- Spain

- /

- Healthcare Services

- /

- BME:CBAV

Undiscovered Gems With Strong Fundamentals For November 2024

Reviewed by Simply Wall St

In the wake of a significant rally in U.S. stocks following the election, with small-cap indices like the Russell 2000 showing notable gains, investors are increasingly optimistic about economic growth and favorable fiscal policies. Amidst this backdrop, identifying stocks with robust fundamentals becomes crucial as they can potentially offer resilience and opportunity in a dynamic market environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| AGI Infra | 61.29% | 29.16% | 33.44% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Abans Holdings | 94.08% | 16.32% | 18.24% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.20% | 16.85% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Clínica Baviera (BME:CBAV)

Simply Wall St Value Rating: ★★★★★☆

Overview: Clínica Baviera, S.A. is a medical company that operates a network of ophthalmology clinics with a market cap of €581.99 million.

Operations: The company generates its revenue primarily from ophthalmology services, amounting to €243.31 million. It focuses on optimizing its cost structure to enhance financial performance.

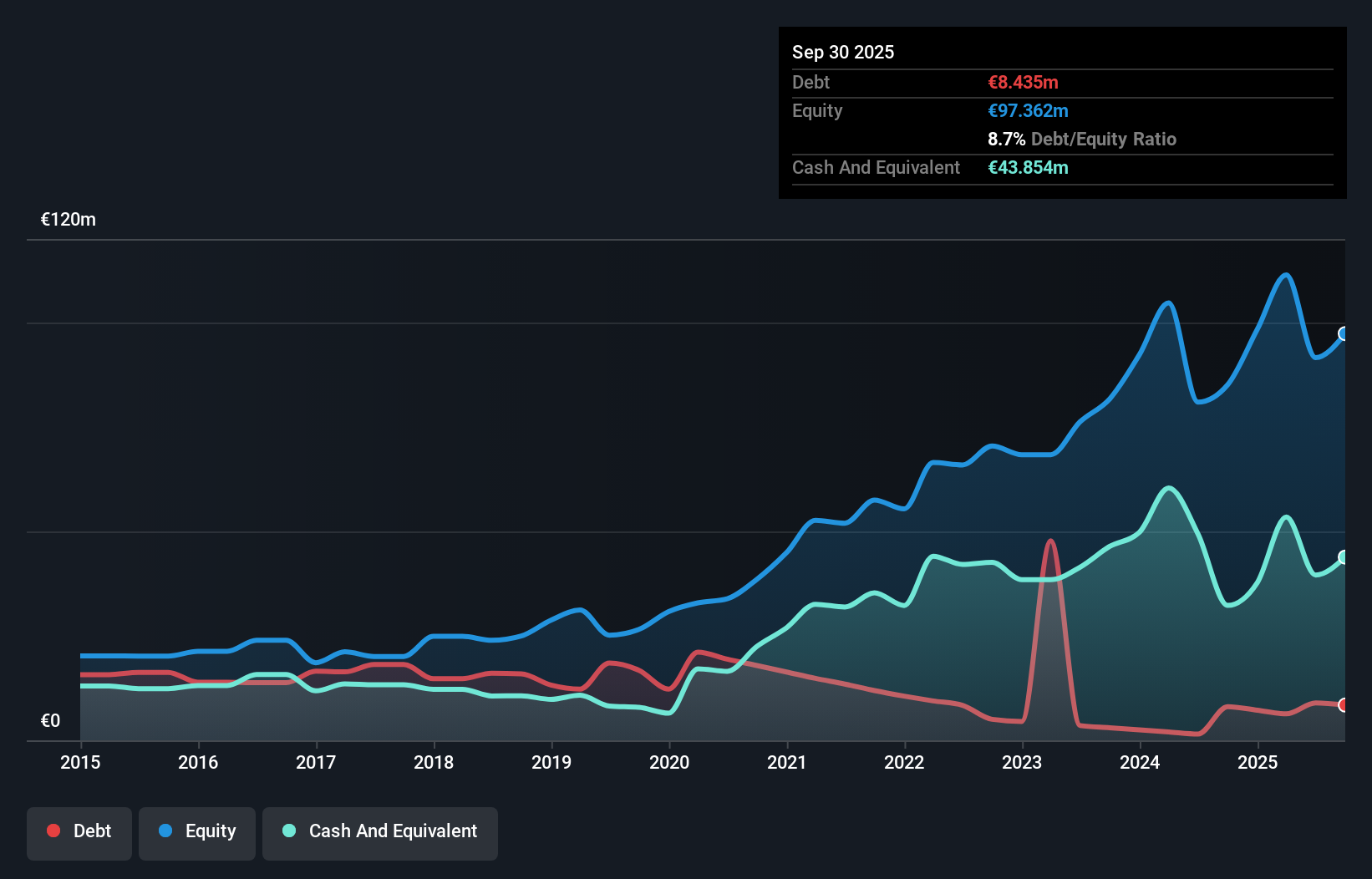

With a notable 22.5% earnings growth over the past year, Clínica Baviera stands out in the healthcare sector, surpassing industry growth of 14.3%. The company has successfully reduced its debt to equity ratio from 73.5% to 1.9% over five years, showcasing strong financial management. Despite recent share price volatility, it trades at a significant discount of 52.1% below estimated fair value, suggesting potential undervaluation opportunities for investors. Additionally, with interest payments well covered by EBIT at an impressive multiple of 144 and more cash than total debt, Clínica Baviera appears financially robust and poised for future stability.

- Click here to discover the nuances of Clínica Baviera with our detailed analytical health report.

Assess Clínica Baviera's past performance with our detailed historical performance reports.

Oba Makarnacilik Sanayi ve Ticaret (IBSE:OBAMS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Oba Makarnacilik Sanayi ve Ticaret A.S. is a company that produces and sells pasta both in Turkey and internationally, with a market cap of TRY18.43 billion.

Operations: Oba Makarnacilik generates revenue primarily from its food processing segment, amounting to TRY20.95 billion.

