positive free cash flow and profitability suggest resilience in navigating market challenges.

- Get an in-depth perspective on Qualitau's performance by reading our health report here.

Explore historical data to track Qualitau's performance over time in our Past section.

Aica Kogyo Company (TSE:4206)

Simply Wall St Value Rating: ★★★★★☆

Overview: Aica Kogyo Company, Limited is engaged in the development, production, and sale of chemical products and building materials both in Japan and internationally, with a market capitalization of ¥207.26 billion.

Operations: Aica Kogyo generates revenue primarily from its chemical products and construction building materials segments, with ¥138.04 billion and ¥109.29 billion respectively. The company's net profit margin shows a notable trend, reflecting its operational efficiency in these sectors.

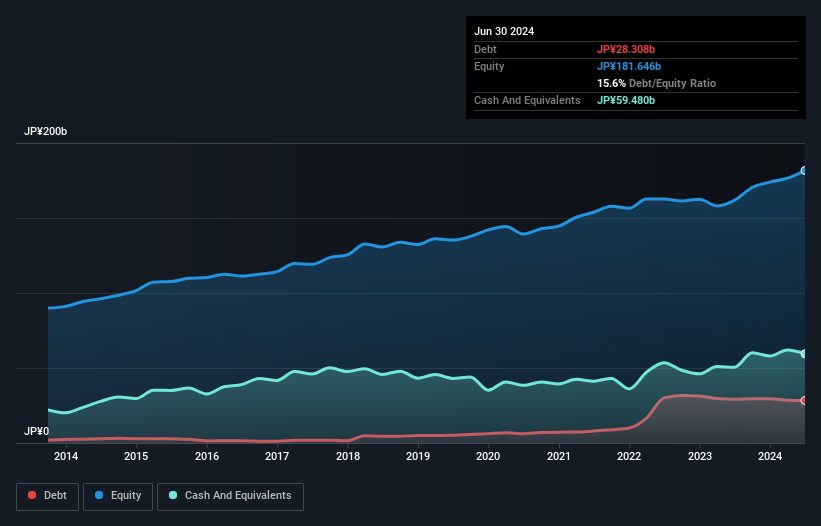

Aica Kogyo, a nimble player in the chemicals sector, has shown impressive earnings growth of 50.7% over the past year, outpacing the industry average of 13.7%. The company seems to be trading at an attractive valuation, currently 34.9% below its estimated fair value. Despite a rise in its debt-to-equity ratio from 4.1% to 15.4% over five years, interest coverage remains strong due to high-quality earnings and more cash than total debt on hand. Recent strategic moves include repurchasing approximately 1.89% of shares for ¥3,999 million and increasing dividends to JPY 56 per share from JPY 52 per share.

- Click here to discover the nuances of Aica Kogyo Company with our detailed analytical health report.

Evaluate Aica Kogyo Company's historical performance by accessing our past performance report.

Eternal Materials (TWSE:1717)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Eternal Materials Co., Ltd. is engaged in the manufacturing and sale of resin and electronic materials, with a market capitalization of approximately NT$33.40 billion.

Operations: Eternal Materials generates significant revenue from its Synthetic Resin, Special Material, and Electronic Materials segments, with the Synthetic Resin segment contributing NT$23.49 billion. The company's net profit margin reflects its financial efficiency in managing production and operational costs.

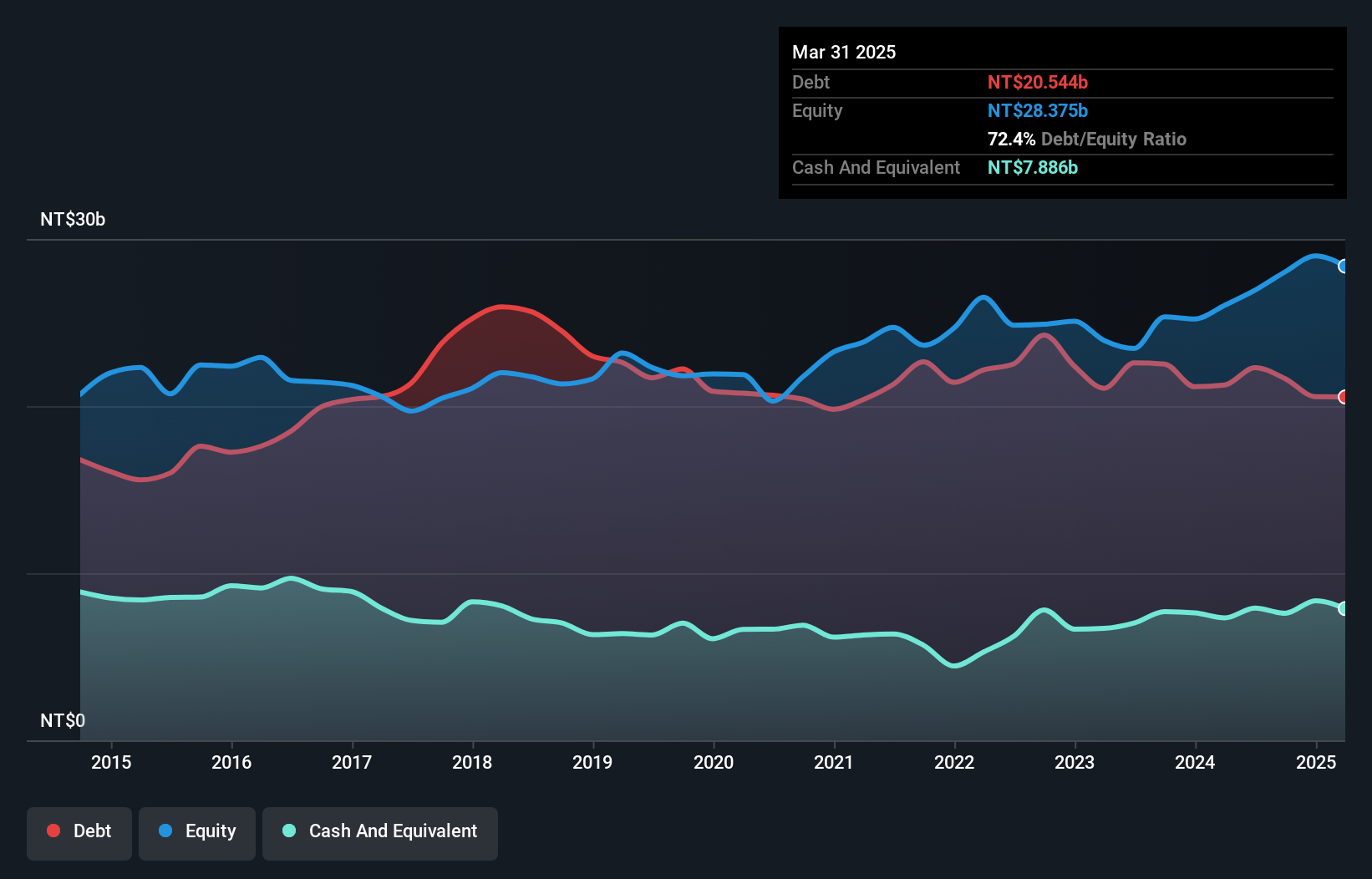

Eternal Materials, a nimble player in the chemicals sector, has shown robust earnings growth of 21.6% over the past year, outpacing its industry peers. Despite this positive momentum, its net debt to equity ratio stands at 50.1%, indicating a relatively high leverage level that isn't fully supported by operating cash flow. The company reported third-quarter sales of TWD 11.33 billion with net income dropping to TWD 456 million from TWD 600 million a year earlier, reflecting some challenges despite overall revenue growth for the nine months period. Notably, Eternal's price-to-earnings ratio of 19x suggests it is trading below the broader TW market average of 20.6x.

Seize The Opportunity

- Reveal the 4654 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Qualitau, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Qualitau might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:QLTU

Qualitau

Engages in the development, manufacture, and sale of test equipment and services for use in the semiconductor industry for European and Far-Eastern markets.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives