- Nigeria

- /

- Electric Utilities

- /

- NGSE:GEREGU

Undiscovered Gems to Watch This September 2024

Reviewed by Simply Wall St

As global markets navigate a period of economic adjustments, including interest rate cuts by the ECB and anticipated changes from the Fed, small-cap stocks have shown resilience with indices like the S&P 600 rebounding from recent declines. This environment presents an intriguing opportunity to explore lesser-known stocks that could benefit from these shifting dynamics. When considering potential investments in this climate, it's crucial to look for companies demonstrating strong fundamentals and growth potential despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Formula Systems (1985) | 35.62% | 10.91% | 13.89% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Central Cooperative Bank AD | 4.88% | 4.12% | 8.95% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Zahrat Al Waha For Trading | 80.05% | 4.97% | -15.99% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Anadolu Anonim Türk Sigorta Sirketi (IBSE:ANSGR)

Simply Wall St Value Rating: ★★★★★★

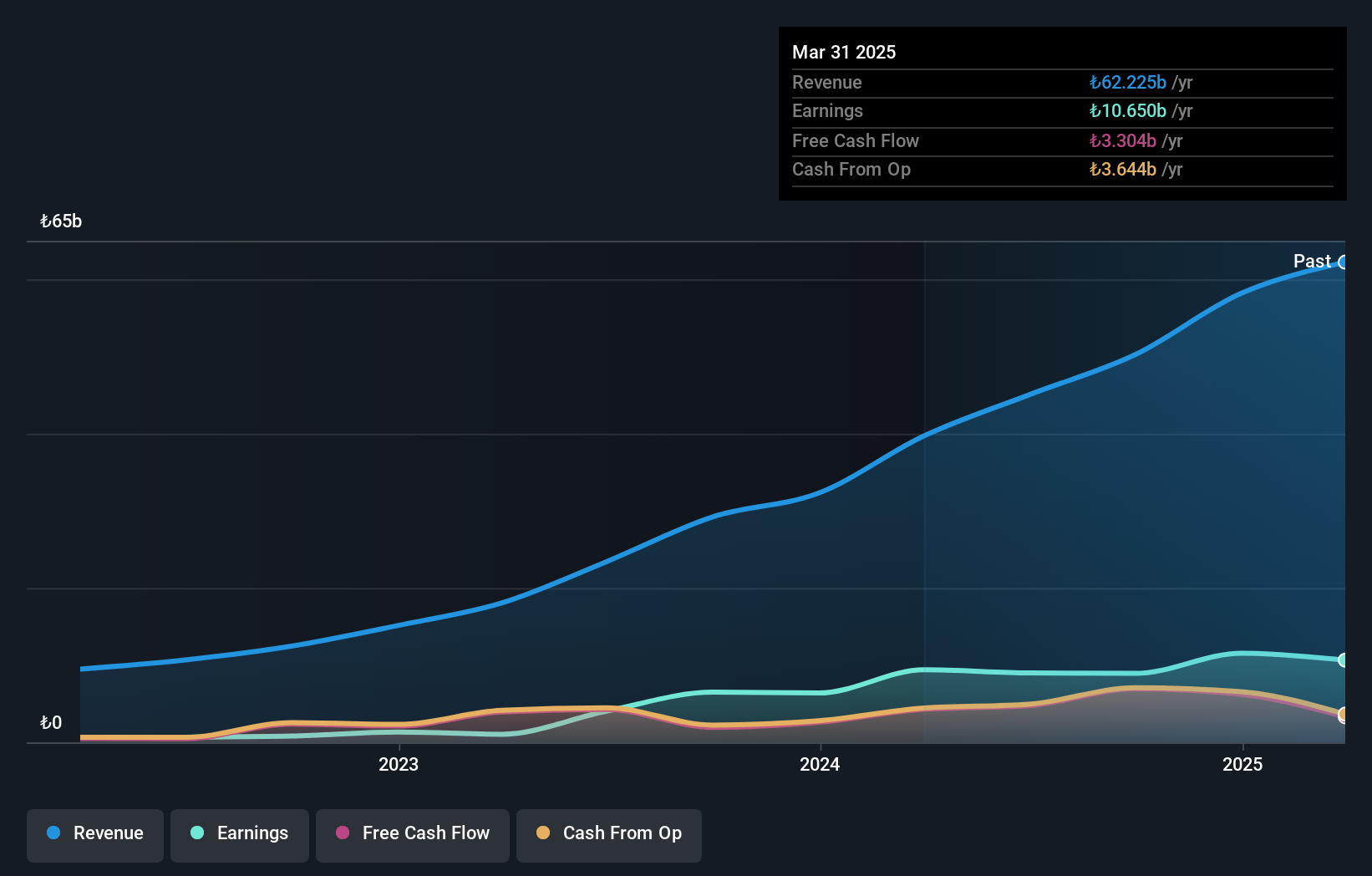

Overview: Anadolu Anonim Türk Sigorta Sirketi offers non-life insurance products in Turkey and has a market cap of TRY40.50 billion.

Operations: Anadolu Anonim Türk Sigorta Sirketi generates revenue primarily from motor vehicles, motor vehicles liability, and disease/health insurance segments, with the largest contributions coming from motor vehicles (TRY11.73 billion) and undistributed revenues (TRY20.13 billion).

