The board of CSE Global Limited (SGX:544) has announced that it will pay a dividend on the 20th of May, with investors receiving SGD0.015 per share. Based on this payment, the dividend yield on the company's stock will be 6.5%, which is an attractive boost to shareholder returns.

Check out our latest analysis for CSE Global

CSE Global's Dividend Is Well Covered By Earnings

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Before this announcement, CSE Global was paying out 75% of earnings, but a comparatively small 50% of free cash flows. This leaves plenty of cash for reinvestment into the business.

Looking forward, earnings per share is forecast to rise by 47.5% over the next year. Under the assumption that the dividend will continue along recent trends, we think the payout ratio could be 50% which would be quite comfortable going to take the dividend forward.

Dividend Volatility

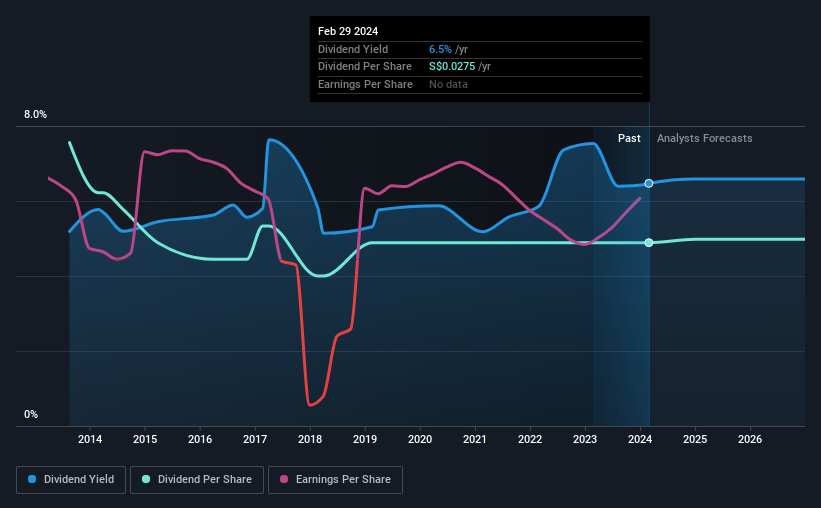

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2014, the annual payment back then was SGD0.0425, compared to the most recent full-year payment of SGD0.0275. The dividend has shrunk at around 4.3% a year during that period. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend's Growth Prospects Are Limited

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Over the past five years, it looks as though CSE Global's EPS has declined at around 3.0% a year. If the company is making less over time, it naturally follows that it will also have to pay out less in dividends. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

Our Thoughts On CSE Global's Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We don't think CSE Global is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 1 warning sign for CSE Global that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:544

CSE Global

An investment holding company, engages in the provision of integrated industrial automation, information technology, and intelligent transport solutions in the Asia Pacific, the Americas, Europe, the Middle East, and Africa.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)