Undiscovered Gems Promising Stocks To Watch In December 2024

Reviewed by Simply Wall St

As global markets continue to scale new heights, with small-cap indices like the Russell 2000 reaching record levels, investors are keenly observing how geopolitical tensions and economic indicators shape market sentiment. Amidst this backdrop of robust market activity and shifting policies, identifying promising stocks requires a keen eye for companies that demonstrate resilience and potential for growth in turbulent times.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Changhong Huayi Compressor (SZSE:000404)

Simply Wall St Value Rating: ★★★★★★

Overview: Changhong Huayi Compressor Co., Ltd. develops, manufactures, and sells compressors both in China and internationally, with a market cap of CN¥5.18 billion.

Operations: The company's primary revenue stream is derived from the sale of compressors. It experienced a net profit margin of 4.5% in the last reporting period, highlighting its profitability in the competitive compressor market.

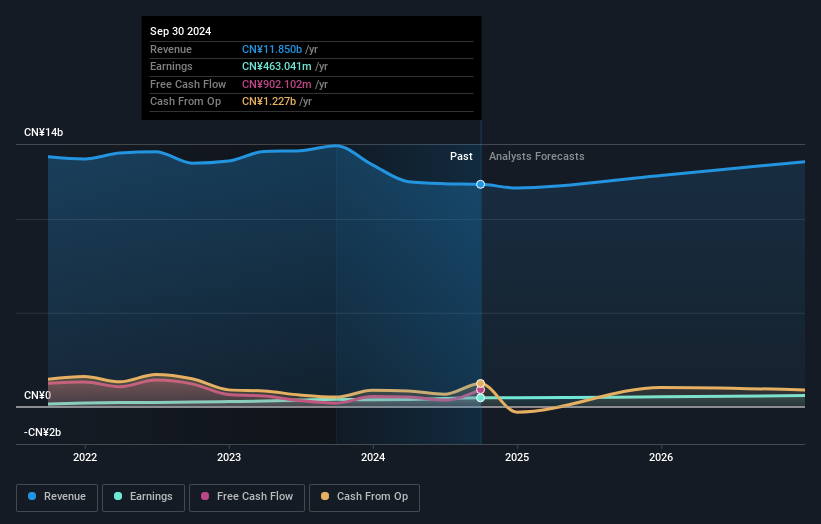

Changhong Huayi Compressor, a notable player in the machinery sector, has shown robust earnings growth of 17.8% over the past year, outpacing its industry peers. Despite a drop in sales to CNY 9.69 billion from CNY 10.73 billion last year, net income rose to CNY 375.94 million from CNY 275.05 million, reflecting improved profitability with basic earnings per share climbing to CNY 0.54 from CNY 0.40 previously reported. The company seems well-positioned financially with more cash than total debt and a reduced debt-to-equity ratio of 25%, suggesting prudent financial management and potential for continued growth.

Shenzhen JT Automation EquipmentLtd (SZSE:300400)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen JT Automation Equipment Co., Ltd specializes in the research, development, production, and sale of intelligent equipment and manufacturing systems, with a market cap of CN¥4.49 billion.

Operations: The primary revenue stream for Shenzhen JT Automation Equipment Co., Ltd comes from its Industrial Automation & Controls segment, generating CN¥720.86 million.

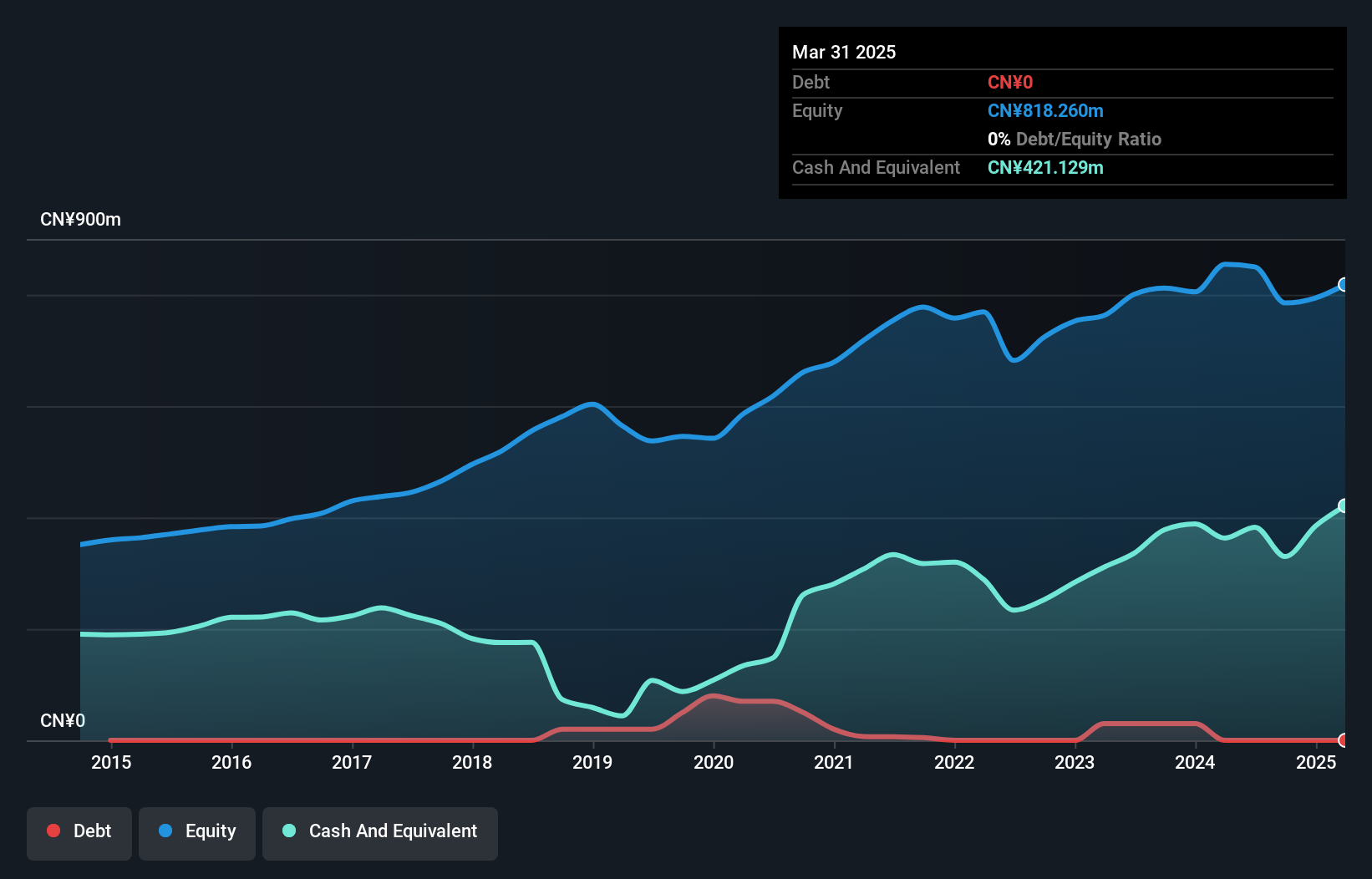

Shenzhen JT Automation Equipment, a nimble player in the machinery sector, shows promising financial health with its debt-free status and high-quality earnings. Over the past year, earnings grew by 8%, outpacing the industry's -0.4% growth rate, although they have decreased by 7.6% annually over five years. The company reported a net income of CNY 60 million for nine months ending September 2024, up from CNY 39 million last year, reflecting improved profitability with basic EPS rising to CNY 0.25 from CNY 0.16. Despite recent volatility in share price, free cash flow remains positive at CNY 111 million as of September end.

C Sun Mfg (TWSE:2467)

Simply Wall St Value Rating: ★★★★★★

Overview: C Sun Mfg Ltd. specializes in providing various processing equipment and has a market capitalization of NT$32.10 billion.

Operations: C Sun Mfg Ltd. generates revenue primarily from Zhisheng Industry, contributing NT$2.46 billion, and Suzhou Top Creation Machines Co Ltd., adding NT$1.44 billion to its financial performance. The company also derives income from Zhisheng Technology, amounting to NT$1.09 billion.

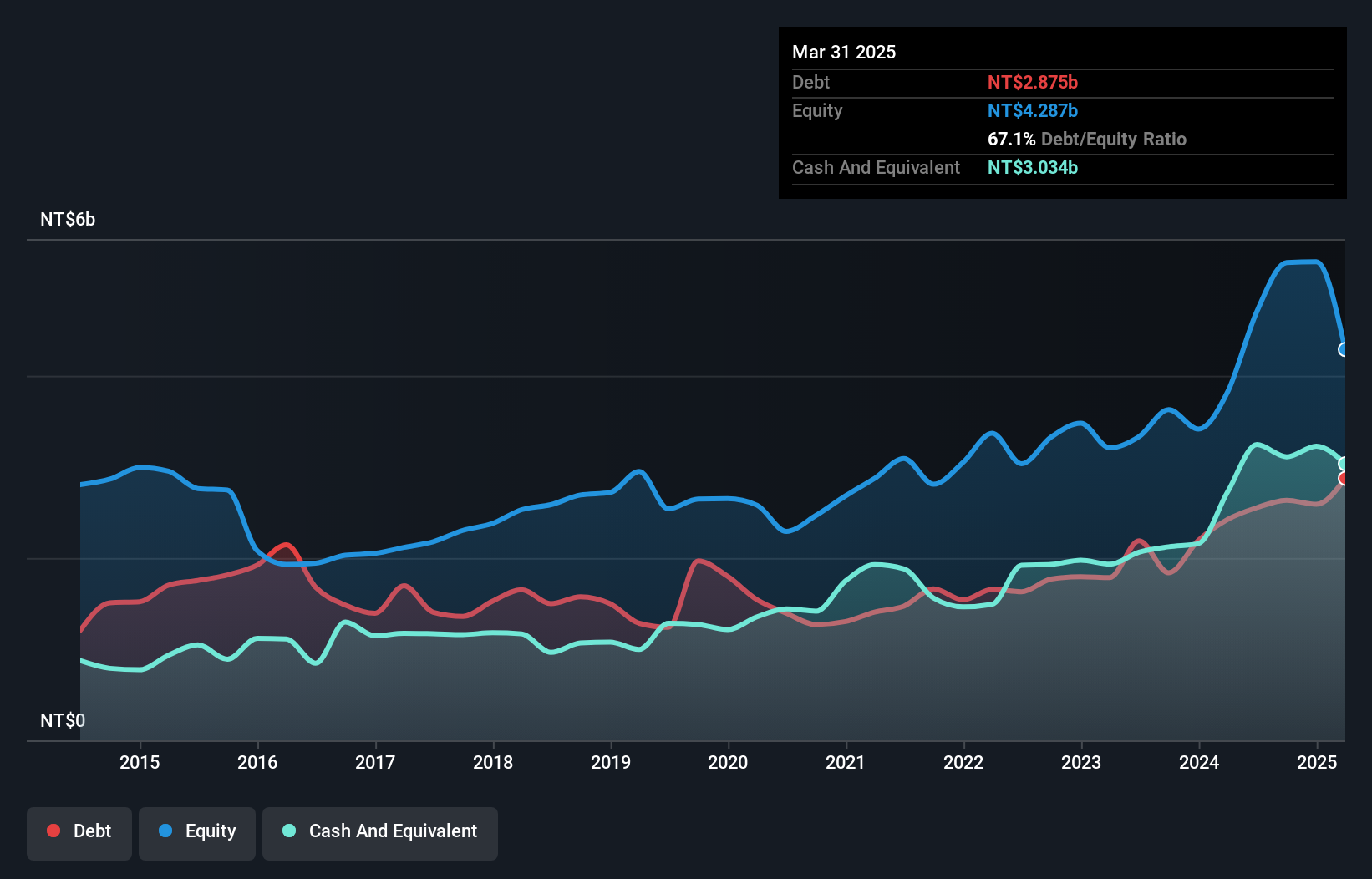

C Sun Mfg, a smaller player in the machinery sector, has shown notable performance with earnings growing by 23.5% over the past year, outpacing the industry average of 14.6%. The company's debt-to-equity ratio improved from 74.4% to 50.2% in five years, indicating better financial health. Despite its volatile share price recently, C Sun remains profitable with free cash flow positive at TWD 524 million for nine months ending September 2024 compared to TWD 376 million a year ago. A recent share repurchase program aims to buy back up to one million shares worth TWD 331 million by year's end.

- Click here to discover the nuances of C Sun Mfg with our detailed analytical health report.

Gain insights into C Sun Mfg's historical performance by reviewing our past performance report.

Make It Happen

- Embark on your investment journey to our 4640 Undiscovered Gems With Strong Fundamentals selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2467

C Sun Mfg

Provides various processing equipment in Taiwan, China, and internationally.

Flawless balance sheet with high growth potential.