- Hong Kong

- /

- Healthcare Services

- /

- SEHK:3309

3 Penny Stocks With Market Caps Up To US$400M And Promising Financials

Reviewed by Simply Wall St

Global markets have been navigating a complex landscape, with recent cautious commentary from the Federal Reserve and political uncertainties contributing to broad-based declines in U.S. stocks, particularly affecting smaller-cap indexes. In such a climate, identifying stocks with solid financial foundations becomes crucial for investors seeking stability and potential growth. While the term "penny stock" may seem outdated, it remains relevant as an investment area where smaller or newer companies can offer significant opportunities when backed by strong financial health. Here, we explore three penny stocks that combine robust balance sheets with promising potential for long-term success.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.15B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.71 | MYR420.07M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.14 | HK$45.59B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

Click here to see the full list of 5,852 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Lhyfe (ENXTPA:LHYFE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lhyfe SA is a renewable energy company that designs, installs, and operates green hydrogen production units in France, with a market cap of €126.91 million.

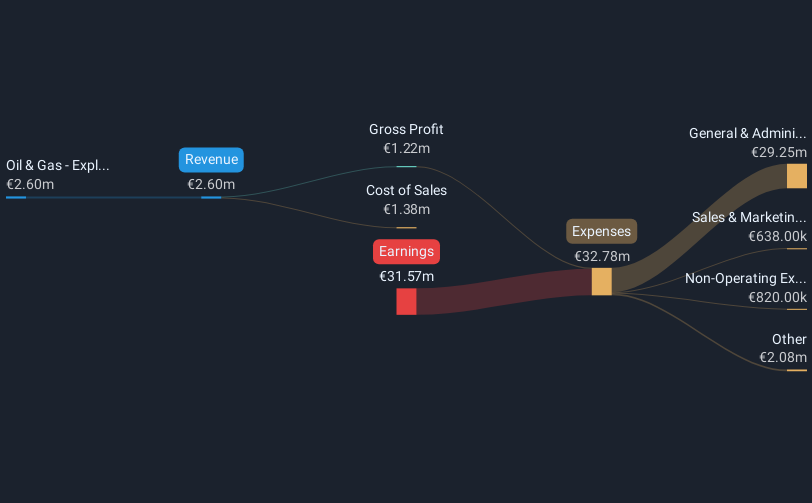

Operations: The company's revenue is derived from its Oil & Gas - Exploration & Production segment, amounting to €2.60 million.

Market Cap: €126.91M

Lhyfe, a renewable energy company with a market cap of €126.91 million, is navigating the challenges typical of its sector. Despite being unprofitable and having losses increase over the past five years, it maintains more cash than total debt and has short-term assets exceeding both its short- and long-term liabilities. The company holds a sufficient cash runway for over a year under current conditions. Although Lhyfe's revenue is forecast to grow significantly, it remains pre-revenue with only €3 million in sales and lacks profitability projections for the next three years, highlighting potential risks for investors in this volatile segment.

- Get an in-depth perspective on Lhyfe's performance by reading our balance sheet health report here.

- Gain insights into Lhyfe's outlook and expected performance with our report on the company's earnings estimates.

C-MER Medical Holdings (SEHK:3309)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: C-MER Medical Holdings Limited is an investment holding company that offers ophthalmic services under the C-MER Dennis Lam brand in Hong Kong and Mainland China, with a market cap of HK$2.46 billion.

Operations: The company generates revenue from three main segments: HK$889.68 million from Hong Kong's medical services, HK$440.81 million from dental operations in Mainland China, and HK$565.70 million from ophthalmic services in Mainland China.

Market Cap: HK$2.46B

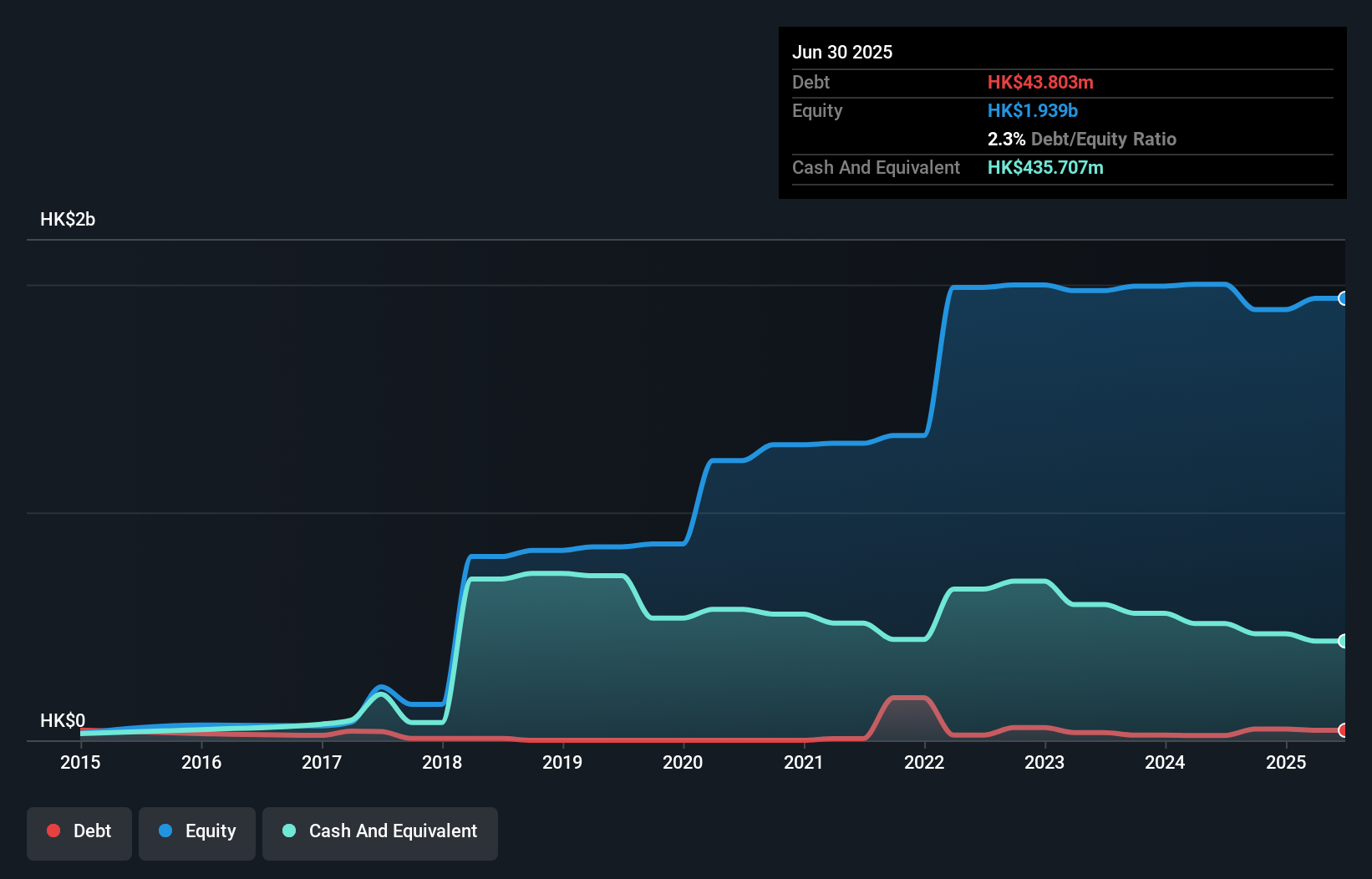

C-MER Medical Holdings, with a market cap of HK$2.46 billion, has become profitable this year, marking a significant milestone for the company. Its revenue streams are diversified across Hong Kong and Mainland China, with substantial income from ophthalmic and dental services. The company's debt is well managed; it has more cash than total debt, and its interest payments are well covered by EBIT at 53.1 times coverage. Additionally, C-MER's board is experienced with an average tenure of 5.5 years. Despite trading significantly below estimated fair value, the stock's low return on equity may concern some investors seeking higher returns in penny stocks.

- Jump into the full analysis health report here for a deeper understanding of C-MER Medical Holdings.

- Explore historical data to track C-MER Medical Holdings' performance over time in our past results report.

Delfi (SGX:P34)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Delfi Limited is an investment holding company that manufactures, markets, distributes, and sells chocolate and confectionery products across Indonesia, the Philippines, Malaysia, Singapore, and internationally with a market cap of SGD479.76 million.

Operations: The company's revenue is primarily derived from Indonesia, contributing $349.57 million, and Regional Markets, which add $183.30 million.

Market Cap: SGD479.76M

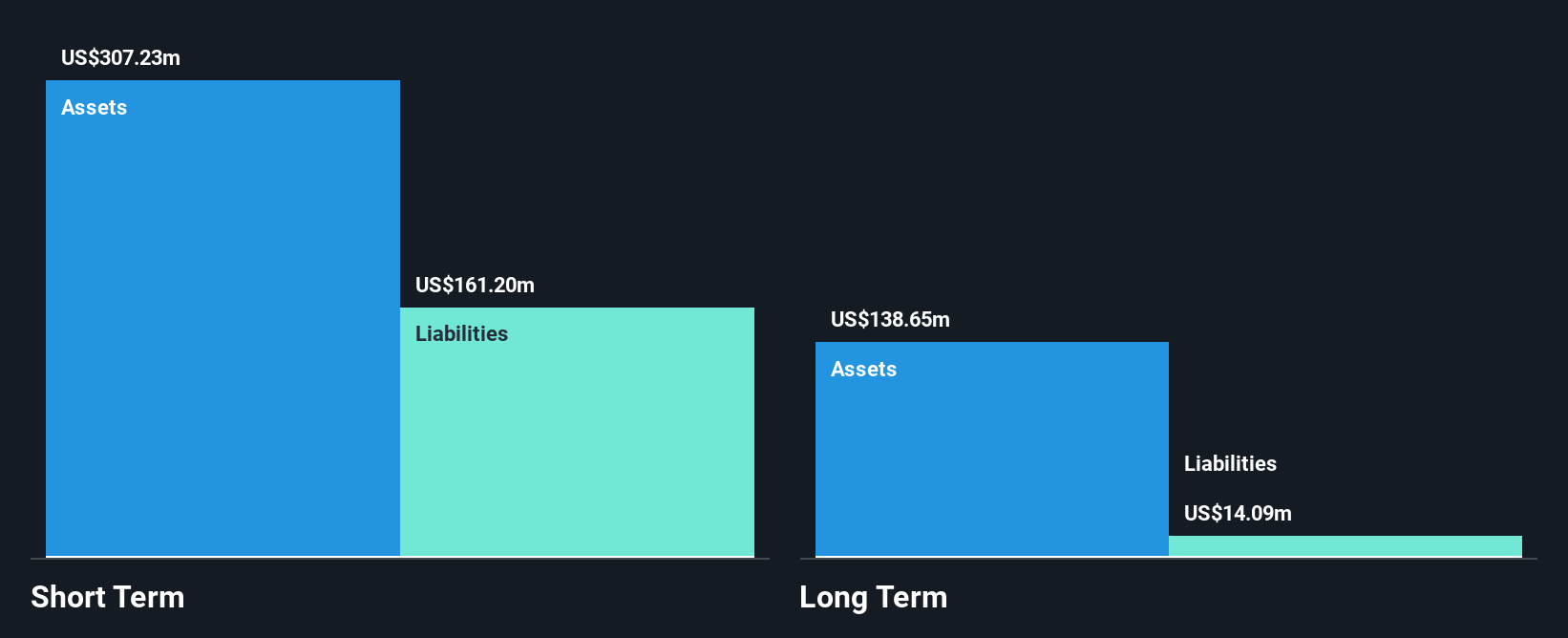

Delfi Limited, with a market cap of SGD479.76 million, primarily generates revenue from Indonesia and regional markets. The company has experienced negative earnings growth over the past year and its net profit margins have decreased from 9.7% to 7.9%. Despite these challenges, Delfi's debt is well covered by operating cash flow at 122.4%, and it maintains more cash than total debt, indicating strong financial management. Recent board changes include the appointment of experienced directors Chin Koon Yew and Lim Seok Bee, potentially enhancing governance as Delfi navigates its current financial landscape amidst trading below estimated fair value.

- Take a closer look at Delfi's potential here in our financial health report.

- Gain insights into Delfi's future direction by reviewing our growth report.

Where To Now?

- Unlock our comprehensive list of 5,852 Penny Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3309

C-MER Medical Holdings

An investment holding company, provides ophthalmic services under the C-MER Dennis Lam brand name in Hong Kong and Mainland China.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives