As Asian markets navigate the complexities of escalating trade tensions between the U.S. and China, investors are increasingly turning their attention to dividend stocks as a potential source of stability and income. In such uncertain times, a good dividend stock is often characterized by its ability to maintain consistent payouts and demonstrate resilience amid market volatility.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| CAC Holdings (TSE:4725) | 5.02% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.87% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.48% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.23% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.73% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.56% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.19% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.39% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.53% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.08% | ★★★★★☆ |

Click here to see the full list of 1209 stocks from our Top Asian Dividend Stocks screener.

We'll examine a selection from our screener results.

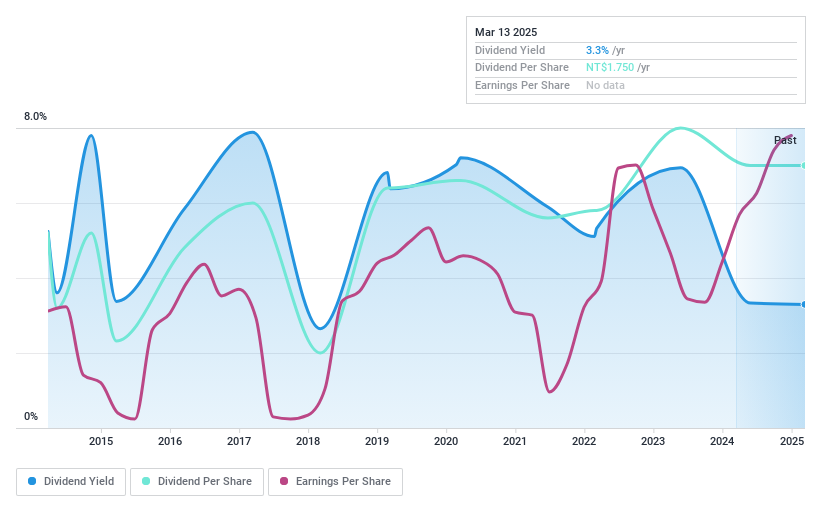

Univacco Technology (TPEX:3303)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Univacco Technology Inc. operates in the stamping foil industry under the UNIVACCO brand, serving both Taiwan and international markets, with a market cap of NT$4.55 billion.

Operations: Univacco Technology Inc. generates revenue of NT$2.99 billion from its Vacuum-Evaporated Thin Films and Optoelectronic Materials segment.

Dividend Yield: 5.7%

Univacco Technology's dividend payments are well-covered by both earnings and cash flows, with a payout ratio of 70.6% and a cash payout ratio of 77.6%. Despite an unstable track record over the past decade, recent increases in dividends suggest potential improvement. The company is trading below its estimated fair value, offering potential upside for investors. Recent announcements include a share buyback program worth TWD 997.65 million to be completed by June 2025, potentially enhancing shareholder value further.

- Delve into the full analysis dividend report here for a deeper understanding of Univacco Technology.

- In light of our recent valuation report, it seems possible that Univacco Technology is trading behind its estimated value.

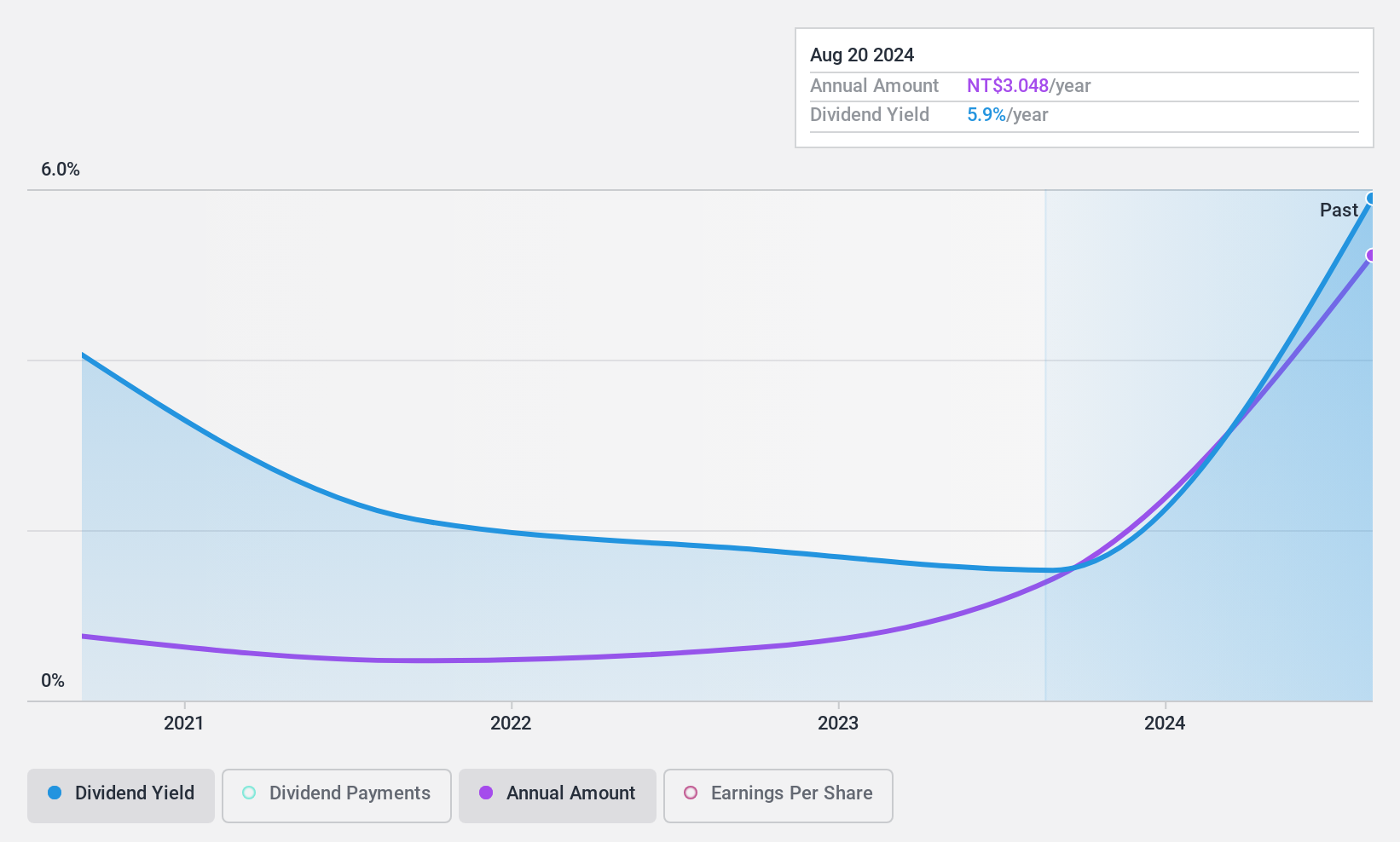

King Polytechnic Engineering (TPEX:6122)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: King Polytechnic Engineering Co., Ltd. is an integrated engineering and construction company operating in Taiwan and internationally, with a market cap of NT$3.50 billion.

Operations: King Polytechnic Engineering Co., Ltd. generates its revenue primarily from two segments: the First Business Unit with NT$1.99 billion and the Second Business Unit (including Public Works Department) with NT$2.00 billion.

Dividend Yield: 7.1%

King Polytechnic Engineering's dividend yield is in the top 25% of the TW market, with a payout ratio of 72.6%, suggesting dividends are well-covered by earnings and cash flows. However, its dividend history is limited to five years and has been volatile. The company recently secured a TWD 2.10 billion contract with Elite Material Co., which may boost revenue and profitability, potentially supporting future dividend payments despite past inconsistencies.

- Dive into the specifics of King Polytechnic Engineering here with our thorough dividend report.

- Our valuation report here indicates King Polytechnic Engineering may be undervalued.

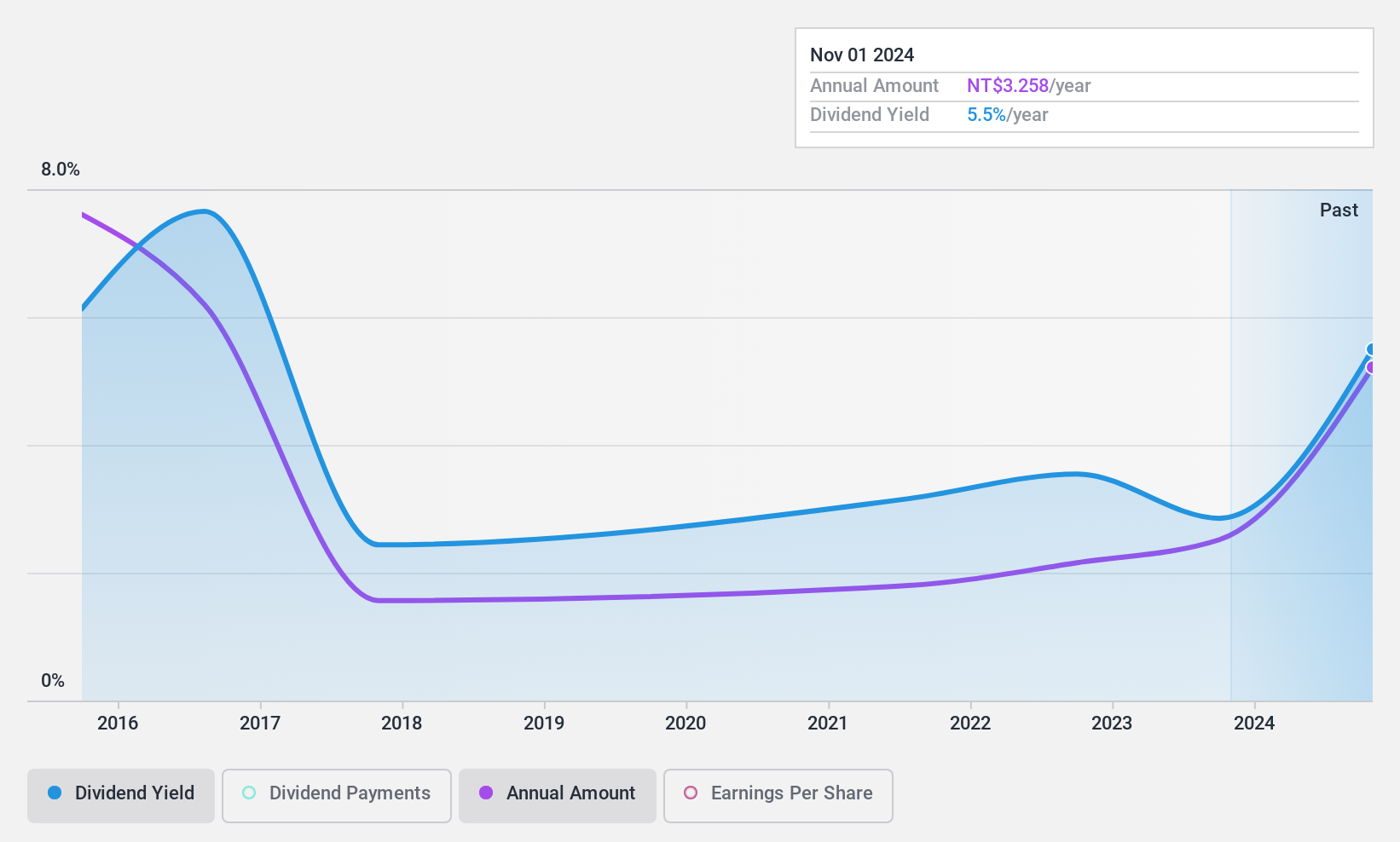

GeoVision (TWSE:3356)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GeoVision Inc., along with its subsidiaries, operates as a digital and networked video surveillance company globally, with a market cap of NT$4.10 billion.

Operations: GeoVision Inc. generates revenue from several geographic segments, including NT$642.20 million from Taiwan, NT$859.79 million from the United States, and NT$191.43 million from the Czech Republic.

Dividend Yield: 6.4%

GeoVision's dividend yield ranks in the top 25% of the TW market, supported by a payout ratio of 49.5%, indicating strong coverage by earnings and cash flows. However, its dividend history is marked by volatility and declines over the past decade. Recent earnings growth of 117.7% may offer some optimism for future payouts, despite past inconsistencies. Upcoming changes to company bylaws could influence governance and potentially impact dividend policies moving forward.

- Click here to discover the nuances of GeoVision with our detailed analytical dividend report.

- Our valuation report unveils the possibility GeoVision's shares may be trading at a premium.

Seize The Opportunity

- Discover the full array of 1209 Top Asian Dividend Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3303

Univacco Technology

Operates in the stamping foil industry under the UNIVACCO brand in Taiwan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives