- Thailand

- /

- Specialized REITs

- /

- SET:IMPACT

Discovering Three Hidden Treasures With Strong Potential

Reviewed by Simply Wall St

As global markets navigate mixed performances, with the S&P 500 marking its best two-year stretch in a quarter-century and small-cap indices like the Russell 2000 showing resilience, investors are keenly observing economic indicators such as the Chicago PMI and GDP forecasts that signal potential shifts in market dynamics. Amidst this backdrop of cautious optimism and strategic positioning, identifying stocks with strong fundamentals and growth potential becomes crucial for those looking to capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

MREIT (PSE:MREIT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MREIT, Inc. is a real estate investment trust with a market capitalization of approximately ₱50.17 billion, focusing on leasing its building properties.

Operations: MREIT generates revenue primarily from leasing its building properties, amounting to approximately ₱3.21 billion.

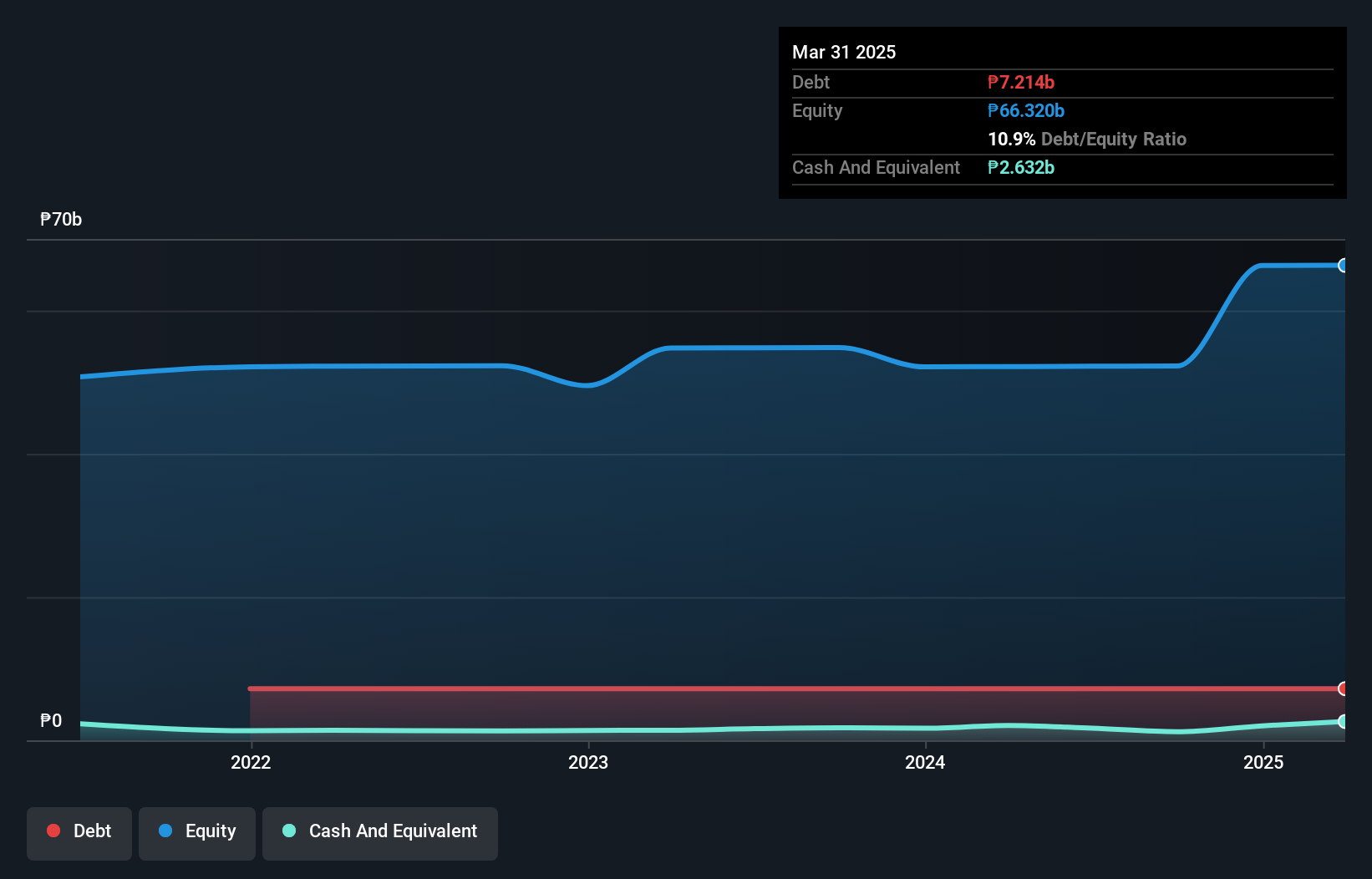

MREIT, a dynamic player in its sector, witnessed an impressive earnings growth of 2274% over the past year, outpacing the Office REITs industry. Despite a significant one-off loss of ₱2.7 billion impacting recent financial results, MREIT remains free cash flow positive and profitable. The company's net debt to equity ratio stands at a satisfactory 11.5%, with interest payments well covered by EBIT at 13 times coverage. Recent reports show stable net income figures for the third quarter and nine months ending September 2024, maintaining basic earnings per share at ₱0.26 and ₱0.78 respectively from continuing operations compared to last year.

- Delve into the full analysis health report here for a deeper understanding of MREIT.

Evaluate MREIT's historical performance by accessing our past performance report.

IMPACT Growth Real Estate Investment Trust (SET:IMPACT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Impact Growth Real Estate Investment Trust is a real estate investment trust established under the Trust for Transaction in Capital Market Act, focusing on property investments with a market cap of THB16.31 billion.

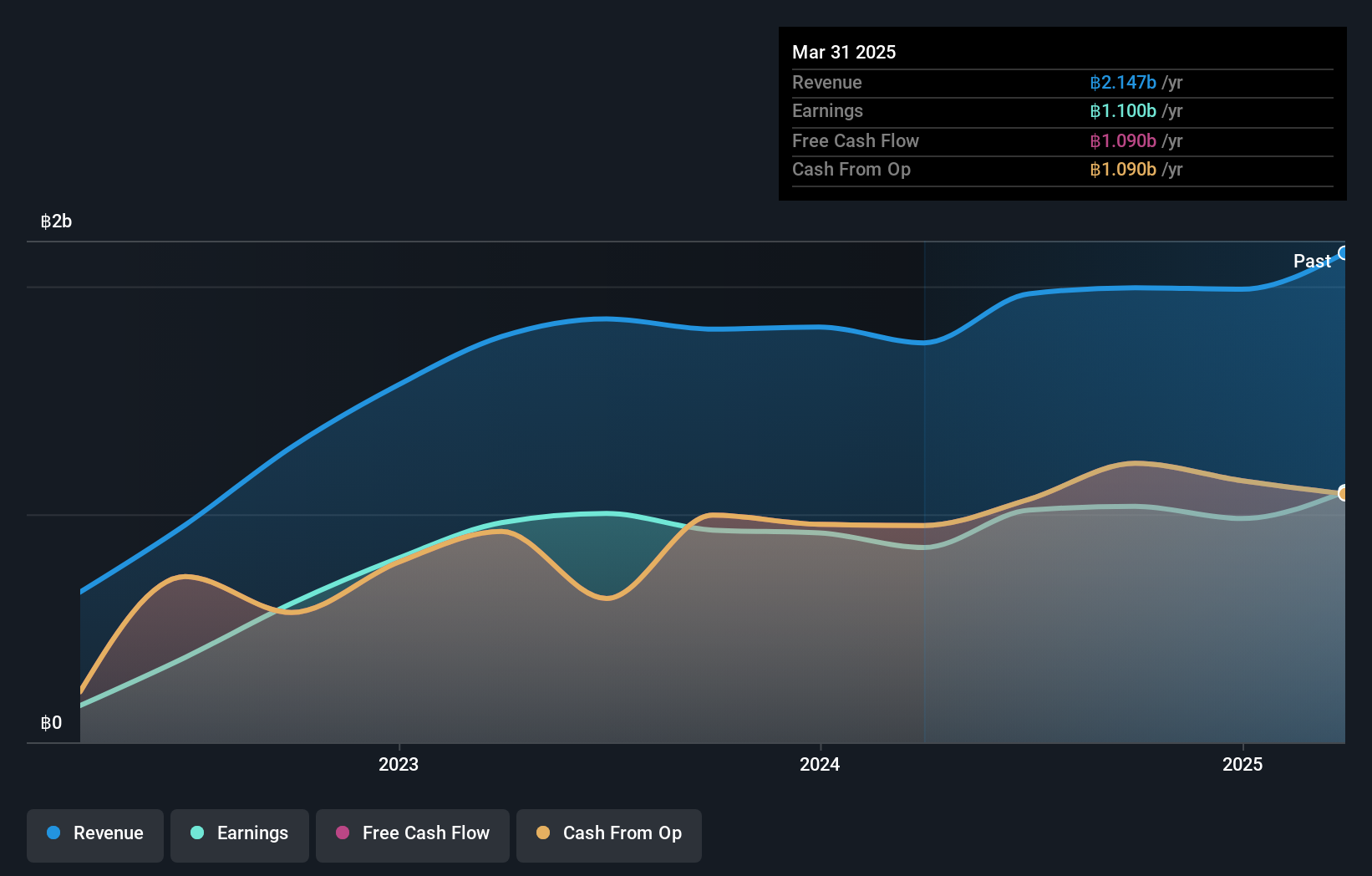

Operations: The Trust generates revenue primarily from providing services on its invested properties, amounting to THB1.99 billion.

IMPACT Growth Real Estate Investment Trust, a smaller player in the market, shows promising growth with its earnings rising by 11.2% over the past year, outpacing the Specialized REITs industry average of 7.7%. The trust is trading at 51% below its estimated fair value, suggesting potential undervaluation. Its net debt to equity ratio stands at a satisfactory 17.6%, and interest payments are well-covered with EBIT coverage of 8.1 times. Recent financial results highlight revenue of THB 413 million for Q2 and net income reaching THB 181 million, indicating robust performance compared to last year’s figures.

FP Partner (TSE:7388)

Simply Wall St Value Rating: ★★★★★☆

Overview: FP Partner Inc. is a company that offers insurance services to both individuals and corporations in Japan, with a market capitalization of ¥48.21 billion.

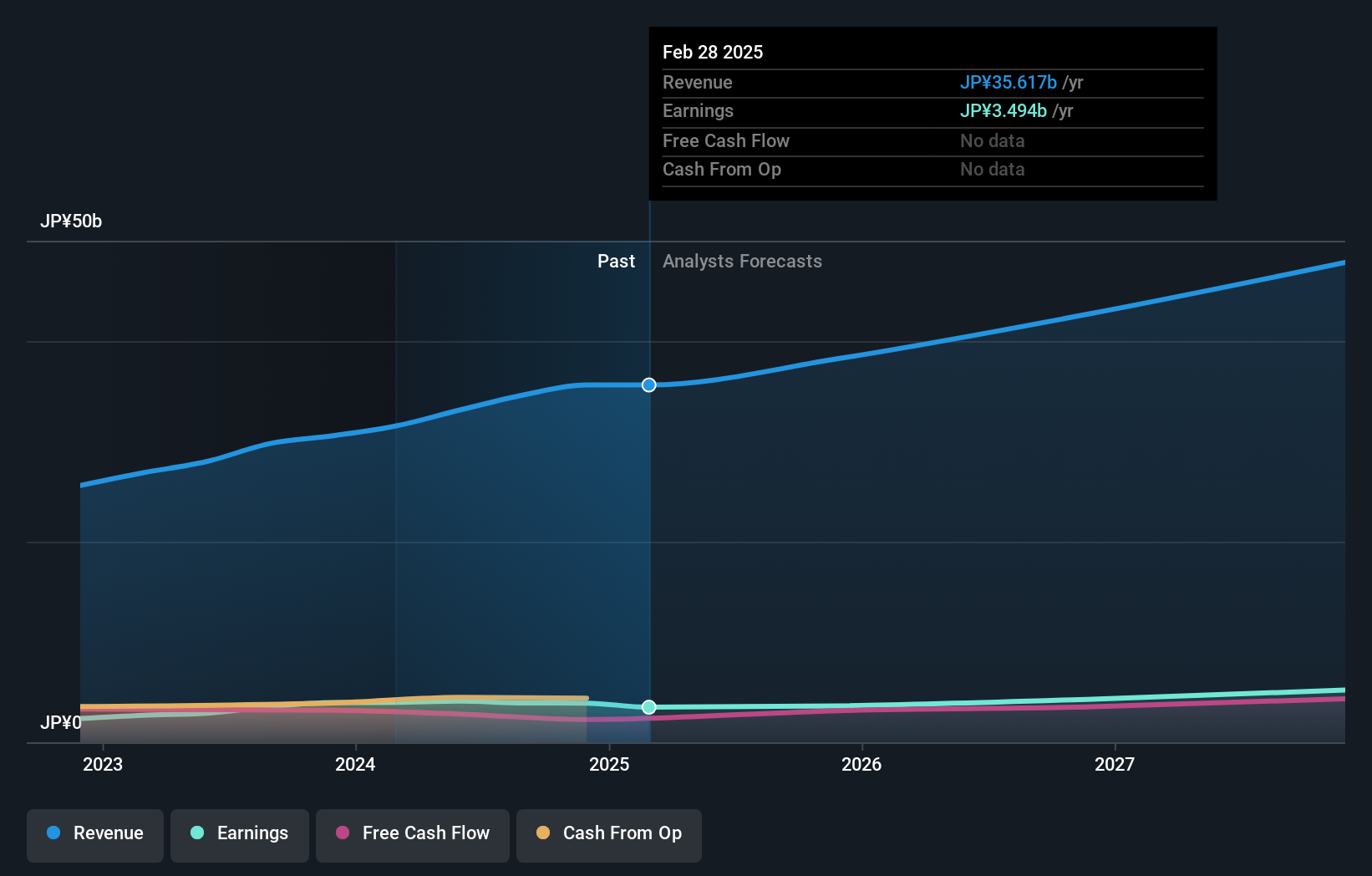

Operations: FP Partner derives its revenue primarily from its Insurance Agency Business, which generated ¥34.63 billion. The company's financial performance is highlighted by a net profit margin of 12.5%, reflecting its profitability within the sector.

FP Partner, a nimble player in the insurance sector, has shown an impressive earnings growth of 36.8% annually over the last five years. Despite recent volatility in its share price, it trades significantly below fair value by 68.6%. The company is free cash flow positive and holds more cash than total debt, indicating financial stability. However, its earnings growth of 10% last year lagged behind the broader industry’s 45.2%. Recent guidance revisions reflect challenges from shifting product demand and external economic factors impacting profit margins. With high-quality past earnings and strong interest coverage, FP Partner remains intriguing for potential investors.

Seize The Opportunity

- Embark on your investment journey to our 4659 Undiscovered Gems With Strong Fundamentals selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:IMPACT

IMPACT Growth Real Estate Investment Trust

Impact Growth Real Estate Investment Trust (“the Trust”) is a real estate investment trust established under the Trust for Transaction in Capital Market Act, B.E.2550 (“the Act”) in accordance with the Trust Deed signed on 22 September 2014 between RMI Company Limited as the Trust Settlor and Kasikorn Asset Management Company Limited as the Trustee.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives