As global markets navigate a landscape of easing U.S. core inflation and strong bank earnings, major indices such as the S&P 500 and Nasdaq Composite have recorded significant gains, reflecting optimism despite recent volatility. In this environment, identifying high growth tech stocks involves considering companies that can capitalize on technological advancements while adapting to shifting economic conditions and investor sentiment.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| TG Therapeutics | 29.87% | 43.91% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.39% | 56.66% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

Click here to see the full list of 1230 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Pearl Abyss (KOSDAQ:A263750)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pearl Abyss Corp. is involved in software development for games and has a market capitalization of approximately ₩1.74 trillion.

Operations: Pearl Abyss generates revenue primarily from game sales, amounting to ₩320.67 billion.

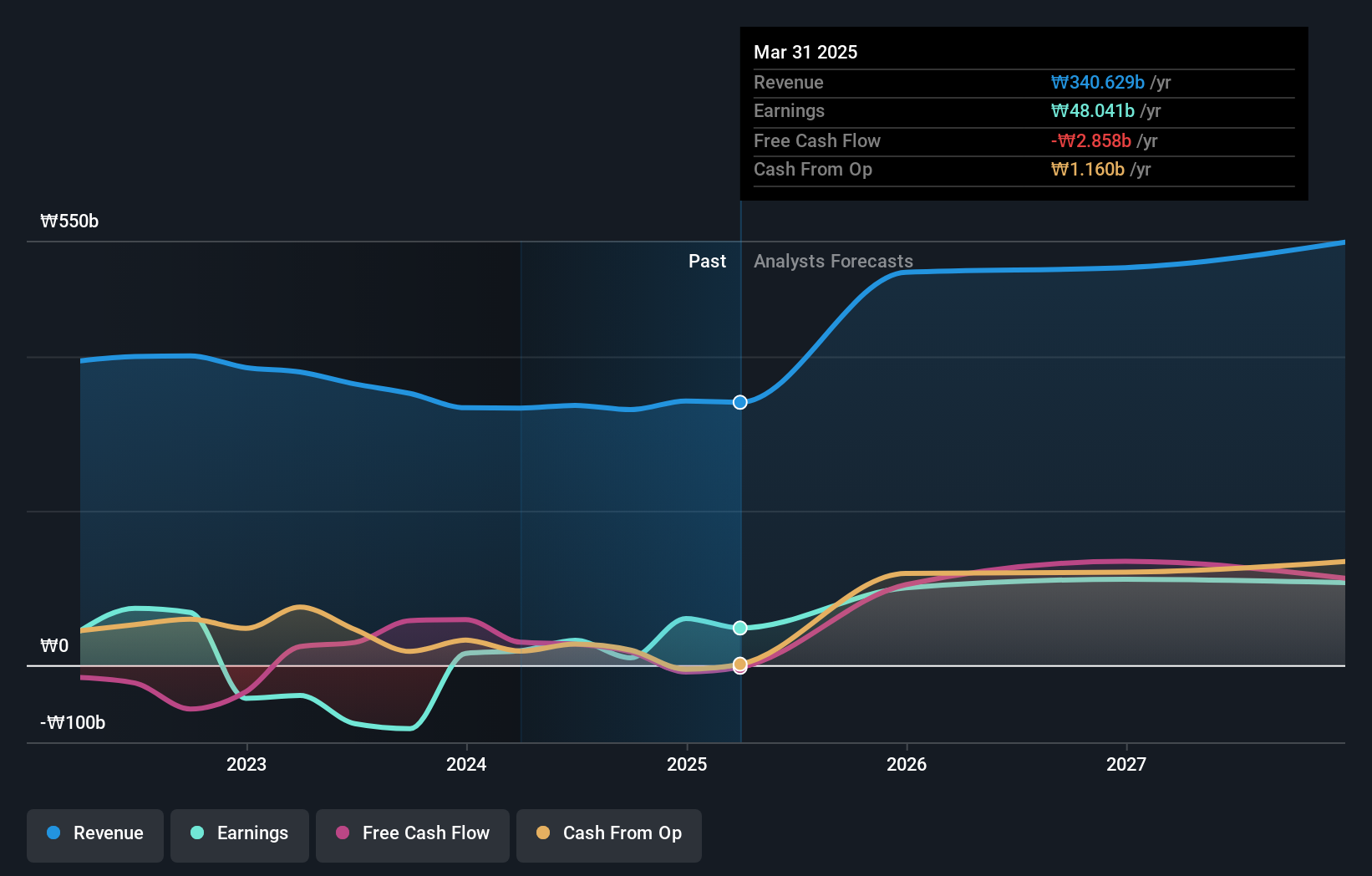

Pearl Abyss, a player in the tech sector, has shown impressive growth metrics that underscore its potential in high-growth markets. With an annualized revenue increase of 22.9% and earnings growth at a robust 78.9%, the company outpaces the broader KR market's figures of 9.4% and 28.8%, respectively. This performance is bolstered by significant R&D investment, aligning with industry trends towards innovation-driven expansion. Moreover, turning profitable this year highlights their effective strategy and operational efficiency in a competitive landscape, positioning them well for sustained future growth amidst evolving market demands.

- Unlock comprehensive insights into our analysis of Pearl Abyss stock in this health report.

Assess Pearl Abyss' past performance with our detailed historical performance reports.

Kakao Games (KOSDAQ:A293490)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kakao Games Corporation operates a mobile and PC online game service platform for gamers worldwide with a market capitalization of ₩1.35 trillion.

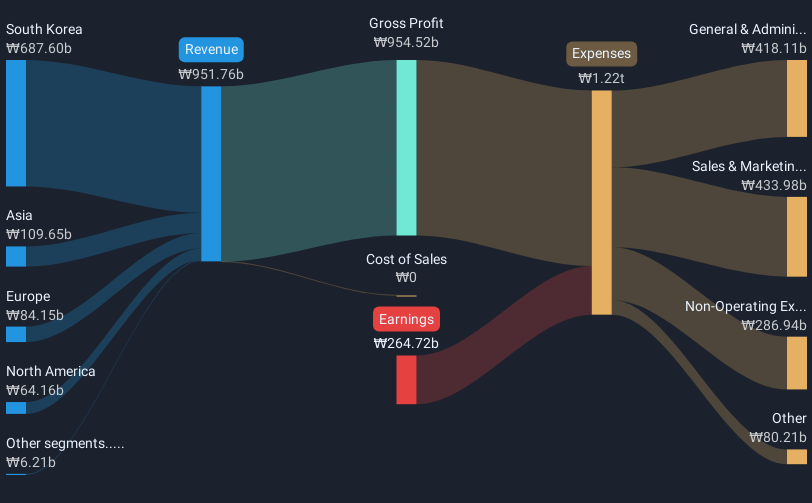

Operations: The company's revenue is primarily derived from its computer graphics segment, amounting to ₩951.76 million.

Kakao Games, amid a challenging landscape, is navigating through its growth phase with a strategic focus on innovation and market adaptation. Despite currently being unprofitable, the company's revenue is expected to grow at 9.4% annually, matching the broader KR market pace. This aligns with their recent presentation at Citi's 2024 Korea Corporate Day, underlining their active engagement in pivotal industry discussions. Impressively, earnings are projected to surge by approximately 129% annually over the next three years, signaling a robust turnaround strategy that could redefine its market stance. Moreover, with an anticipated shift to profitability and a low forecast return on equity of 5.9%, Kakao Games exemplifies the volatile yet potentially rewarding nature of high-growth tech sectors focused on entertainment and digital content.

- Dive into the specifics of Kakao Games here with our thorough health report.

Gain insights into Kakao Games' historical performance by reviewing our past performance report.

Shenzhen Kangtai Biological Products (SZSE:300601)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Kangtai Biological Products Co., Ltd. is a company engaged in the development, production, and sale of vaccines with a market capitalization of CN¥16.41 billion.

Operations: Kangtai Biological Products generates revenue primarily from its biochemical product segment, amounting to CN¥3.03 billion. The company's focus on vaccine development and production is a key component of its business operations.

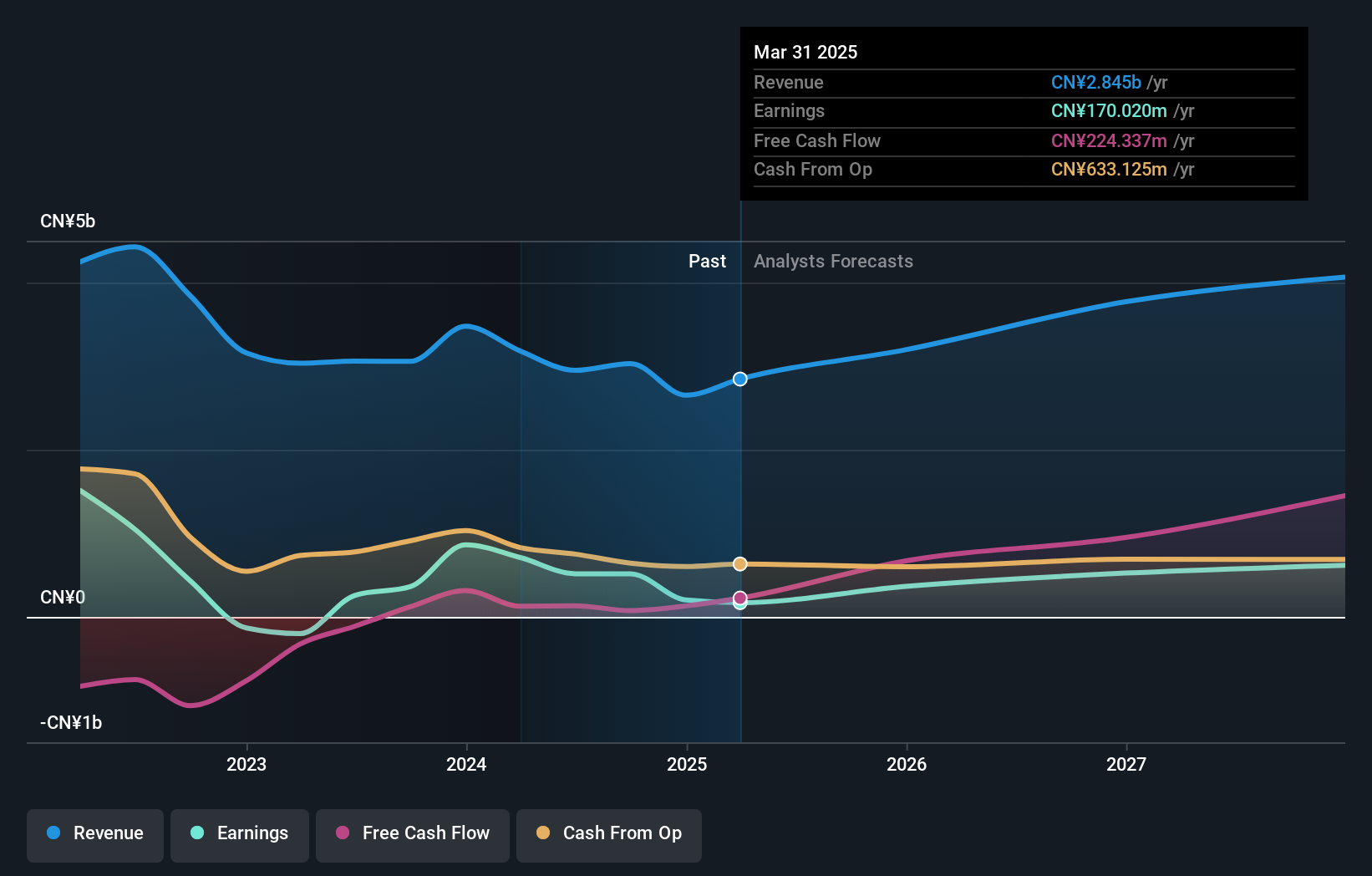

Amidst a shifting landscape in biotechnology, Shenzhen Kangtai Biological Products has demonstrated significant financial dynamics with a reported 21.7% annual revenue growth, outpacing the broader Chinese market's 13.4%. Despite recent challenges highlighted by a decline in net income from CNY 697.05 million to CNY 351.1 million over nine months, the company's strategic maneuvers in R&D and corporate governance are noteworthy. Particularly, its R&D commitment is evident as it continues to innovate within the biotech sector, aligning with industry demands for advanced biological products. The recent shareholders' meeting also reflects proactive steps towards refining corporate strategies and enhancing shareholder value through key executive reappointments and adjustments in capital allocation policies.

Key Takeaways

- Unlock our comprehensive list of 1230 High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300601

Shenzhen Kangtai Biological Products

Shenzhen Kangtai Biological Products Co., Ltd.

Undervalued with high growth potential.