As global markets navigate a mixed economic landscape marked by declining consumer confidence and fluctuating indices, investors are increasingly seeking stability through dividend stocks. In such an environment, selecting stocks with strong dividend yields can provide a steady income stream, making them an attractive option for those looking to bolster their portfolios amidst uncertainty.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.33% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.66% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.26% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1946 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

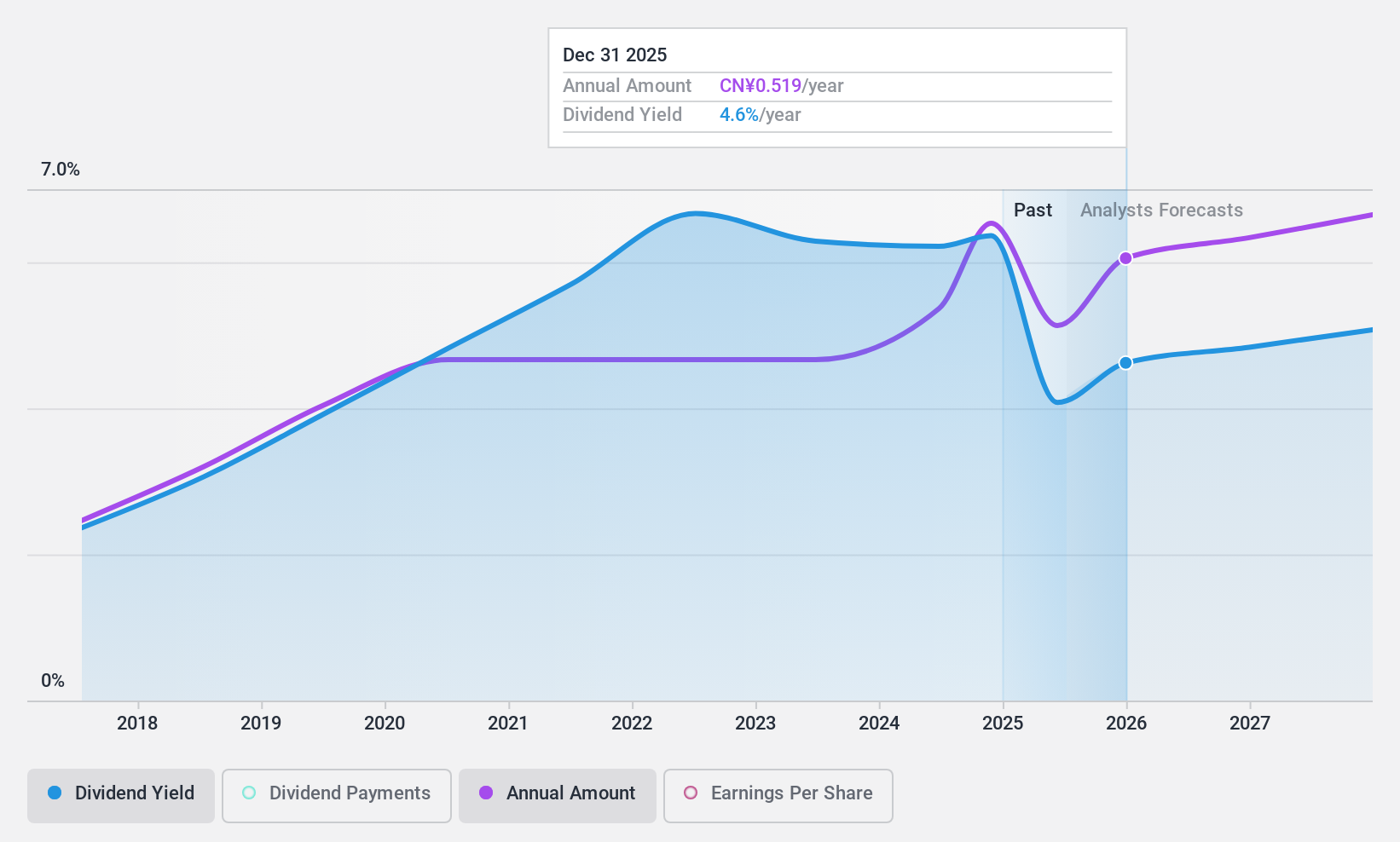

Bank of Shanghai (SHSE:601229)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Shanghai Co., Ltd. offers a range of personal and corporate banking products and services mainly in Mainland China, with a market cap of CN¥129.99 billion.

Operations: Bank of Shanghai Co., Ltd. generates revenue through its diverse personal and corporate banking products and services in Mainland China.

Dividend Yield: 6.1%

Bank of Shanghai's dividend yield is among the top 25% in China, supported by a payout ratio of 47.8%, indicating sustainability. Despite only seven years of dividend history, payments have been stable and growing. Recent inclusion in key indices like the SSE 180 reflects market confidence. The bank's innovative TourCard launch with Citigroup could enhance its growth prospects, although net interest income has slightly declined recently to CNY 24.99 billion from CNY 27.25 billion last year.

- Click here and access our complete dividend analysis report to understand the dynamics of Bank of Shanghai.

- According our valuation report, there's an indication that Bank of Shanghai's share price might be on the cheaper side.

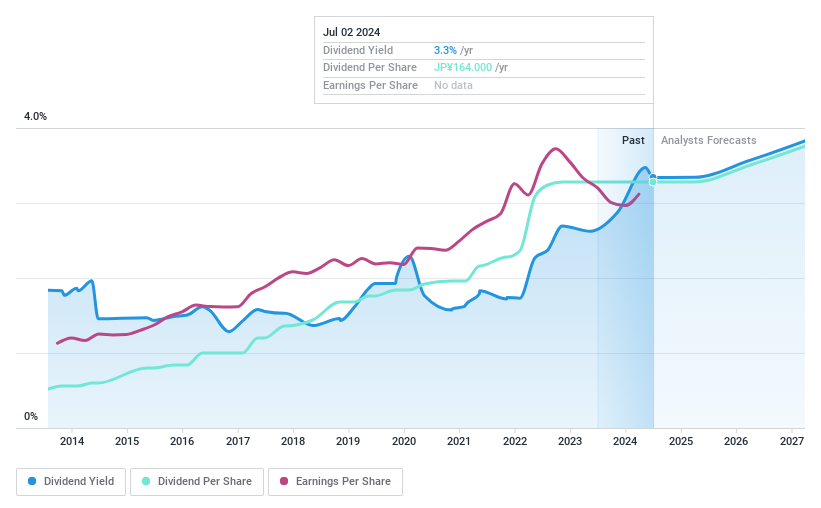

Nissan Chemical (TSE:4021)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nissan Chemical Corporation operates in the chemicals, performance materials, agricultural chemicals, and pharmaceuticals sectors both in Japan and internationally, with a market cap of approximately ¥680.77 billion.

Operations: Nissan Chemical Corporation generates revenue from several key segments, including Trading at ¥111.27 billion, Performance Materials at ¥92.67 billion, Agricultural Chemicals at ¥86.02 billion, Chemicals at ¥35.54 billion, and Healthcare at ¥6.05 billion.

Dividend Yield: 3.3%

Nissan Chemical's dividend yield of 3.31% is below the top 25% in Japan but remains reliable and stable over the past decade, supported by a payout ratio of 58.2%. The company has recently raised its earnings guidance and completed a share buyback, indicating financial health. Dividends are covered by cash flows despite an 89.8% cash payout ratio, suggesting sustainability amidst consistent profit growth of 6.4% annually over five years.

- Dive into the specifics of Nissan Chemical here with our thorough dividend report.

- The valuation report we've compiled suggests that Nissan Chemical's current price could be inflated.

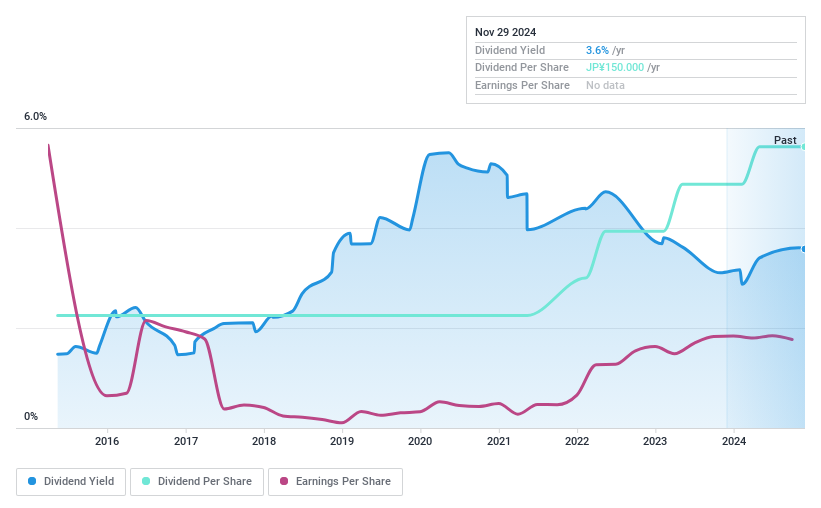

Tokyo Kiraboshi Financial Group (TSE:7173)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tokyo Kiraboshi Financial Group, Inc. offers financial services primarily to small and medium-sized enterprises in Japan, with a market cap of ¥137.86 billion.

Operations: Tokyo Kiraboshi Financial Group, Inc. generates revenue through its primary segments of Banking, which accounts for ¥107.90 billion, and Leasing Business, contributing ¥14.82 billion.

Dividend Yield: 3.3%

Tokyo Kiraboshi Financial Group offers a reliable and stable dividend, growing steadily over the past decade. Its current yield of 3.29% is below Japan's top quartile but remains well-covered by earnings with a low payout ratio of 18.9%. However, the company faces challenges with a high level of bad loans at 2.1% and maintains an insufficient allowance for these loans at 24%, which may impact future dividend sustainability.

- Click to explore a detailed breakdown of our findings in Tokyo Kiraboshi Financial Group's dividend report.

- Our comprehensive valuation report raises the possibility that Tokyo Kiraboshi Financial Group is priced lower than what may be justified by its financials.

Next Steps

- Navigate through the entire inventory of 1946 Top Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokyo Kiraboshi Financial Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7173

Tokyo Kiraboshi Financial Group

Provides financial services for small and medium-sized enterprise in Japan.

Good value with adequate balance sheet and pays a dividend.