- Turkey

- /

- Marine and Shipping

- /

- IBSE:GSDHO

3 Penny Stocks With Market Caps Larger Than US$10M To Watch

Reviewed by Simply Wall St

Global markets have recently experienced mixed performances, with major stock indexes showing a combination of gains and declines as the year closed out. For investors looking beyond traditional blue-chip stocks, penny stocks—typically smaller or newer companies—remain an intriguing option despite being a somewhat outdated term. These stocks can offer unique opportunities when backed by strong financials, and we will explore three such penny stocks that stand out for their potential value and growth prospects in today's market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.76 | MYR449.66M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.78 | HK$41.63B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.425 | MYR1.18B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £152.06M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.55 | £67.7M | ★★★★☆☆ |

Click here to see the full list of 5,810 stocks from our Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Pearl Gold (DB:02P)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pearl Gold AG is a holding company that invests in gold mining projects in Africa and has a market capitalization of €14.75 million.

Operations: Currently, there are no reported revenue segments for this holding company that focuses on gold mining investments in Africa.

Market Cap: €14.75M

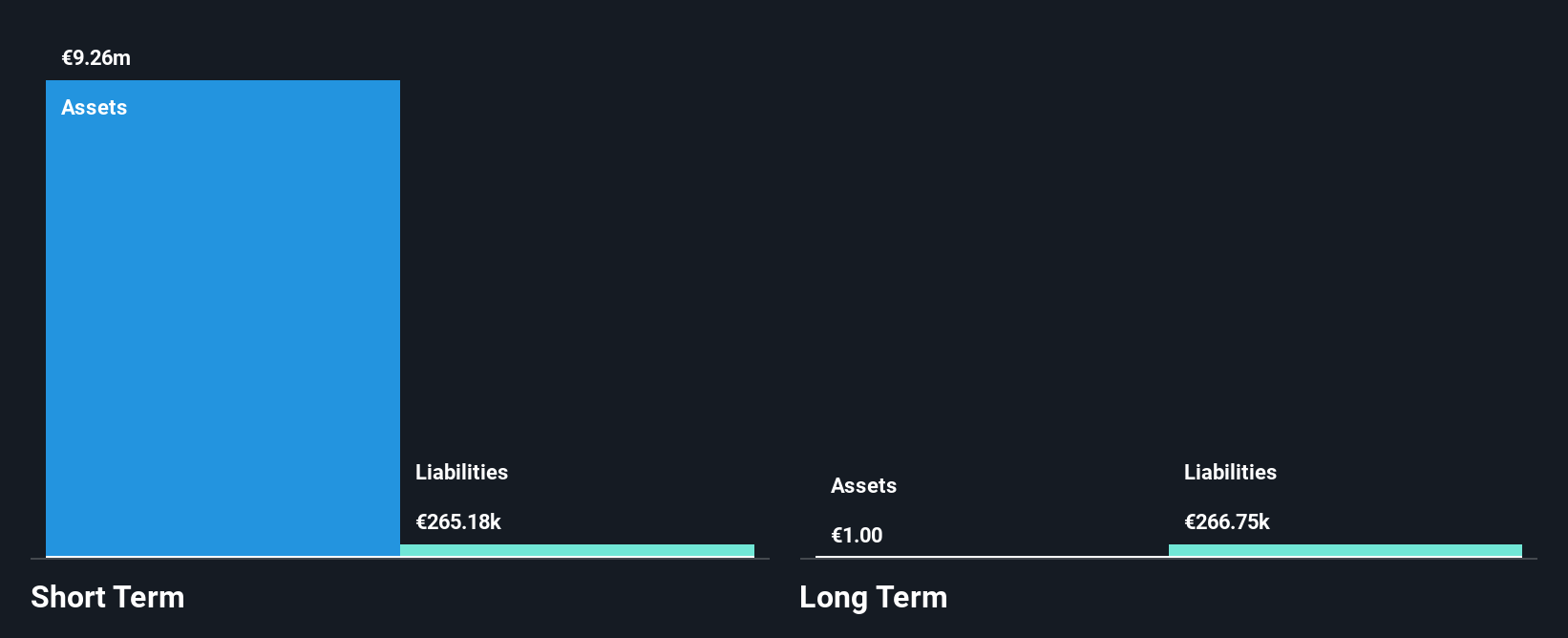

Pearl Gold AG, with a market cap of €14.75 million, is pre-revenue and unprofitable, having seen losses increase by 25% annually over the past five years. Despite being debt-free and having sufficient short-term assets (€13.4M) to cover both short- and long-term liabilities, its share price remains highly volatile. The company's negative return on equity (-5.08%) reflects its ongoing challenges in generating profits from gold mining investments in Africa. While shareholder dilution has not been significant recently, the board's experience offers some stability amidst financial uncertainties typical of penny stocks in early development stages.

- Take a closer look at Pearl Gold's potential here in our financial health report.

- Understand Pearl Gold's track record by examining our performance history report.

GSD Holding (IBSE:GSDHO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: GSD Holding A.S. operates in finance, shipping, energy, and education sectors through its subsidiaries and has a market capitalization of TRY3.97 billion.

Operations: The company's revenue is derived from its operations in Turkey, specifically TRY9.36 billion from holding activities and TRY1.10 billion from marine activities both domestically and internationally.

Market Cap: TRY3.97B

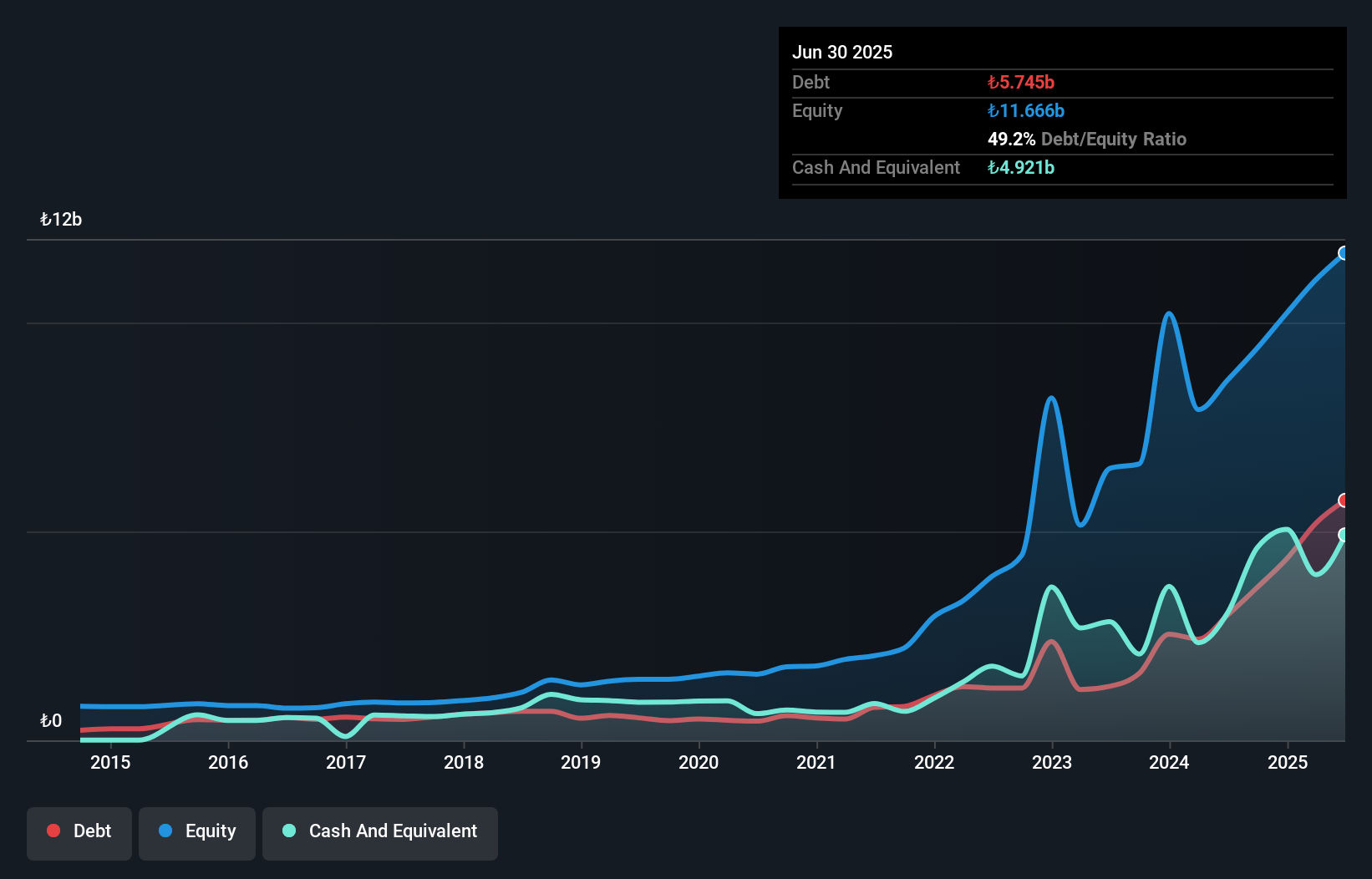

GSD Holding A.S., with a market cap of TRY3.97 billion, has shown recent financial improvement, reporting a net income of TRY82.84 million in Q3 2024 compared to a significant loss the previous year. Despite being unprofitable over the past five years with declining earnings by 53.1% annually, it maintains strong liquidity, as short-term assets exceed both short- and long-term liabilities significantly. The company's cash runway is robust for over three years based on current free cash flow trends, although its dividend sustainability remains questionable due to insufficient coverage by earnings or free cash flows.

- Click to explore a detailed breakdown of our findings in GSD Holding's financial health report.

- Examine GSD Holding's past performance report to understand how it has performed in prior years.

Medivir (OM:MVIR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Medivir AB (publ) is a pharmaceutical company that develops and commercializes cancer treatments in the Nordic region, Europe, and internationally, with a market cap of SEK356.69 million.

Operations: The company's revenue is derived entirely from its Pharmaceuticals segment, amounting to SEK7.03 million.

Market Cap: SEK356.69M

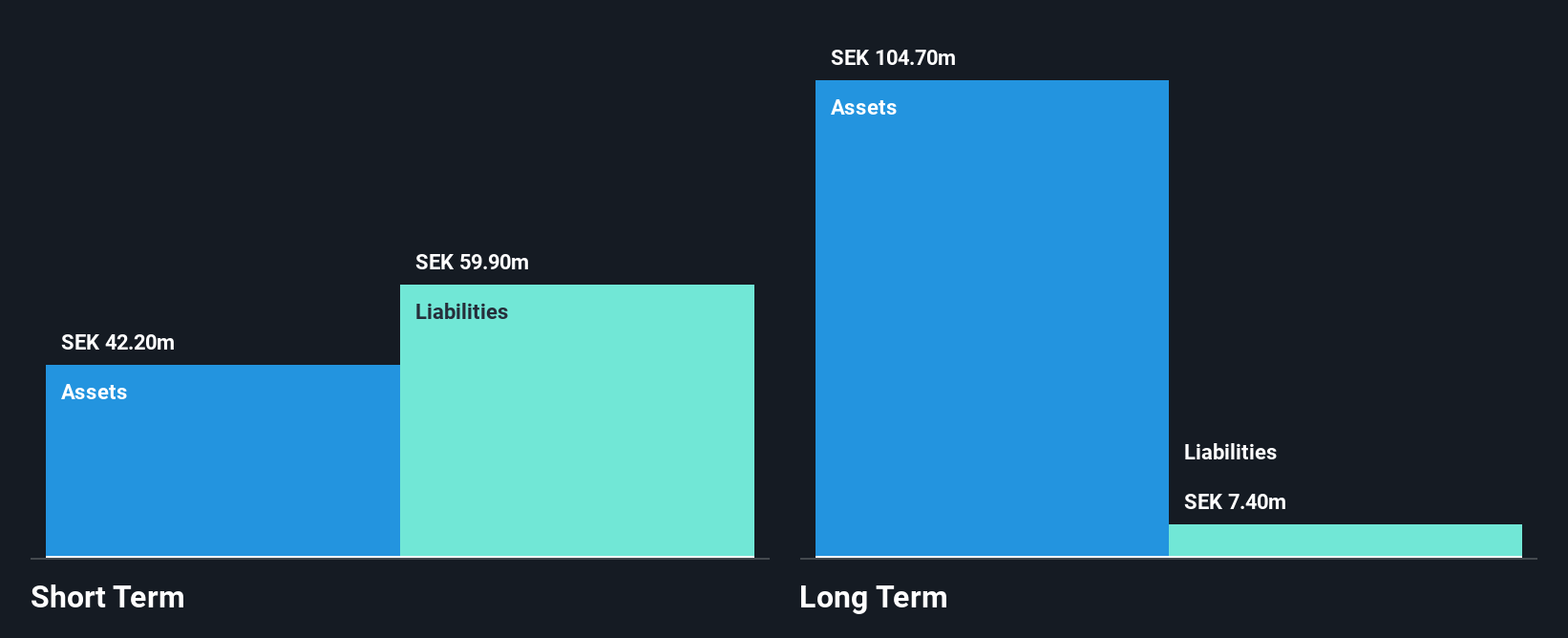

Medivir AB, with a market cap of SEK356.69 million, is navigating its pre-revenue phase in the biotech sector by focusing on innovative cancer treatments. The company recently announced the US IND approval for a phase 2b study combining fostrox and Lenvima for advanced HCC, following promising outcomes from earlier trials showing extended treatment benefits and improved patient outcomes. Despite being unprofitable and having less than a year of cash runway, Medivir maintains strong short-term asset coverage over liabilities and remains debt-free. However, shareholder dilution has occurred as shares outstanding increased by 7.3% last year.

- Click here to discover the nuances of Medivir with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Medivir's future.

Summing It All Up

- Reveal the 5,810 hidden gems among our Penny Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:GSDHO

GSD Holding

Through its subsidiaries, engages in finance, shipping, energy, and education businesses.

Excellent balance sheet low.

Market Insights

Community Narratives