Global Penny Stocks Spotlight: Frencken Group And 2 More Hidden Opportunities

Reviewed by Simply Wall St

As global markets navigate a week marked by volatility and cautious optimism, investors are keenly observing shifts in monetary policy and economic indicators. In this landscape, penny stocks—though often overlooked due to their vintage nomenclature—can still present unique opportunities for growth. By focusing on companies with solid financial foundations, investors may discover potential long-term value in these smaller or newer enterprises.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.52 | HK$927.78M | ✅ 4 ⚠️ 1 View Analysis > |

| IVE Group (ASX:IGL) | A$2.73 | A$412.19M | ✅ 4 ⚠️ 3 View Analysis > |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR0.575 | MYR292.38M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.58 | HK$2.17B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.21 | SGD490.4M | ✅ 4 ⚠️ 1 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.29 | MYR518M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.26 | SGD12.83B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.5375 | $313.92M | ✅ 4 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.035 | €282.66M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 3,577 stocks from our Global Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Frencken Group (SGX:E28)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Frencken Group Limited is an investment holding company that offers original design, original equipment, and diversified integrated manufacturing solutions globally, with a market cap of SGD640.64 million.

Operations: Frencken Group generates its revenue primarily from the Mechatronics segment, contributing SGD768.23 million, and the Integrated Manufacturing Services (IMS) segment, which adds SGD81.94 million.

Market Cap: SGD640.64M

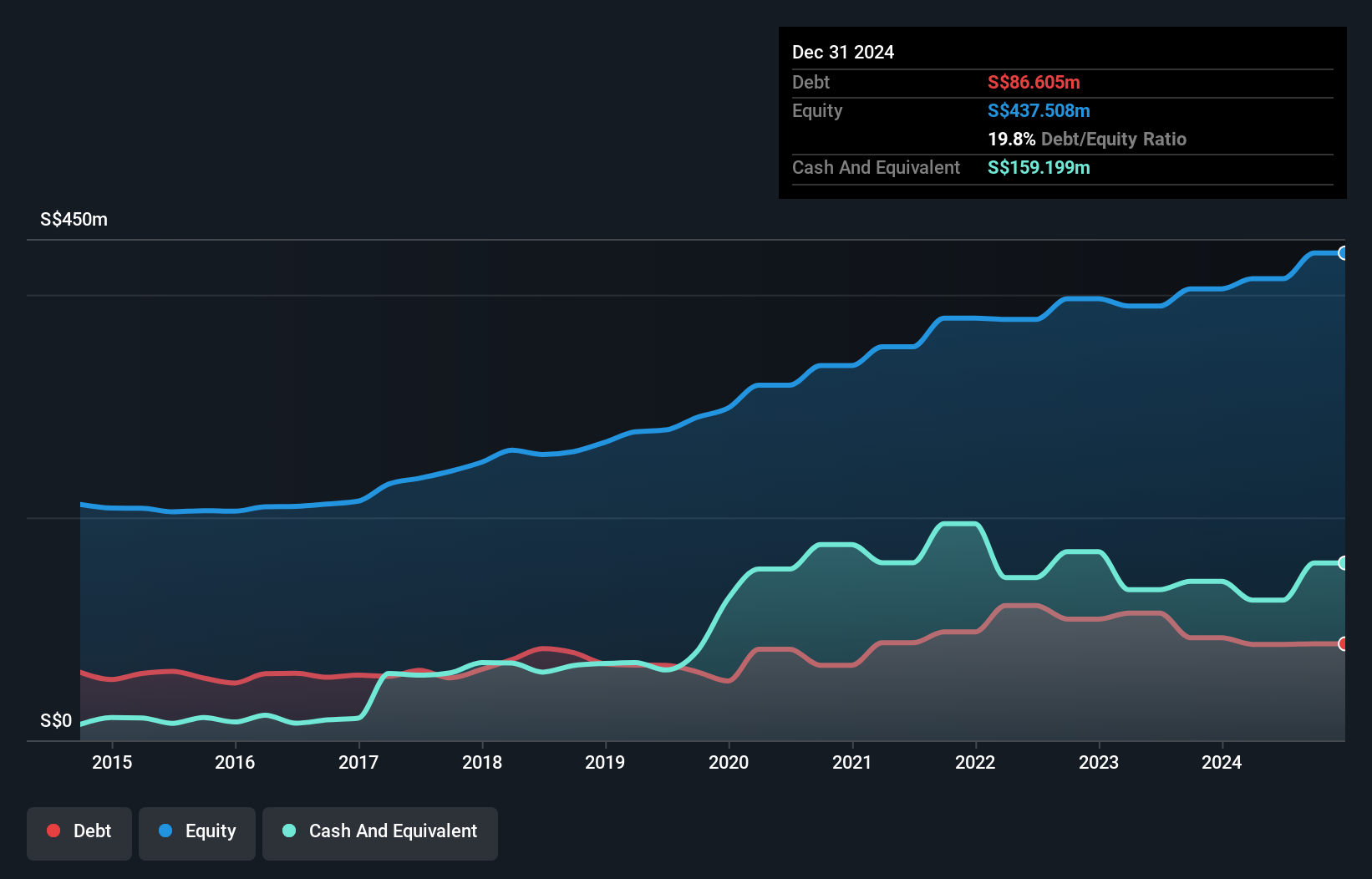

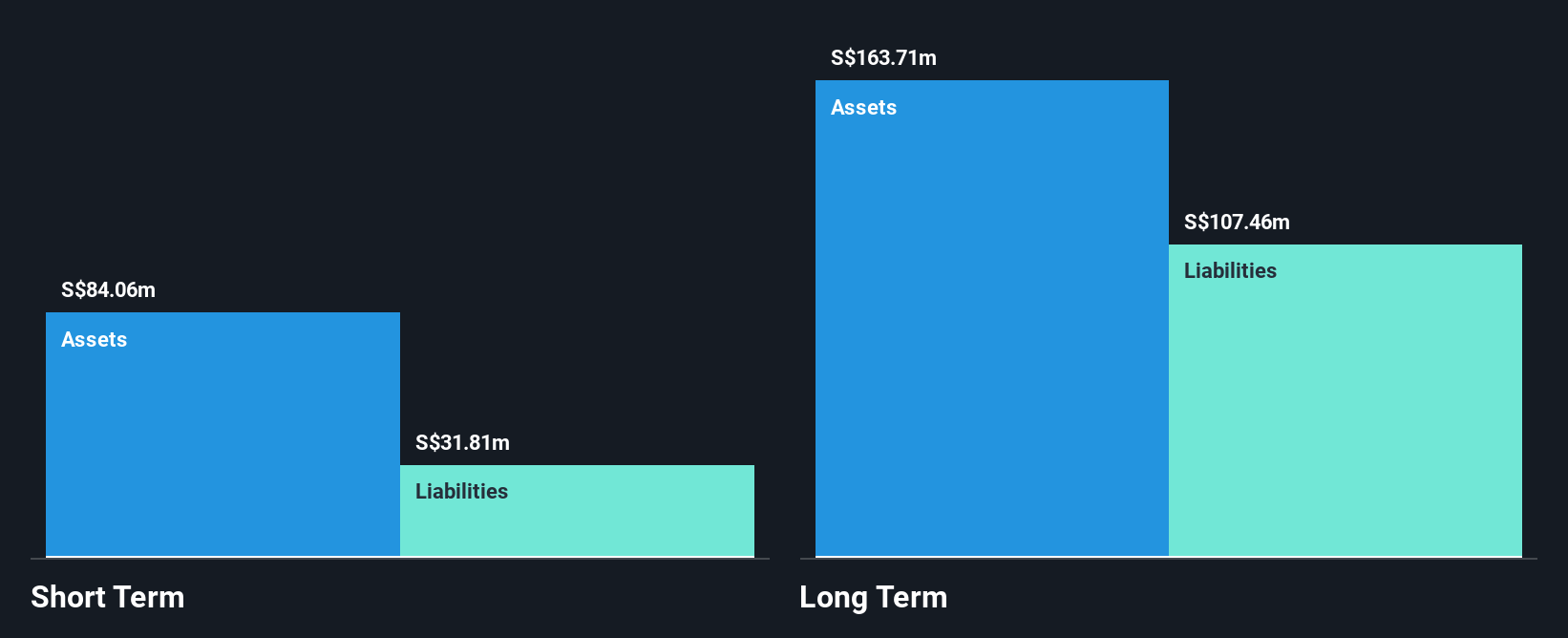

Frencken Group Limited, with a market cap of SGD640.64 million, has shown solid financial health and operational stability. Its short-term assets significantly exceed both short and long-term liabilities, indicating robust liquidity. Recent earnings for the half year ended June 30, 2025, reported sales of SGD431.38 million and net income of SGD19.94 million, reflecting growth from the previous year. The company's debt is well-covered by operating cash flow and interest payments are adequately managed by EBIT at an 8.1x coverage ratio. While its profit margins have slightly decreased to 4.6%, Frencken's strategic expansion in Singapore aims to enhance production capacity and operational efficiency in its Mechatronics segment, potentially positioning it favorably within the semiconductor industry’s growth trajectory.

- Navigate through the intricacies of Frencken Group with our comprehensive balance sheet health report here.

- Assess Frencken Group's future earnings estimates with our detailed growth reports.

Q & M Dental Group (Singapore) (SGX:QC7)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Q & M Dental Group (Singapore) Limited is an investment holding company that offers private dental healthcare services in Singapore, Malaysia, China, and internationally, with a market cap of SGD444.51 million.

Operations: The company generates revenue primarily from its Core Dental Business, which accounted for SGD176.77 million.

Market Cap: SGD444.51M

Q & M Dental Group (Singapore) Limited, with a market cap of SGD444.51 million, has faced challenges in earnings growth, reporting a net income of SGD3.86 million for the half year ended June 30, 2025, down from SGD9.65 million the previous year. Despite this decline and a large one-off loss impacting recent results, its debt is well covered by operating cash flow and interest payments are adequately managed with EBIT coverage at 4.6x. The company declared a first interim dividend of 0.40 cent per share for H1 2025 but faces sustainability concerns as dividends are not well covered by earnings currently.

- Take a closer look at Q & M Dental Group (Singapore)'s potential here in our financial health report.

- Gain insights into Q & M Dental Group (Singapore)'s future direction by reviewing our growth report.

Allwin Telecommunication (SZSE:002231)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Allwin Telecommunication Co., Ltd. is engaged in military electronic informationization, audio and video command systems, and network communications in China, with a market cap of CN¥1.11 billion.

Operations: The company generates revenue from various regions in China, with East China contributing CN¥80.74 million, Central South China CN¥10.99 million, and Northeast China CN¥8.75 million.

