As global markets react to China's robust stimulus measures and the U.S. sees record highs in key indices, small-cap stocks remain an intriguing investment opportunity amid this dynamic economic landscape. In this environment, identifying stocks with strong fundamentals becomes crucial for investors seeking stability and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mobile Telecommunications | NA | 4.98% | 0.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Share India Securities | 24.23% | 37.59% | 48.98% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

We'll examine a selection from our screener results.

United Bank for Africa (NGSE:UBA)

Simply Wall St Value Rating: ★★★★☆☆

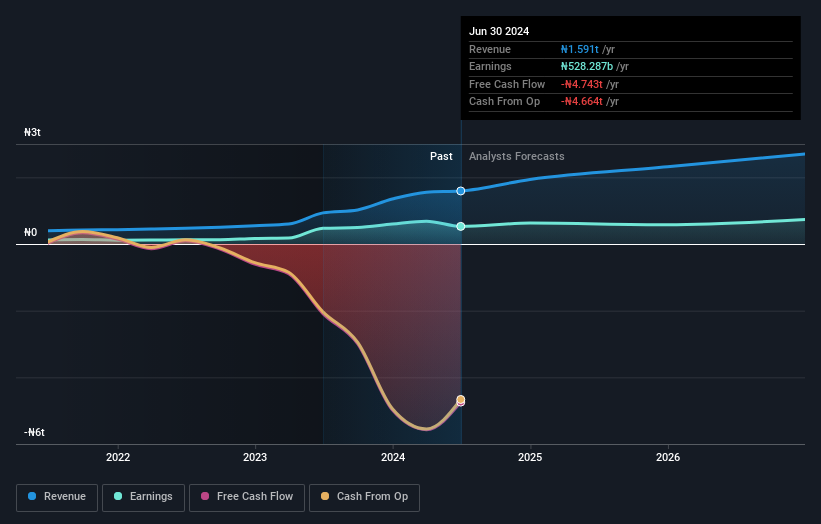

Overview: United Bank for Africa Plc, along with its subsidiaries, offers corporate, commercial, and retail banking services across Nigeria, other parts of Africa, and internationally with a market cap of NGN967.84 billion.

Operations: United Bank for Africa Plc generates revenue primarily from corporate, commercial, and retail banking services. The company's net profit margin is 19.56%.

UBA, with a P/E ratio of 1.4x, well below the NG market average of 7.5x, presents an intriguing opportunity. Total assets stand at NGN25,369.4B and total equity at NGN2,611.7B, indicating solid financial footing despite high bad loans (5.8%). Earnings growth over the past year was a remarkable 286%, outpacing the industry’s 122%. However, net income for H1 2024 dipped to NGN304M from NGN374M last year while EPS fell to NGN8.9 from NGN10.95.

- Unlock comprehensive insights into our analysis of United Bank for Africa stock in this health report.

Explore historical data to track United Bank for Africa's performance over time in our Past section.

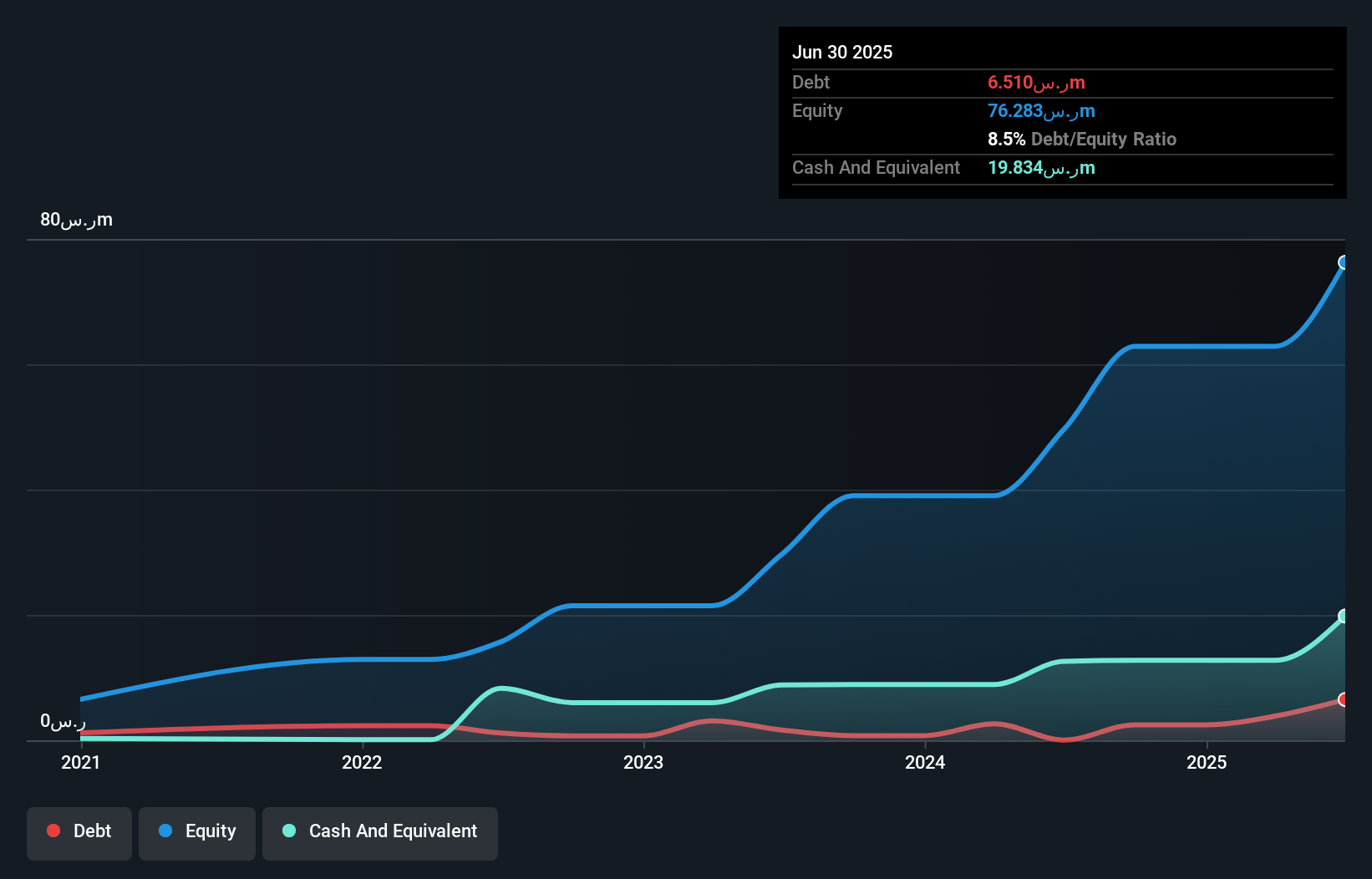

Edarat Communication and Information Technology (SASE:9557)

Simply Wall St Value Rating: ★★★★★☆

Overview: Edarat Communication and Information Technology Co. (SASE:9557) specializes in providing cloud services and data center engineering solutions, with a market cap of SAR1.30 billion.

Operations: The company generates its revenue primarily from cloud services (SAR38.44 million) and data center engineering services (SAR47.55 million).

Edarat Communication and Information Technology reported significant earnings growth, with net income for the second quarter at SAR 9.66 million, up from SAR 5.37 million a year ago. The company also secured a notable project with Almaviva Saudi Arabia worth SAR 7.14 million to provide cloud services for public transport systems over five years and six months. Additionally, Edarat's interest payments are well covered by EBIT, boasting a coverage ratio of 59.9x, indicating strong financial health.

- Click here to discover the nuances of Edarat Communication and Information Technology with our detailed analytical health report.

Learn about Edarat Communication and Information Technology's historical performance.

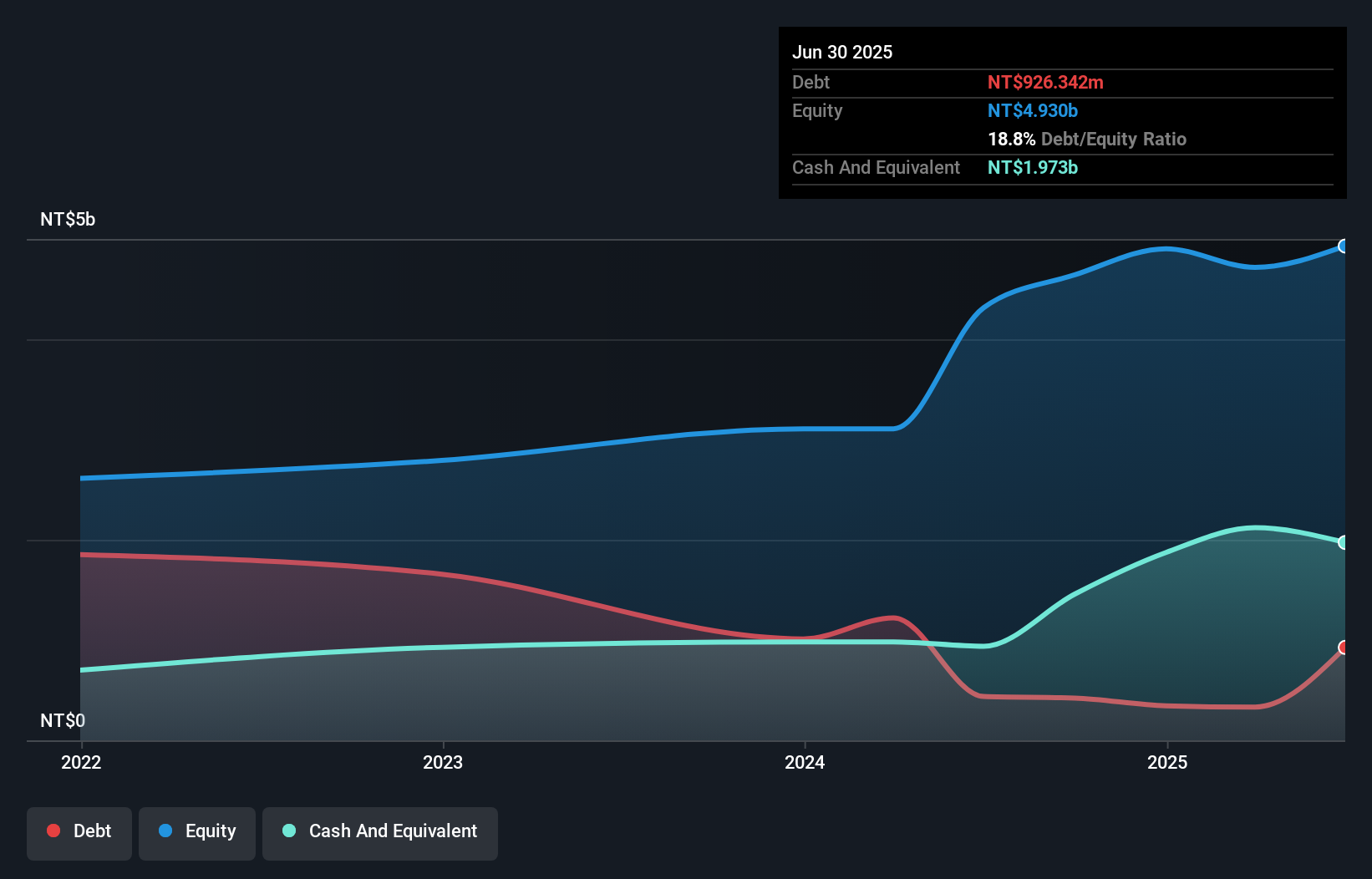

Syntec Technology (TPEX:7750)

Simply Wall St Value Rating: ★★★★★☆

Overview: Syntec Technology Co., Ltd. manufactures PC-based digital controllers specializing in machine tools and has a market cap of NT$36.63 billion.

Operations: Revenue primarily comes from the Machinery & Industrial Equipment segment, amounting to NT$9.58 billion.

Syntec Technology's recent performance has been impressive, with half-year sales reaching TWD 5.63 billion, up from TWD 3.93 billion a year ago. Net income soared to TWD 805.59 million compared to last year's TWD 320.87 million. Basic earnings per share rose to TWD 13.35 from TWD 5.43 previously, indicating strong profitability growth of over 91%. The company's EBIT covers interest payments by an astonishing factor of 86 times, highlighting robust financial health and high-quality earnings amidst industry competition.

- Click here and access our complete health analysis report to understand the dynamics of Syntec Technology.

Assess Syntec Technology's past performance with our detailed historical performance reports.

Key Takeaways

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4791 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NGSE:UBA

United Bank for Africa

Primarily provides corporate, commercial, and retail banking services in Nigeria, rest of Africa, and internationally.

Outstanding track record established dividend payer.