Anadolu Anonim Türk Sigorta Sirketi, a promising player in the insurance sector, has shown remarkable earnings growth of 122.8% over the past year. The company reported net income of TRY 2.82 billion for Q2 2024 and TRY 5.68 billion for the first six months, compared to TRY 3.21 billion and TRY 3.07 billion respectively from the previous year. With a P/E ratio at just 4.5x against Turkey's market average of 16.1x, it offers significant value potential while being debt-free and generating positive free cash flow consistently.

- Click to explore a detailed breakdown of our findings in Anadolu Anonim Türk Sigorta Sirketi's health report.

Learn about Anadolu Anonim Türk Sigorta Sirketi's historical performance.

Geregu Power (NGSE:GEREGU)

Simply Wall St Value Rating: ★★★★★☆

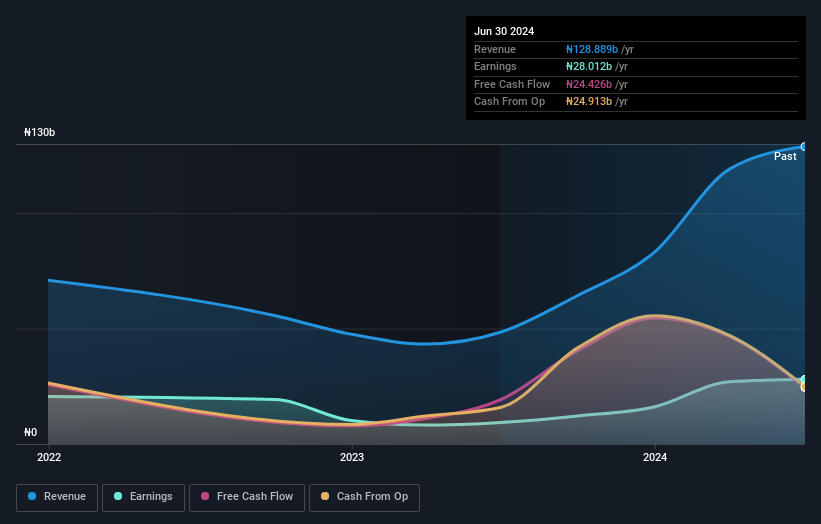

Overview: Geregu Power Plc engages in the generation and sale of electric power in Nigeria, with a market cap of ₦2.88 trillion.

Operations: Geregu Power generates revenue primarily from its non-regulated utility segment, amounting to ₦128.89 billion. The company's market cap stands at ₦2.88 trillion.

Geregu Power has shown impressive financial performance, with earnings growing by 199.9% over the past year, surpassing the Electric Utilities industry's 11.9%. The company's debt to equity ratio rose significantly from 2.5% to 128% in five years, yet its net debt to equity ratio is a satisfactory 32.1%. Recent results for Q2 and H1 of 2024 revealed sales of NGN30.25 billion and NGN80.68 billion respectively, with net income at NGN5.55 billion and NGN20.01 billion for each period.

- Take a closer look at Geregu Power's potential here in our health report.

Review our historical performance report to gain insights into Geregu Power's's past performance.

Mercuries Life Insurance (TWSE:2867)

Simply Wall St Value Rating: ★★★★☆☆

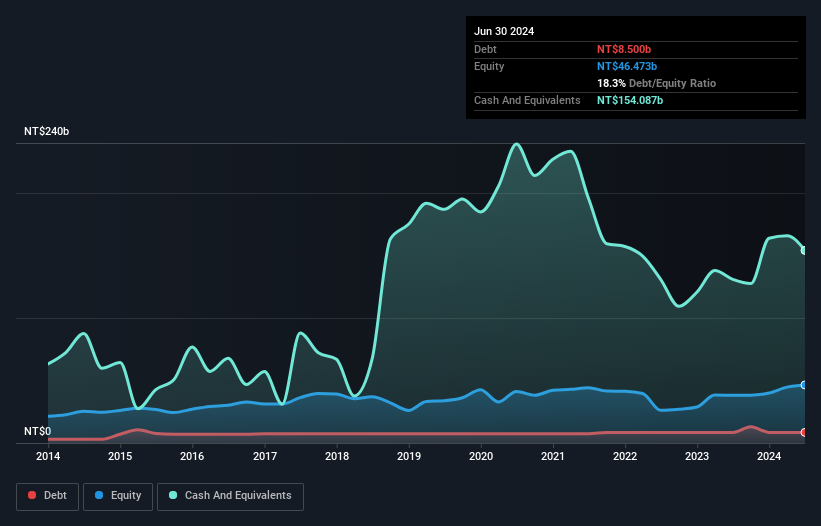

Overview: Mercuries Life Insurance Company Ltd. offers life insurance products in Taiwan and has a market cap of NT$41.63 billion.

Operations: Mercuries Life Insurance generates revenue primarily from its life insurance business, amounting to NT$92.82 billion.

Mercuries Life Insurance, a smaller player in the insurance sector, has shown significant turnaround this year. The company reported net income of TWD 3.26 billion for Q2 2024, reversing a net loss of TWD 1.72 billion from the same period last year. Basic earnings per share improved to TWD 0.64 from a loss per share of TWD 0.37 previously. Additionally, its debt-to-equity ratio decreased from 22% to 18% over five years, reflecting prudent financial management and reduced leverage.

Where To Now?

- Unlock our comprehensive list of 4742 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NGSE:GEREGU

Geregu Power

Engages in the generation and sale of electric power in Nigeria.

Solid track record with excellent balance sheet.