- Japan

- /

- Construction

- /

- TSE:1775

Undiscovered Gems Three Promising Stocks for January 2025

Reviewed by Simply Wall St

As we approach January 2025, global markets are navigating a landscape marked by mixed economic indicators and fluctuating consumer confidence, with major stock indexes experiencing moderate gains despite recent reversals. In this environment, identifying promising stocks requires a keen eye for companies that exhibit strong fundamentals and resilience amidst broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Lithium Chile | NA | nan | 42.01% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

GDH Supertime Group (SZSE:001338)

Simply Wall St Value Rating: ★★★★★☆

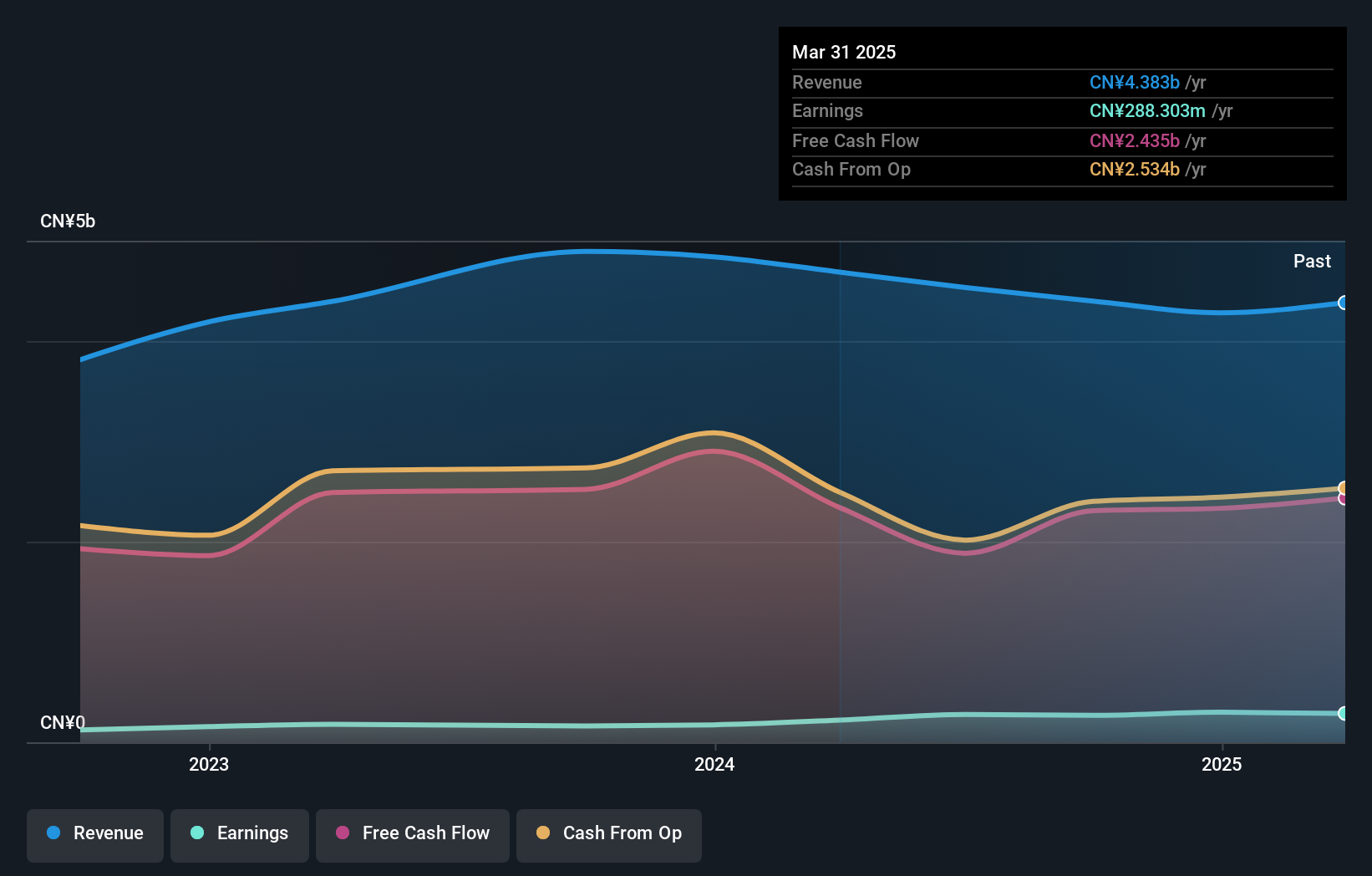

Overview: GDH Supertime Group Company Limited focuses on the development, production, and sale of malt to beer manufacturers in China, with a market cap of CN¥5.46 billion.

Operations: GDH Supertime Group generates revenue primarily from its beer-making segment, totaling CN¥4.15 billion. The company's financial performance is influenced by its cost structure and market dynamics within the malt industry in China.

GDH Supertime Group, a relatively small player in its sector, has demonstrated impressive financial health with earnings growth of 65.3% over the past year, outpacing the Beverage industry's 16.1%. The company is trading at a significant discount, valued at 87% below its estimated fair value. Despite an increase in the debt-to-equity ratio from 1% to 11.2% over five years, GDH Supertime maintains high-quality earnings and positive free cash flow. Recent reports show net income rising to CNY 219 million for nine months ending September 2024, up from CNY 125 million last year despite lower sales figures.

- Navigate through the intricacies of GDH Supertime Group with our comprehensive health report here.

Gain insights into GDH Supertime Group's past trends and performance with our Past report.

Fuji Furukawa Engineering & ConstructionLtd (TSE:1775)

Simply Wall St Value Rating: ★★★★★☆

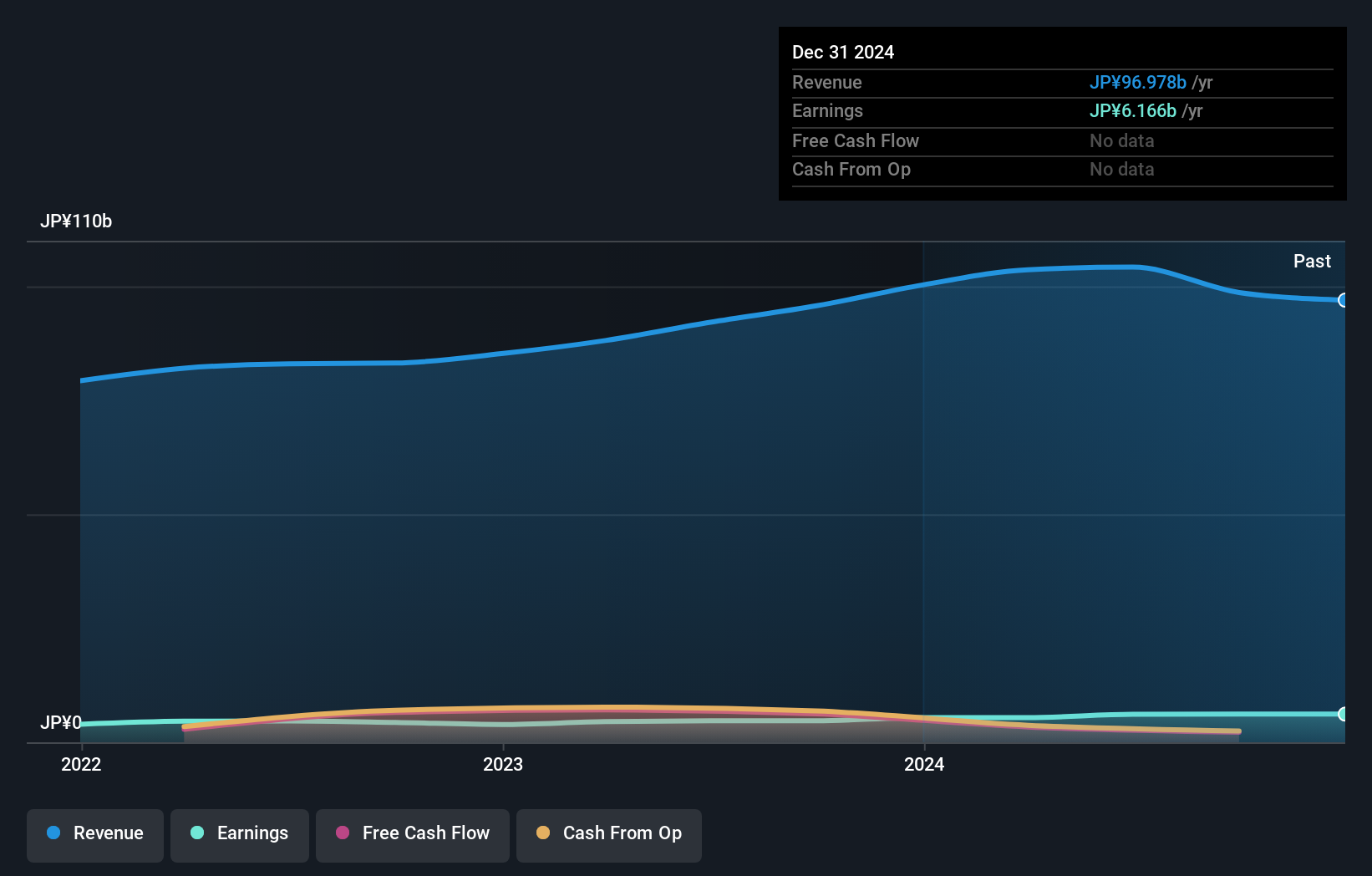

Overview: Fuji Furukawa Engineering & Construction Co. Ltd. operates in the engineering and construction industry, with a market cap of ¥71.13 billion.

Operations: The company generates revenue primarily through its engineering and construction services. It has a market capitalization of ¥71.13 billion, reflecting its position in the industry.

Fuji Furukawa Engineering & Construction Ltd. stands out with a solid financial footing, boasting a price-to-earnings ratio of 11.5x, which is attractive compared to the broader JP market's 13.7x. The company has demonstrated robust earnings growth of 30.5% over the past year, surpassing its industry peers who grew at 20.7%. Interest payments are well covered by EBIT at an impressive 987.6x, indicating strong financial health and stability in managing debt obligations. Recent news highlights Fuji Electric's acquisition plan to own nearly all shares by February 2025, potentially impacting future operations and market presence significantly.

Showa Sangyo (TSE:2004)

Simply Wall St Value Rating: ★★★★★☆

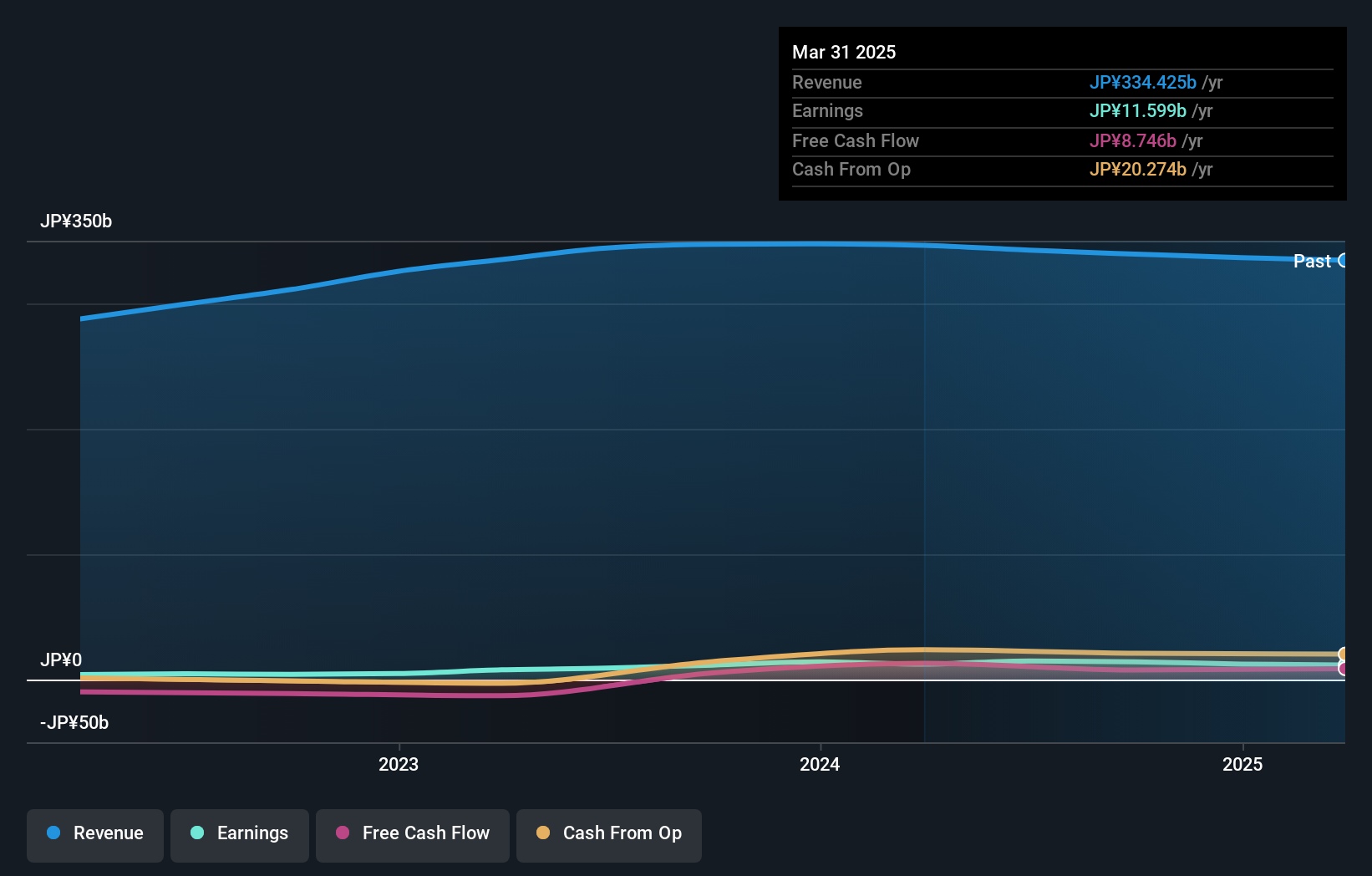

Overview: Showa Sangyo Co., Ltd. is a Japanese company engaged in the manufacturing, processing, and sale of food products with a market capitalization of ¥92.06 billion.

Operations: Showa Sangyo generates revenue primarily from its Food Business, which accounts for ¥281.35 billion, and its Feed Business, contributing ¥57.29 billion.

Showa Sangyo, a promising player in the food industry, has seen its earnings grow by 23% over the past year, outpacing the industry's average of 19.5%. The company is trading at 21.2% below its estimated fair value, indicating potential undervaluation. With a net debt to equity ratio of 35.3%, it maintains satisfactory leverage levels while generating positive free cash flow. Recent events include a dividend increase to JPY 40 per share for Q2 FY2025 from JPY 30 last year, reflecting confidence in financial stability and future growth prospects despite forecasts suggesting an average earnings decline of 6.8% annually for the next three years.

- Get an in-depth perspective on Showa Sangyo's performance by reading our health report here.

Gain insights into Showa Sangyo's historical performance by reviewing our past performance report.

Next Steps

- Navigate through the entire inventory of 4638 Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1775

Fuji Furukawa Engineering & ConstructionLtd

Fuji Furukawa Engineering & Construction Co.Ltd.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives