- Japan

- /

- Construction

- /

- TSE:3443

Bioteque And 2 Other Top Dividend Stocks

Reviewed by Simply Wall St

In the current global market landscape, investors are navigating a complex environment marked by cautious Federal Reserve commentary and looming political uncertainties, which have contributed to recent declines in major U.S. stock indices. Despite these challenges, economic data such as robust GDP growth and rising retail sales suggest underlying resilience in the economy. In this context, dividend stocks can offer a reliable income stream and potential stability amidst market volatility. This article explores Bioteque and two other prominent dividend stocks that may appeal to investors seeking consistent returns in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.93% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.28% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.52% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.76% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.02% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.72% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1937 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Bioteque (TPEX:4107)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bioteque Corporation manufactures and sells medical devices across Asia, South America, North America, and internationally with a market cap of NT$8.45 billion.

Operations: Bioteque Corporation's revenue is primarily derived from its Third Division (NT$1.02 billion), First Business Unit (NT$654.58 million), and Second Business Unit (NT$409.94 million).

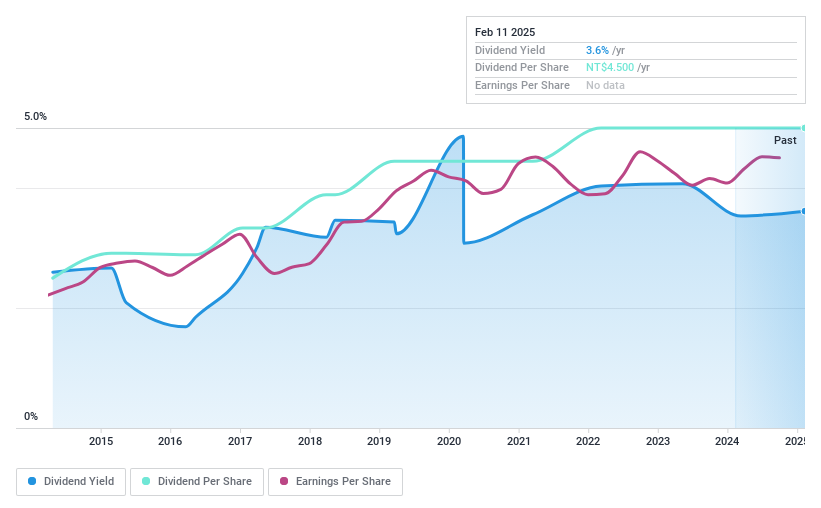

Dividend Yield: 3.6%

Bioteque offers a reliable dividend, growing steadily over the past decade with stable payouts, supported by a reasonable payout ratio of 62.5% and cash payout ratio of 50.4%. Its dividend yield is modest at 3.63%, below the top tier in Taiwan's market but backed by solid earnings growth of 8.3% last year. Recent earnings showed increased sales to TWD 1.57 billion for nine months, supporting its sustainable dividend strategy amidst expansion plans costing TWD 180 million.

- Click here and access our complete dividend analysis report to understand the dynamics of Bioteque.

- The analysis detailed in our Bioteque valuation report hints at an inflated share price compared to its estimated value.

Kawada Technologies (TSE:3443)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kawada Technologies, Inc. operates in the steel, civil engineering, architecture, and IT service sectors in Japan with a market cap of ¥46.37 billion.

Operations: Kawada Technologies, Inc. generates revenue from its operations in the steel, civil engineering, architecture, and IT service sectors within Japan.

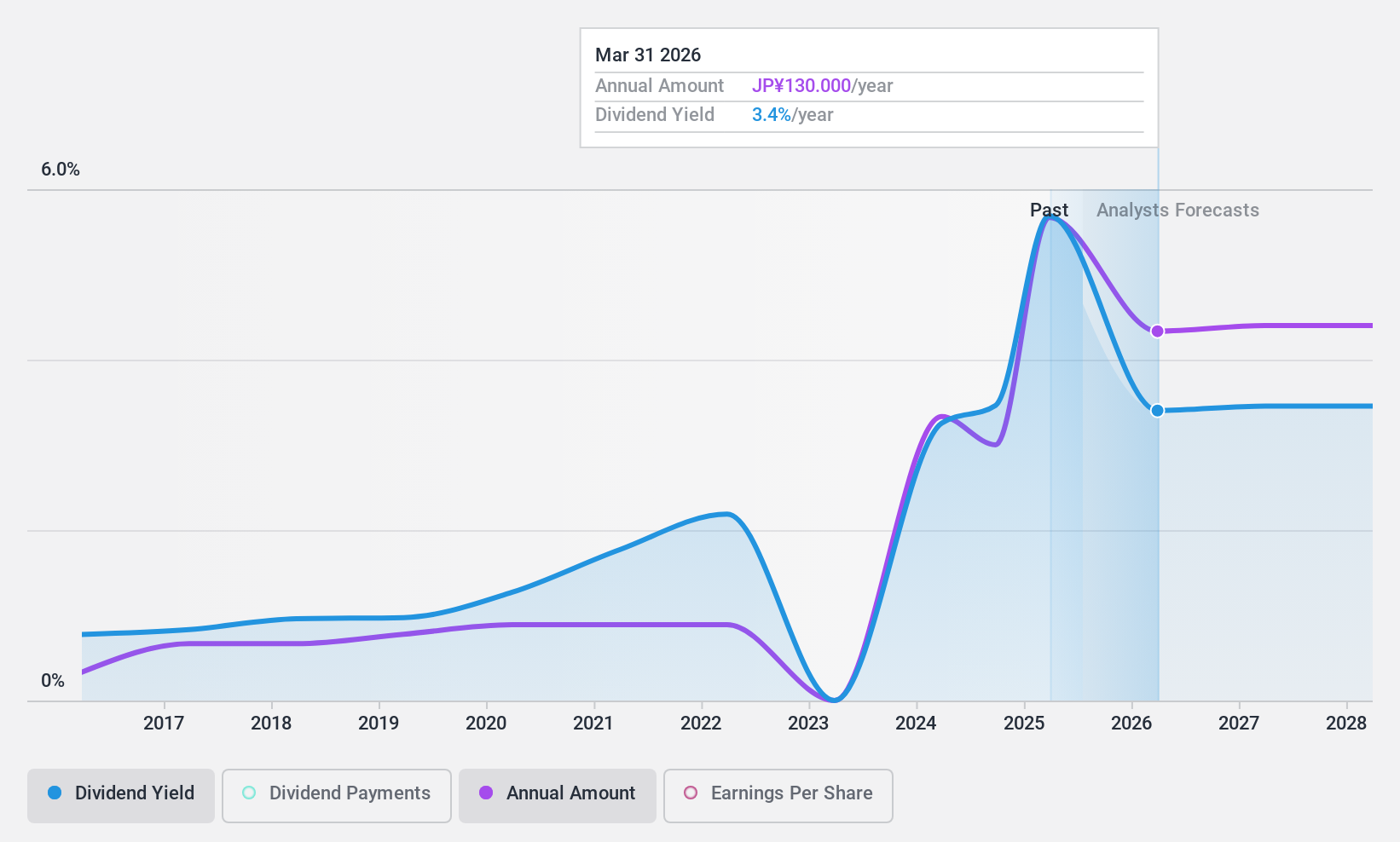

Dividend Yield: 4%

Kawada Technologies' dividend yield of 4.05% ranks in the top 25% of Japan's market, yet its payments have been volatile over the past decade. Despite a low payout ratio of 22.6%, dividends are not covered by free cash flows, raising sustainability concerns as earnings are forecast to decline by 8.3% annually over three years. Recent guidance indicates a significant dividend reduction from ¥393 to ¥55 per share, with plans for interim dividends starting fiscal year-end March 2025.

- Take a closer look at Kawada Technologies' potential here in our dividend report.

- According our valuation report, there's an indication that Kawada Technologies' share price might be on the cheaper side.

Japan Cash Machine (TSE:6418)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Japan Cash Machine Co., Ltd. engages in the development, manufacturing, and sale of money-handling and amusement center machines both domestically in Japan and internationally, with a market cap of ¥26.74 billion.

Operations: Japan Cash Machine Co., Ltd.'s revenue segments include Global Gaming at ¥21.43 billion, Domestic Commercial at ¥4.10 billion, Overseas Commercial at ¥6.64 billion, and Recreation Hall Equipment at ¥7.37 billion.

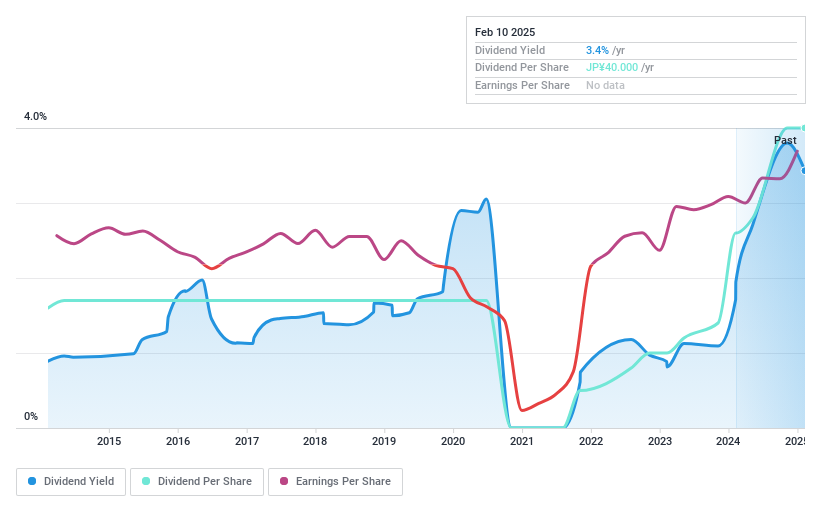

Dividend Yield: 4%

Japan Cash Machine's dividend yield of 3.96% places it in the top 25% of Japan's market, but its payments have been volatile over the past decade. Despite a low payout ratio of 21%, dividends are not covered by free cash flows, suggesting sustainability issues. Recent announcements indicate a significant increase in dividends from ¥7 to ¥14 per share for Q2 and guidance for year-end dividends rising from ¥19 to ¥36 per share, reflecting strong earnings growth.

- Dive into the specifics of Japan Cash Machine here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Japan Cash Machine is trading beyond its estimated value.

Seize The Opportunity

- Discover the full array of 1937 Top Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kawada Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3443

Kawada Technologies

Engages in the steel, civil engineering, architecture, and IT service sectors in Japan.

Solid track record, good value and pays a dividend.