- Japan

- /

- Auto Components

- /

- TSE:5970

3 Top Dividend Stocks Offering Up To 4.6% Yield

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, investors are keenly observing sector-specific impacts, with financials and energy benefiting from deregulation hopes while healthcare faces challenges. In this climate of fluctuating yields and economic signals, dividend stocks can offer a stable income stream, making them an attractive option for those seeking to balance growth with consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.16% | ★★★★★★ |

| Globeride (TSE:7990) | 4.18% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.29% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.40% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.43% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.89% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.79% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.43% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.84% | ★★★★★★ |

Click here to see the full list of 1951 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

G-Tekt (TSE:5970)

Simply Wall St Dividend Rating: ★★★★★★

Overview: G-Tekt Corporation manufactures and sells auto body components and transmission parts in Japan and internationally, with a market cap of ¥67.55 billion.

Operations: G-Tekt Corporation generates revenue from the production and sale of auto body components and transmission parts both domestically in Japan and in international markets.

Dividend Yield: 4.5%

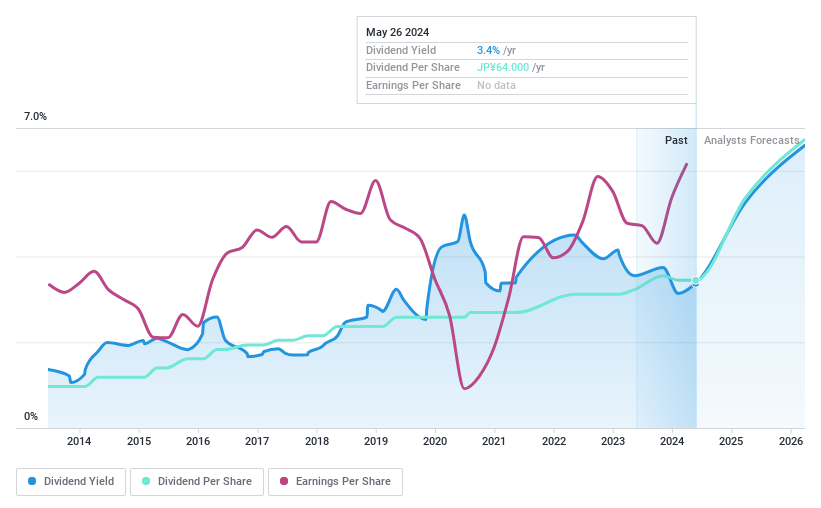

G-Tekt offers a compelling dividend profile with a yield of 4.46%, placing it in the top 25% of JP market payers. Over the past decade, its dividends have grown reliably and remained stable, supported by a low payout ratio of 13.5% and reasonable cash flow coverage at 55.3%. Additionally, G-Tekt's earnings have recently increased by 20.7%, enhancing its ability to sustain dividends while trading at an attractive P/E ratio of 6x compared to the market average.

- Navigate through the intricacies of G-Tekt with our comprehensive dividend report here.

- The valuation report we've compiled suggests that G-Tekt's current price could be quite moderate.

Isuzu Motors (TSE:7202)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Isuzu Motors Limited manufactures and sells commercial vehicles, light commercial vehicles, and diesel engines and components worldwide, with a market cap of ¥1.43 trillion.

Operations: Isuzu Motors Limited generates revenue of ¥3.29 billion from the manufacture and sale of vehicles, their components, and industrial engines globally.

Dividend Yield: 4.7%

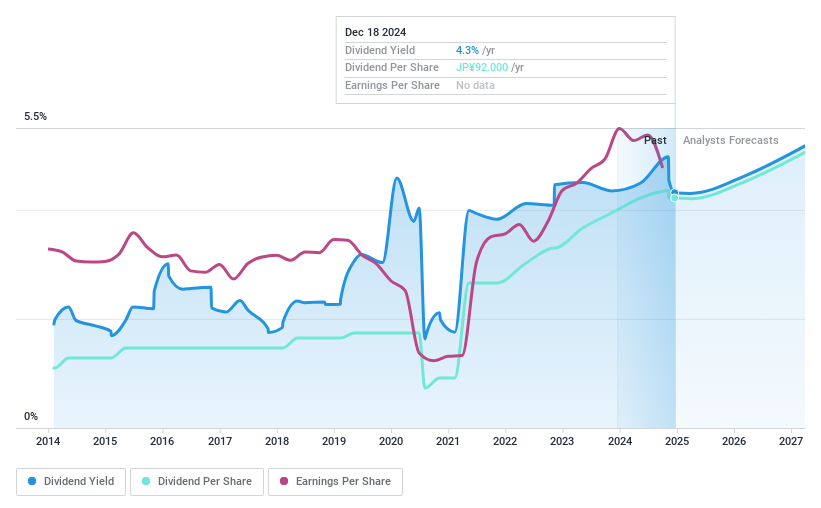

Isuzu Motors' dividend profile is robust, with a yield of 4.69%, ranking it in the top 25% of Japanese market payers. The company's dividends have shown consistent growth and stability over the past decade, supported by a payout ratio of 45.5% and cash flow coverage at 55%. Despite recent guidance lowering earnings expectations due to challenging overseas markets, Isuzu increased its dividend to ¥46 per share for Q2 FY2025, reflecting confidence in its financial resilience.

- Get an in-depth perspective on Isuzu Motors' performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Isuzu Motors' share price might be too optimistic.

Chien Kuo Construction (TWSE:5515)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chien Kuo Construction Co., Ltd. operates in the construction industry in Taiwan and China, with a market capitalization of NT$5.48 billion.

Operations: Chien Kuo Construction Co., Ltd. generates revenue of NT$4.69 billion from its construction activities in Taiwan and China.

Dividend Yield: 4.6%

Chien Kuo Construction offers a high dividend yield at 4.6%, placing it among the top 25% of payers in Taiwan. However, its dividend history is marked by volatility and lack of growth over the past decade. The dividends are well-covered by earnings (payout ratio: 51.3%) and cash flows (cash payout ratio: 25.6%). Recent financial developments include its addition to the S&P Global BMI Index and a special cash dividend announced on November 1, 2024.

- Delve into the full analysis dividend report here for a deeper understanding of Chien Kuo Construction.

- The analysis detailed in our Chien Kuo Construction valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Discover the full array of 1951 Top Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5970

G-Tekt

Manufactures and sells auto body components and transmission parts in Japan and internationally.

Flawless balance sheet 6 star dividend payer.