- Turkey

- /

- Basic Materials

- /

- IBSE:OYAKC

Top 3 Middle Eastern Dividend Stocks To Consider In October 2025

Reviewed by Simply Wall St

As most Gulf stock markets experience gains amid prospects of a U.S. rate cut, investor sentiment across the Middle East has been buoyed by favorable economic forecasts and monetary stability linked to the dollar-pegged currencies. In this environment, dividend stocks can offer a compelling investment opportunity, providing potential income streams while navigating the evolving market dynamics.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Turkiye Garanti Bankasi (IBSE:GARAN) | 3.69% | ★★★★★☆ |

| Saudi Telecom (SASE:7010) | 9.38% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.15% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.53% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.36% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 3.88% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.14% | ★★★★★☆ |

| Computer Direct Group (TASE:CMDR) | 8.08% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.10% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.25% | ★★★★★☆ |

Click here to see the full list of 69 stocks from our Top Middle Eastern Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Çelebi Hava Servisi (IBSE:CLEBI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Çelebi Hava Servisi A.S. offers ground handling, cargo, and warehouse services to both domestic and international airlines as well as private air cargo companies primarily in Turkey, with a market cap of TRY37.86 billion.

Operations: Çelebi Hava Servisi A.S. generates revenue from two main segments: Airport Ground Services, including ground handling services, which contribute TRY14.54 billion, and Cargo and Warehouse Services, which add TRY7.49 billion.

Dividend Yield: 4%

Çelebi Hava Servisi's dividend yield of 4.04% is among the top 25% in Turkey, with dividends covered by earnings (52.3%) and cash flows (41%). Despite a decade-long increase in payouts, dividends have been volatile, experiencing significant annual drops. Recent financials show revenue growth but declining net income and EPS compared to last year, indicating potential challenges for dividend stability despite strong coverage metrics. The stock trades at a discount to its estimated fair value.

- Dive into the specifics of Çelebi Hava Servisi here with our thorough dividend report.

- Our valuation report here indicates Çelebi Hava Servisi may be undervalued.

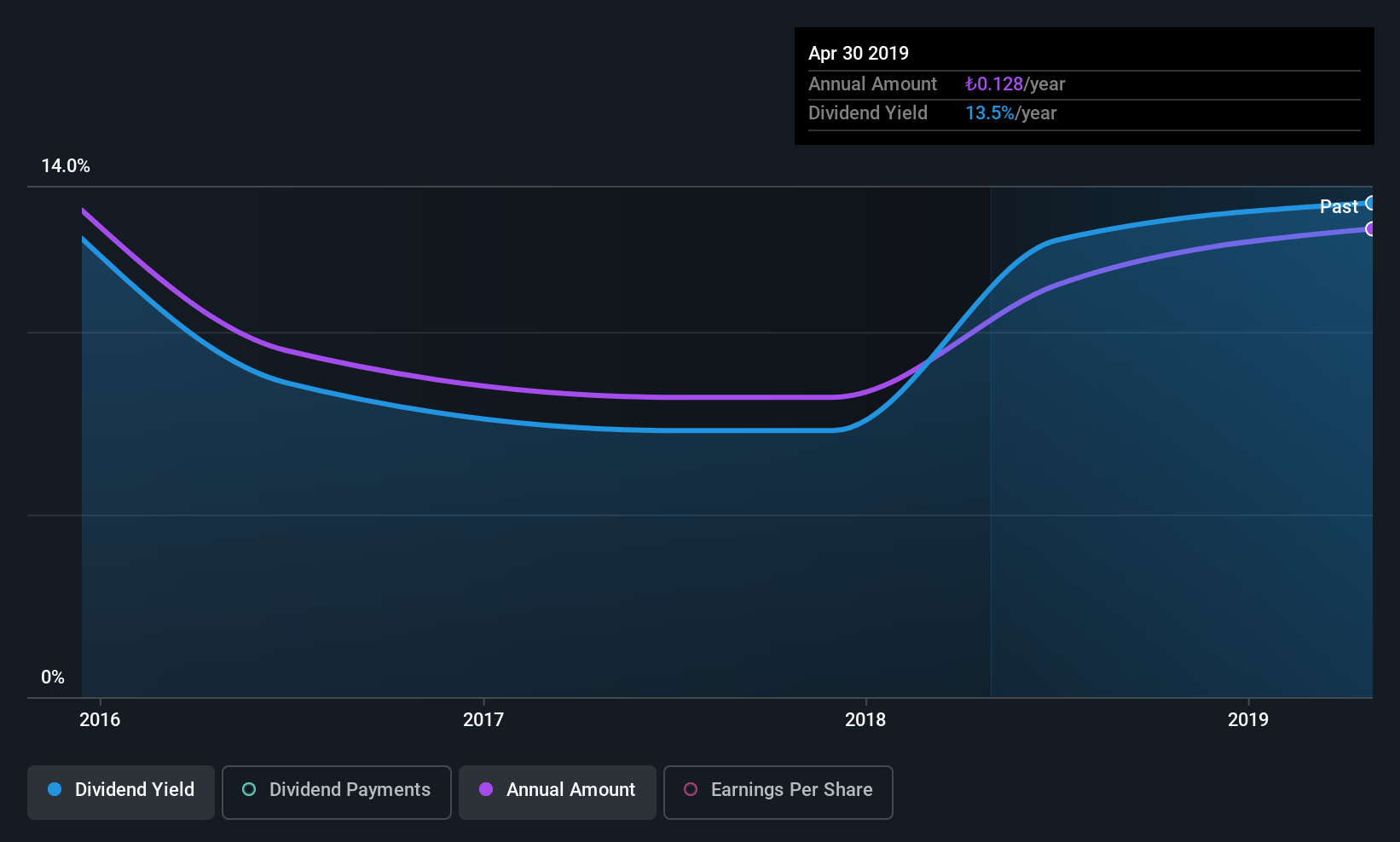

OYAK Çimento Fabrikalari (IBSE:OYAKC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: OYAK Çimento Fabrikalari A.S., along with its subsidiaries, is involved in the production and sale of clinker and cement in Turkey, with a market capitalization of TRY104.82 billion.

Operations: OYAK Çimento Fabrikalari A.S. generates revenue through its Cement segment, which accounts for TRY27.41 billion, and its Ready-Mixed Concrete segment, contributing TRY15.78 billion.

Dividend Yield: 4.6%

OYAK Çimento Fabrikalari offers a dividend yield of 4.64%, ranking within the top 25% in Turkey, though it's not fully covered by free cash flows. While dividends have increased over the past decade, they remain volatile and unreliable, with a payout ratio of 71.9%. Recent financials show declining sales and net income, which may impact future payouts. The stock's price-to-earnings ratio of 15.5x is below the Turkish market average, suggesting potential value despite earnings concerns.

- Click here and access our complete dividend analysis report to understand the dynamics of OYAK Çimento Fabrikalari.

- The valuation report we've compiled suggests that OYAK Çimento Fabrikalari's current price could be inflated.

Saudi Awwal Bank (SASE:1060)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Saudi Awwal Bank, with a market cap of SAR66.99 billion, operates in the Kingdom of Saudi Arabia offering comprehensive banking and financial services through its subsidiaries.

Operations: Saudi Awwal Bank's revenue segments include Treasury services at SAR2.05 billion, Capital Markets generating SAR429.19 million, Wealth & Personal Banking contributing SAR4.08 billion, and Corporate and Institutional Banking bringing in SAR7.08 billion.

Dividend Yield: 6.2%

Saudi Awwal Bank's dividend yield of 6.15% places it in the top 25% of Saudi Arabian payers, with a sustainable payout ratio of 52.3%. Despite a history of volatility, dividends have grown over the past decade. Recent financials reveal steady earnings growth, supporting future payouts. The bank completed a $1.25 billion green bond offering and announced SAR 2,055 million in dividends for H1 2025, highlighting its commitment to shareholder returns amidst strategic debt financing activities.

- Navigate through the intricacies of Saudi Awwal Bank with our comprehensive dividend report here.

- The analysis detailed in our Saudi Awwal Bank valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Embark on your investment journey to our 69 Top Middle Eastern Dividend Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:OYAKC

OYAK Çimento Fabrikalari

Engages in the production and sale of clinker and cement in Turkey.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives