- Thailand

- /

- Real Estate

- /

- SET:PIN

3 Reliable Dividend Stocks Yielding Up To 9.8%

Reviewed by Simply Wall St

In a week marked by choppy global markets, U.S. equities faced declines due to inflation concerns and political uncertainty, while European stocks showed resilience amid expectations of interest rate cuts. With these market dynamics in mind, investors often turn to dividend stocks for their potential stability and income generation; reliable dividend stocks can offer a buffer against volatility by providing consistent returns through dividends even when broader market conditions are uncertain.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.36% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.00% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.74% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.64% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.89% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.21% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.17% | ★★★★★★ |

Click here to see the full list of 2007 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

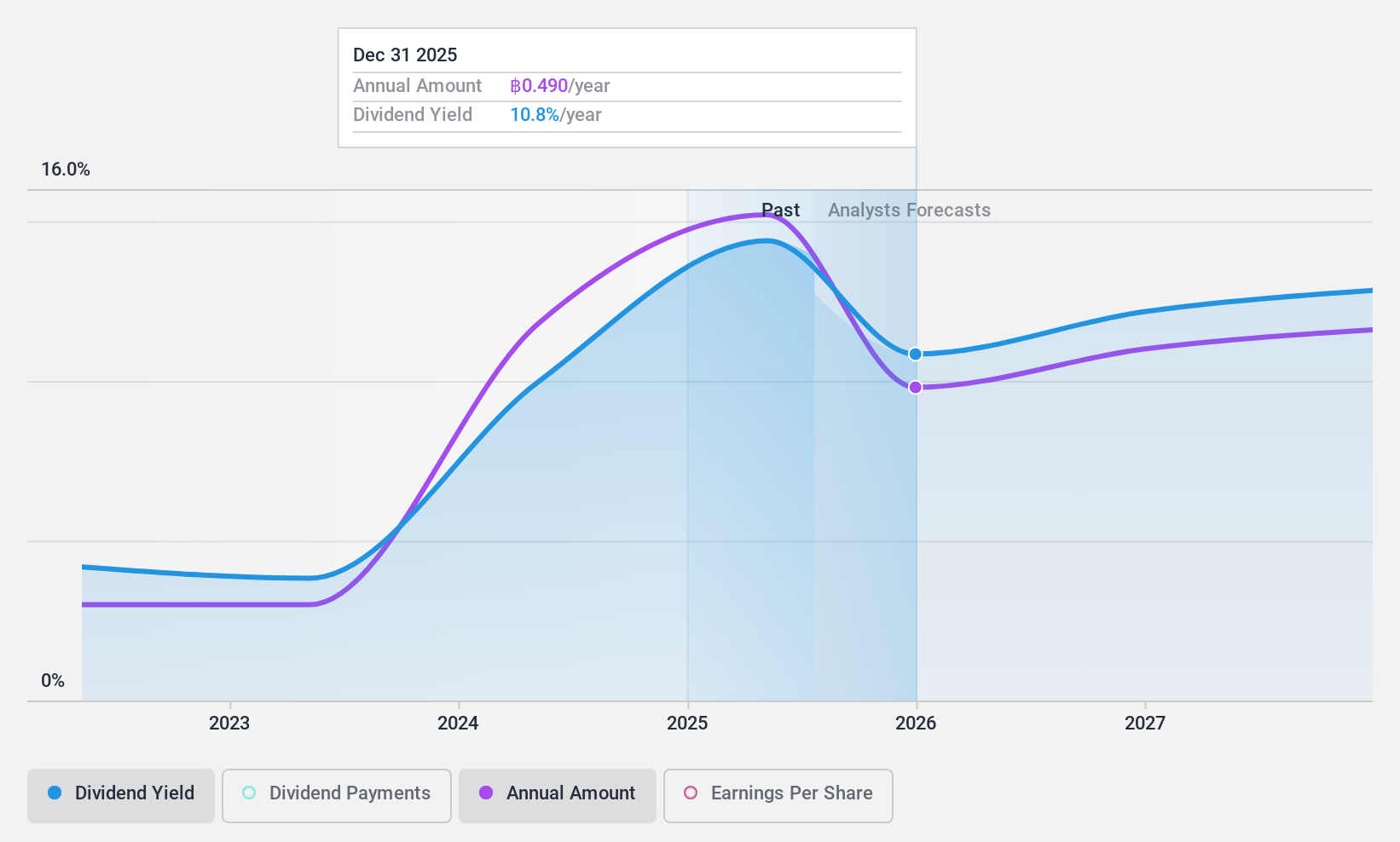

Pinthong Industrial Park (SET:PIN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pinthong Industrial Park Public Company Limited, with a market cap of THB6.96 billion, is involved in the development and rental of real estate projects in Thailand through its subsidiaries.

Operations: Pinthong Industrial Park Public Company Limited generates revenue primarily from its industrial estate segment, which amounts to THB4.51 billion.

Dividend Yield: 9.8%

Pinthong Industrial Park's dividends are supported by a low payout ratio of 33.8%, indicating sustainability through earnings, while a cash payout ratio of 39.2% ensures coverage by cash flows. Despite only three years of dividend history, payments have been stable and growing. Recent earnings growth to THB 1.35 billion for the nine months ended September 2024 underscores robust financial health, though future earnings are expected to decline annually by an average of 9.8%.

- Get an in-depth perspective on Pinthong Industrial Park's performance by reading our dividend report here.

- According our valuation report, there's an indication that Pinthong Industrial Park's share price might be on the cheaper side.

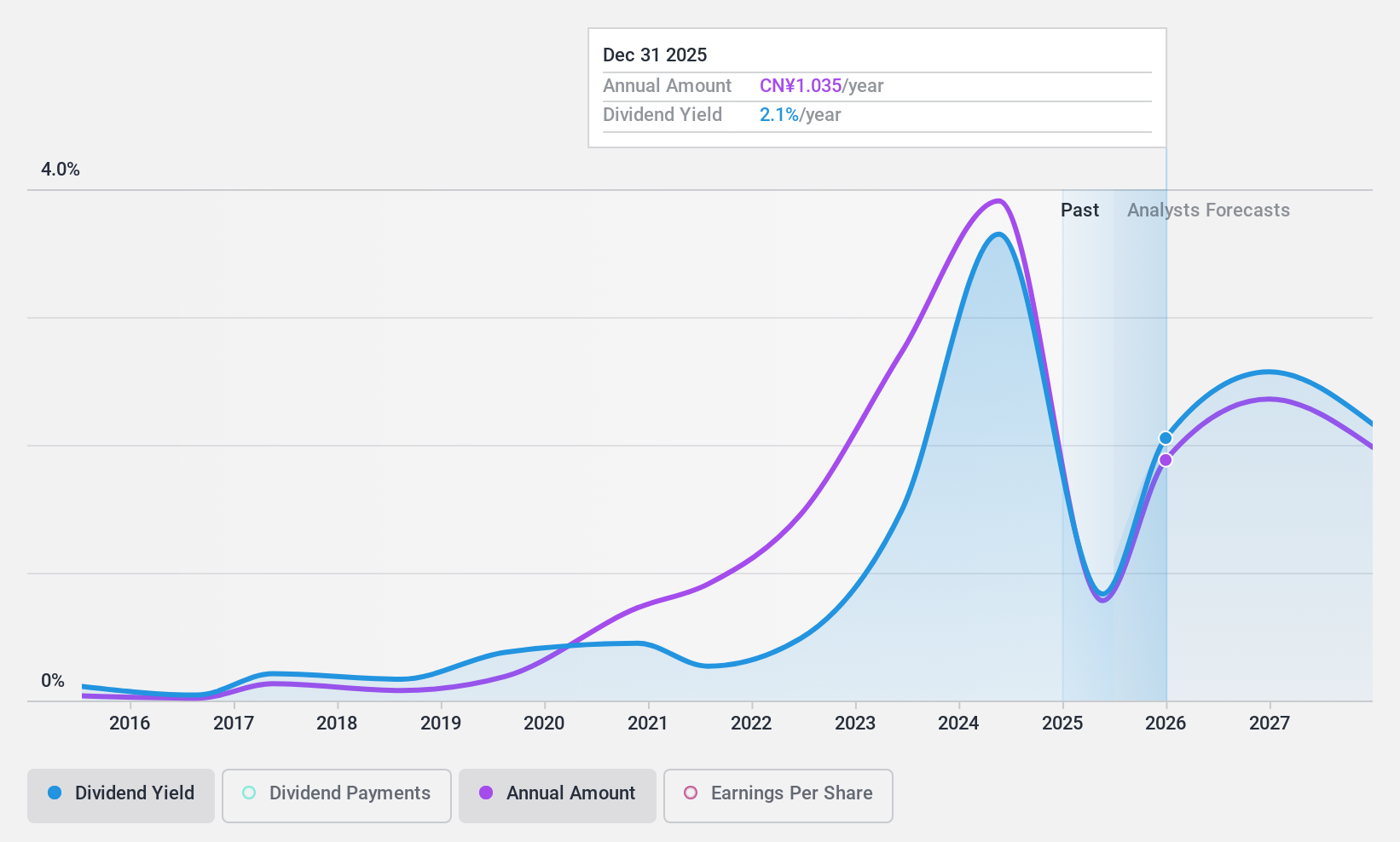

Shede Spirits (SHSE:600702)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shede Spirits Co., Ltd., along with its subsidiaries, is engaged in the design, production, and sale of liquor products in China and has a market capitalization of approximately CN¥18.54 billion.

Operations: Shede Spirits Co., Ltd. generates its revenue primarily through the design, production, and sale of liquor products within China.

Dividend Yield: 3.8%

Shede Spirits' dividend yield of 3.8% ranks in the top 25% of CN market payers, but sustainability is questionable due to lack of free cash flow coverage despite a reasonable payout ratio of 62.9%. Earnings have declined, with net income dropping to CNY 668.9 million for the first nine months of 2024 from CNY 1.29 billion a year ago, impacting dividend reliability and stability over the past decade despite some growth. Recent buybacks may support shareholder value but don't directly bolster dividend security.

- Click to explore a detailed breakdown of our findings in Shede Spirits' dividend report.

- The analysis detailed in our Shede Spirits valuation report hints at an deflated share price compared to its estimated value.

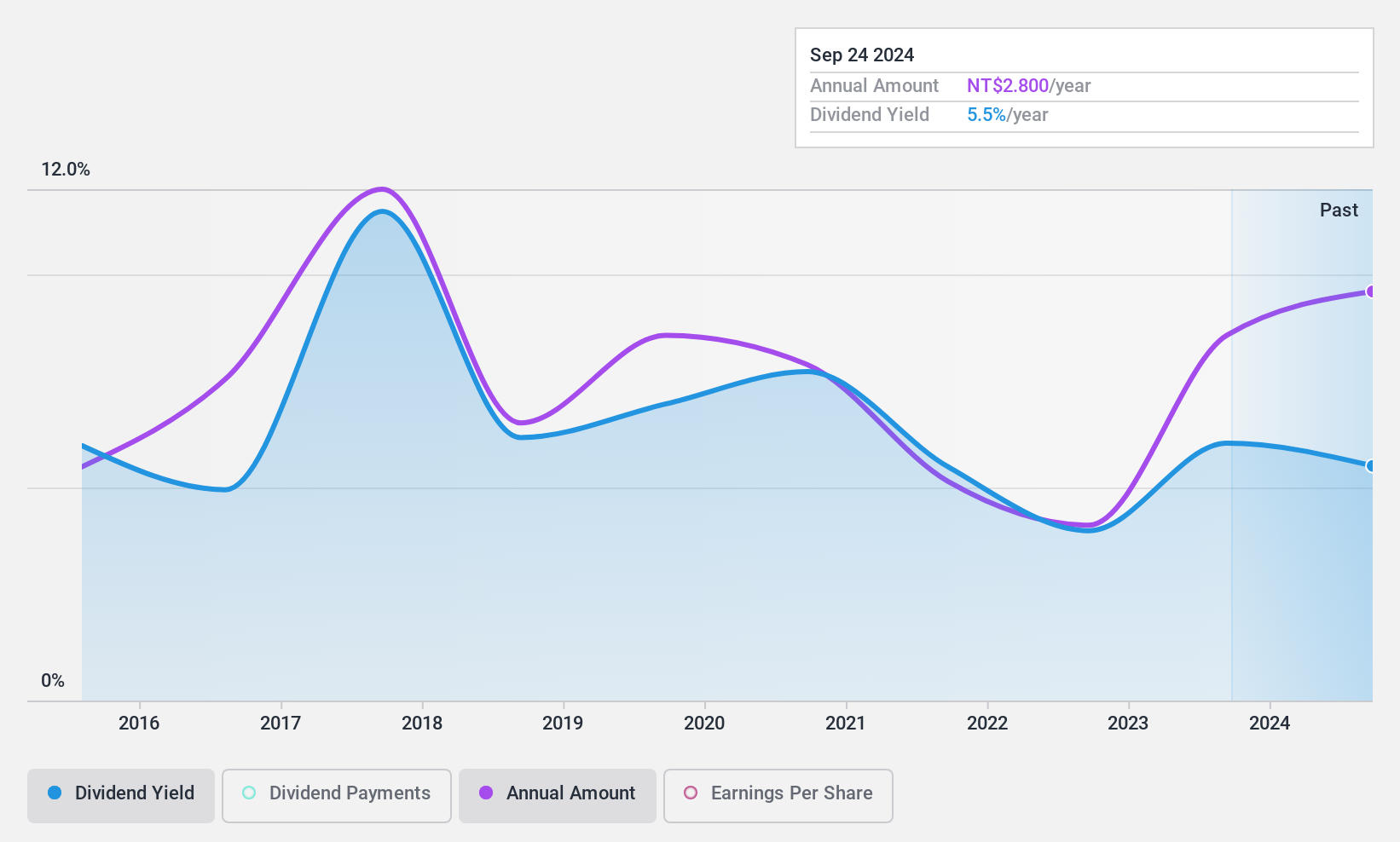

Hanpin Electron (TWSE:2488)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hanpin Electron Co., Ltd. designs, manufactures, and sells electronic consumer products, professional audio products, and DJ equipment across Taiwan, China, Hong Kong, and Singapore with a market cap of NT$4.15 billion.

Operations: Hanpin Electron Co., Ltd.'s revenue primarily comes from its Audio Department, which generated NT$2.76 billion.

Dividend Yield: 5.1%

Hanpin Electron's dividend yield of 5.09% places it among the top 25% of payers in the TW market. Despite a reasonable payout ratio of 60.1%, dividends have been volatile over the past decade, raising concerns about reliability. However, with a low cash payout ratio of 24.7%, dividends are well covered by cash flows, suggesting sustainability. Recent earnings show mixed results; sales increased but net income declined in Q3 2024 compared to the previous year.

- Navigate through the intricacies of Hanpin Electron with our comprehensive dividend report here.

- Our valuation report here indicates Hanpin Electron may be undervalued.

Where To Now?

- Gain an insight into the universe of 2007 Top Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:PIN

Pinthong Industrial Park

Engages in the development and rental of real estate projects in Thailand.

Outstanding track record, undervalued and pays a dividend.