- Singapore

- /

- Real Estate

- /

- SGX:C09

City Developments (SGX:C09): Valuation Check After £280m Holiday Inn London Kensington Acquisition

Reviewed by Simply Wall St

City Developments (SGX:C09) just closed a £280 million deal for the 706 room Holiday Inn London Kensington High Street, a sizeable bet that tight UK hospitality supply and easing rates can help keep this asset cash generative.

See our latest analysis for City Developments.

Investors seem to be backing that strategy, with City Developments’ 90 day share price return of 7.62 percent and strong year to date share price return of 43.36 percent suggesting positive momentum despite a modest 5 year total shareholder return of 4.16 percent.

If this London deal has you thinking about what else could re rate on improving fundamentals, it might be worth exploring fast growing stocks with high insider ownership as your next hunting ground for ideas.

With the stock already up sharply this year and still trading below consensus price targets, the key question now is whether City Developments remains undervalued on its refreshed growth profile or if the market is already pricing in the next leg of upside.

Most Popular Narrative: 10.4% Undervalued

With City Developments last closing at SGD 7.34 against a narrative fair value near SGD 8.20, the story assumes meaningful upside from here.

The analysts have a consensus price target of SGD7.225 for City Developments based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SGD9.01, and the most bearish reporting a price target of just SGD4.8.

Curious how robust double digit top line growth, fatter profit margins and a richer future earnings multiple can all coexist in one model? See what assumptions power that fair value call.

Result: Fair Value of $8.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stretched gearing and ongoing reliance on divestment gains mean any credit shock or weak asset sale prices could quickly challenge the bullish assumptions.

Find out about the key risks to this City Developments narrative.

Another View: Multiples Send a Different Signal

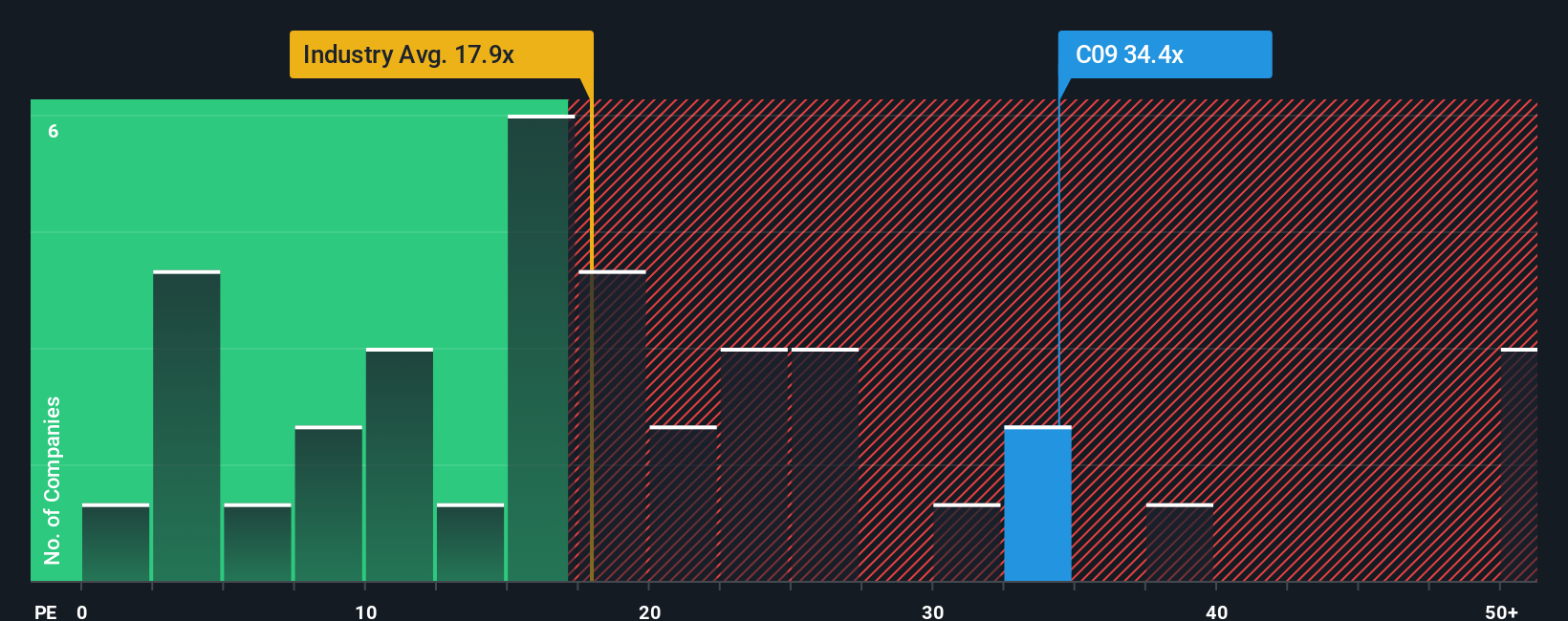

While the narrative fair value suggests upside, the current 33.7 times earnings tells a tougher story. City Developments trades far richer than both peers at 15.4 times and the sector fair ratio of 24.7 times, which hints at downside risk if sentiment or growth expectations slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own City Developments Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a full narrative in minutes, Do it your way.

A great starting point for your City Developments research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at a single opportunity. Use the Simply Wall St Screener to uncover fresh ideas that match your strategy before the market runs ahead.

- Capture potential mispricings by targeting companies trading below their cash flow value through these 908 undervalued stocks based on cash flows, giving you a head start on overlooked opportunities.

- Tap into long term innovation trends by zeroing in on disruptive businesses at the frontier of machine learning with these 26 AI penny stocks while the crowd is still catching up.

- Boost your income game by focusing on companies that pay you to wait using these 13 dividend stocks with yields > 3%, so your portfolio works harder in every market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:C09

City Developments

City Developments Limited (CDL) is a leading global real estate company with a network spanning 168 locations in 29 countries and regions.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)