- Turkey

- /

- Wireless Telecom

- /

- IBSE:TCELL

3 Stocks Estimated To Be Up To 49.5% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate a mixed performance with the S&P 500 and Nasdaq Composite closing out a strong year despite recent volatility, investors are keenly observing shifts in economic indicators such as the Chicago PMI and GDP forecasts. Amid these fluctuations, identifying undervalued stocks can be crucial for investors seeking opportunities; these stocks may offer potential value by trading below their intrinsic worth, particularly in an environment where market sentiment is influenced by economic data releases and policy changes.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥27.90 | CN¥55.57 | 49.8% |

| Fevertree Drinks (AIM:FEVR) | £6.605 | £13.12 | 49.7% |

| Tongqinglou Catering (SHSE:605108) | CN¥21.68 | CN¥43.25 | 49.9% |

| Zhende Medical (SHSE:603301) | CN¥21.05 | CN¥42.00 | 49.9% |

| AeroEdge (TSE:7409) | ¥1763.00 | ¥3511.45 | 49.8% |

| Vault Minerals (ASX:VAU) | A$0.33 | A$0.66 | 49.9% |

| Mr. Cooper Group (NasdaqCM:COOP) | US$94.43 | US$187.71 | 49.7% |

| Shandong Weigao Orthopaedic Device (SHSE:688161) | CN¥24.03 | CN¥47.76 | 49.7% |

| Vogo (ENXTPA:ALVGO) | €2.91 | €5.81 | 49.9% |

| Genscript Biotech (SEHK:1548) | HK$9.63 | HK$19.15 | 49.7% |

Here's a peek at a few of the choices from the screener.

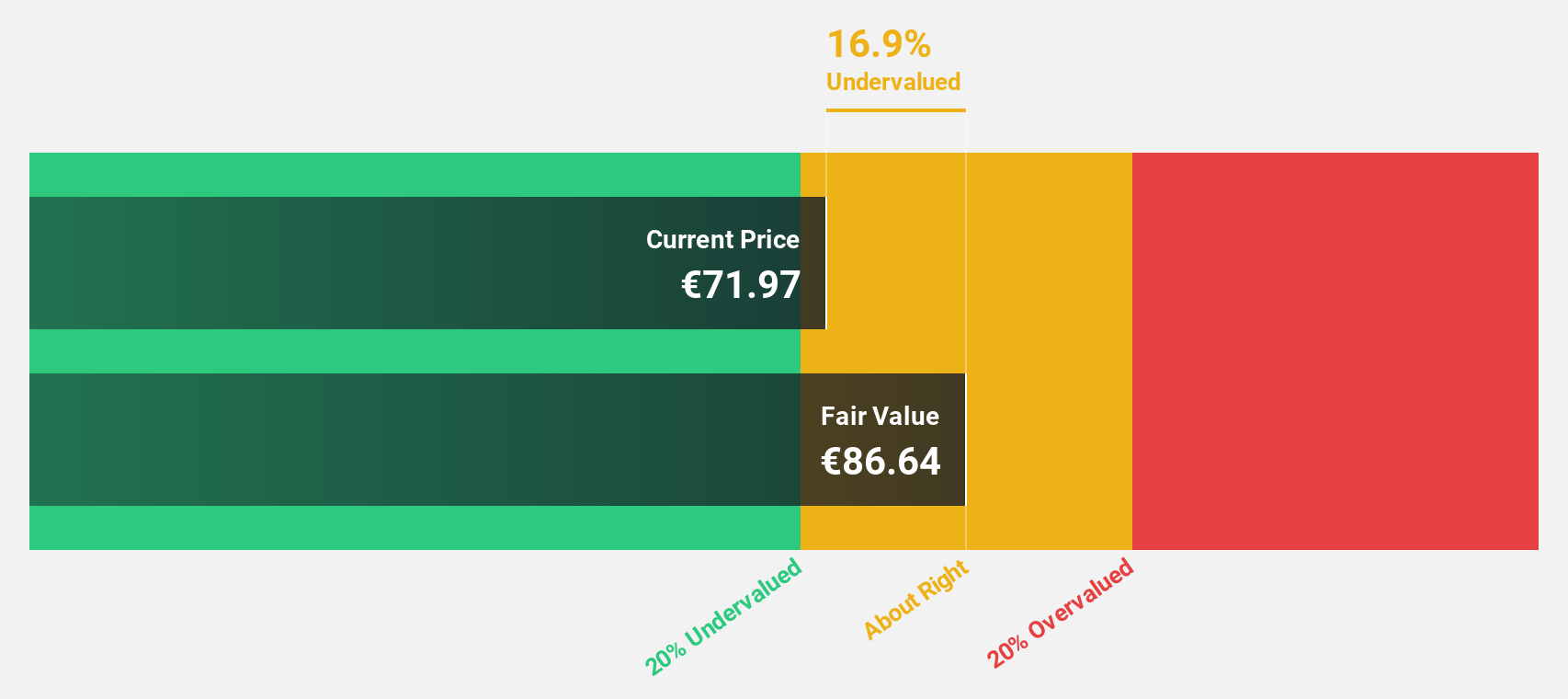

RENK Group (DB:R3NK)

Overview: RENK Group AG is involved in the design, engineering, production, testing, and servicing of customized drive systems both in Germany and internationally, with a market cap of €1.92 billion.

Operations: The company's revenue segments include €315.97 million from the M&I Segment, €631.93 million from the VMS Segment, and €119.59 million from the Slide Bearings Segment.

Estimated Discount To Fair Value: 47.6%

RENK Group is trading significantly below its estimated fair value of €36.3, with a current price of €19.03, indicating potential undervaluation based on discounted cash flows. Despite a decrease in net income to €7.01 million for the first nine months of 2024, revenue grew by 16% year-over-year to €778.34 million. Forecasts suggest robust earnings growth at 47.1% annually, outpacing the German market's expected growth rate and supporting positive future prospects despite recent profit margin declines.

- Our comprehensive growth report raises the possibility that RENK Group is poised for substantial financial growth.

- Navigate through the intricacies of RENK Group with our comprehensive financial health report here.

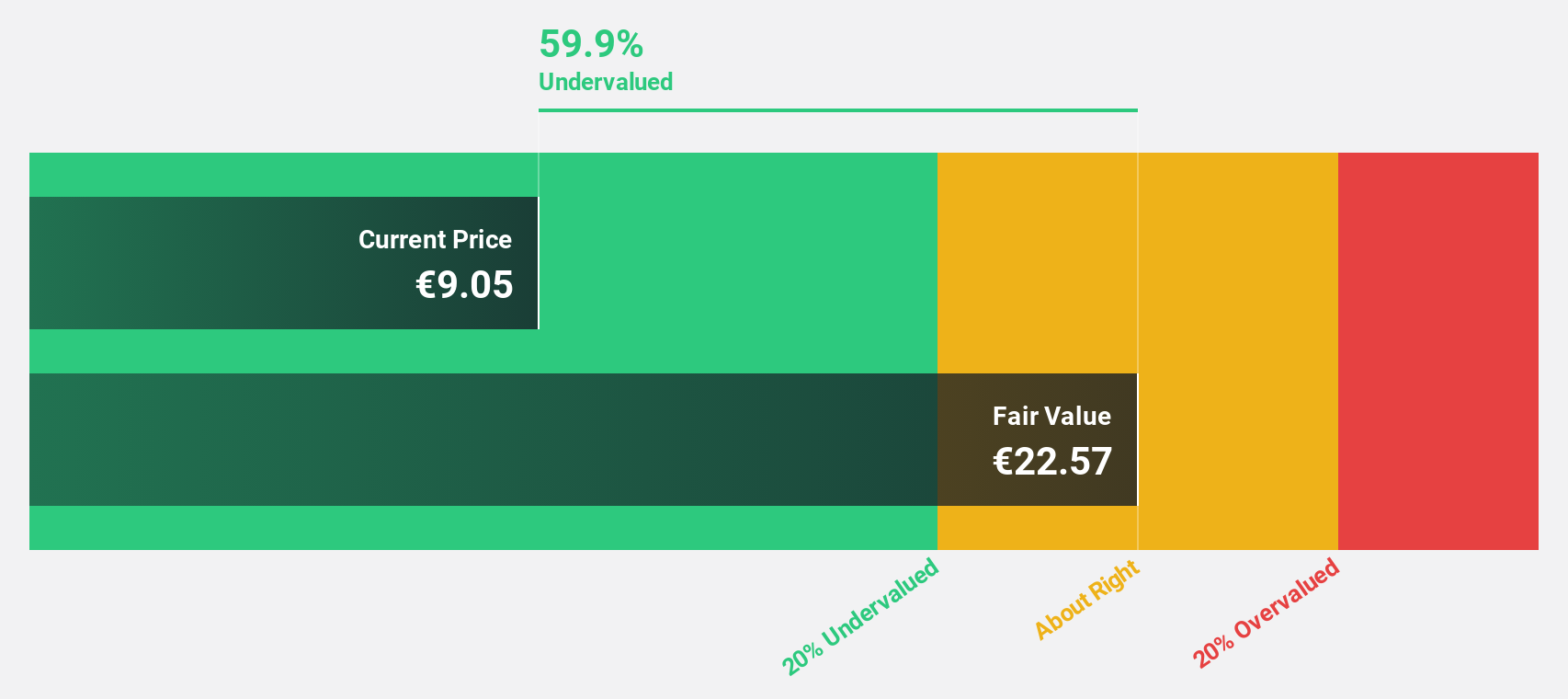

Brunel International (ENXTAM:BRNL)

Overview: Brunel International N.V. offers secondment, project management, recruitment, and consultancy services across various regions including the Netherlands, Australasia, the Middle East, India, Asia, the Americas, and the DACH region with a market cap of €501.01 million.

Operations: Brunel International generates revenue through its services in secondment, project management, recruitment, and consultancy across regions such as the Netherlands, Australasia, the Middle East, India, Asia, the Americas, and the DACH region.

Estimated Discount To Fair Value: 49.5%

Brunel International is trading at €9.93, significantly below its estimated fair value of €19.65, highlighting potential undervaluation based on discounted cash flows. Revenue is projected to grow by 8.7% annually, slightly above the Dutch market average, while earnings are expected to rise significantly at 23.1% per year over the next three years. However, its dividend yield of 5.54% lacks coverage by earnings, and Return on Equity remains low at a forecasted 14.9%.

- Our earnings growth report unveils the potential for significant increases in Brunel International's future results.

- Delve into the full analysis health report here for a deeper understanding of Brunel International.

