- Singapore

- /

- Real Estate

- /

- SGX:C09

Revenues Working Against City Developments Limited's (SGX:C09) Share Price

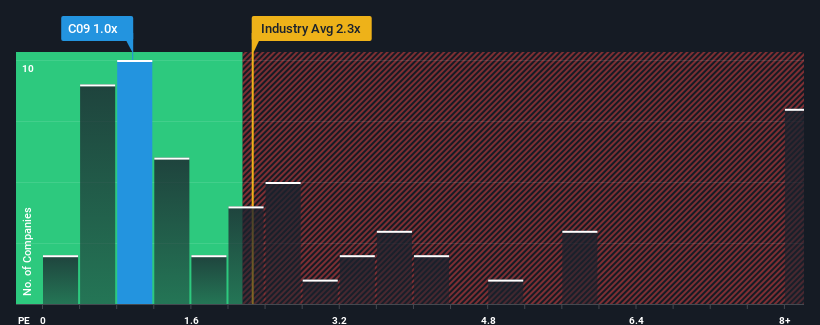

With a price-to-sales (or "P/S") ratio of 1x City Developments Limited (SGX:C09) may be sending bullish signals at the moment, given that almost half of all the Real Estate companies in Singapore have P/S ratios greater than 2.3x and even P/S higher than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for City Developments

What Does City Developments' P/S Mean For Shareholders?

Recent times have been advantageous for City Developments as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think City Developments' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For City Developments?

There's an inherent assumption that a company should underperform the industry for P/S ratios like City Developments' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 50%. The latest three year period has also seen an excellent 134% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 7.8% per annum during the coming three years according to the eleven analysts following the company. Meanwhile, the broader industry is forecast to expand by 3.0% per annum, which paints a poor picture.

With this information, we are not surprised that City Developments is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does City Developments' P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of City Developments' analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, City Developments' poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for City Developments (1 is a bit unpleasant!) that you should be aware of.

If these risks are making you reconsider your opinion on City Developments, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:C09

City Developments

City Developments Limited (CDL) is a leading global real estate company with a network spanning 168 locations in 29 countries and regions.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives