Discover Nan Juen International Among 3 Stocks Possibly Trading Below Fair Value

Reviewed by Simply Wall St

As global markets navigate a mixed economic landscape, with U.S. consumer confidence dipping and European stocks experiencing modest gains, investors are keenly observing potential opportunities amidst the fluctuations. In this environment, identifying undervalued stocks becomes crucial as they may offer attractive entry points for those looking to capitalize on discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Globetronics Technology Bhd (KLSE:GTRONIC) | MYR0.585 | MYR1.17 | 49.9% |

| Decisive Dividend (TSXV:DE) | CA$5.93 | CA$11.83 | 49.9% |

| S Foods (TSE:2292) | ¥2737.00 | ¥5472.35 | 50% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.77 | €5.51 | 49.7% |

| Cettire (ASX:CTT) | A$1.51 | A$3.02 | 50% |

| Charter Hall Group (ASX:CHC) | A$14.35 | A$28.66 | 49.9% |

| Medley (TSE:4480) | ¥3835.00 | ¥7645.06 | 49.8% |

| Ally Financial (NYSE:ALLY) | US$36.01 | US$71.77 | 49.8% |

| Progress Software (NasdaqGS:PRGS) | US$65.15 | US$129.87 | 49.8% |

| SkyCity Entertainment Group (NZSE:SKC) | NZ$1.45 | NZ$2.89 | 49.8% |

Here we highlight a subset of our preferred stocks from the screener.

Nan Juen International (TPEX:6584)

Overview: Nan Juen International Co., Ltd. is involved in the research, development, manufacture, and trading of steel ball guide rails in Taiwan with a market cap of NT$11.21 billion.

Operations: The company's revenue primarily comes from the manufacture and sale of steel ball rails, amounting to NT$1.79 billion.

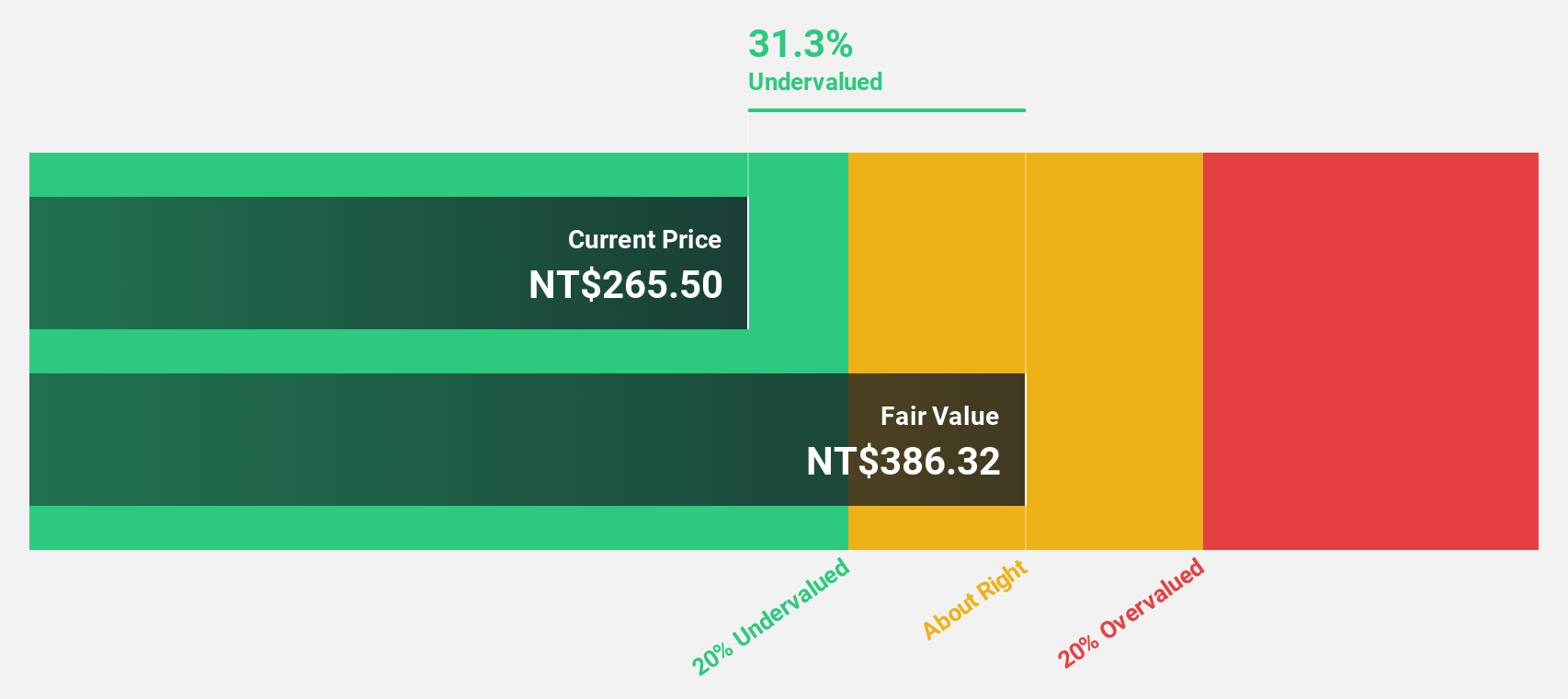

Estimated Discount To Fair Value: 35.4%

Nan Juen International is trading at NT$170, significantly below its estimated fair value of NT$263.22, indicating it may be undervalued based on cash flows. Despite high debt levels not fully covered by operating cash flow, the company has shown strong financial performance with a nine-month net income of NT$140.85 million compared to a loss last year. Earnings and revenue are expected to grow significantly above the market average over the next three years.

