As global markets react to the Federal Reserve's recent rate cut, U.S. stocks have surged to new highs, reflecting investor optimism about prolonged monetary easing. Amid this backdrop of economic shifts and market rallies, dividend stocks present a compelling opportunity for those seeking steady income and potential growth. In today's article, we will explore Fidelity Bank and two other leading dividend stocks that stand out in the current market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.79% | ★★★★★★ |

| Globeride (TSE:7990) | 4.34% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.16% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.83% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.15% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.87% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.21% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.26% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.75% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.94% | ★★★★★★ |

Click here to see the full list of 2104 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Fidelity Bank (NGSE:FIDELITYBK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fidelity Bank Plc offers a range of banking products and services to both corporate and individual customers in Nigeria, with a market cap of NGN478.72 billion.

Operations: Fidelity Bank Plc generates revenue from its diverse banking products and services offered to corporate and individual clients in Nigeria.

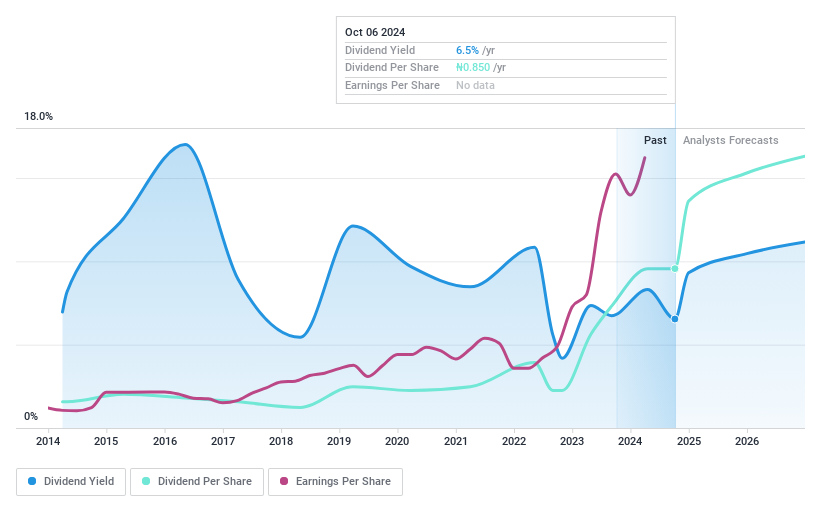

Dividend Yield: 6.2%

Fidelity Bank's dividend yield (6.25%) is slightly below the top 25% of dividend payers in the NG market (6.64%). However, its low payout ratio (23.6%) ensures dividends are well covered by earnings and forecasted to remain sustainable over the next three years (24.9%). Despite a history of volatile and unreliable dividend payments, recent earnings growth at 34.3% annually over five years indicates potential for future stability and growth in dividends.

- Dive into the specifics of Fidelity Bank here with our thorough dividend report.

- According our valuation report, there's an indication that Fidelity Bank's share price might be on the expensive side.

LH Shopping Centers Leasehold Real Estate Investment Trust (SET:LHSC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LH Shopping Centers Leasehold Real Estate Investment Trust, managed by Land and Houses Fund Management Company Limited, focuses on investing in shopping centers and has a market cap of THB5.66 billion.

Operations: Revenue from rental of immovable properties for LH Shopping Centers Leasehold Real Estate Investment Trust is THB1.36 billion.

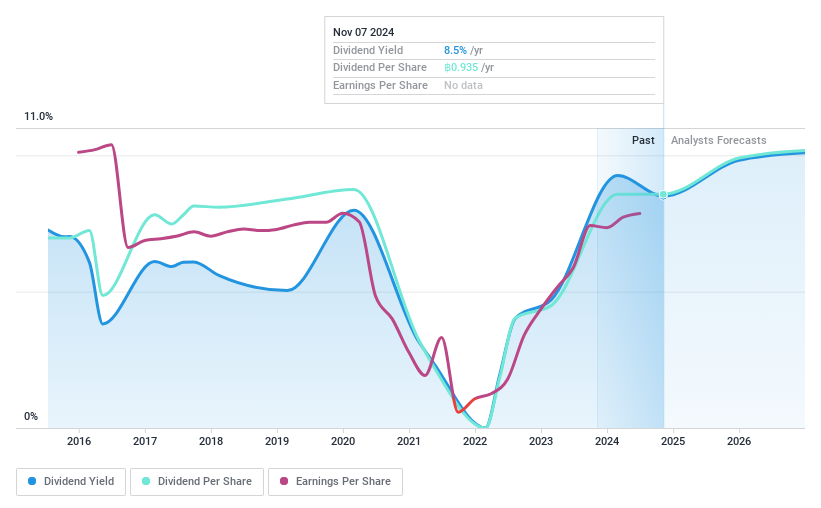

Dividend Yield: 8.1%

LH Shopping Centers Leasehold Real Estate Investment Trust (LHSC) has an attractive dividend yield of 8.06%, placing it in the top 25% of dividend payers in the Thai market. Despite a history of volatile and unreliable payments, recent earnings growth (40.7% over the past year) supports its current payout ratio (79.5%). Dividends are covered by both earnings and cash flows, with recent increases reflecting positive financial performance, including Q2 net income rising to THB 153.37 million from THB 141.37 million year-on-year.

- Delve into the full analysis dividend report here for a deeper understanding of LH Shopping Centers Leasehold Real Estate Investment Trust.

- The analysis detailed in our LH Shopping Centers Leasehold Real Estate Investment Trust valuation report hints at an deflated share price compared to its estimated value.

Young Fast Optoelectronics (TWSE:3622)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Young Fast Optoelectronics Co., Ltd. engages in the research, development, manufacture, and sale of various touch panels across Taiwan, the rest of Asia, and the Americas with a market cap of NT$9.16 billion.

Operations: Young Fast Optoelectronics Co., Ltd.'s revenue segments include NT$378.90 million from the Optoelectronic Business Group and NT$1.38 billion from the Mechanical and Electrical Business Group.

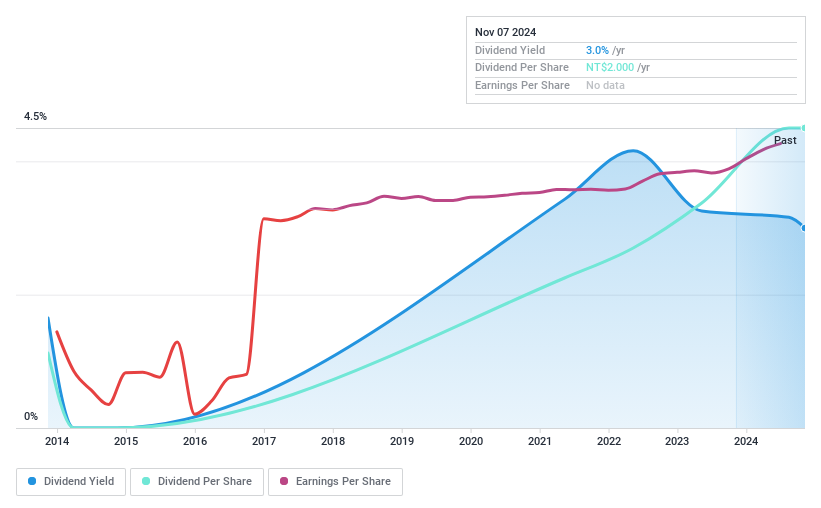

Dividend Yield: 3%

Young Fast Optoelectronics has shown significant earnings growth (79.4% over the past year) and recently announced a cash dividend of TWD 2 per share, payable on September 20, 2024. Despite trading at a substantial discount to its estimated fair value (63.7%), the company's dividend history has been volatile and unreliable over the past decade. However, current dividends are well-covered by both earnings (41.2% payout ratio) and cash flows (53.1% cash payout ratio).

- Get an in-depth perspective on Young Fast Optoelectronics' performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Young Fast Optoelectronics shares in the market.

Seize The Opportunity

- Dive into all 2104 of the Top Dividend Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NGSE:FIDELITYBK

Fidelity Bank

Provides various banking products and services to corporate and individual customers in Nigeria.

Solid track record with excellent balance sheet and pays a dividend.