As global markets navigate a landscape of easing inflation and robust bank earnings, U.S. stocks have rebounded, with value stocks outperforming growth shares amid a backdrop of strong financial sector performance. In this environment, identifying growth companies with high insider ownership can be particularly appealing as it often signals management's confidence in their business prospects and aligns their interests with those of shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Medley (TSE:4480) | 34.1% | 27.2% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 108.3% |

| Findi (ASX:FND) | 35.8% | 110.7% |

Here we highlight a subset of our preferred stocks from the screener.

Moltiply Group (BIT:MOL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Moltiply Group S.p.A. operates comparison platforms and offers outsourcing services for credit processes, asset management, and insurance claims management in Italy, with a market cap of €1.34 billion.

Operations: The company generates revenue from its Mavriq Division (€208.81 million) and Moltiply BPO&Tech (€225.83 million) segments.

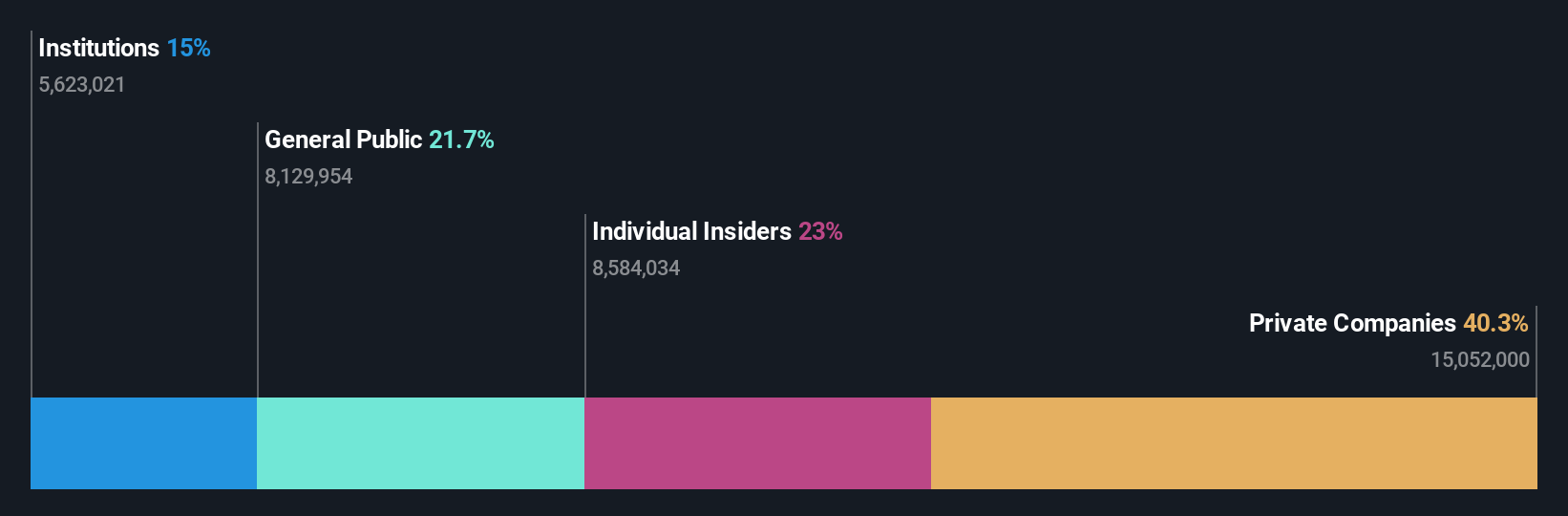

Insider Ownership: 22.9%

Moltiply Group is poised for significant growth, with earnings expected to increase 29.7% annually, outpacing the Italian market's 6.8%. Revenue growth of 7.4% per year also surpasses the local market average of 4.1%. However, its Return on Equity is forecasted to remain low at 15.1% in three years. Recent discussions about acquiring Verivox GmbH for over €250 million ($263 million) could enhance its strategic position and drive further expansion opportunities.

- Click here to discover the nuances of Moltiply Group with our detailed analytical future growth report.

- Our valuation report here indicates Moltiply Group may be overvalued.

Beijing Konruns PharmaceuticalLtd (SHSE:603590)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Konruns Pharmaceutical Co., Ltd. is involved in the research, development, production, and sale of pharmaceuticals both in China and internationally, with a market cap of CN¥3.72 billion.

Operations: The company's revenue is primarily derived from its Pharmaceutical Manufacturing segment, which generated CN¥846.29 million.

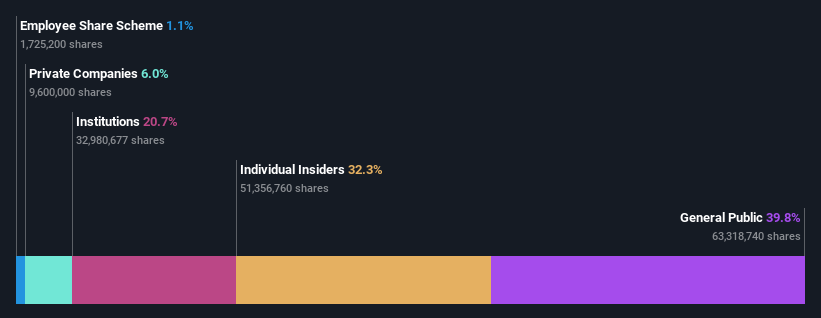

Insider Ownership: 32.3%

Beijing Konruns Pharmaceutical is set for robust growth, with earnings projected to rise 34.3% annually, surpassing the Chinese market's 25.2%. Revenue is also expected to grow at 24.1% per year, outpacing the market average. However, its Return on Equity is anticipated to be low at 7.9% in three years. Despite being dropped from the S&P Global BMI Index recently, it maintains a competitive Price-To-Earnings ratio of 33.6x against the market's 34.6x.

- Dive into the specifics of Beijing Konruns PharmaceuticalLtd here with our thorough growth forecast report.

- The analysis detailed in our Beijing Konruns PharmaceuticalLtd valuation report hints at an inflated share price compared to its estimated value.

Zbit Semiconductor (SHSE:688416)

Simply Wall St Growth Rating: ★★☆☆☆☆

Overview: Zbit Semiconductor, Inc. is an integrated circuit design company in China that focuses on the R&D, design, and sale of memory and MCU chips with a market cap of CN¥2.94 billion.

Operations: The company's revenue primarily comes from its semiconductors segment, which generated CN¥351.52 million.

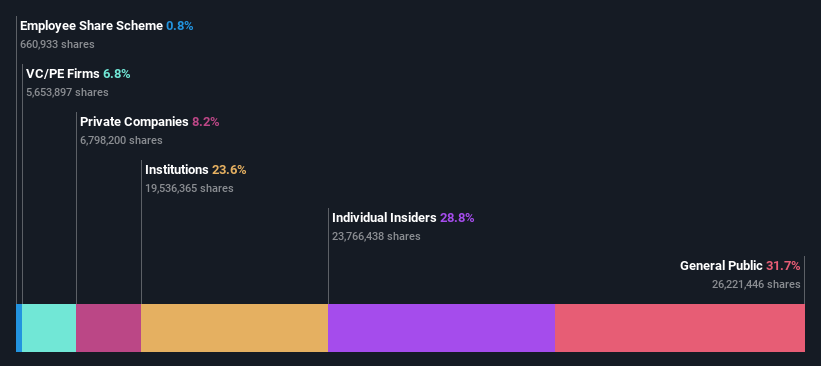

Insider Ownership: 28.8%

Zbit Semiconductor's insider ownership aligns with its growth potential, despite current unprofitability. Revenue is projected to grow at 22.1% annually, outpacing the Chinese market's 13.4%. The company recently announced a CNY 60 million share buyback to enhance employee incentives and long-term growth prospects. However, volatility in share price and ongoing losses present challenges as it remains forecasted to be unprofitable over the next three years.

- Take a closer look at Zbit Semiconductor's potential here in our earnings growth report.

- Our valuation report unveils the possibility Zbit Semiconductor's shares may be trading at a premium.

Taking Advantage

- Navigate through the entire inventory of 1464 Fast Growing Companies With High Insider Ownership here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Konruns PharmaceuticalLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603590

Beijing Konruns PharmaceuticalLtd

Engages in the research and development, production, and sale of pharmaceuticals in China and internationally.

High growth potential with excellent balance sheet.