- United Arab Emirates

- /

- Insurance

- /

- ADX:FIDELITYUNITED

Middle Eastern Penny Stocks With Promising Potential In September 2025

Reviewed by Simply Wall St

Recent developments in the Middle Eastern markets have seen a positive trend, with Gulf stocks rising after regional central banks mirrored the U.S. Federal Reserve's rate cut, signaling potential economic support and growth. For investors interested in exploring beyond well-known companies, penny stocks—typically representing smaller or newer entities—continue to present intriguing opportunities despite their vintage label. These stocks can offer surprising value when backed by solid financials and clear growth prospects, making them worth considering for those seeking potential long-term gains.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| E.E.A.M.I (TASE:EEAM-M) | ₪0.074 | ₪7.26M | ✅ 2 ⚠️ 4 View Analysis > |

| Maharah for Human Resources (SASE:1831) | SAR4.61 | SAR2.07B | ✅ 2 ⚠️ 3 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.64 | SAR1.46B | ✅ 2 ⚠️ 1 View Analysis > |

| Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi (IBSE:MEGAP) | TRY4.73 | TRY1.3B | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.07 | AED2.16B | ✅ 5 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.30 | AED683.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.11 | AED359.2M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.05 | AED13.01B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.85 | AED517.02M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.673 | ₪198.72M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 80 stocks from our Middle Eastern Penny Stocks screener.

We'll examine a selection from our screener results.

United Fidelity Insurance Company (P.S.C.) (ADX:FIDELITYUNITED)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: United Fidelity Insurance Company (P.S.C.) operates in the United Arab Emirates, offering a range of general and life insurance products, with a market cap of AED 256 million.

Operations: The company generates revenue from three main segments: Consumer (AED 184.48 million), Commercial (-AED 66.73 million), and Employee Benefits (AED 215.80 million).

Market Cap: AED256M

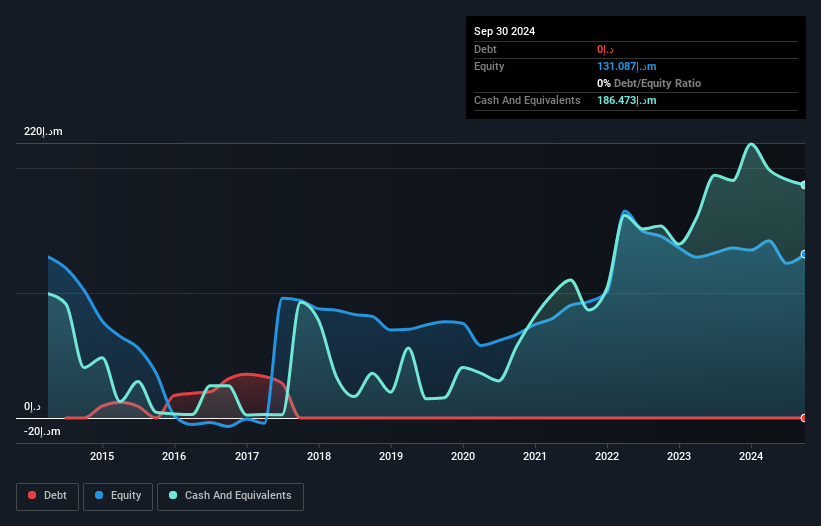

United Fidelity Insurance Company (P.S.C.) has shown recent progress, reporting a net income of AED 2.39 million for Q2 2025, compared to a significant loss in the previous year. Despite this improvement, the company remains unprofitable overall with an increasing debt-to-equity ratio and short-term liabilities exceeding assets. The management team is relatively new, averaging 1.7 years in tenure, which may impact strategic continuity. However, the company's cash position is strong enough to cover its obligations for over a year without additional funding if current cash flow trends persist.

- Click here to discover the nuances of United Fidelity Insurance Company (P.S.C.) with our detailed analytical financial health report.

- Assess United Fidelity Insurance Company (P.S.C.)'s previous results with our detailed historical performance reports.

Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret A.S. operates in the manufacturing sector, specializing in vehicle-mounted equipment, with a market capitalization of TRY3.45 billion.

Operations: The company generates revenue primarily from its vehicle equipment manufacturing segment, amounting to TRY1.32 billion.

Market Cap: TRY3.45B

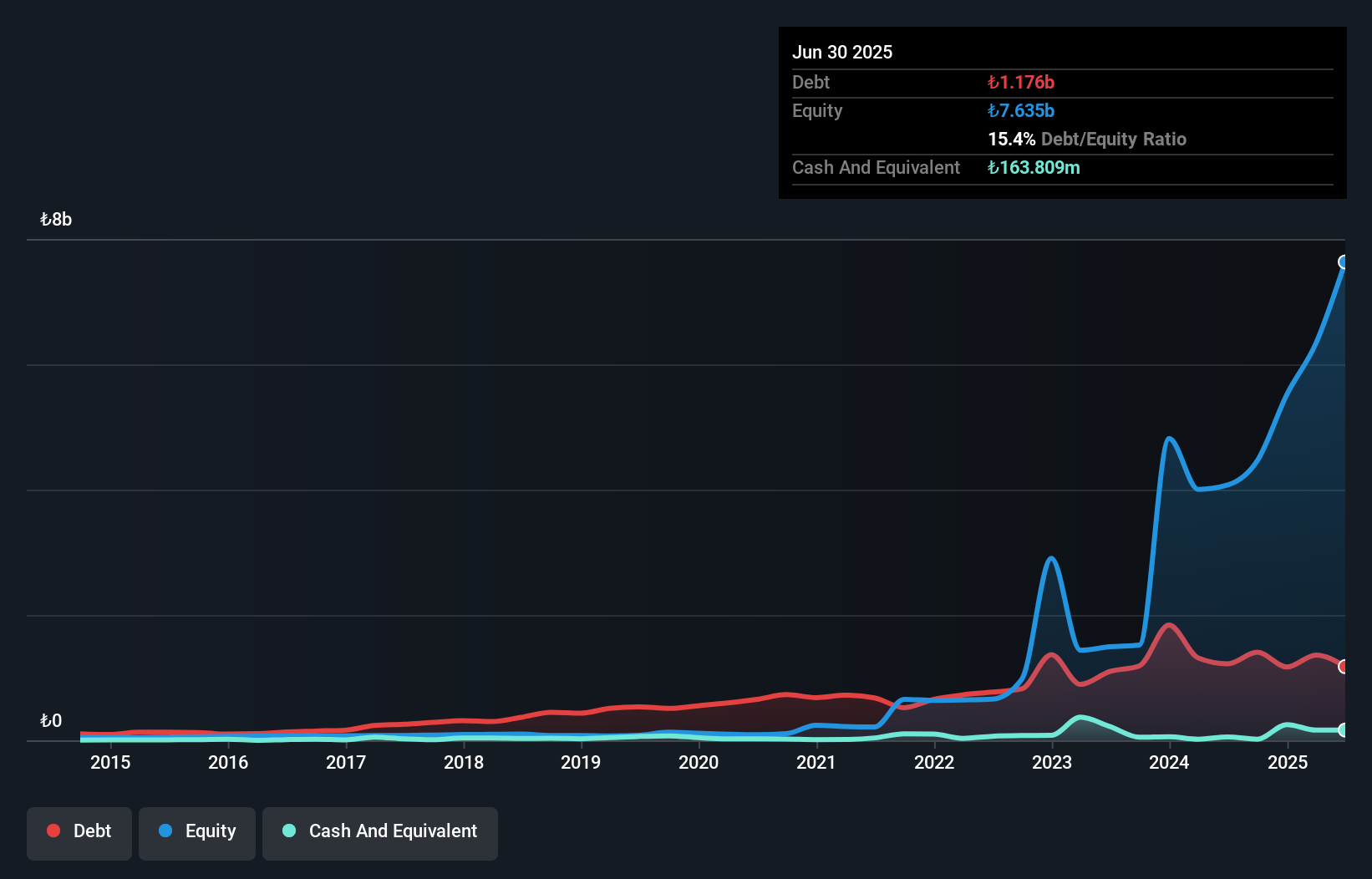

Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret A.S. has demonstrated a turnaround, reporting TRY 62.19 million in net income for Q2 2025, reversing a loss from the previous year. The company's debt-to-equity ratio has significantly improved to 15.4% from very high levels over five years, indicating better financial health. Short-term assets of TRY9.9 billion comfortably cover both short and long-term liabilities, enhancing liquidity stability despite volatile share prices and low return on equity (10.3%). Earnings quality remains high with no recent shareholder dilution, although interest coverage by EBIT is slightly below optimal at 2.8x.

- Dive into the specifics of Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret here with our thorough balance sheet health report.

- Gain insights into Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret's historical outcomes by reviewing our past performance report.

Human Xtensions (TASE:HUMX-M)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Human Xtensions Ltd. is a medical robotics company in Israel that develops, manufactures, markets, and sells modular medical devices for minimally invasive surgical operations with a market cap of ₪7.38 million.

Operations: Currently, there are no reported revenue segments for this medical robotics company based in Israel.

Market Cap: ₪7.38M

Human Xtensions Ltd., a medical robotics company in Israel, is pre-revenue with less than US$1 million in revenue. Despite being unprofitable, it has reduced losses by 12.3% annually over the past five years and recently reported a net income of ₪0.52 million for H1 2025, reversing a significant loss from the previous year. The company is debt-free and its short-term assets exceed liabilities, though it faces high share price volatility and has less than one year of cash runway based on current free cash flow trends. The board is experienced with an average tenure of 4.6 years.

- Click to explore a detailed breakdown of our findings in Human Xtensions' financial health report.

- Evaluate Human Xtensions' historical performance by accessing our past performance report.

Seize The Opportunity

- Discover the full array of 80 Middle Eastern Penny Stocks right here.

- Ready To Venture Into Other Investment Styles? These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:FIDELITYUNITED

United Fidelity Insurance Company (P.S.C.)

Engages in writing various classes of general and life insurance in the United Arab Emirates.

Adequate balance sheet with very low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)