We Think Shareholders May Consider Being More Generous With Zavarovalnica Triglav, d.d.'s (LJSE:ZVTG) CEO Compensation Package

Key Insights

- Zavarovalnica Triglav d.d to hold its Annual General Meeting on 3rd of June

- CEO Andrej Slapar's total compensation includes salary of €227.4k

- The total compensation is 81% less than the average for the industry

- Zavarovalnica Triglav d.d's total shareholder return over the past three years was 46% while its EPS grew by 0.6% over the past three years

Shareholders will probably not be disappointed by the robust results at Zavarovalnica Triglav, d.d. (LJSE:ZVTG) recently and they will be keeping this in mind as they go into the AGM on 3rd of June. This would also be a chance for them to hear the board review the financial results, discuss future company strategy to further improve the business and vote on any resolutions such as executive remuneration. We have prepared some analysis below and we show why we think CEO compensation looks decent with even the possibility for a raise.

Check out our latest analysis for Zavarovalnica Triglav d.d

How Does Total Compensation For Andrej Slapar Compare With Other Companies In The Industry?

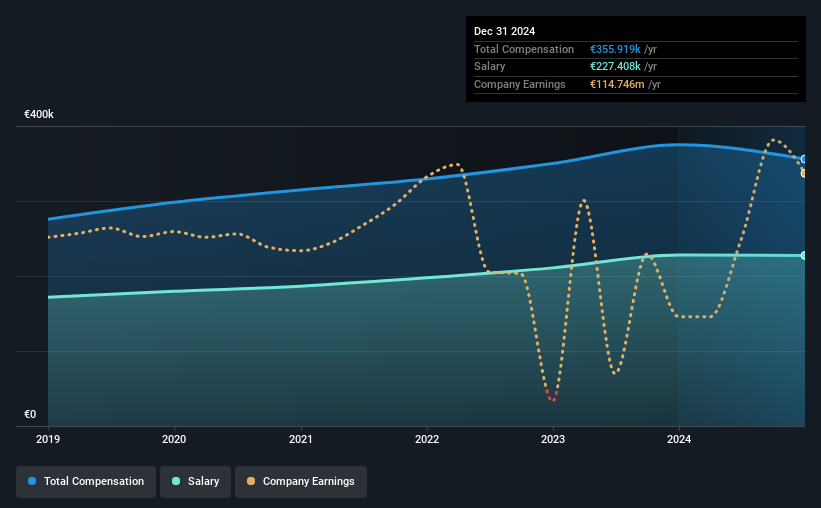

At the time of writing, our data shows that Zavarovalnica Triglav, d.d. has a market capitalization of €1.1b, and reported total annual CEO compensation of €356k for the year to December 2024. That's slightly lower by 5.1% over the previous year. Notably, the salary which is €227.4k, represents most of the total compensation being paid.

On comparing similar companies from the Slovenia Insurance industry with market caps ranging from €882m to €2.8b, we found that the median CEO total compensation was €1.9m. This suggests that Andrej Slapar is paid below the industry median. Moreover, Andrej Slapar also holds €65k worth of Zavarovalnica Triglav d.d stock directly under their own name.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | €227k | €228k | 64% |

| Other | €129k | €147k | 36% |

| Total Compensation | €356k | €375k | 100% |

Speaking on an industry level, nearly 40% of total compensation represents salary, while the remainder of 60% is other remuneration. According to our research, Zavarovalnica Triglav d.d has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Zavarovalnica Triglav, d.d.'s Growth Numbers

Zavarovalnica Triglav, d.d. saw earnings per share stay pretty flat over the last three years. In the last year, its revenue is up 14%.

We would argue that the modest growth in revenue is a notable positive. And, while modest, the EPS growth is noticeable. So while we'd stop just short of calling this a top performer, but we think it is well worth watching. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Zavarovalnica Triglav, d.d. Been A Good Investment?

Boasting a total shareholder return of 46% over three years, Zavarovalnica Triglav, d.d. has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

While the company seems to be headed in the right direction performance-wise, there's always room for improvement. Assuming the business continues to grow at a good clip, few shareholders would raise any objections to the CEO's remuneration. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for Zavarovalnica Triglav d.d that you should be aware of before investing.

Important note: Zavarovalnica Triglav d.d is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zavarovalnica Triglav d.d might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LJSE:ZVTG

Zavarovalnica Triglav d.d

Provides various life and non-life insurance products in Slovenia and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion