High Growth Tech Stocks Including None With Potential Growth

Reviewed by Simply Wall St

Amidst a backdrop of record highs in major U.S. stock indices, fueled by optimism over potential trade deals and AI infrastructure investments, the market has shown a preference for growth stocks over value shares, despite large-cap stocks generally outperforming their smaller-cap counterparts. In this environment, identifying promising high-growth tech stocks requires careful consideration of their exposure to burgeoning sectors like artificial intelligence and their ability to capitalize on favorable economic trends.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1230 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Logo Yazilim Sanayi ve Ticaret (IBSE:LOGO)

Simply Wall St Growth Rating: ★★★★☆☆

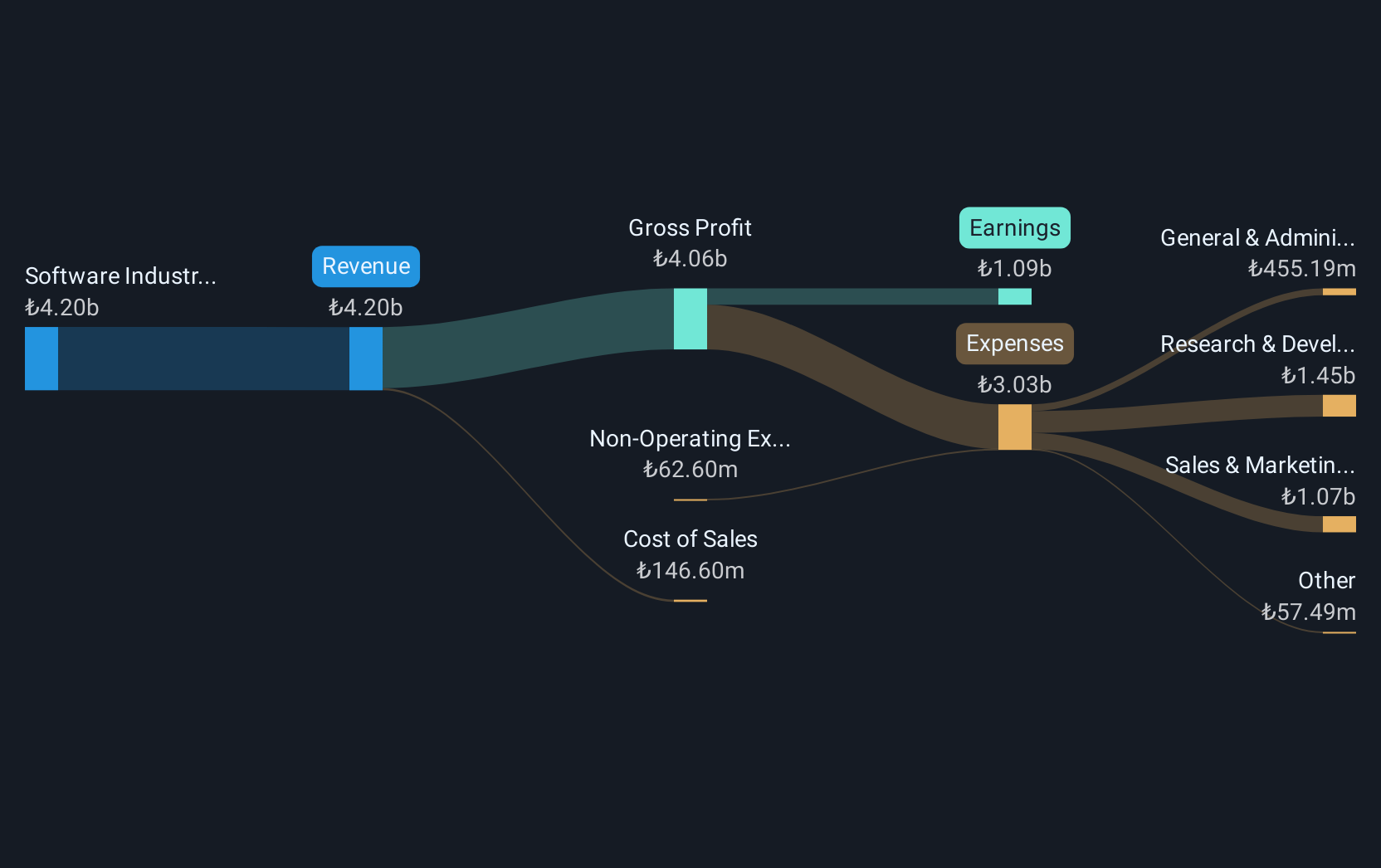

Overview: Logo Yazilim Sanayi ve Ticaret A.S. is a company that develops and markets software solutions in Turkey and Romania, with a market capitalization of TRY11.79 billion.

Operations: The company generates revenue primarily from the software industry, amounting to TRY3.56 billion. Operating in Turkey and Romania, it focuses on developing and marketing software solutions tailored to these markets.

Logo Yazilim Sanayi ve Ticaret has demonstrated robust financial performance, with earnings forecasted to grow by an impressive 60.7% annually. This growth rate surpasses the broader Turkish market's average of 33.2%. The company's recent third-quarter results revealed a significant turnaround, posting a net income of TRY 111.31 million compared to a net loss in the previous year, underscoring its recovery and potential in the competitive software industry. With revenue also on an upward trajectory at a rate of 24.3% per year, Logo Yazilim is positioning itself as a resilient player amidst evolving tech landscapes, although it slightly trails the Turkish market growth rate of 26.2%.

Serko (NZSE:SKO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Serko Limited is a Software-as-a-Service technology company that offers online travel booking software solutions and expense management services across New Zealand, Australia, North America, Europe, and other international markets with a market cap of NZ$454.55 million.

Operations: Serko generates revenue primarily through its software solutions, amounting to NZ$74.45 million. The company focuses on providing online travel booking and expense management services across various international markets.

Serko is navigating a transformative phase, with its revenue projected to increase by 22.2% annually, outpacing the New Zealand market's growth of 4.5%. Despite current unprofitability, earnings are expected to surge by 65.44% per year as it edges towards profitability within three years—a pace well above average market projections. The recent integration of NDC content with Amadeus marks a strategic expansion in Serko’s airline retailing capabilities through its Zeno platform, enhancing corporate travel solutions and aligning with major carriers like Qantas for future distribution strategies. This move not only broadens Serko's service offerings but also strengthens its position in the competitive travel technology landscape, promising significant impacts on future revenue streams and market share.

- Delve into the full analysis health report here for a deeper understanding of Serko.

Examine Serko's past performance report to understand how it has performed in the past.

Xiamen Jihong Technology (SZSE:002803)

Simply Wall St Growth Rating: ★★★★★☆

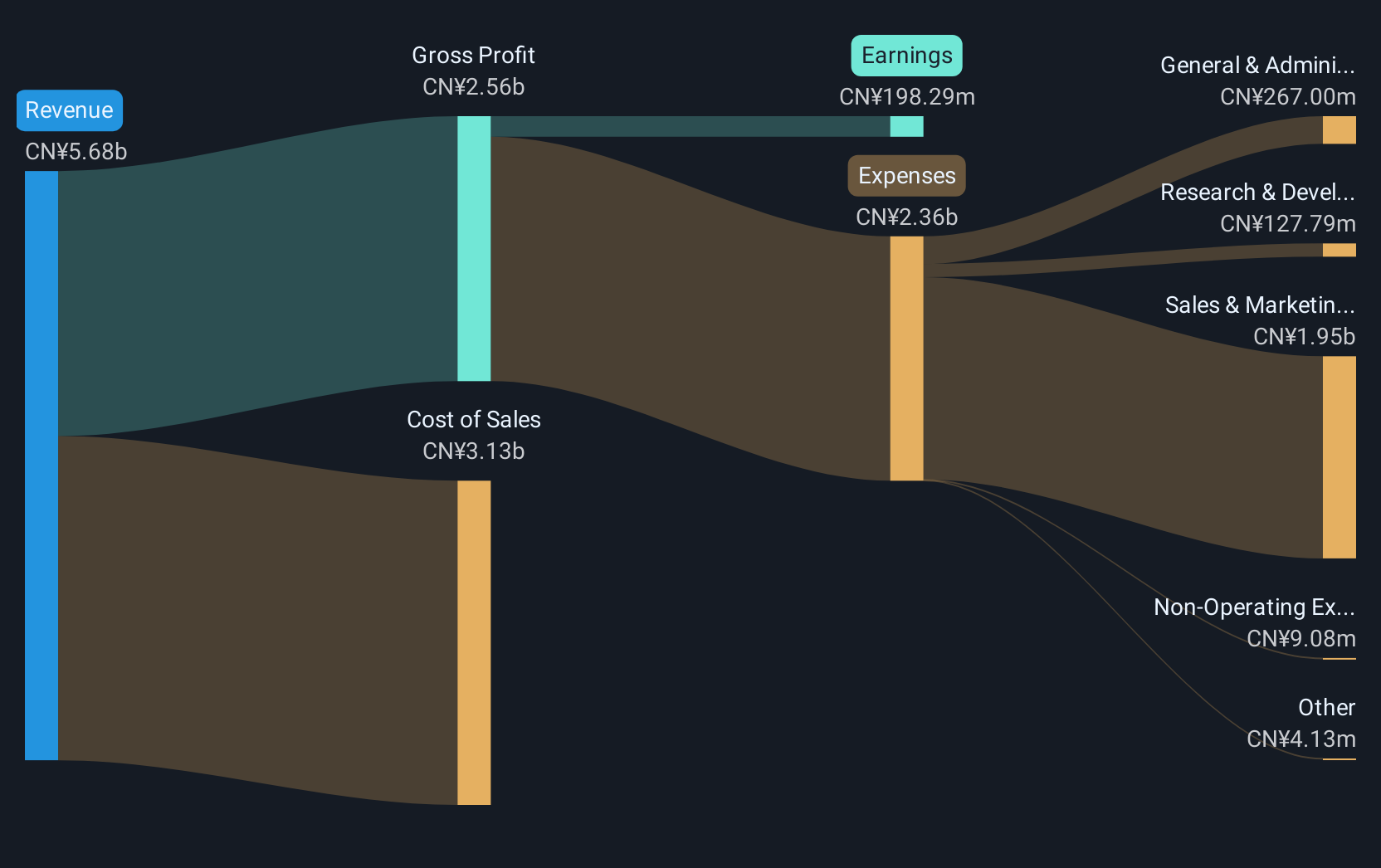

Overview: Xiamen Jihong Technology Co., Ltd. operates in the cross-border social e-commerce sector in China with a market capitalization of CN¥4.87 billion.

Operations: The company focuses on cross-border social e-commerce, leveraging digital platforms to facilitate international trade and consumer engagement. It operates primarily within China, contributing significantly to its revenue stream.

Xiamen Jihong Technology has demonstrated a robust growth trajectory, with its revenue forecast to climb by 22.2% annually, significantly outpacing the broader Chinese market's growth. This surge is underpinned by a strategic focus on R&D, where the firm invested 5% of its revenue last year, aligning with industry leaders who prioritize innovation for competitive advantage. Additionally, the company's recent share repurchase program underscores a commitment to enhancing shareholder value and supporting long-term corporate objectives, reflecting strong internal confidence in its financial health and future prospects.

- Unlock comprehensive insights into our analysis of Xiamen Jihong Technology stock in this health report.

Assess Xiamen Jihong Technology's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Click this link to deep-dive into the 1230 companies within our High Growth Tech and AI Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:LOGO

Logo Yazilim Sanayi ve Ticaret

Develops and markets software solutions in Turkey and internationally.

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)