Market Cap: CN¥1.11B

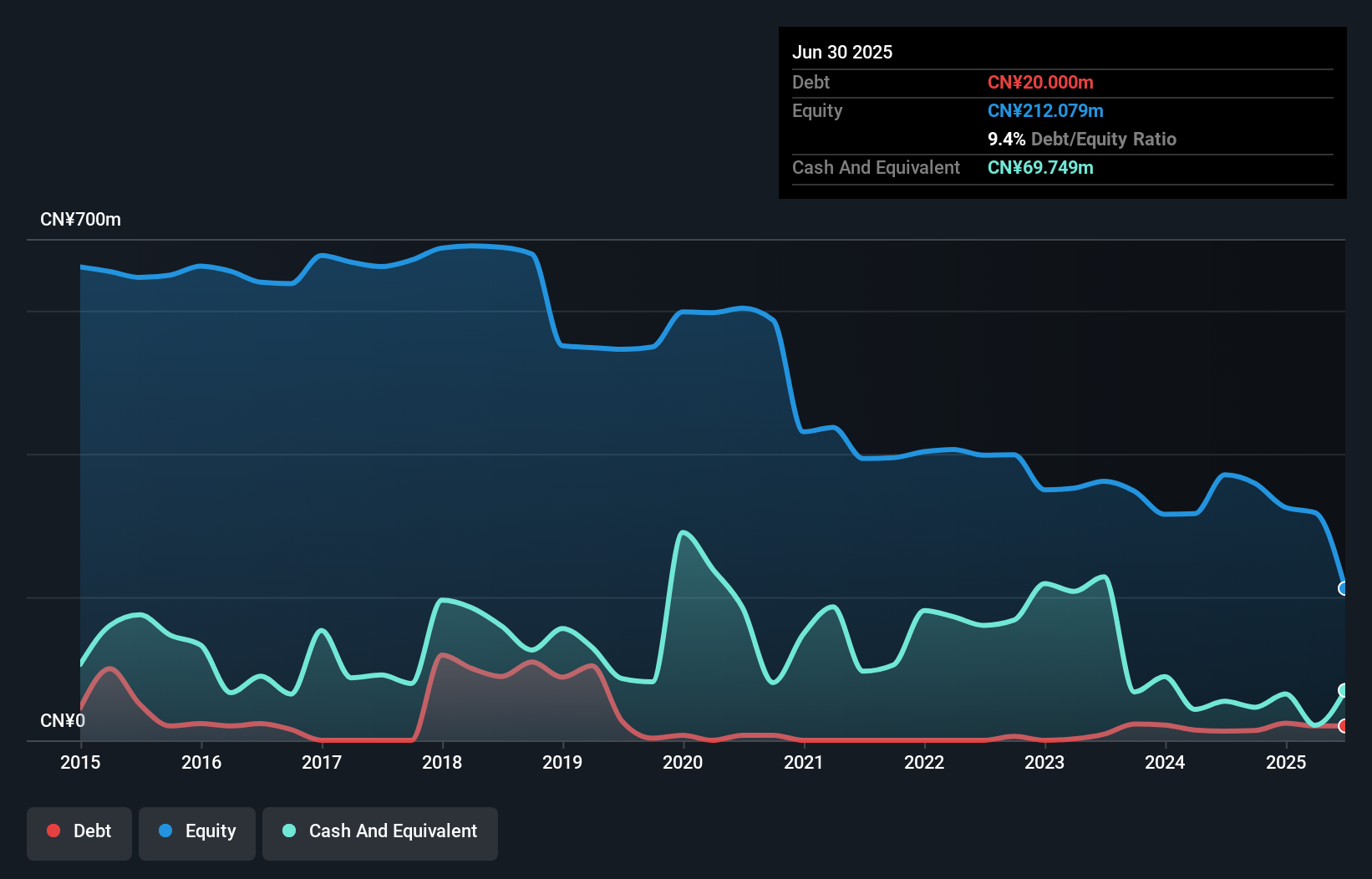

Allwin Telecommunication Co., Ltd. is navigating significant financial challenges, with recent earnings showing a sharp decline in revenue to CN¥23.48 million for the half year ended June 30, 2025, from CN¥209.74 million the previous year. The company remains unprofitable with a net loss of CN¥89.07 million and negative return on equity at -73.01%. Despite having more cash than debt and sufficient short-term assets to cover liabilities, its share price has been highly volatile recently. While management is experienced, the board's average tenure suggests limited experience which may impact strategic decisions moving forward.

- Unlock comprehensive insights into our analysis of Allwin Telecommunication stock in this financial health report.

- Gain insights into Allwin Telecommunication's past trends and performance with our report on the company's historical track record.

Taking Advantage

- Click here to access our complete index of 3,577 Global Penny Stocks.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:E28

Frencken Group

An investment holding company, provides original design, original equipment, and diversified integrated manufacturing solutions worldwide.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)