As global markets experience a rebound, driven by easing core U.S. inflation and strong bank earnings, investors are closely monitoring growth stocks, which have recently underperformed value shares. In this environment, companies with high insider ownership can be particularly attractive as they often signal confidence from those who know the business best and may offer potential resilience amid fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Medley (TSE:4480) | 34.1% | 27.2% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 108.3% |

| Findi (ASX:FND) | 35.8% | 110.7% |

Let's explore several standout options from the results in the screener.

Shenzhen Capchem Technology (SZSE:300037)

Simply Wall St Growth Rating: ★★★★★☆

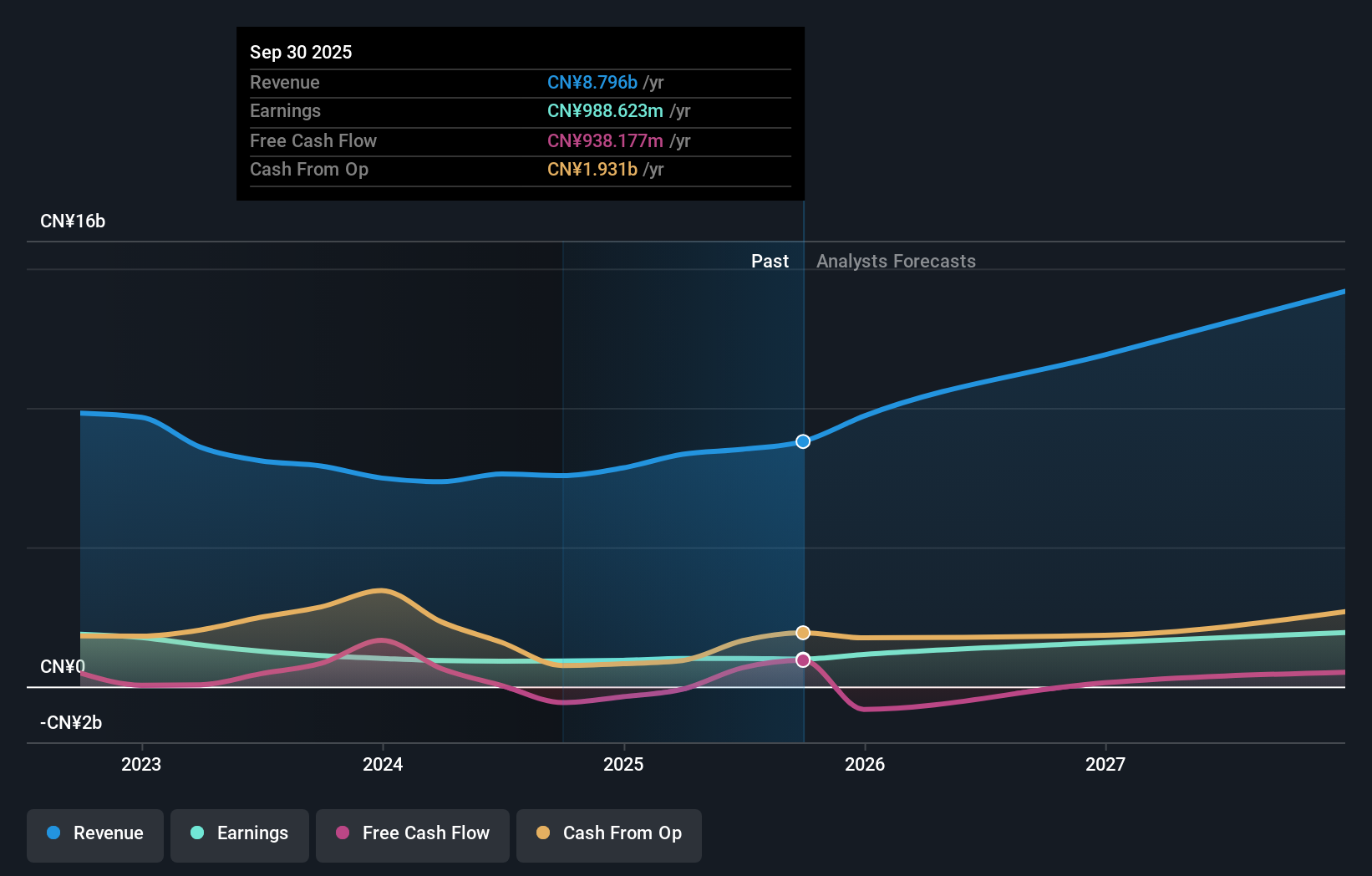

Overview: Shenzhen Capchem Technology Co., Ltd. engages in the research, development, production, sale, and servicing of electronic chemicals and functional materials both in China and internationally, with a market cap of CN¥25.76 billion.

Operations: Shenzhen Capchem Technology generates revenue through its electronic chemicals products and functional materials operations, serving both domestic and international markets.

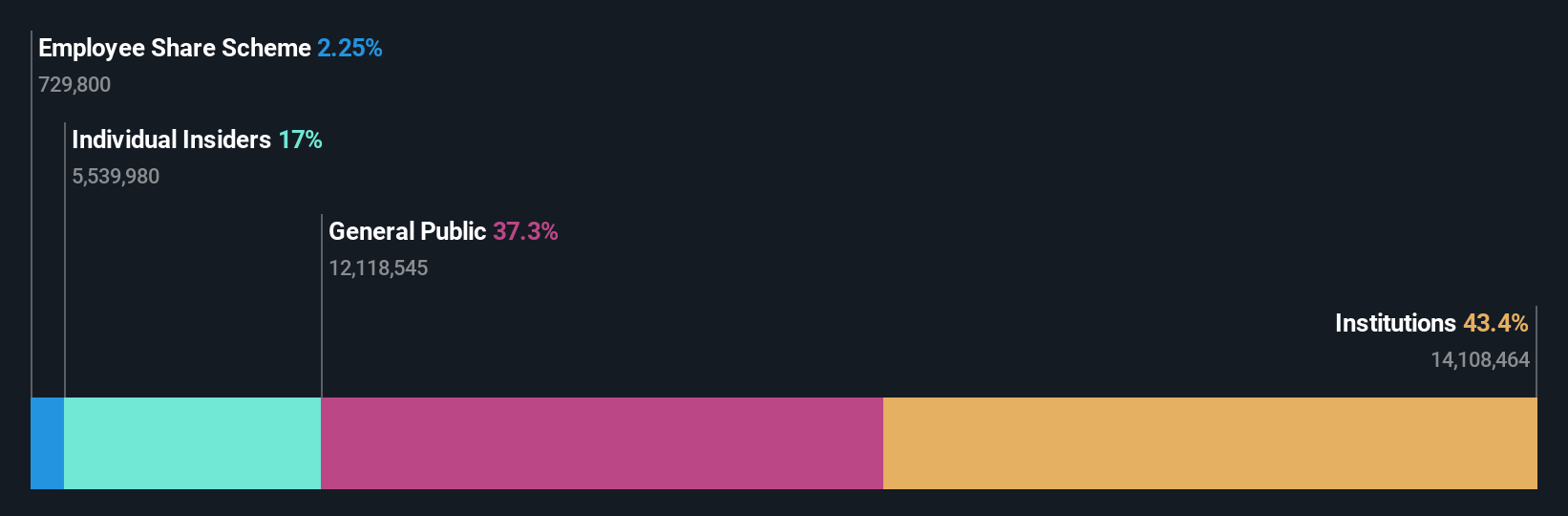

Insider Ownership: 39.4%

Shenzhen Capchem Technology is positioned for growth with earnings projected to increase by 28.4% annually, outpacing the Chinese market. Despite a low forecasted return on equity of 17.2%, its price-to-earnings ratio of 28.5x suggests good value compared to the market average of 34.6x. Recent share buybacks totaling CNY 100.05 million indicate management's confidence in its prospects, though dividend sustainability remains a concern due to limited free cash flow coverage.

- Click here and access our complete growth analysis report to understand the dynamics of Shenzhen Capchem Technology.

- The analysis detailed in our Shenzhen Capchem Technology valuation report hints at an deflated share price compared to its estimated value.

Tri Chemical Laboratories (TSE:4369)

Simply Wall St Growth Rating: ★★★★★☆

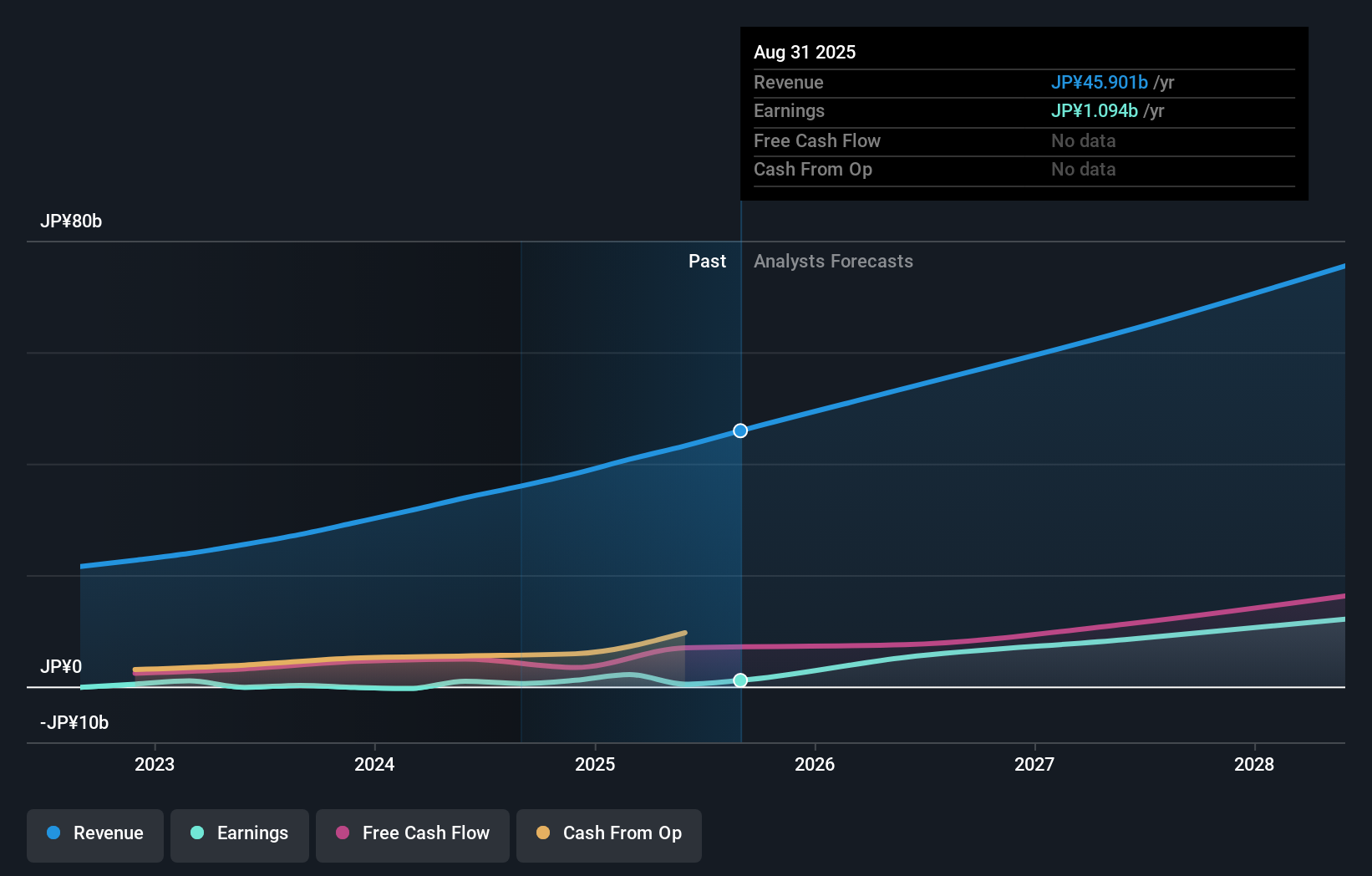

Overview: Tri Chemical Laboratories Inc. specializes in providing chemical products for semiconductors, coating, optical fibers, solar cells, and compound semiconductors, with a market cap of ¥1.10 billion.

Operations: The company's revenue is primarily derived from its High-Purity Chemical Compound Business for Manufacturing Semiconductors, totaling ¥16.14 billion.

Insider Ownership: 17.4%

Tri Chemical Laboratories is poised for significant growth, with earnings expected to rise by 29.35% annually, surpassing the Japanese market's average growth. The stock trades at a substantial discount of 42.5% below its estimated fair value, indicating potential upside as analysts anticipate a 35.1% price increase. Despite high revenue growth forecasts of 22%, the company's return on equity remains modest at an expected 18.7%. Recent insider trading data is unavailable for analysis.

- Click here to discover the nuances of Tri Chemical Laboratories with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Tri Chemical Laboratories is trading behind its estimated value.

Sansan (TSE:4443)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sansan, Inc. is a Japanese company that focuses on the planning, development, and selling of cloud-based solutions, with a market cap of ¥289.96 billion.

Operations: Sansan's revenue primarily stems from its cloud-based solutions segment in Japan.

Insider Ownership: 39.2%

Sansan is expected to see substantial earnings growth of 38.6% annually, outpacing the Japanese market's average. Despite its high volatility, the stock trades at a 32.8% discount to its estimated fair value, suggesting potential upside. Revenue is forecasted to grow at 16.2% per year, faster than the market's rate but below significant growth levels. The company became profitable this year and has no recent insider trading data available for analysis.

- Navigate through the intricacies of Sansan with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Sansan implies its share price may be lower than expected.

Seize The Opportunity

- Get an in-depth perspective on all 1464 Fast Growing Companies With High Insider Ownership by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300037

Shenzhen Capchem Technology

Researches and develops, produces, sells, and services electronic chemicals products and functional materials in China and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives