- Turkey

- /

- Hotel and Resort REITs

- /

- IBSE:AKFGY

Akfen Gayrimenkul Yatirim Ortakligi And 2 Other Promising Penny Stocks With Robust Financials

Reviewed by Simply Wall St

Global markets have recently shown mixed performance, with major indices like the S&P 500 and Nasdaq Composite closing out a strong year despite some end-of-year volatility. For investors exploring opportunities beyond well-known large-cap stocks, penny stocks remain an intriguing area of interest. Although the term "penny stocks" might seem outdated, these smaller or newer companies can offer significant value when supported by robust financials. In this article, we explore three penny stocks that exhibit strong financial foundations and potential for long-term growth.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.425 | MYR1.18B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.64 | HK$40.08B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.56 | A$65.64M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.968 | £152.06M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.46 | £180.84M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.58 | £67.7M | ★★★★☆☆ |

Click here to see the full list of 5,820 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Akfen Gayrimenkul Yatirim Ortakligi (IBSE:AKFGY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Akfen Gayrimenkul Yatirim Ortakligi, established in 2006 from Aksel Tourism Investments and Management Inc., operates as a real estate investment trust with a market cap of TRY8.31 billion.

Operations: The company generates revenue from real estate investments totaling TRY817.07 million.

Market Cap: TRY8.31B

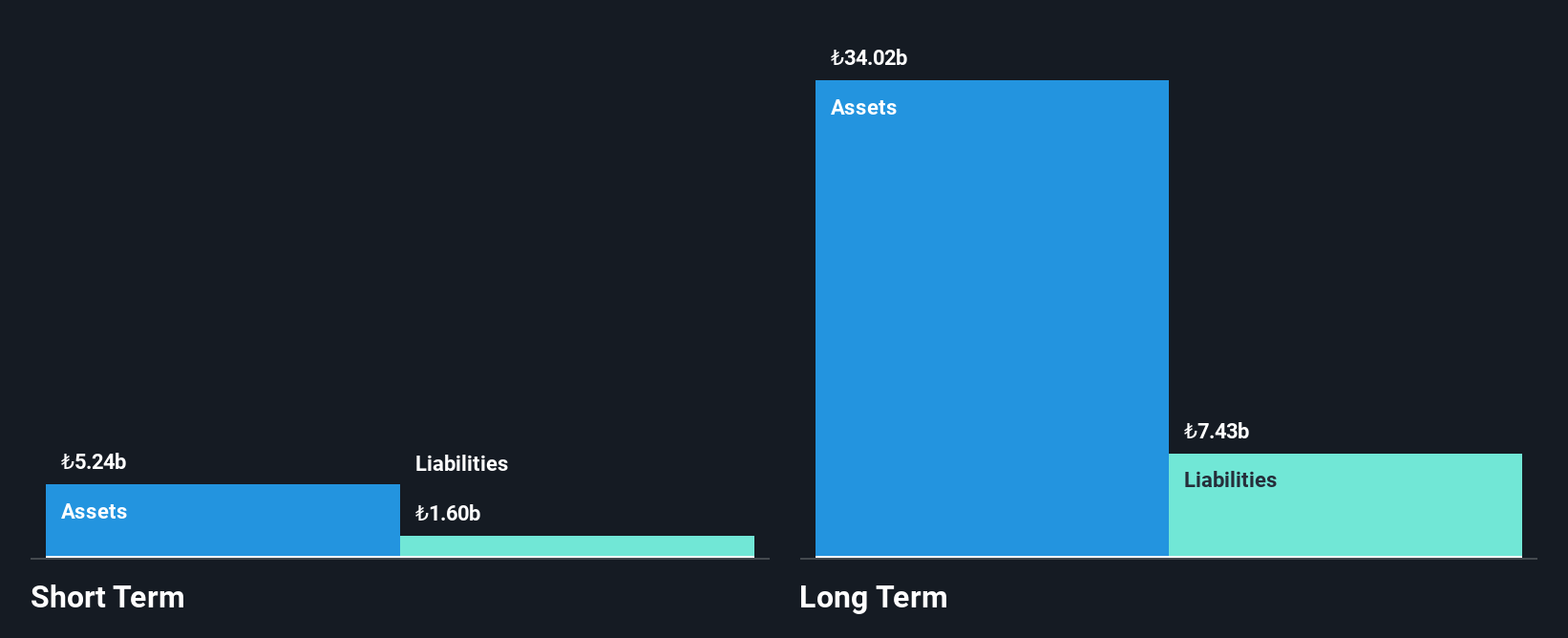

Akfen Gayrimenkul Yatirim Ortakligi, with a market cap of TRY8.31 billion, has shown some financial challenges and improvements. Despite being unprofitable, it has reduced its debt significantly over the past five years and maintains a satisfactory net debt to equity ratio of 7.5%. The company's short-term assets cover its short-term liabilities but fall short for long-term obligations. Recent earnings reports indicate declining sales and net income compared to the previous year, highlighting ongoing profitability issues despite stable weekly volatility and experienced management. Overall, Akfen's financial position reflects both potential risks and areas for cautious optimism in the penny stock landscape.

- Navigate through the intricacies of Akfen Gayrimenkul Yatirim Ortakligi with our comprehensive balance sheet health report here.

- Understand Akfen Gayrimenkul Yatirim Ortakligi's track record by examining our performance history report.

Tiong Woon Corporation Holding (SGX:BQM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tiong Woon Corporation Holding Ltd is an investment holding company that offers integrated services for the oil and gas, petrochemical, infrastructure, and construction sectors, with a market cap of SGD148.37 million.

Operations: The company generates revenue from its Heavy Lift & Haulage segment (SGD139.84 million), Marine Transportation (SGD3.97 million), and Trading activities (SGD1.56 million).

Market Cap: SGD148.37M

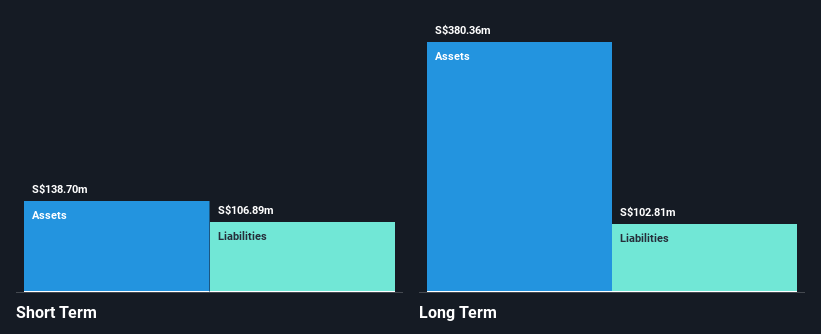

Tiong Woon Corporation Holding Ltd, with a market cap of SGD148.37 million, demonstrates financial stability and growth potential. Its short-term assets of SGD138.7 million exceed both short-term and long-term liabilities, indicating strong liquidity management. The company has achieved a net profit margin improvement to 12.7% from last year's 11.6%, alongside stable weekly volatility at 3%. Earnings grew by 16% over the past year, surpassing industry averages but below its five-year average growth rate of 25.8%. Recent board changes may impact governance dynamics while dividends have been increased, reflecting shareholder value focus amidst strategic shifts.

- Take a closer look at Tiong Woon Corporation Holding's potential here in our financial health report.

- Understand Tiong Woon Corporation Holding's earnings outlook by examining our growth report.

Jiangsu Sihuan Bioengineering (SZSE:000518)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jiangsu Sihuan Bioengineering Co., Ltd. operates in the pharmaceutical industry in China with a market capitalization of CN¥2.72 billion.

Operations: Jiangsu Sihuan Bioengineering Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥2.72B

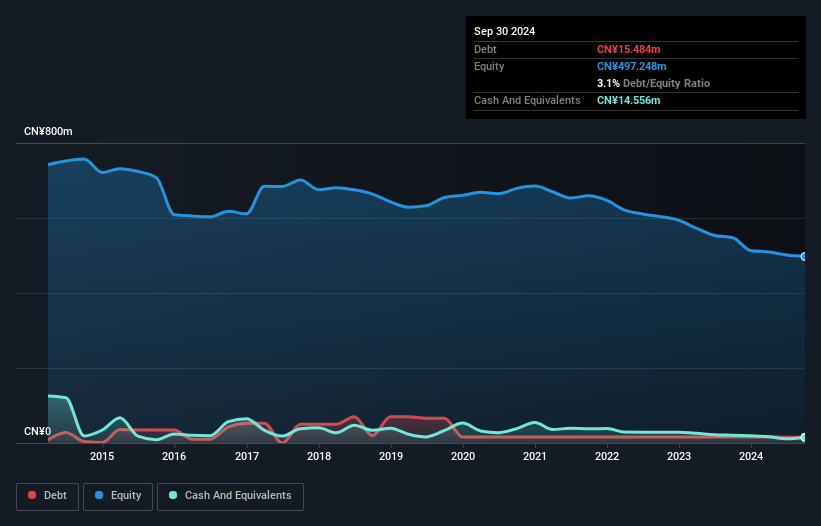

Jiangsu Sihuan Bioengineering Co., Ltd., with a market cap of CN¥2.72 billion, faces challenges typical of many penny stocks, including high volatility and ongoing unprofitability. Despite reporting sales of CN¥155.99 million for the nine months ending September 2024, the company remains in a net loss position, though losses have narrowed compared to the previous year. The firm's financial structure shows strength with short-term assets significantly exceeding both short-term and long-term liabilities and a satisfactory net debt to equity ratio at 0.2%. However, its negative return on equity highlights profitability concerns amidst an experienced board overseeing operations.

- Click here and access our complete financial health analysis report to understand the dynamics of Jiangsu Sihuan Bioengineering.

- Evaluate Jiangsu Sihuan Bioengineering's historical performance by accessing our past performance report.

Next Steps

- Navigate through the entire inventory of 5,820 Penny Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:AKFGY

Akfen Gayrimenkul Yatirim Ortakligi

Akfen Real Estate Investment Trust Inc. was established in 2006 by transforming and restructuring Aksel Tourism Investments and Management Inc., which started its activities in 1997, into a real estate investment trust.

Adequate balance sheet and overvalued.

Market Insights

Community Narratives