Undiscovered Gems And 2 Other Promising Small Caps Backed By Strong Fundamentals

Reviewed by Simply Wall St

In the current market environment, characterized by cautious sentiment following the Federal Reserve's recent rate cut and ongoing concerns about economic stability, small-cap stocks have faced significant challenges. With indices like the S&P 600 for small caps experiencing notable declines, investors are increasingly on the lookout for opportunities that can weather such volatility. Identifying stocks with strong fundamentals becomes crucial in this context, as these companies often possess robust financial health and growth potential that can provide resilience amid broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| Mildef Crete | NA | 0.93% | 9.96% | ★★★★★★ |

| Forest Packaging GroupLtd | 17.72% | 2.87% | -6.03% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| PBA Holdings Bhd | 1.86% | 7.41% | 40.17% | ★★★★★☆ |

| Lee's Pharmaceutical Holdings | 14.22% | -1.39% | -14.93% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Group Up Industrial (TPEX:6664)

Simply Wall St Value Rating: ★★★★★★

Overview: Group Up Industrial Co., Ltd. manufactures and trades in general boxed-shaped equipment across Taiwan, China, and international markets with a market capitalization of NT$14.83 billion.

Operations: Group Up Industrial generates revenue primarily from its QunYi Segment, which contributes NT$2.36 billion, and the Suzhou WangQun Segment, adding NT$148.32 million.

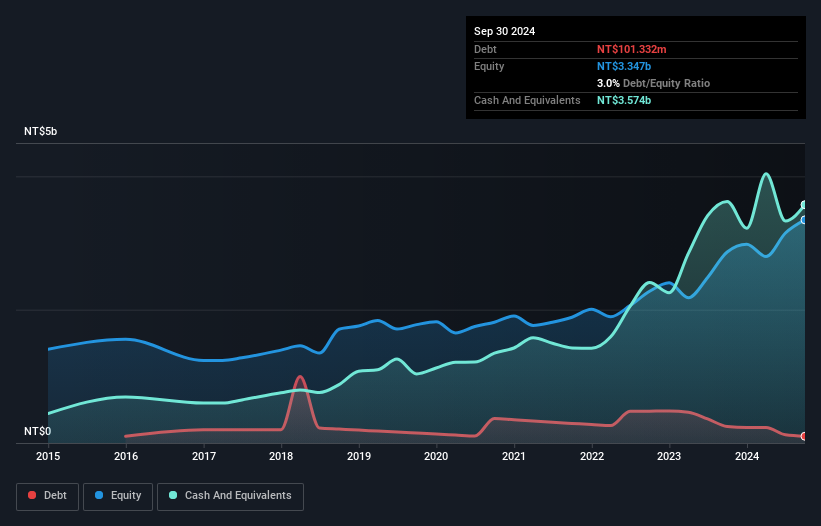

Group Up Industrial, a smaller player in the machinery sector, has shown consistent earnings growth at 26.1% annually over the past five years. Its debt-to-equity ratio has improved significantly from 8.4% to 3%, indicating better financial health. Despite this progress, recent quarterly results revealed a dip in net income to TWD 170 million from TWD 251 million year-on-year, with basic earnings per share dropping to TWD 2.9 from TWD 4.45. The company remains profitable with high-quality earnings and more cash than total debt, suggesting resilience despite industry challenges.

- Navigate through the intricacies of Group Up Industrial with our comprehensive health report here.

Understand Group Up Industrial's track record by examining our Past report.

Nihon Parkerizing (TSE:4095)

Simply Wall St Value Rating: ★★★★★★

Overview: Nihon Parkerizing Co., Ltd. specializes in the manufacture and supply of surface treatment chemicals both in Japan and internationally, with a market cap of ¥151.45 billion.

Operations: Nihon Parkerizing generates revenue primarily from its Chemicals Segment, which accounts for ¥58.39 billion, followed by the Processing Business at ¥47.28 billion and the Equipment Business at ¥22.79 billion.

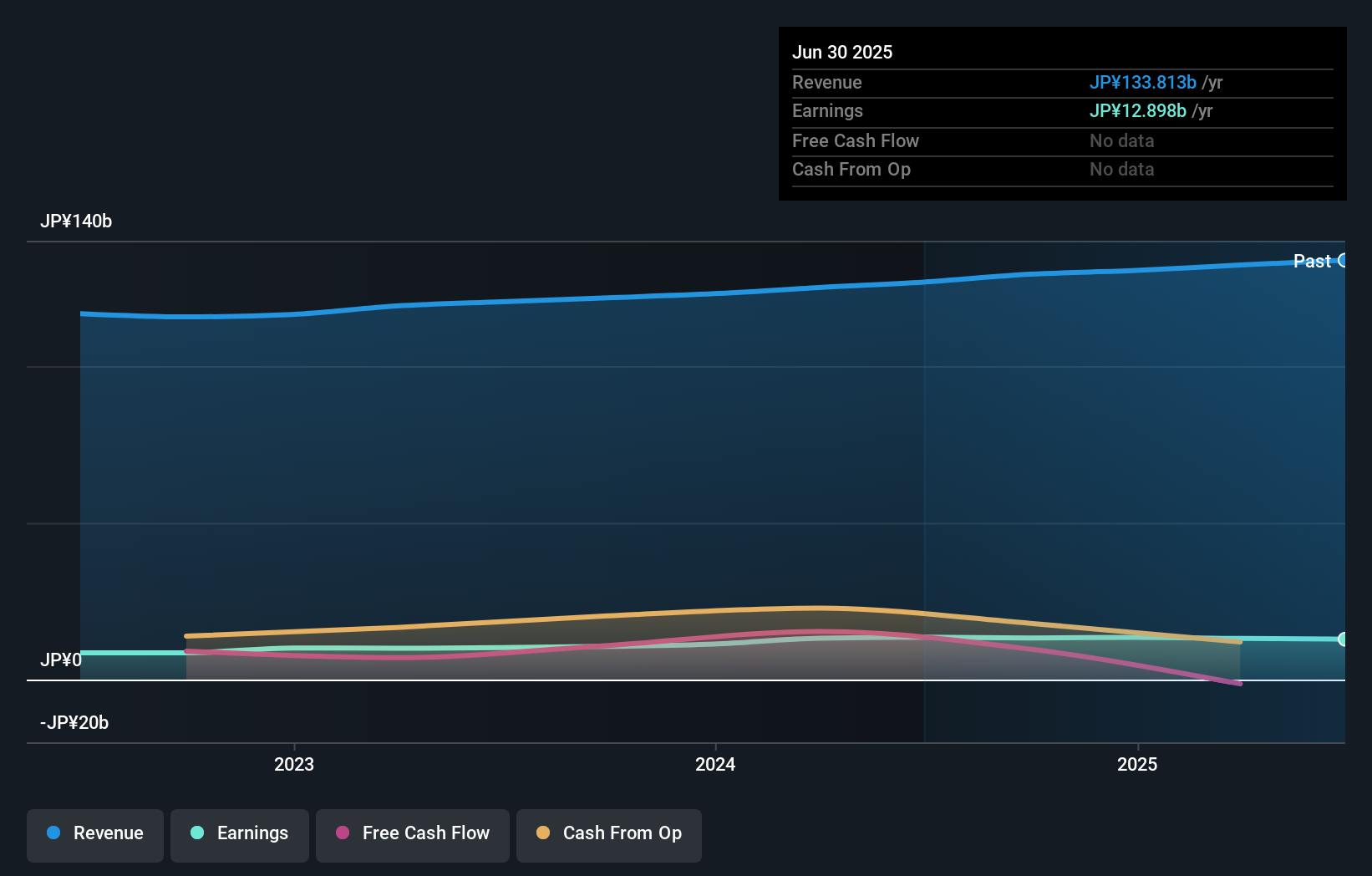

Nihon Parkerizing, a noteworthy player in the chemicals industry, has shown impressive earnings growth of 25% over the past year, outpacing the industry's 14%. With a debt-to-equity ratio reduced to 0.3% from 1% over five years and a price-to-earnings ratio of 11.4x below Japan's market average of 13.4x, it presents an attractive valuation. The company recently completed a share buyback of ¥3 billion for 2.5 million shares or about 2%, indicating confidence in its future prospects and financial health while maintaining high-quality earnings without concerns over interest coverage.

- Dive into the specifics of Nihon Parkerizing here with our thorough health report.

Gain insights into Nihon Parkerizing's past trends and performance with our Past report.

Chugoku Marine Paints (TSE:4617)

Simply Wall St Value Rating: ★★★★★★

Overview: Chugoku Marine Paints, Ltd. specializes in the production and sale of functional coatings globally, with a market capitalization of ¥114.87 billion.

Operations: Chugoku Marine Paints generates revenue primarily from its operations in Japan, China, and Europe and the United States, with these regions contributing ¥48.33 billion, ¥30.66 billion, and ¥29.07 billion respectively. The company's net profit margin is a key financial metric to consider when evaluating its performance over time.

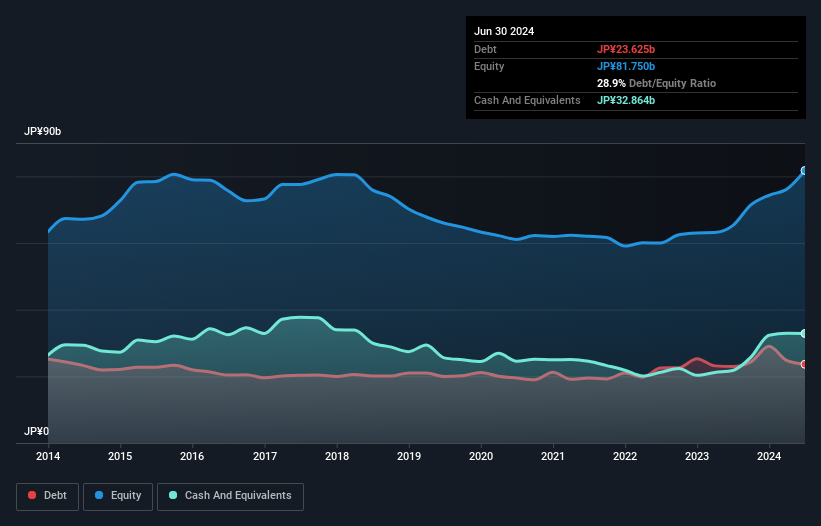

Chugoku Marine Paints, a notable player in the coatings industry, is trading at 20.3% below its estimated fair value, suggesting potential undervaluation. The company boasts an impressive earnings growth of 66.5% over the past year, outpacing the Chemicals industry's 14%. Over five years, its debt-to-equity ratio has improved from 31.1% to 25.5%, indicating effective debt management strategies and more cash than total debt further solidifying financial stability. However, projections indicate earnings may decrease by an average of 13.5% annually over the next three years, presenting a cautious outlook for future profitability despite current high-quality earnings and positive free cash flow status.

Seize The Opportunity

- Click this link to deep-dive into the 4632 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4617

Flawless balance sheet with solid track record and pays a dividend.