- Singapore

- /

- Specialized REITs

- /

- SGX:DCRU

Digital Core REIT (SGX:DCRU) Return Earnings Supports Bullish Narrative

Reviewed by Simply Wall St

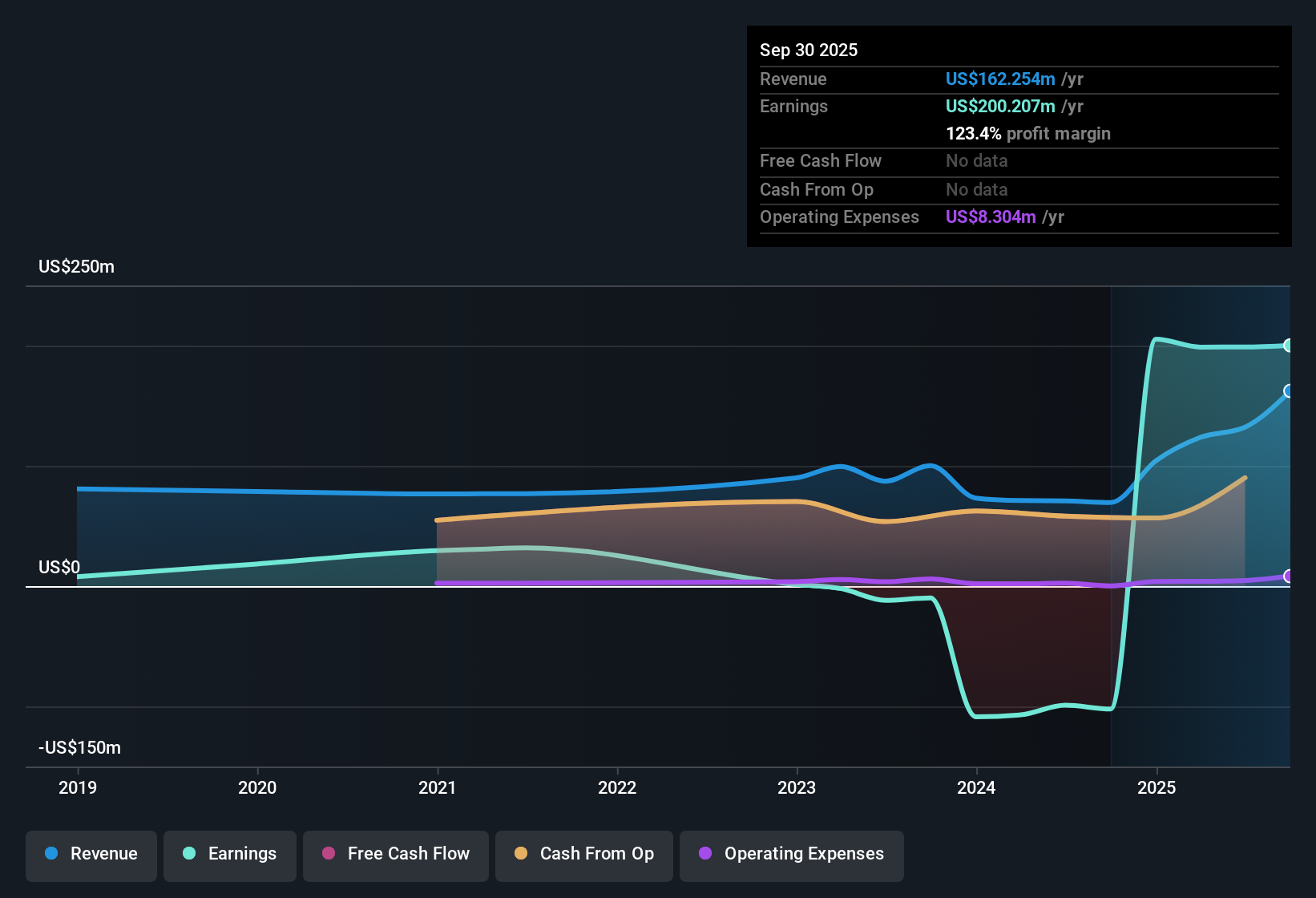

Digital Core REIT (SGX:DCRU) just returned to profitability after a brief cross over into the red, reporting net profit margins on the rise over the last year and an average annual earnings growth of 88.5% across the past three years. Notably, recent results in FH2 2024 include a major one-off gain of $251.6 million, which slighlty complicates comparison to prior periods. However, despite recording lower GAAP net income, the quality of the earnings can't be questioned. While shares are trading below an internal fair value estimate at $0.51, analysts are forecasting future earnings to decline sharply by 59.6% annually over the next three years, setting the stage for a valuation debate.

See our full analysis for Digital Core REIT.

The next section sets these headline results against the most widely discussed narratives on Simply Wall St, showing where the numbers align and where the prevailing story may be up for debate.

Curious how numbers become stories that shape markets? Explore Community Narratives

Forecast Revenue Trails Market Growth

- Digital Core REIT’s revenue is forecast to grow at 3.1% per year, lagging behind the broader Singapore market’s expected rate of 3.8% per year.

- Prevailing analysis highlights this muted growth outlook as a key challenge, especially when set against the backdrop of sector optimism about long-term digital infrastructure demand.

- Despite data center REITs being viewed as resilient thanks to structural technology trends, DCRU’s revenue projections do not indicate any outperformance compared to the market.

- Some investors may look for catalyst events such as major new leasing deals to shift sentiment, but the current guidance suggests only steady, not accelerating, top-line progress for DCRU in the next few years.

Dividend Sustainability Faces Financial Pressure

- The risk profile flags sustainability concerns for dividends and finances, with forward-looking earnings expected to decline sharply by 59.6% annually over the next three years.

- Prevailing analysis raises doubts about how much room DCRU really has to maintain payouts, even as investors continue to prize REITs for their yield and stability.

- With profitability boosted by a major $251.6 million one-off gain that distorts underlying trends, future cash flows may not be robust enough to support historic dividend levels.

- Financial stress could increase if tenant or financing risks materialize, further challenging the usual REIT expectation of stable distributions.

Valuation Discount Stands Out Despite Weak Outlook

- DCRU shares trade at just 3.3x Price-to-Earnings, far below the peer average of 20.4x and the global specialized REITs average of 17.8x, and sit well under the DCF fair value of $1.28 with the current share price at $0.51.

- Prevailing analysis finds this steep discount hard to ignore but warns that cheapness alone may not be enough to overcome the drag from falling earnings and uncertain dividend coverage.

- Bargain hunters may seize on the apparent value gap, but the rapid expected drop in earnings complicates simple mean reversion arguments often used by value investors.

- Sector resilience can offer some downside protection, yet the low valuation reflects real doubts around DCRU’s medium-term fundamentals and its ability to regain lost ground.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Digital Core REIT's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

DCRU’s steep earnings decline and doubts around dividend sustainability signal that future payouts could be at real risk.

If stable and growing income matters to you, check out these 1988 dividend stocks with yields > 3% to find companies with proven, more reliable dividend records that may better fit your goals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:DCRU

Digital Core REIT

Digital Core REIT (SGX: DCRU) is a leading pure-play data centre REIT listed in Singapore and sponsored by Digital Realty, the largest global data centre owner and operator.

Undervalued average dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion