- Nigeria

- /

- Capital Markets

- /

- NGSE:UCAP

3 High-Yield Dividend Stocks Offering Up To 4.4%

Reviewed by Simply Wall St

As global markets react to cooling labor data and unexpected economic contractions, investors are seeking stability amidst the volatility. In such an environment, high-yield dividend stocks can offer a reliable income stream while potentially cushioning against market downturns. When selecting dividend stocks, it's crucial to consider companies with strong fundamentals and consistent payout histories, especially in uncertain times like these.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.41% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.13% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.08% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 7.22% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.25% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.21% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.73% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.79% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Innotech (TSE:9880) | 5.00% | ★★★★★★ |

Click here to see the full list of 2081 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Bangladesh Submarine Cables (DSE:BSCPLC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bangladesh Submarine Cables PLC provides bandwidth through submarine cable to operators offering voice and data services in Bangladesh and has a market cap of BDT 18.70 billion.

Operations: Bangladesh Submarine Cables PLC generates BDT 4.66 billion in revenue from providing communications services through submarine cables.

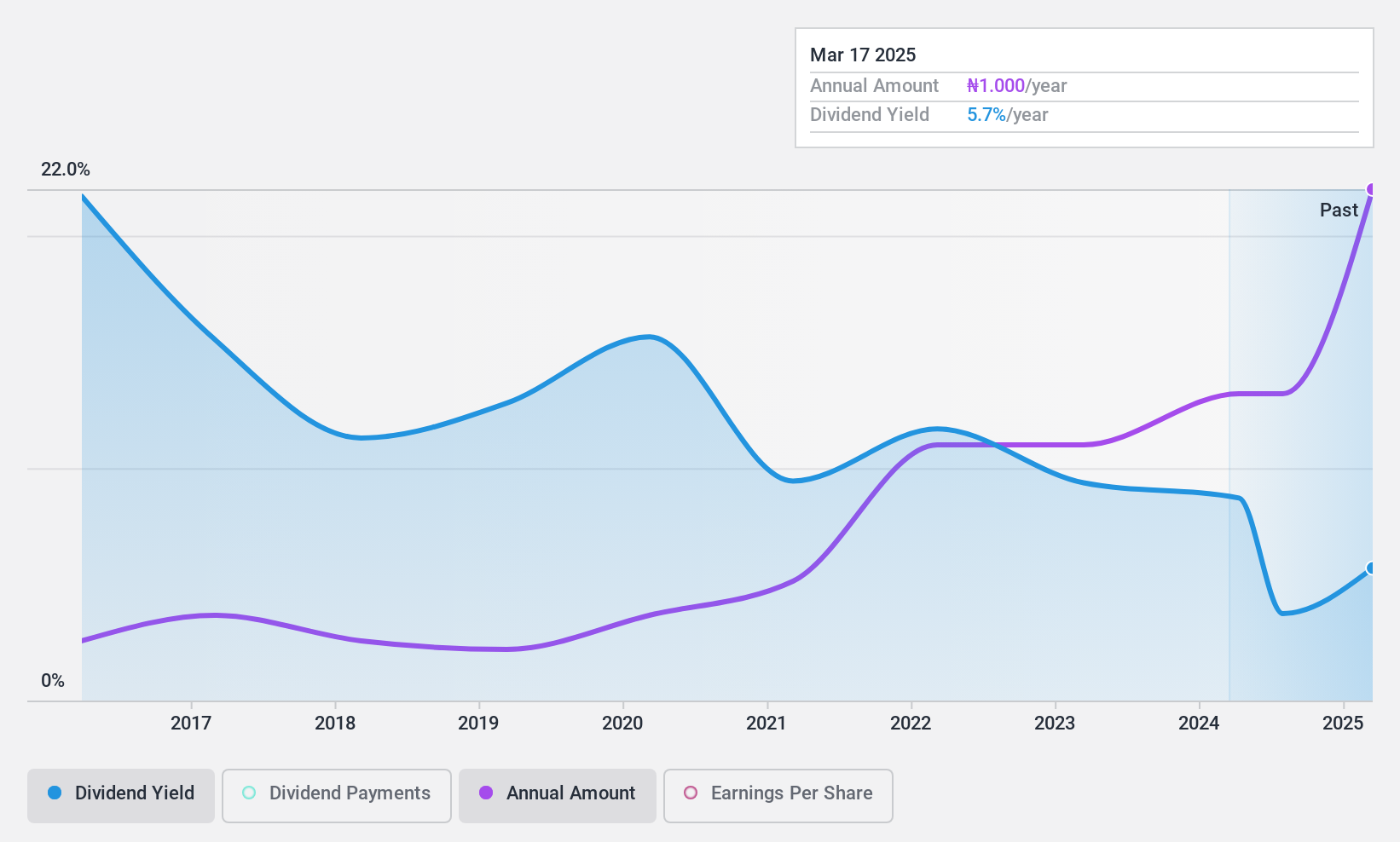

Dividend Yield: 4.5%

Bangladesh Submarine Cable Company Limited (BSCPLC) has shown volatility in its dividend payments over the past decade, with an unreliable growth pattern. Despite a reasonably low payout ratio of 35.4%, suggesting dividends are well covered by earnings, the high cash payout ratio of 96.4% indicates poor coverage by free cash flows. The current dividend yield of 4.5% places it in the top 25% of BD market payers, but sustainability remains a concern due to inadequate free cash flow coverage.

- Click here to discover the nuances of Bangladesh Submarine Cables with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Bangladesh Submarine Cables' share price might be too optimistic.

United Capital (NGSE:UCAP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Capital Plc, with a market cap of NGN263.70 billion, operates in Nigeria offering investment banking, portfolio management, securities trading, and trusteeship services through its subsidiaries.

Operations: United Capital Plc's revenue segments include brokerage services, which generated NGN23.88 billion.

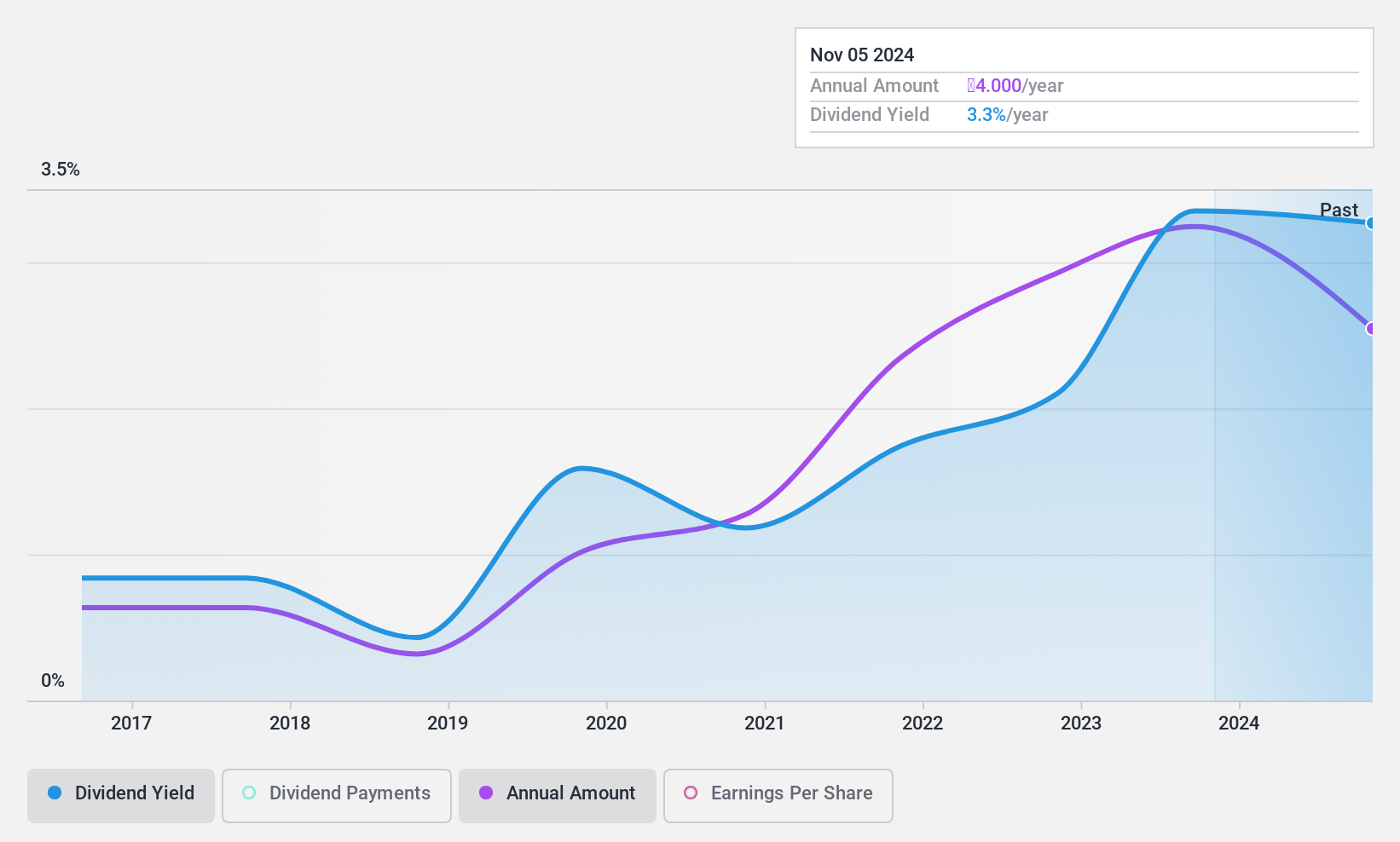

Dividend Yield: 4.1%

United Capital Plc's recent earnings report shows strong revenue growth to NGN 15.15 billion and net income of NGN 7.74 billion for H1 2024, indicating robust financial health. The company's dividend payout ratio of 74.7% suggests dividends are well-covered by earnings, while a low cash payout ratio of 5.2% ensures coverage by cash flows. However, its dividend history has been volatile and unreliable over the past decade, despite recent increases in payments.

- Dive into the specifics of United Capital here with our thorough dividend report.

- The valuation report we've compiled suggests that United Capital's current price could be inflated.

Xinjiang Xuefeng Sci-Tech(Group)Co.Ltd (SHSE:603227)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xinjiang Xuefeng Sci-Tech(Group)Co.,Ltd (ticker: SHSE:603227), with a market cap of CN¥7.49 billion, engages in the research and development, production, and sale of civil explosives through its subsidiaries.

Operations: Xinjiang Xuefeng Sci-Tech(Group)Co.,Ltd generates revenue primarily from the research, development, production, and sale of civil explosives.

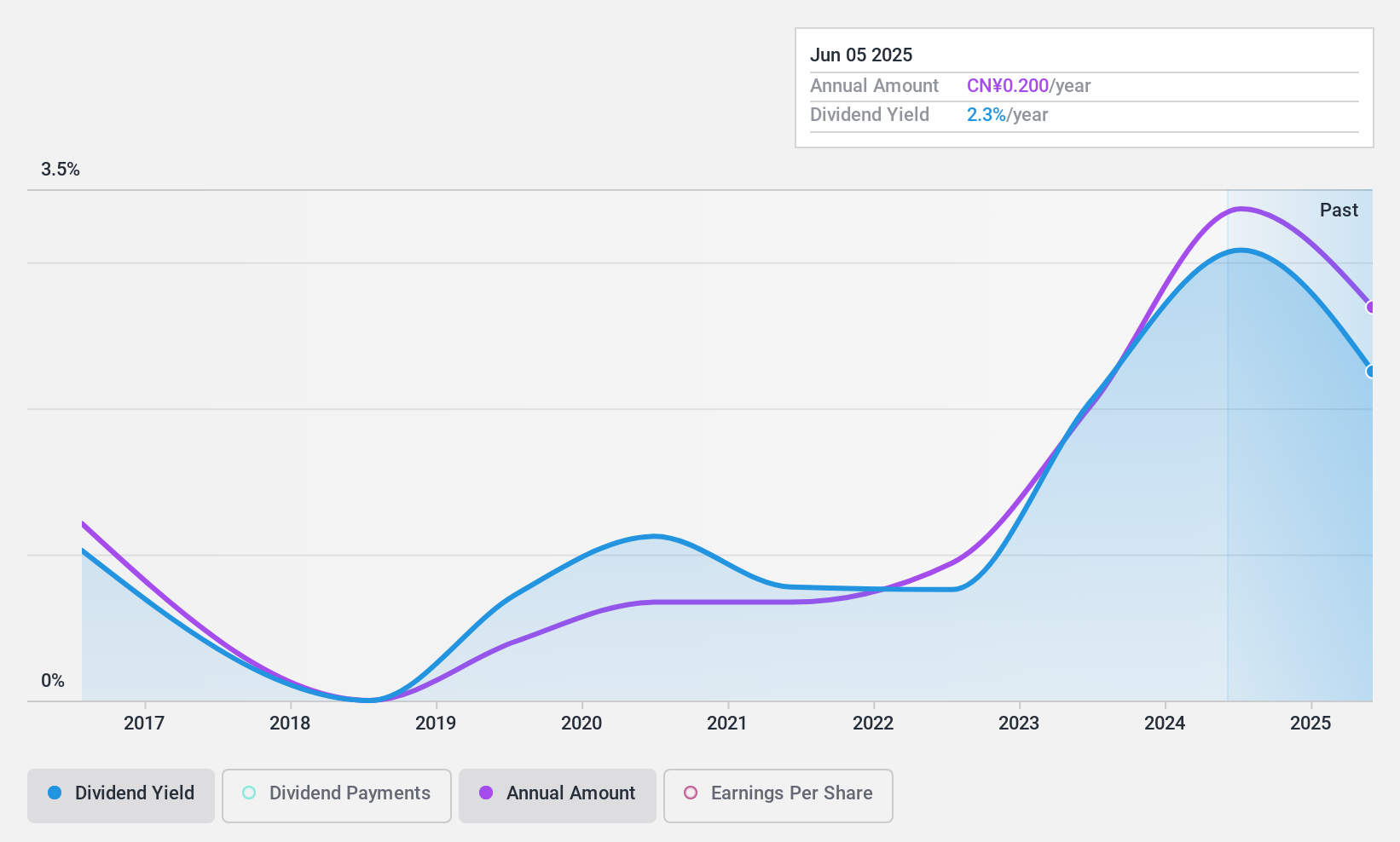

Dividend Yield: 3.5%

Xinjiang Xuefeng Sci-Tech(Group)Co.Ltd has a dividend yield of 3.49%, placing it in the top 25% of CN market payers. The company's dividends are well-covered by earnings (35.7% payout ratio) and cash flows (27.9% cash payout ratio). However, its dividend history is volatile, with payments over the past eight years being unreliable. Recent news includes a CNY 2.2 billion stake acquisition by Guangdong Hongda Holdings, pending regulatory approvals.

- Take a closer look at Xinjiang Xuefeng Sci-Tech(Group)Co.Ltd's potential here in our dividend report.

- Our valuation report here indicates Xinjiang Xuefeng Sci-Tech(Group)Co.Ltd may be undervalued.

Where To Now?

- Dive into all 2081 of the Top Dividend Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NGSE:UCAP

United Capital

Provides investment banking, portfolio management, securities trading, and trusteeship services in Nigeria.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives