- China

- /

- Oil and Gas

- /

- SZSE:002259

Undervalued Opportunities: Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

With cooling inflation and robust bank earnings, major U.S. stock indexes have rebounded, with value stocks outperforming growth shares significantly. In such a market climate, identifying undervalued opportunities becomes crucial for investors looking to diversify their portfolios. Though the term 'penny stock' might sound like a relic of past trading days, these smaller or newer companies can still offer significant returns when supported by strong financials.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.14B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.67 | HK$41.79B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.97 | HK$628.44M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.944 | £150.76M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR425.99M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.10 | £776.24M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.425 | £178.93M | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$141.28M | ★★★★☆☆ |

Click here to see the full list of 5,726 stocks from our Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

JBM (Healthcare) (SEHK:2161)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: JBM (Healthcare) Limited is an investment holding company involved in the manufacture, marketing, distribution, and sale of branded healthcare and wellness products across Hong Kong, Macau, Mainland China, and international markets with a market cap of approximately HK$1.43 billion.

Operations: The company's revenue is derived from three main segments: Branded Medicines with HK$215.22 million, Health and Wellness Products generating HK$85.81 million, and Proprietary Chinese Medicines contributing HK$419.51 million.

Market Cap: HK$1.43B

JBM (Healthcare) Limited has shown robust financial health and growth, with a recent earnings increase of 67.2% over the past year, surpassing its five-year average and industry benchmarks. The company reported HK$398.95 million in sales for the half year ending September 2024, alongside a net income rise to HK$95.88 million from HK$62.46 million the previous year. Its strategic share buyback program has reduced outstanding shares by nearly 10%, enhancing shareholder value without significant dilution. Strong cash reserves cover both short- and long-term liabilities effectively, while interest payments are well-covered by EBIT at a ratio of 29.3 times.

- Unlock comprehensive insights into our analysis of JBM (Healthcare) stock in this financial health report.

- Gain insights into JBM (Healthcare)'s past trends and performance with our report on the company's historical track record.

KuangChi Science (SEHK:439)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: KuangChi Science Limited is an investment holding company that develops artificial intelligence technology and related products in the People’s Republic of China, Hong Kong, and internationally, with a market cap of approximately HK$1.26 billion.

Operations: The company's revenue is primarily derived from its Aerospace & Defense segment, amounting to HK$81.71 million.

Market Cap: HK$1.26B

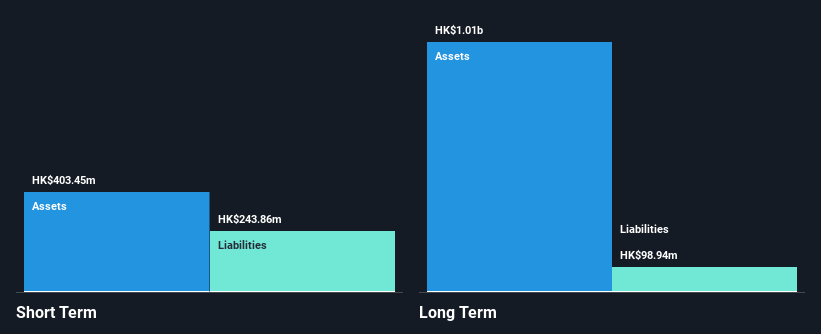

KuangChi Science Limited, with a market cap of HK$1.26 billion, primarily generates revenue from its Aerospace & Defense segment, totaling HK$81.71 million. Despite being unprofitable, the company has reduced losses significantly over five years and maintains more cash than total debt. Its short-term assets of HK$342.2 million cover both short- and long-term liabilities comfortably. The board and management team are experienced with average tenures of 7.8 and 2.1 years respectively. While it has a stable cash runway for over a year based on current free cash flow, its high volatility suggests caution in the penny stock space.

- Dive into the specifics of KuangChi Science here with our thorough balance sheet health report.

- Examine KuangChi Science's past performance report to understand how it has performed in prior years.

Sichuan Shengda Forestry Industry (SZSE:002259)

Simply Wall St Financial Health Rating: ★★★★☆☆

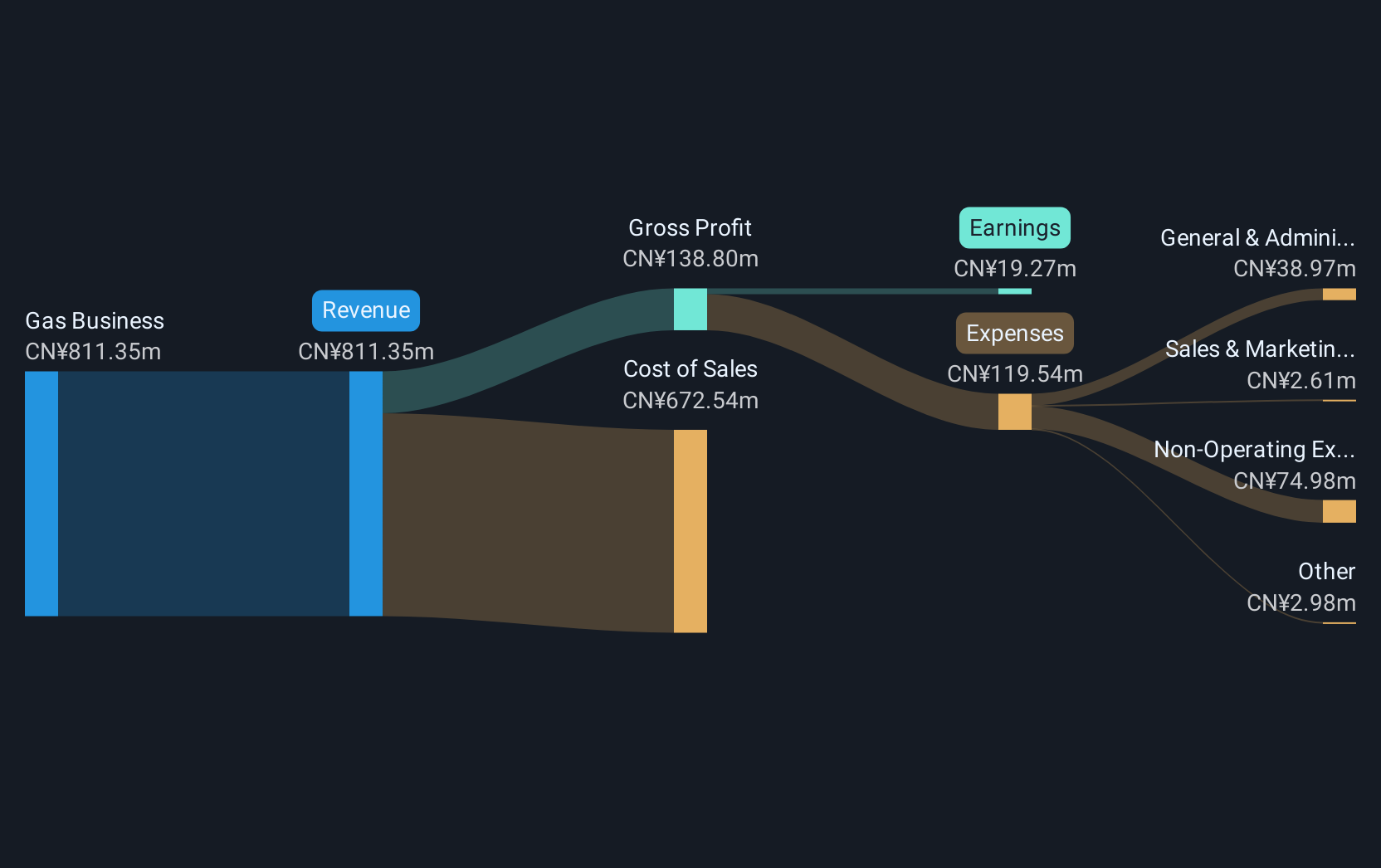

Overview: Sichuan Shengda Forestry Industry Co., Ltd operates in the production and sale of liquefied natural gas (LNG) in China, with a market cap of CN¥1.66 billion.

Operations: The company generates revenue primarily from its gas business, amounting to CN¥685.80 million.

Market Cap: CN¥1.66B

Sichuan Shengda Forestry Industry, with a market cap of CN¥1.66 billion, focuses on LNG production and sales in China. Despite reporting a net loss of CN¥20.31 million for the nine months ending September 2024, the company has maintained sufficient cash runway for over three years due to positive free cash flow growth. Its short-term assets exceed short-term liabilities but fall short against long-term obligations. The board is experienced with an average tenure of 4.3 years, while shareholders have not faced significant dilution recently. Although unprofitable, it holds more cash than total debt and has reduced losses over five years significantly.

- Click here to discover the nuances of Sichuan Shengda Forestry Industry with our detailed analytical financial health report.

- Explore historical data to track Sichuan Shengda Forestry Industry's performance over time in our past results report.

Taking Advantage

- Click through to start exploring the rest of the 5,723 Penny Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002259

Sichuan Shengda Forestry Industry

Engages in the production and sale of liquefied natural gas (LNG) in China.

Adequate balance sheet with weak fundamentals.