- Our earnings growth report unveils the potential for significant increases in Nan Juen International's future results.

- Delve into the full analysis health report here for a deeper understanding of Nan Juen International.

Japan Eyewear Holdings (TSE:5889)

Overview: Japan Eyewear Holdings Co., Ltd. operates in the planning, designing, manufacturing, wholesaling, and retailing of eyewear products in Japan with a market cap of ¥58.09 billion.

Operations: Revenue segments consist of Four Nines at ¥5.60 billion and Kaneko Glasses at ¥10.34 billion.

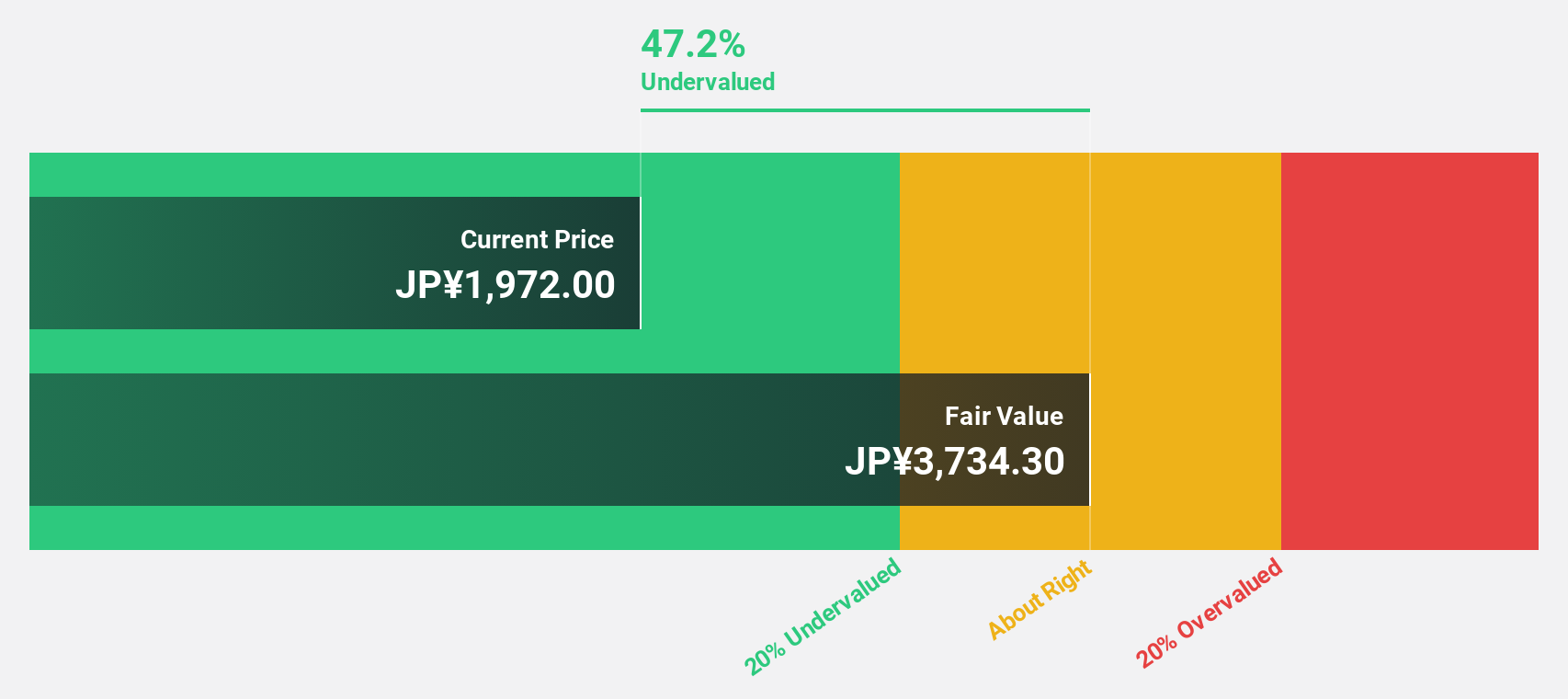

Estimated Discount To Fair Value: 25.8%

Japan Eyewear Holdings is trading at ¥2,410, which is 25.8% below its estimated fair value of ¥3,246.26, highlighting potential undervaluation based on cash flows. Despite high debt levels and recent share price volatility, the company revised its earnings guidance upward due to robust sales driven by strong inbound tourism. Earnings are forecast to grow at 15.24% annually—above the market average—and recent profit growth was substantial over the past year at a very large rate.

- Upon reviewing our latest growth report, Japan Eyewear Holdings' projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Japan Eyewear Holdings.

DTS (TSE:9682)

Overview: DTS Corporation offers systems integration services in Japan and has a market cap of ¥174.46 billion.

Operations: The company's revenue is derived from three main segments: Platform & Services at ¥29.38 billion, Business & Solutions contributing ¥49.81 billion, and Technology & Solutions generating ¥42.66 billion.

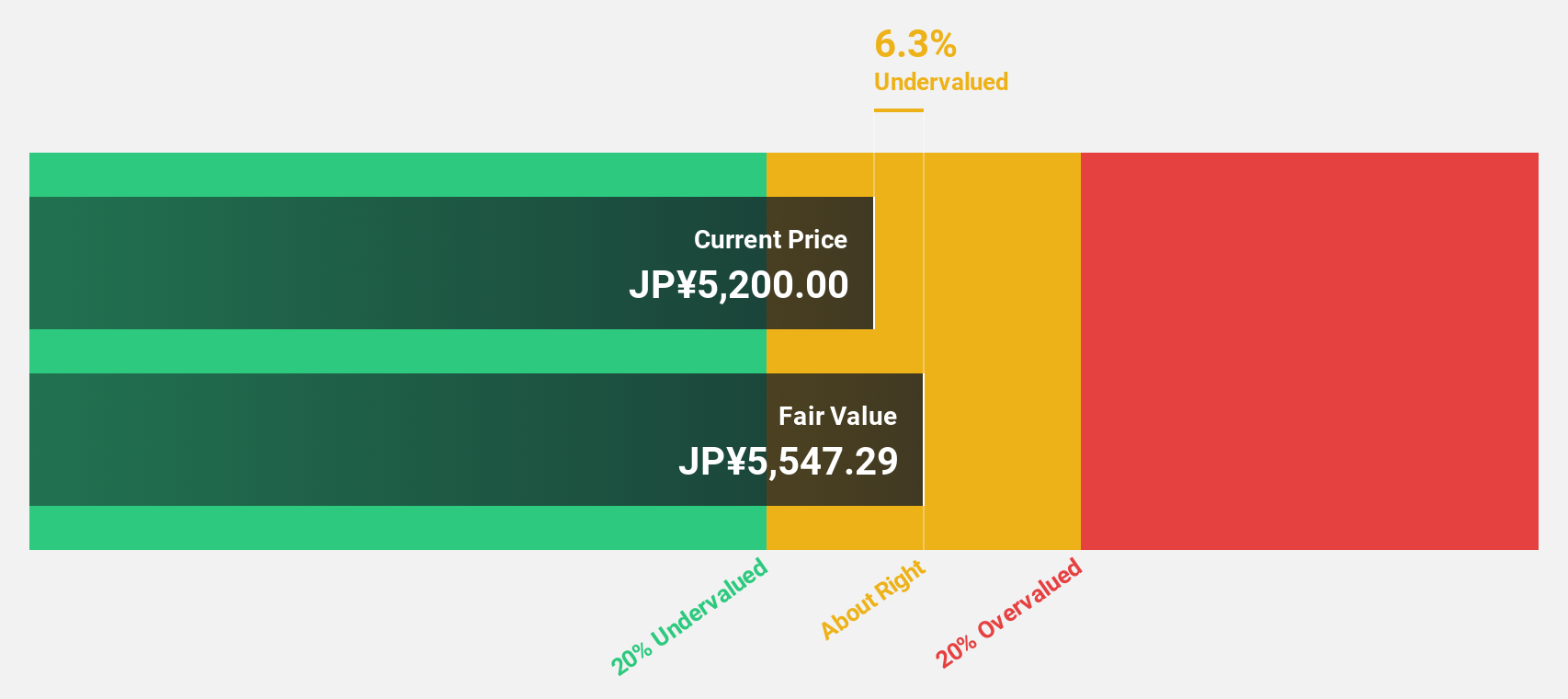

Estimated Discount To Fair Value: 12.9%

DTS Corporation is trading at ¥4,195, approximately 12.9% below its estimated fair value of ¥4,814.96, indicating potential undervaluation based on cash flows. Despite an unstable dividend track record and modest revenue growth forecast of 6.7% annually—above the Japanese market average—the company shows promising earnings growth projected at 12.3% per year. Recent share buybacks aim to improve capital efficiency and enhance shareholder returns by repurchasing shares worth ¥5 billion by March 2025.

- Our expertly prepared growth report on DTS implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on DTS' balance sheet by reading our health report here.

Seize The Opportunity

- Delve into our full catalog of 878 Undervalued Stocks Based On Cash Flows here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9682

Flawless balance sheet with reasonable growth potential and pays a dividend.