- China

- /

- Aerospace & Defense

- /

- SHSE:600184

3 Stocks Believed To Be Trading Below Estimated Fair Value

Reviewed by Simply Wall St

As global markets respond to easing inflation and strong bank earnings, major indices have rebounded, with value stocks notably outperforming growth shares. This environment presents opportunities for investors to explore stocks that may be trading below their estimated fair value, particularly as sectors like energy and financials show resilience. Identifying undervalued stocks involves assessing companies whose market prices do not fully reflect their intrinsic worth, making them potential candidates for future appreciation in a recovering market.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Livero (TSE:9245) | ¥1558.00 | ¥3105.30 | 49.8% |

| Alltop Technology (TPEX:3526) | NT$264.50 | NT$526.96 | 49.8% |

| Strike CompanyLimited (TSE:6196) | ¥3595.00 | ¥7189.64 | 50% |

| Fevertree Drinks (AIM:FEVR) | £6.575 | £13.12 | 49.9% |

| Solum (KOSE:A248070) | ₩18700.00 | ₩37346.38 | 49.9% |

| North Electro-OpticLtd (SHSE:600184) | CN¥10.81 | CN¥21.57 | 49.9% |

| Vestas Wind Systems (CPSE:VWS) | DKK92.60 | DKK184.75 | 49.9% |

| ASMPT (SEHK:522) | HK$75.15 | HK$150.05 | 49.9% |

| St. James's Place (LSE:STJ) | £9.315 | £18.60 | 49.9% |

| Condor Energies (TSX:CDR) | CA$1.82 | CA$3.63 | 49.8% |

Let's explore several standout options from the results in the screener.

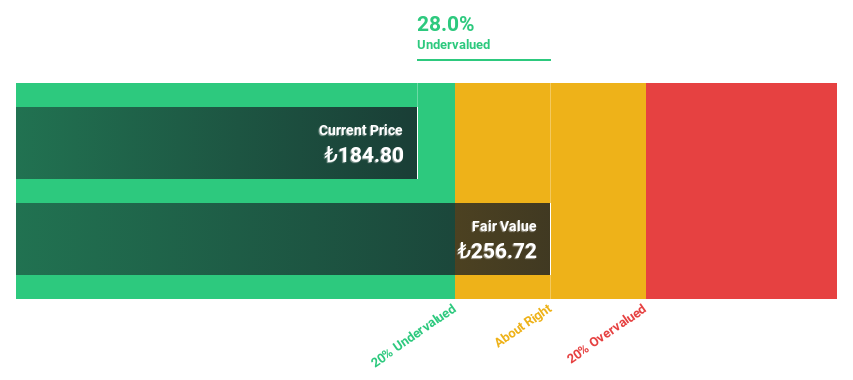

Dogus Otomotiv Servis ve Ticaret (IBSE:DOAS)

Overview: Dogus Otomotiv Servis ve Ticaret A.S., along with its subsidiaries, functions as an automotive importer and distributor in Turkey, with a market cap of TRY41.93 billion.

Operations: The company's revenue segments include Real Estate, contributing TRY547.36 million.

Estimated Discount To Fair Value: 19.5%

Dogus Otomotiv Servis ve Ticaret's recent earnings report highlights a challenging year-over-year performance, with net income dropping significantly. Despite this, the stock trades at 19.5% below its estimated fair value and shows good relative value compared to peers. While profit margins have decreased, revenue and earnings are forecasted to grow faster than the market, suggesting potential undervaluation based on cash flows. However, its dividend is not well covered by current earnings or free cash flows.

- Our comprehensive growth report raises the possibility that Dogus Otomotiv Servis ve Ticaret is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Dogus Otomotiv Servis ve Ticaret's balance sheet health report.

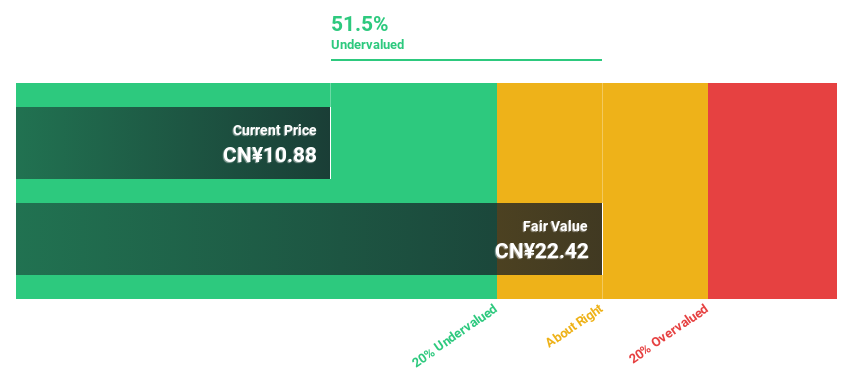

North Electro-OpticLtd (SHSE:600184)

Overview: North Electro-Optic Co., Ltd. is engaged in the research, development, production, and sale of optoelectronic materials and devices both in China and internationally, with a market cap of approximately CN¥5 billion.

Operations: Unfortunately, the provided Business operations text does not include specific revenue segment details or figures for North Electro-Optic Co., Ltd. If you have additional information about their revenue segments, please share it so I can assist you further.

Estimated Discount To Fair Value: 49.9%

North Electro-Optic Ltd. is trading at CN¥10.81, significantly below its estimated fair value of CN¥21.57, presenting a strong case for undervaluation based on cash flows. Despite recent challenges, including a decrease in net income and revenue compared to the previous year, the company's earnings are forecasted to grow substantially at 46% annually over the next three years, outpacing market expectations. However, profit margins have declined from 2.6% to 1.5%.

- Our earnings growth report unveils the potential for significant increases in North Electro-OpticLtd's future results.

- Dive into the specifics of North Electro-OpticLtd here with our thorough financial health report.

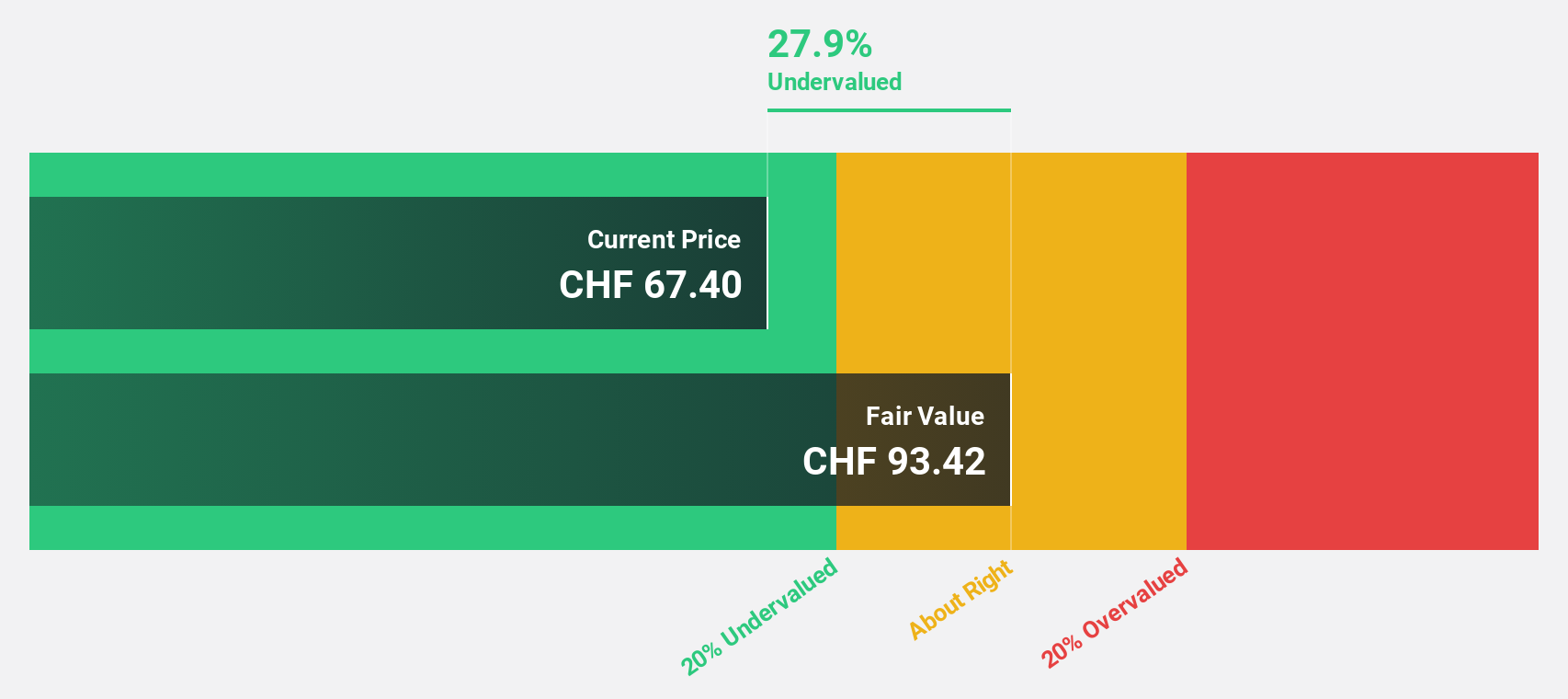

COLTENE Holding (SWX:CLTN)

Overview: COLTENE Holding AG is a company that develops, manufactures, and sells dental disposables, tools, and equipment across Europe, the Middle East, Africa, North America, Latin America, and Asia/Oceania with a market cap of CHF320.28 million.

Operations: The company's revenue from disposables, tools, and equipment for dental professionals and laboratories amounts to CHF238.80 million.

Estimated Discount To Fair Value: 40.1%

COLTENE Holding, trading at CHF55, is undervalued with an estimated fair value of CHF91.84. Despite a decline in profit margins from 9.1% to 5.2%, the company's earnings are expected to grow significantly at 22.9% annually over the next three years, surpassing the Swiss market's growth rate of 11.1%. However, revenue growth is projected at a modest 3.3% annually, below the market average of 4.3%.

- Insights from our recent growth report point to a promising forecast for COLTENE Holding's business outlook.

- Take a closer look at COLTENE Holding's balance sheet health here in our report.

Seize The Opportunity

- Delve into our full catalog of 873 Undervalued Stocks Based On Cash Flows here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if North Electro-OpticLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600184

North Electro-OpticLtd

Researches, develops, produces, and sells optoelectronic materials and devices in China and internationally.

Flawless balance sheet and good value.