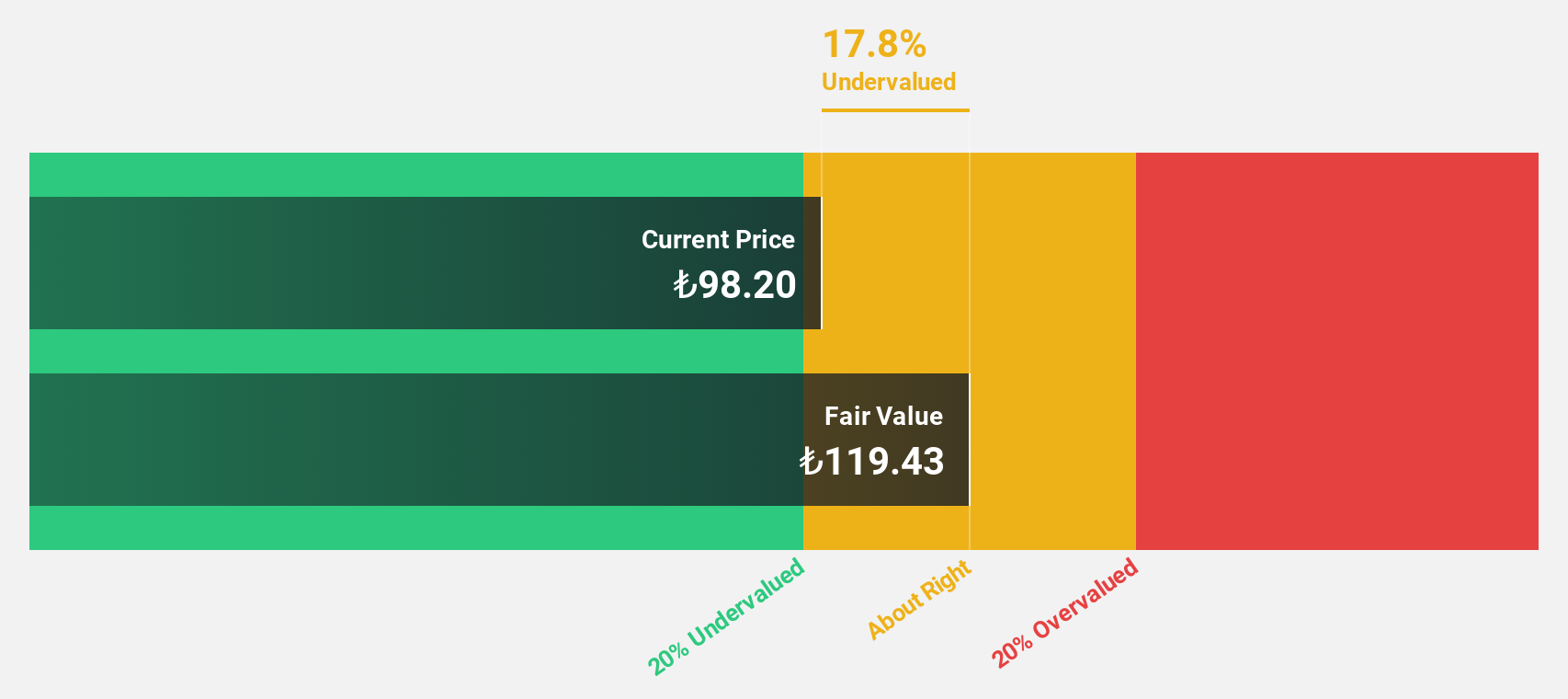

Turkcell Iletisim Hizmetleri (IBSE:TCELL)

Overview: Turkcell Iletisim Hizmetleri A.S. offers digital services across Turkey, Belarus, the Turkish Republic of Northern Cyprus, and the Netherlands, with a market cap of TRY213.44 billion.

Operations: The company's revenue segments include Turkcell Turkey at TRY98.38 billion, Fintech at TRY5.98 billion, and Turkcell International at TRY2.83 billion.

Estimated Discount To Fair Value: 48.5%

Turkcell Iletisim Hizmetleri is trading at TRY 97.95, significantly below its estimated fair value of TRY 190.03, suggesting potential undervaluation based on discounted cash flows. Despite an unstable dividend track record, earnings are forecast to grow significantly at 28.16% annually over the next three years, although slightly slower than the Turkish market average. Recent advancements in quantum-safe network security with Nokia further bolster Turkcell’s technological edge and future resilience in telecom infrastructure.

- Insights from our recent growth report point to a promising forecast for Turkcell Iletisim Hizmetleri's business outlook.

- Click to explore a detailed breakdown of our findings in Turkcell Iletisim Hizmetleri's balance sheet health report.

Seize The Opportunity

- Take a closer look at our Undervalued Stocks Based On Cash Flows list of 893 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Turkcell Iletisim Hizmetleri might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:TCELL

Turkcell Iletisim Hizmetleri

Provides digital services in Turkey, Belarus, Turkish Republic of Northern Cyprus, and the Netherlands.

Very undervalued with flawless balance sheet and pays a dividend.