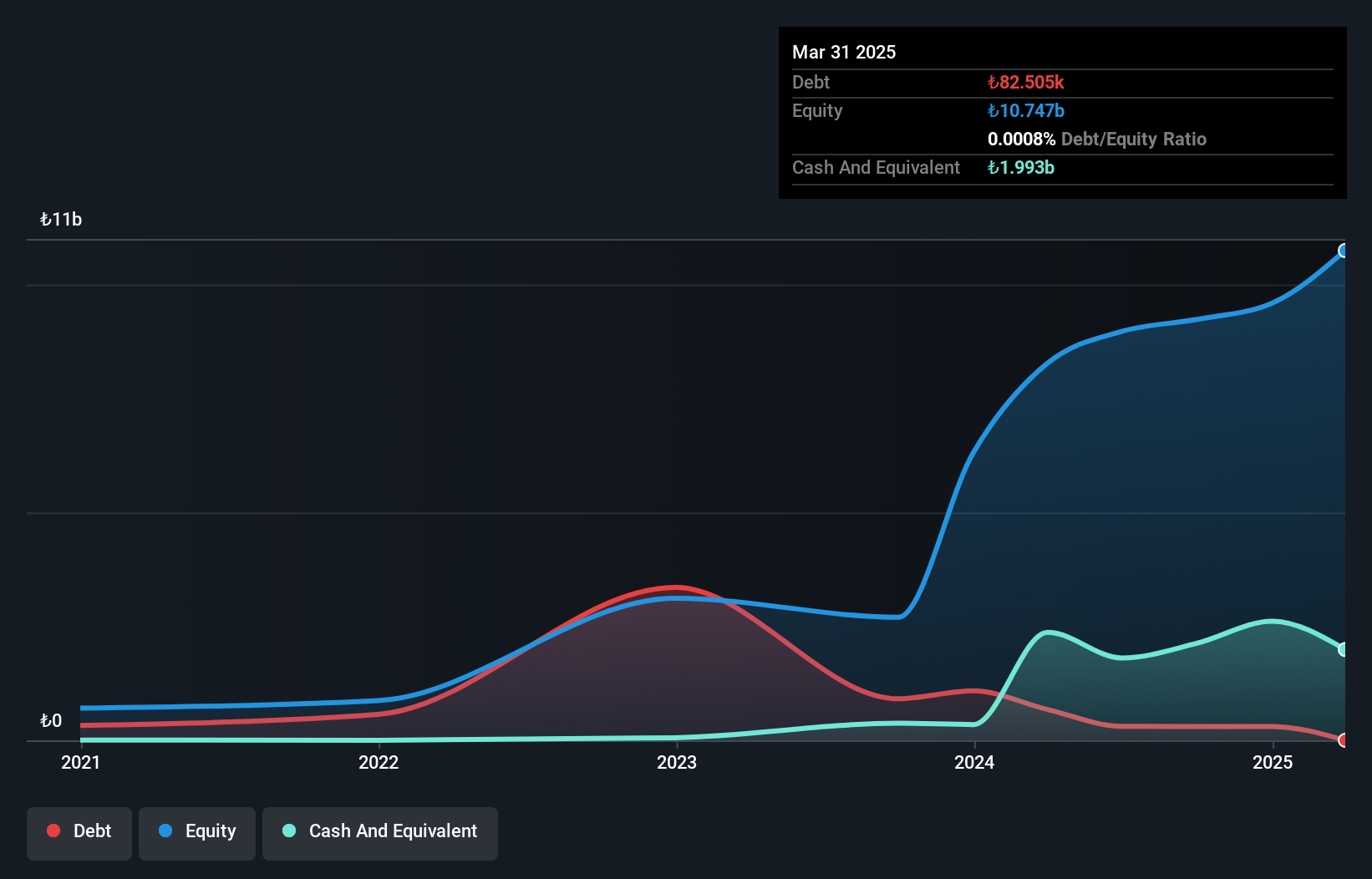

Oba Makarnacilik, a small player in the food industry, has recently turned profitable, which is noteworthy given the industry's 15% earnings contraction. The company's price-to-earnings ratio of 9.2x suggests it might be undervalued compared to Turkey's market average of 14.6x. Despite its profitability and high-quality earnings, Oba faces challenges with interest coverage as EBIT covers only 0.9 times its debt payments—below the ideal threshold of three times. Additionally, being added to the S&P Global BMI Index could enhance visibility and attract more investors moving forward.

Philip Morris CR (SEP:TABAK)

Simply Wall St Value Rating: ★★★★★★

Overview: Philip Morris CR a.s. operates through its subsidiary, Philip Morris Slovakia s.r.o., to manufacture and market tobacco products under various brands in the Czech Republic and Slovak Republic, with a market cap of CZK44.75 billion.

Operations: The company generates revenue primarily from its distribution activities, with CZK14.69 billion from the Czech Republic and CZK6.16 billion from the Slovak Republic. Its manufacturing services contribute an additional CZK2.78 billion to total revenues.

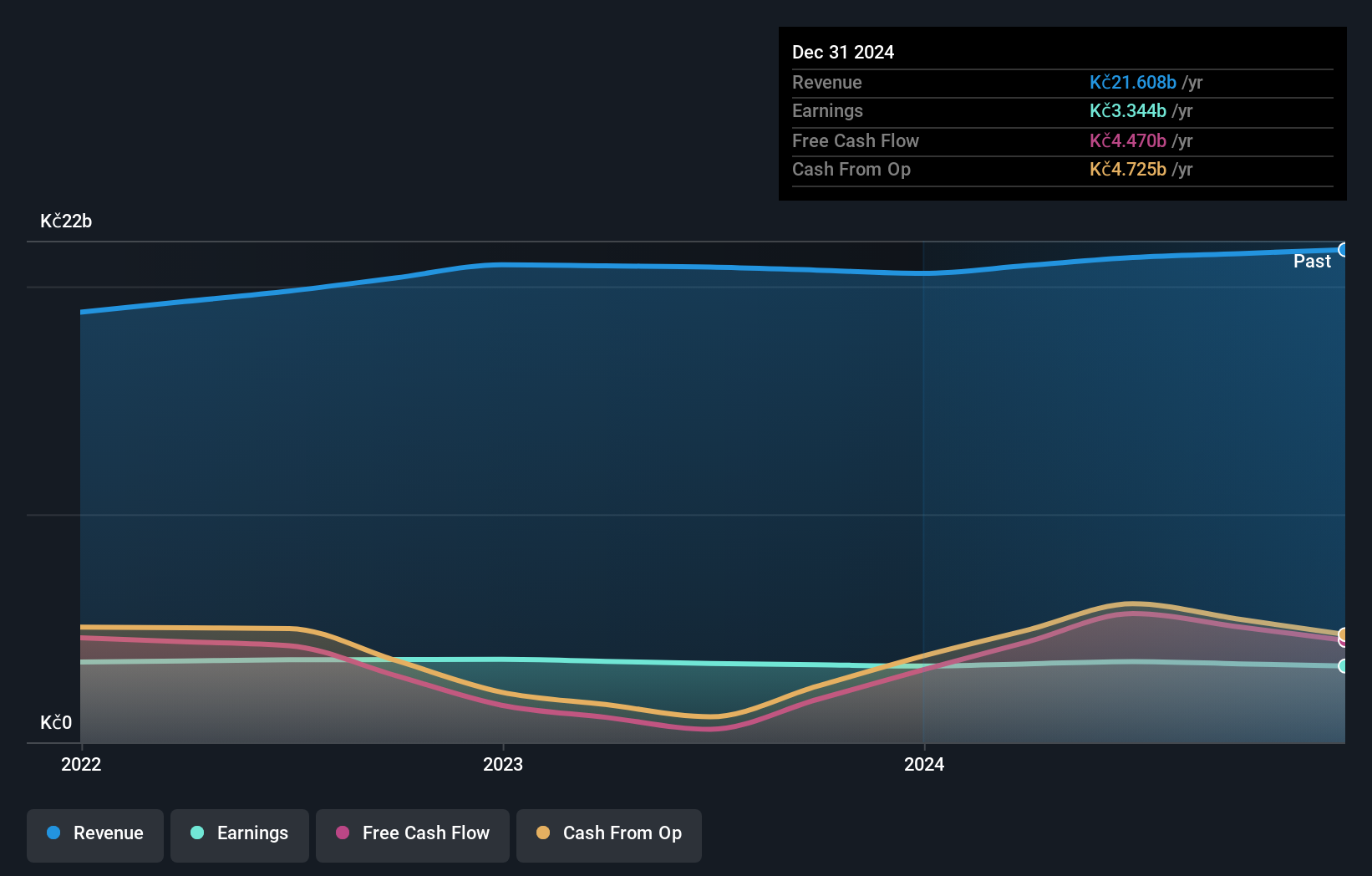

Philip Morris CR, a relatively smaller player in the tobacco industry, reported half-year sales of CZK 10.40 billion, up from CZK 9.71 billion the previous year. Net income also rose to CZK 1.85 billion from CZK 1.65 billion, reflecting steady growth despite earnings declining by an average of 3% annually over five years. Basic earnings per share increased to CZK 674 from CZK 602, indicating solid performance amidst industry challenges. The company operates debt-free and trades at a significant discount to its estimated fair value by about 75%, suggesting potential undervaluation in the market context.

- Click here and access our complete health analysis report to understand the dynamics of Philip Morris CR.

Gain insights into Philip Morris CR's past trends and performance with our Past report.

Seize The Opportunity

- Explore the 4658 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:CBAV

Clínica Baviera

A medical company, operates a network of ophthalmology clinics in Spain and Europe.

Good value with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives