- Japan

- /

- Household Products

- /

- TSE:4985

Undiscovered Gems Three Promising Stocks To Explore In January 2025

Reviewed by Simply Wall St

As global markets wrapped up the year with moderate gains, driven largely by large-cap growth stocks, attention has turned to the potential of small-cap companies amid declining consumer confidence and mixed economic indicators. Despite these challenges, opportunities may arise in lesser-known stocks that possess strong fundamentals and resilience in a fluctuating market environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Lithium Chile | NA | nan | 42.01% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Corporación Actinver S. A. B. de C. V (BMV:ACTINVR B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Corporación Actinver, S. A. B. de C. V., operates through its subsidiaries to offer financial and investment banking services to businesses and individuals both in Mexico and internationally, with a market capitalization of MX$9.52 billion.

Operations: Actinver generates revenue primarily through financial and investment banking services, with a focus on providing these services to both businesses and individuals. The company's net profit margin has shown notable trends over recent periods, reflecting its operational efficiency in managing costs relative to income.

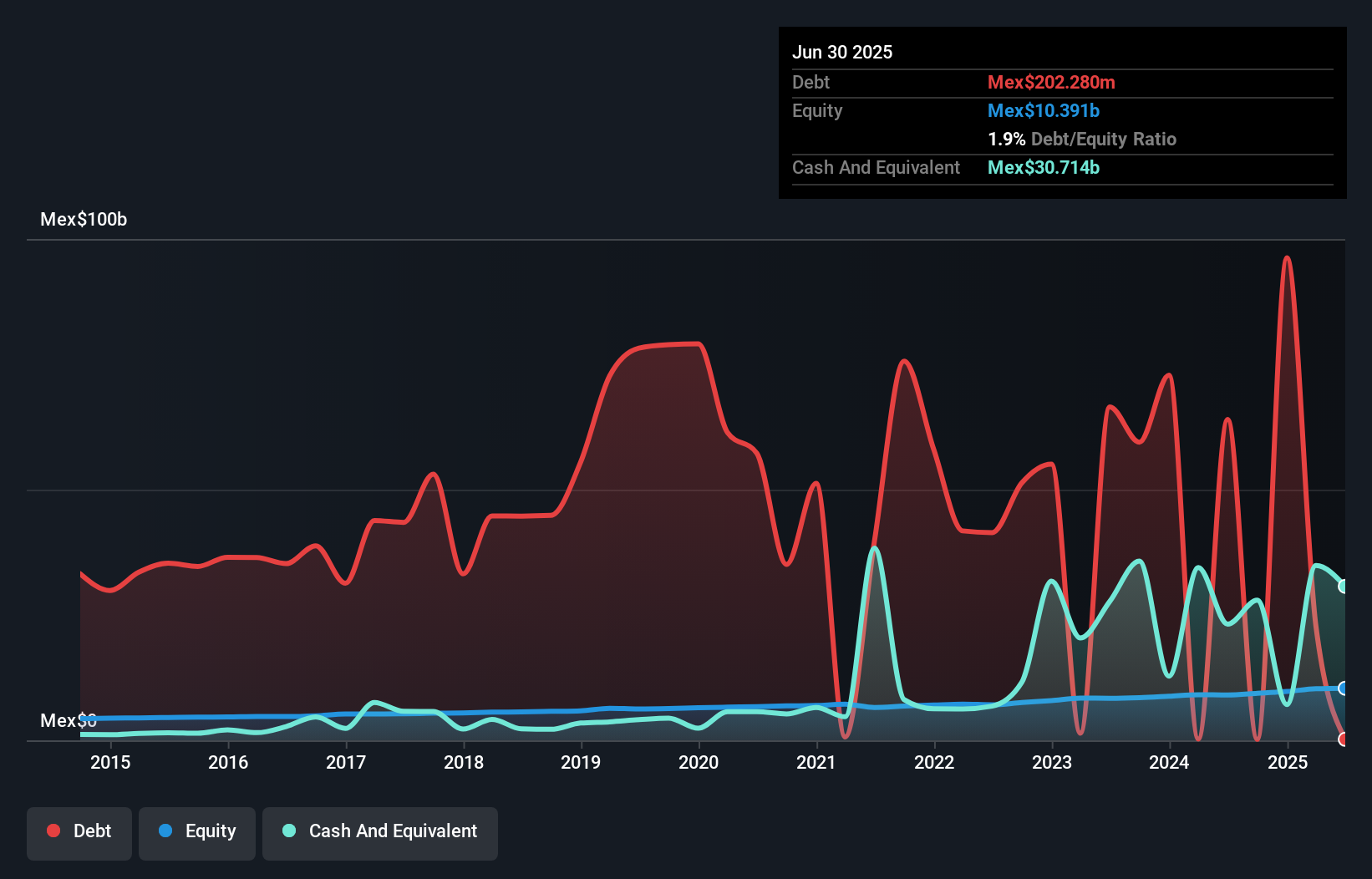

Actinver, a financial player with MX$153 billion in assets and MX$9.4 billion in equity, shows a mixed profile. Despite having a high level of bad loans at 3.7%, it maintains a sufficient allowance for these at 108%. The company reported earnings growth of 9.3% last year, outpacing the industry average of 6.7%, and is forecasted to grow by 10.73% annually. Trading at a price-to-earnings ratio of 7.4x compared to the market's 11.6x suggests good value relative to peers, yet its reliance on higher-risk funding sources could be concerning for some investors.

Advanced Echem Materials (TPEX:4749)

Simply Wall St Value Rating: ★★★★★☆

Overview: Advanced Echem Materials Company Limited specializes in developing and manufacturing special chemical materials for semiconductor and display applications in Taiwan, with a market capitalization of NT$55.71 billion.

Operations: The primary revenue stream for Advanced Echem Materials is from electronic components and parts, generating NT$2.99 billion. The company's market capitalization stands at NT$55.71 billion.

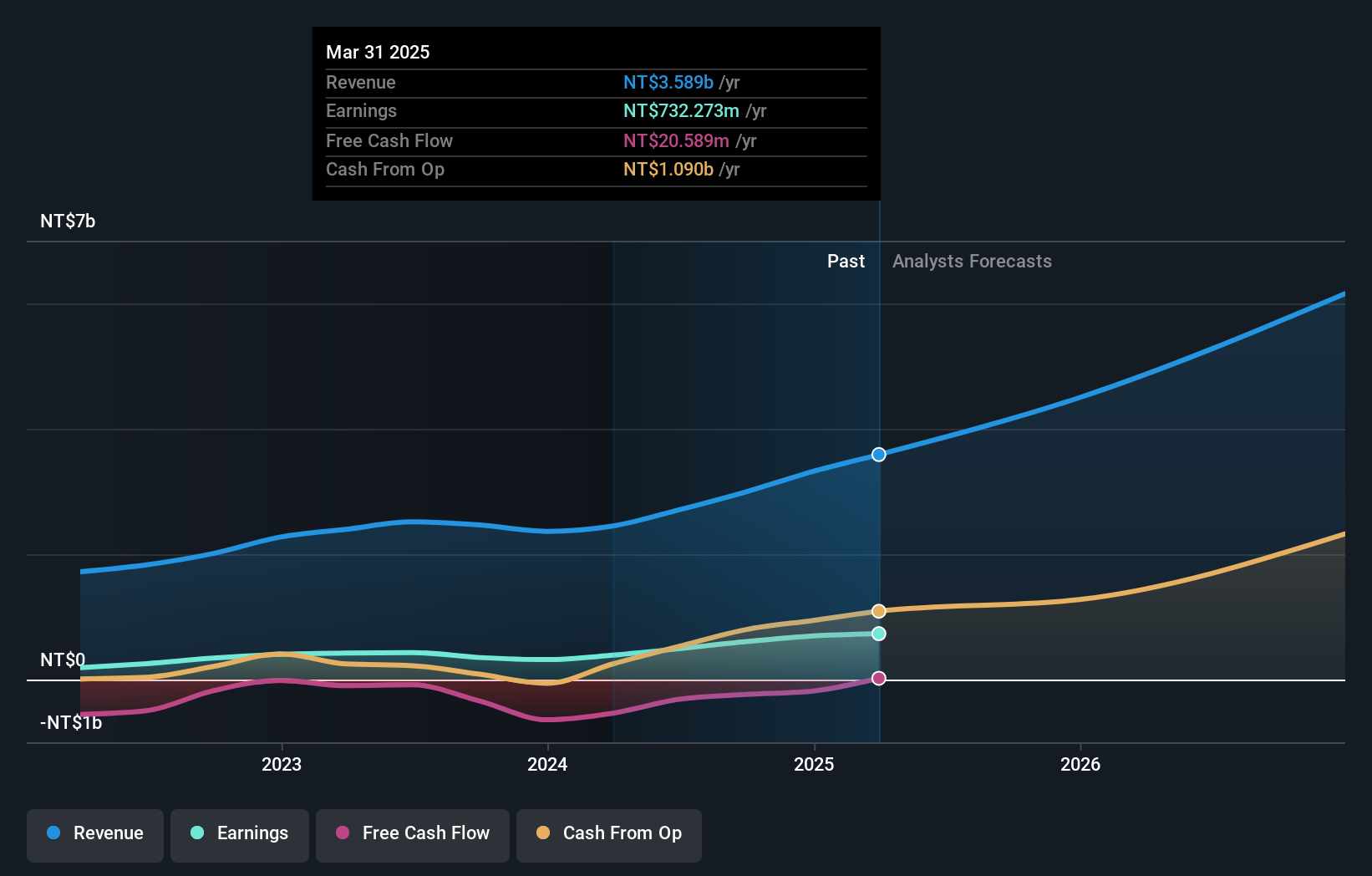

Advanced Echem Materials, a small player in its field, has shown impressive financial performance with earnings growing by 72.5% over the past year, outpacing the semiconductor industry's 5.9%. The company's debt to equity ratio has increased from 28.3% to 54% over five years, yet it maintains a satisfactory net debt to equity ratio of 35.1%. Recent earnings announcements reveal third-quarter sales of TWD 856.82 million and net income of TWD 155.72 million, both significantly higher than last year's figures. Additionally, they filed a follow-on equity offering worth TWD 4.81 billion in December 2024.

Earth (TSE:4985)

Simply Wall St Value Rating: ★★★★★★

Overview: Earth Corporation is involved in the manufacture, marketing, import, and export of pharmaceutical products, quasi-drug products, medical tools, and household products both in Japan and internationally with a market cap of ¥121.95 billion.

Operations: Earth Corporation generates revenue primarily from its Household Products Business, contributing ¥146.22 billion, followed by the Comprehensive Environment Hygiene Business at ¥31.25 billion.

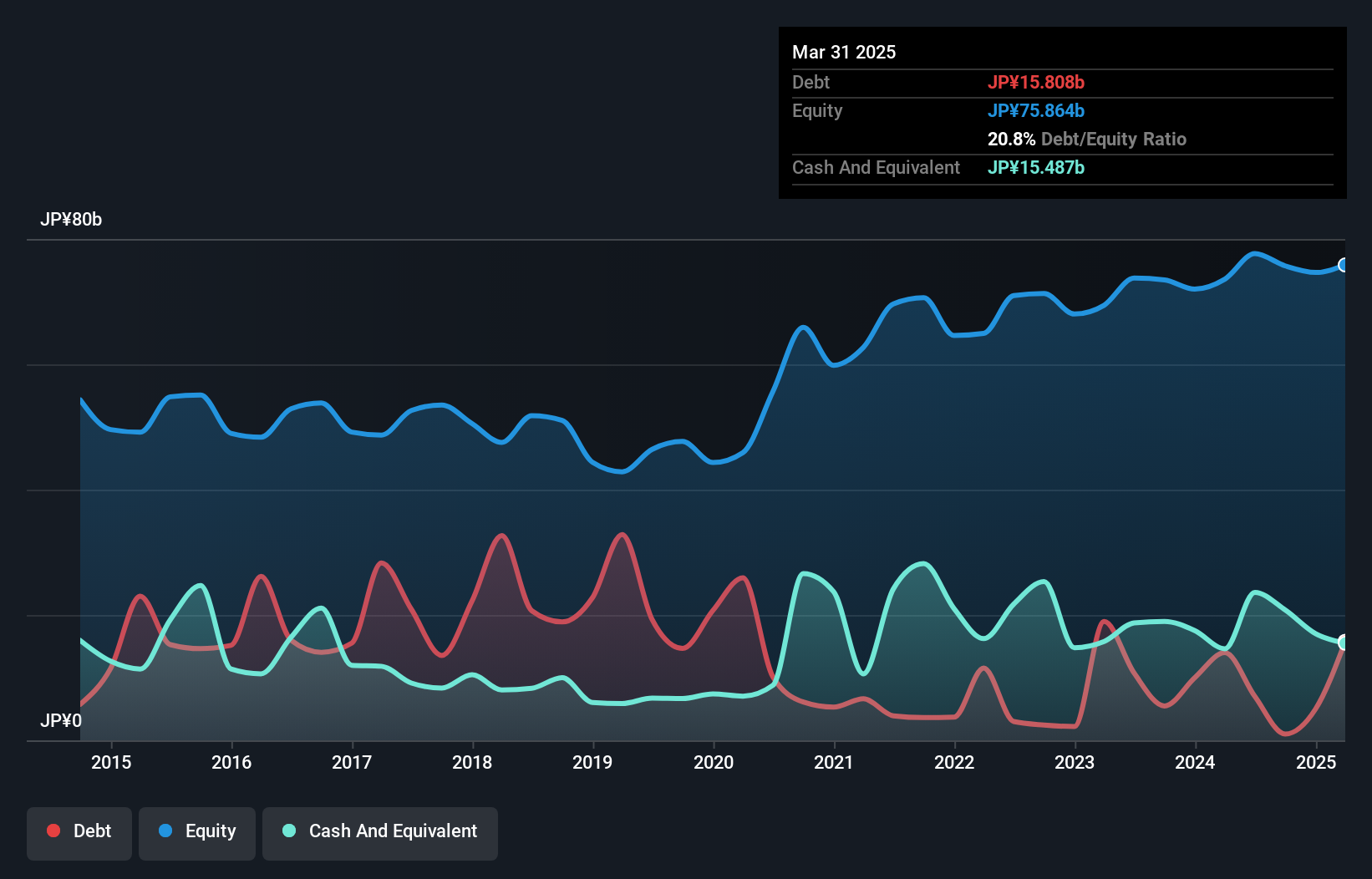

Earth Corporation, a promising player in its industry, has been showcasing impressive performance metrics. Over the past year, earnings grew by 56.9%, outpacing the Household Products industry's 25.4% growth rate. The company appears to have high-quality earnings and is trading at a valuation that's 16.3% below its estimated fair value. Furthermore, Earth has effectively managed its debt over time, reducing the debt-to-equity ratio from 30.7% to just 1.3% over five years, indicating prudent financial management and positioning it well for continued growth prospects in the coming years.

Summing It All Up

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4638 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Earth might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4985

Earth

Engages in manufacture, marketing, import, and export of household and insecticides products in Japan and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives