In the current global market landscape, investor sentiment has been heavily influenced by cautious Federal Reserve commentary and political uncertainties, leading to a decline in U.S. stocks despite some recovery efforts. Amid these fluctuations, growth companies with strong insider ownership often signal confidence from those who know the business best, making them potentially attractive in uncertain times.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 23.9% | 37.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Partners Group Holding (SWX:PGHN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Partners Group Holding AG is a private equity firm that focuses on direct, secondary, and primary investments in private equity, real estate, infrastructure, and debt with a market cap of CHF31.80 billion.

Operations: The company's revenue segments include CHF1.19 billion from Private Equity, CHF254.90 million from Infrastructure, CHF218.90 million from Private Credit, and CHF190.90 million from Real Estate.

Insider Ownership: 17%

Revenue Growth Forecast: 15.8% p.a.

Partners Group Holding is experiencing robust earnings growth, projected at 14.5% annually, outpacing the Swiss market. Revenue is also expected to grow faster than the market at 15.8% per year. However, its dividend yield of 3.2% isn't well-covered by earnings or cash flow, and the company maintains a high debt level. Recent discussions suggest potential asset sales in education and renewable sectors, aligning with strategic repositioning efforts amidst strong insider ownership influence on decision-making processes.

- Unlock comprehensive insights into our analysis of Partners Group Holding stock in this growth report.

- According our valuation report, there's an indication that Partners Group Holding's share price might be on the expensive side.

Kotobuki Spirits (TSE:2222)

Simply Wall St Growth Rating: ★★★★☆☆

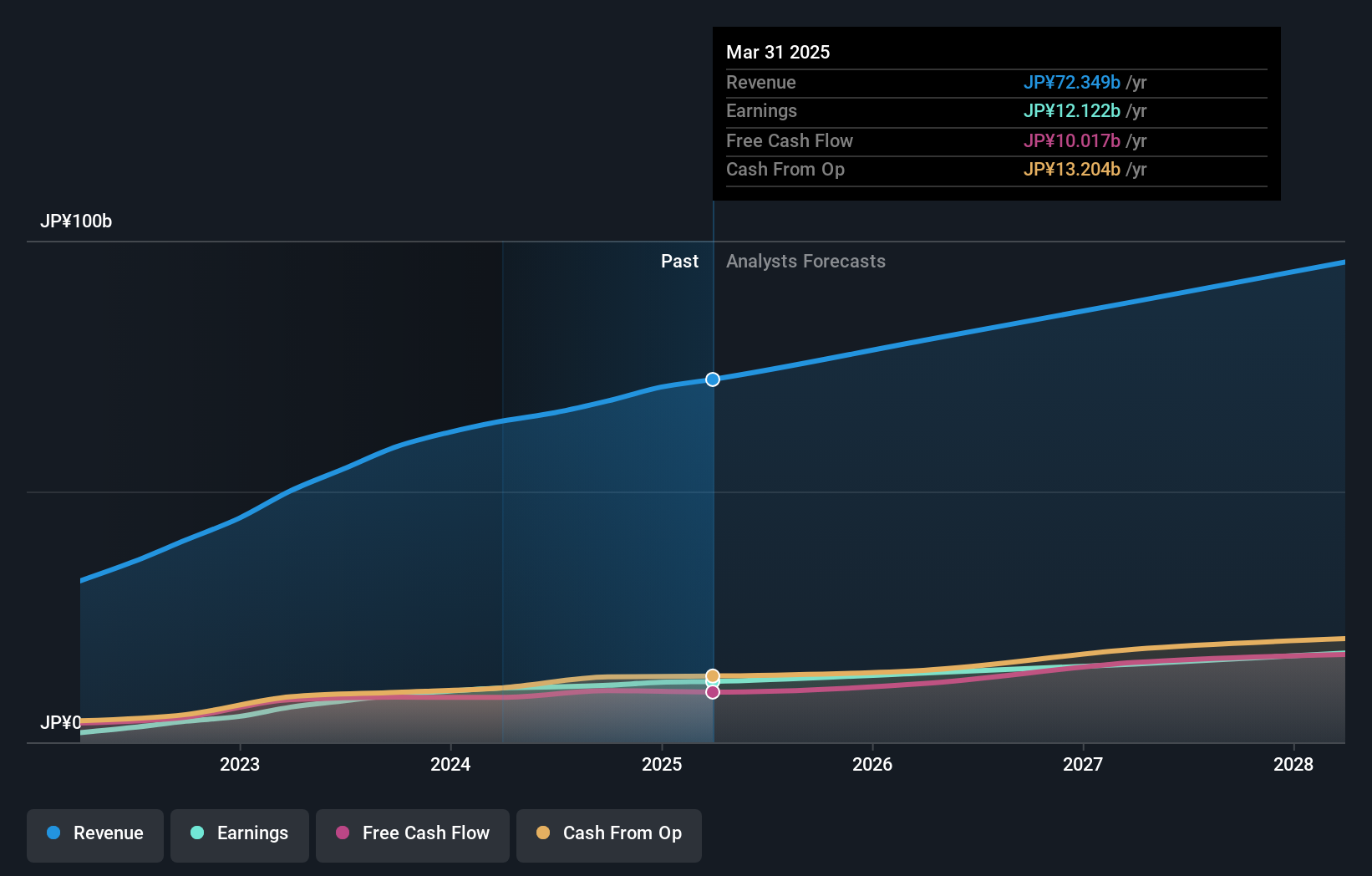

Overview: Kotobuki Spirits Co., Ltd. is a Japanese company that produces and sells sweets, with a market cap of ¥325.22 billion.

Operations: The company's revenue is primarily derived from its segments: Shukrei at ¥27.89 billion, KCC Co., Ltd. at ¥19.67 billion, Kotobuki Confectionery/Tajima Kotobuki at ¥13.87 billion, Sales Subsidiaries at ¥7.15 billion, and Kujukushima at ¥6.75 billion.

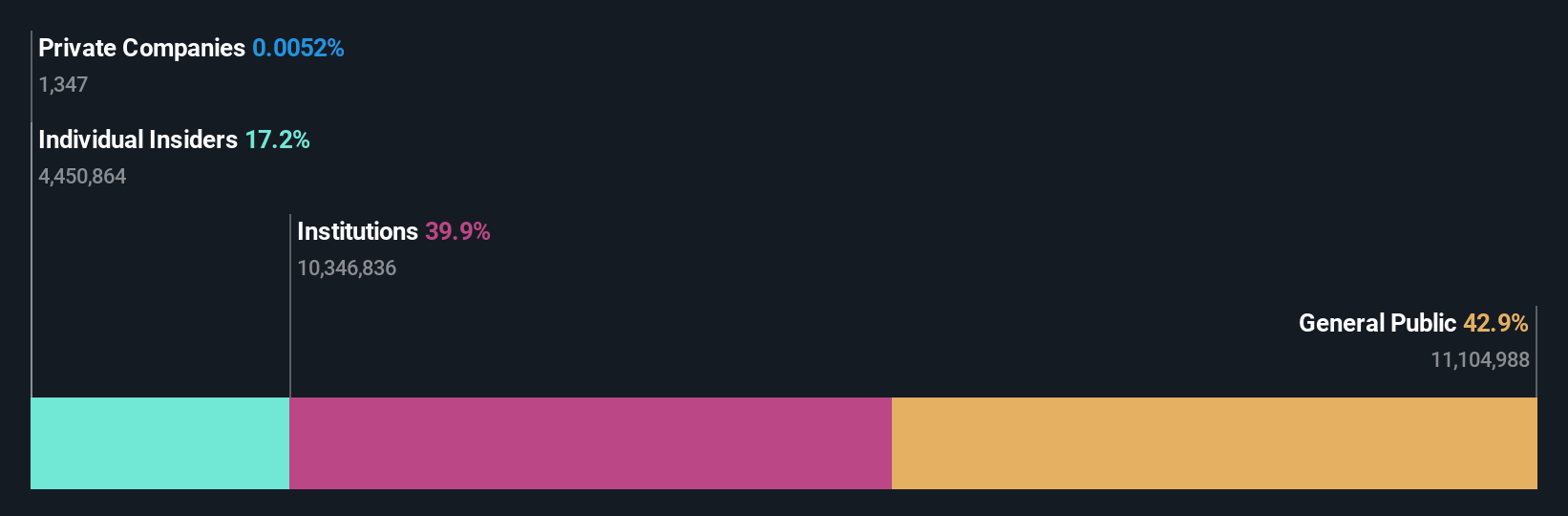

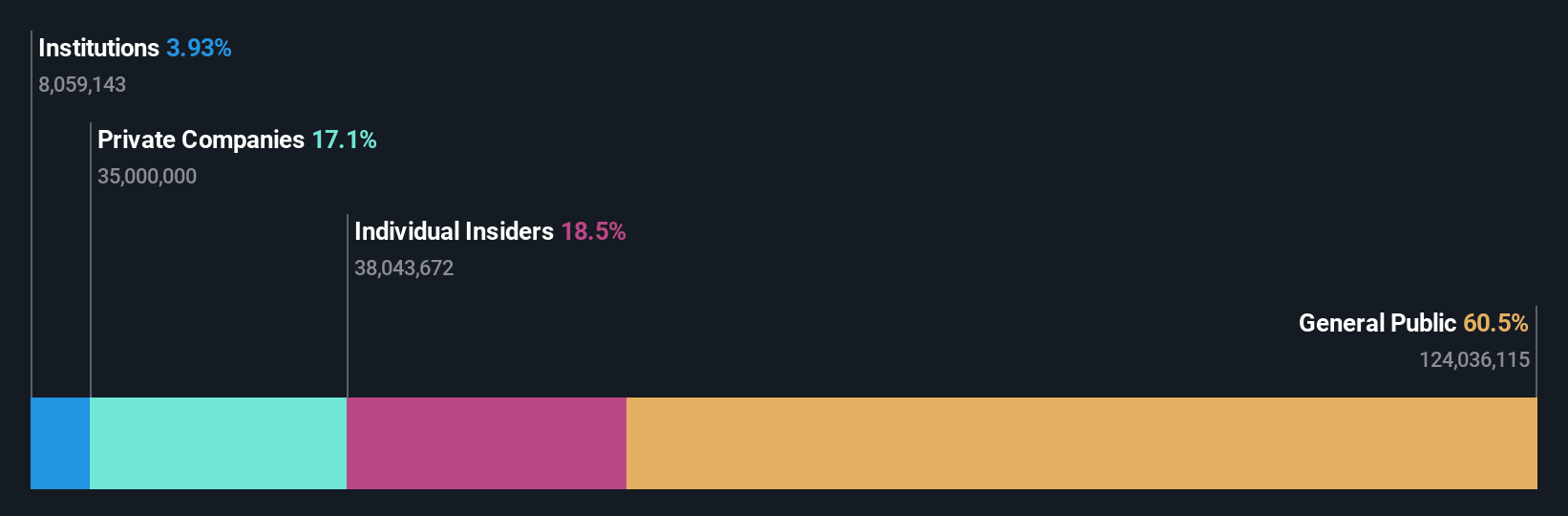

Insider Ownership: 29.4%

Revenue Growth Forecast: 12.5% p.a.

Kotobuki Spirits is forecasted to achieve robust earnings growth at 15.4% annually, surpassing the Japanese market average, though revenue growth of 12.5% per year remains moderate. The company recently announced a share buyback program worth ¥3 billion to enhance shareholder returns and improve capital efficiency, alongside a follow-on equity offering of 2,584,800 shares. Despite no recent insider trading activity reported, high insider ownership likely influences strategic decisions significantly.

- Get an in-depth perspective on Kotobuki Spirits' performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Kotobuki Spirits' current price could be inflated.

Chenming Electronic Tech (TWSE:3013)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chenming Electronic Tech Corp. is an OEM/ODM manufacturer involved in the R&D, manufacturing, and sale of computer cases, server chassis, mobile device components, and molds across Taiwan, China, the United States, and internationally with a market cap of NT$27.18 billion.

Operations: The company's revenue segment primarily consists of the production and sales of computer and mobile device components, amounting to NT$8.53 billion.

Insider Ownership: 18.7%

Revenue Growth Forecast: 58.0% p.a.

Chenming Electronic Tech. demonstrates strong growth potential with earnings expected to increase by 105% annually, significantly outpacing the Taiwanese market. Recent Q3 results show sales of TWD 2.66 billion and net income of TWD 164.48 million, both more than double the previous year’s figures, indicating robust performance. Despite past shareholder dilution and high share price volatility, substantial insider ownership may align management interests with shareholders' long-term goals amid a fixed-income offering of TWD 570.05 million.

- Click to explore a detailed breakdown of our findings in Chenming Electronic Tech's earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Chenming Electronic Tech shares in the market.

Next Steps

- Click here to access our complete index of 1512 Fast Growing Companies With High Insider Ownership.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kotobuki Spirits might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2222

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives