- Taiwan

- /

- Metals and Mining

- /

- TWSE:9958

Exploring Three Promising Stocks with Strong Potential

Reviewed by Simply Wall St

In a week marked by tariff uncertainties and softer-than-expected U.S. job growth, global markets experienced mixed reactions, with major indices like the S&P 500 seeing slight declines while European stocks showed resilience. Amid these fluctuations, small-cap stocks continue to capture attention as investors seek opportunities in companies that could benefit from shifting economic landscapes and evolving trade dynamics. In this context, identifying promising stocks often involves looking for those with strong fundamentals and potential for growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NPR-Riken | 12.24% | 14.08% | 50.12% | ★★★★★★ |

| NS United Kaiun Kaisha | 55.99% | 13.51% | 20.23% | ★★★★★★ |

| DoshishaLtd | NA | 2.43% | 2.36% | ★★★★★★ |

| Uoriki | NA | 3.85% | 9.40% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Chuo WarehouseLtd | 12.11% | 0.82% | 7.95% | ★★★★★★ |

| MIRARTH HOLDINGSInc | 261.26% | 3.32% | 0.93% | ★★★★★☆ |

| Nikko | 33.49% | 5.29% | -7.39% | ★★★★★☆ |

| Mr Max Holdings | 54.12% | 0.97% | 4.23% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Zhejiang Jinghua Laser TechnologyLtd (SHSE:603607)

Simply Wall St Value Rating: ★★★★☆☆

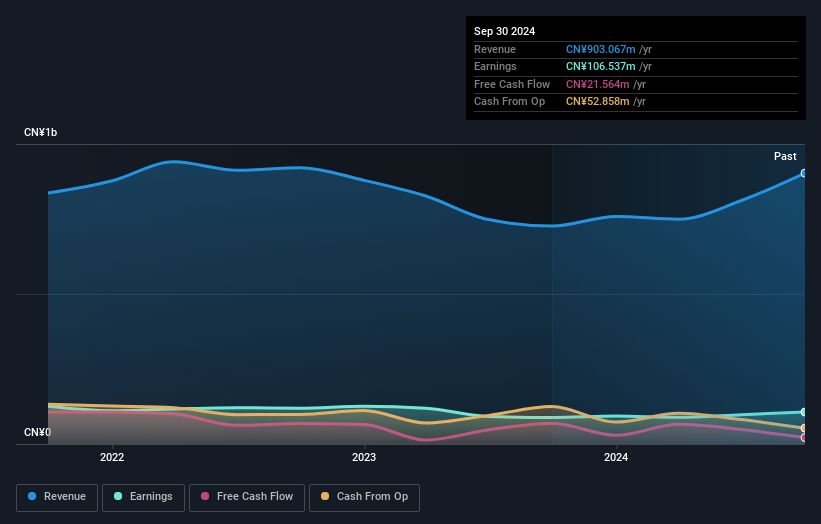

Overview: Zhejiang Jinghua Laser Technology Co., Ltd is engaged in the development, manufacturing, and sale of laser holographic molded products, with a market capitalization of CN¥3.21 billion.

Operations: Zhejiang Jinghua Laser Technology generates revenue primarily from the sale of laser holographic molded products. The company's cost structure and profitability are influenced by its gross profit margin trends, which have shown variability over recent periods.

Zhejiang Jinghua Laser Technology, a small player in the tech space, has shown impressive growth with a 21% increase in earnings over the past year, outpacing the Forestry industry's 19%. The company demonstrates financial prudence with more cash than total debt and free cash flow positivity. However, its debt-to-equity ratio has risen to 31% over five years. Despite this leverage increase, it maintains high-quality earnings and covers interest payments comfortably. With a price-to-earnings ratio of 30.9x below the CN market average of 36.7x, it seems attractively valued for potential investors seeking growth opportunities in niche markets.

- Dive into the specifics of Zhejiang Jinghua Laser TechnologyLtd here with our thorough health report.

Learn about Zhejiang Jinghua Laser TechnologyLtd's historical performance.

L&K Engineering (TWSE:6139)

Simply Wall St Value Rating: ★★★★★★

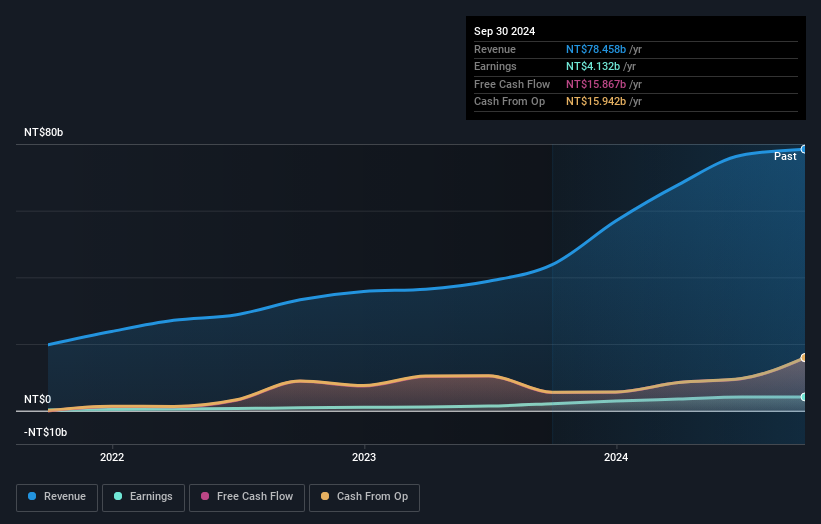

Overview: L&K Engineering Co., Ltd. offers turnkey engineering services across Taiwan, Hong Kong, and internationally, with a market capitalization of NT$57.67 billion.

Operations: L&K Engineering Co., Ltd. generates revenue primarily from its L1 Company and L2 Company segments, with NT$25.53 billion and NT$17.10 billion respectively. After accounting for adjustments and eliminations, the total revenue stands at NT$37.77 billion.

L&K Engineering, a smaller player in the commercial services sector, seems to be a compelling option with its stock trading at 91.3% below estimated fair value. Over the past year, earnings soared by 98.5%, outpacing industry averages significantly. The company has effectively slashed its debt to equity ratio from 48.6% to 14.4% over five years, showcasing prudent financial management and robust cash flow generation as it maintains more cash than total debt obligations. Recent results indicate sales of TWD 16,408 million for Q3 and net income of TWD 1,009 million, reflecting steady performance despite slight EPS variations from last year’s figures.

- Get an in-depth perspective on L&K Engineering's performance by reading our health report here.

Assess L&K Engineering's past performance with our detailed historical performance reports.

Century Iron and Steel IndustrialLtd (TWSE:9958)

Simply Wall St Value Rating: ★★★★★☆

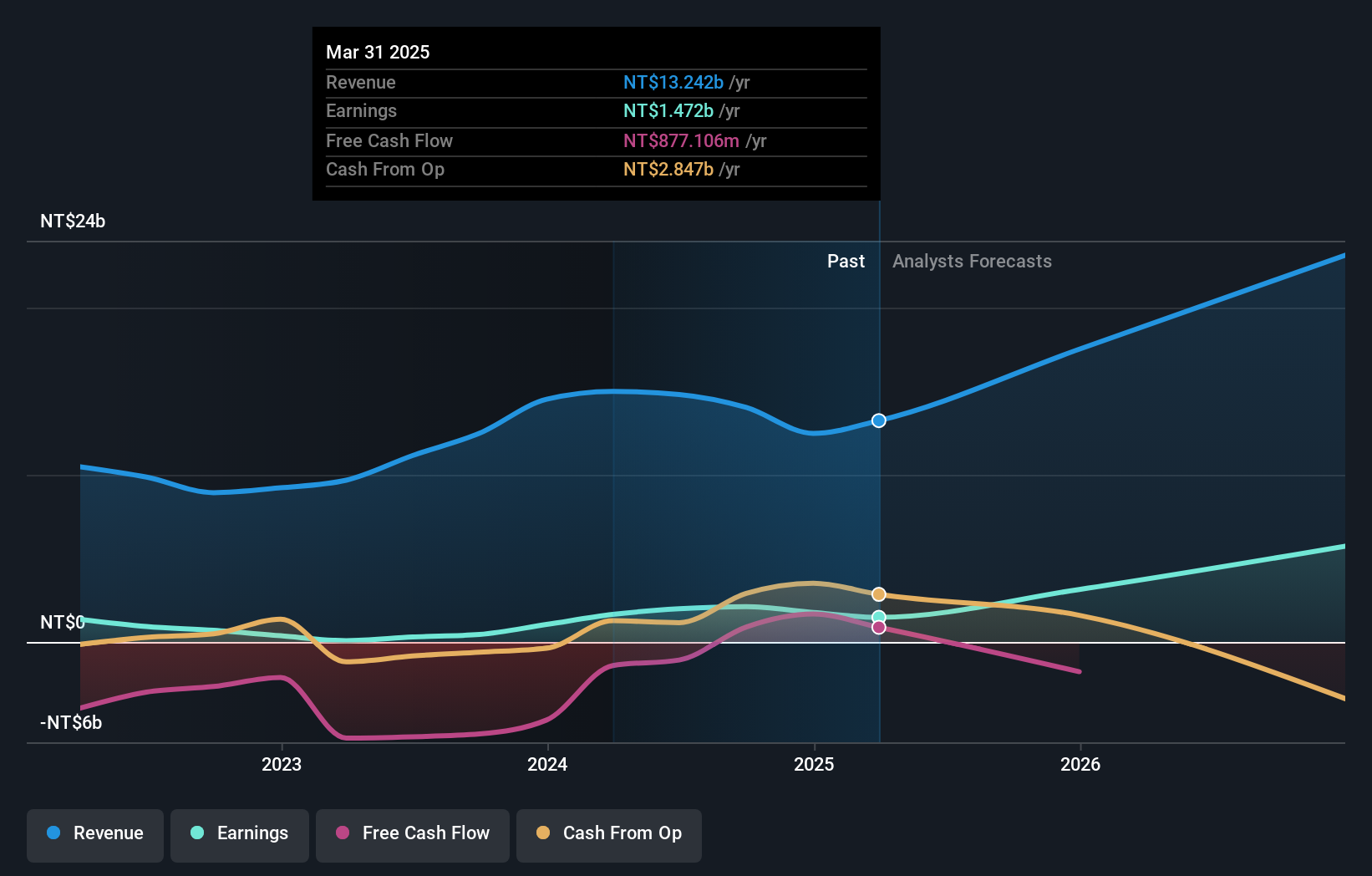

Overview: Century Iron and Steel Industrial Co., Ltd. is a company involved in the production and supply of steel structures, with a market capitalization of NT$41.87 billion.

Operations: Century Iron and Steel Industrial Co., Ltd. generates revenue primarily from its Building Reinforcing Steel Structure segment, amounting to NT$14.03 billion.

Century Iron and Steel Industrial Ltd. is making waves with a remarkable earnings growth of 369% over the past year, outpacing the Metals and Mining industry average of 12%. The company has demonstrated strong financial health with interest payments well covered by EBIT at an impressive 18 times coverage, ensuring stability in its operations. Despite a rise in debt to equity from 32.9% to 59.1% over five years, the current net debt to equity ratio at 35% remains satisfactory. Recent earnings reports show net income for Q3 at TWD 437 million compared to TWD 312 million last year, highlighting robust profitability improvements.

- Navigate through the intricacies of Century Iron and Steel IndustrialLtd with our comprehensive health report here.

Understand Century Iron and Steel IndustrialLtd's track record by examining our Past report.

Next Steps

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4698 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:9958

Century Iron and Steel IndustrialLtd

Century Iron and Steel Industrial Co.,Ltd.

Exceptional growth potential with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives