CTBC Financial Holding's (TWSE:2891) investors will be pleased with their stellar 166% return over the last five years

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on a lighter note, a good company can see its share price rise well over 100%. For example, the CTBC Financial Holding Co., Ltd. (TWSE:2891) share price has soared 110% in the last half decade. Most would be very happy with that. It's down 2.6% in the last seven days.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

View our latest analysis for CTBC Financial Holding

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

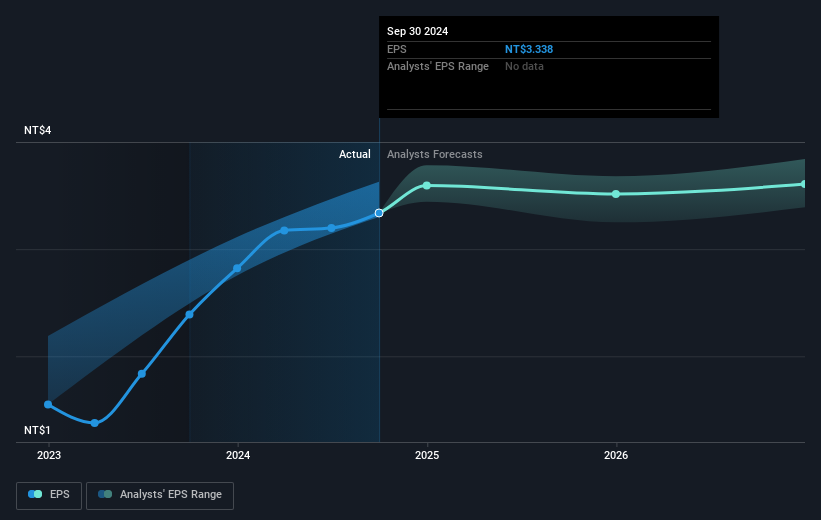

During five years of share price growth, CTBC Financial Holding achieved compound earnings per share (EPS) growth of 8.4% per year. This EPS growth is lower than the 16% average annual increase in the share price. This suggests that market participants hold the company in higher regard, these days. That's not necessarily surprising considering the five-year track record of earnings growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that CTBC Financial Holding has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, CTBC Financial Holding's TSR for the last 5 years was 166%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that CTBC Financial Holding shareholders have received a total shareholder return of 38% over one year. Of course, that includes the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 22% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Is CTBC Financial Holding cheap compared to other companies? These 3 valuation measures might help you decide.

We will like CTBC Financial Holding better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2891

CTBC Financial Holding

Engages in the banking, bills financing, credit card, trust, insurance, securities, futures, venture capital, and other financial related business investment activities in Taiwan, Asia, and North America.

Solid track record established dividend payer.