As the Singapore market continues to navigate a dynamic economic landscape, investors are increasingly looking for stable income sources amidst fluctuating indices. In this context, dividend stocks stand out as attractive options, offering consistent returns that can provide a cushion against market volatility.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 6.99% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.76% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.70% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.28% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.61% | ★★★★★☆ |

| QAF (SGX:Q01) | 6.21% | ★★★★★☆ |

| Genting Singapore (SGX:G13) | 4.88% | ★★★★☆☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.34% | ★★★★☆☆ |

| Oversea-Chinese Banking (SGX:O39) | 5.87% | ★★★★☆☆ |

| Delfi (SGX:P34) | 7.15% | ★★★★☆☆ |

Click here to see the full list of 19 stocks from our Top SGX Dividend Stocks screener.

We'll examine a selection from our screener results.

Hour Glass (SGX:AGS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Hour Glass Limited is an investment holding company that retails and distributes watches, jewelry, and other luxury products across Singapore, Hong Kong, Japan, Australia, New Zealand, Malaysia, Thailand, and Vietnam with a market cap of SGD1.00 billion.

Operations: The Hour Glass Limited generates SGD1.13 billion from its retailing and distribution of watches, jewelry, and other luxury products.

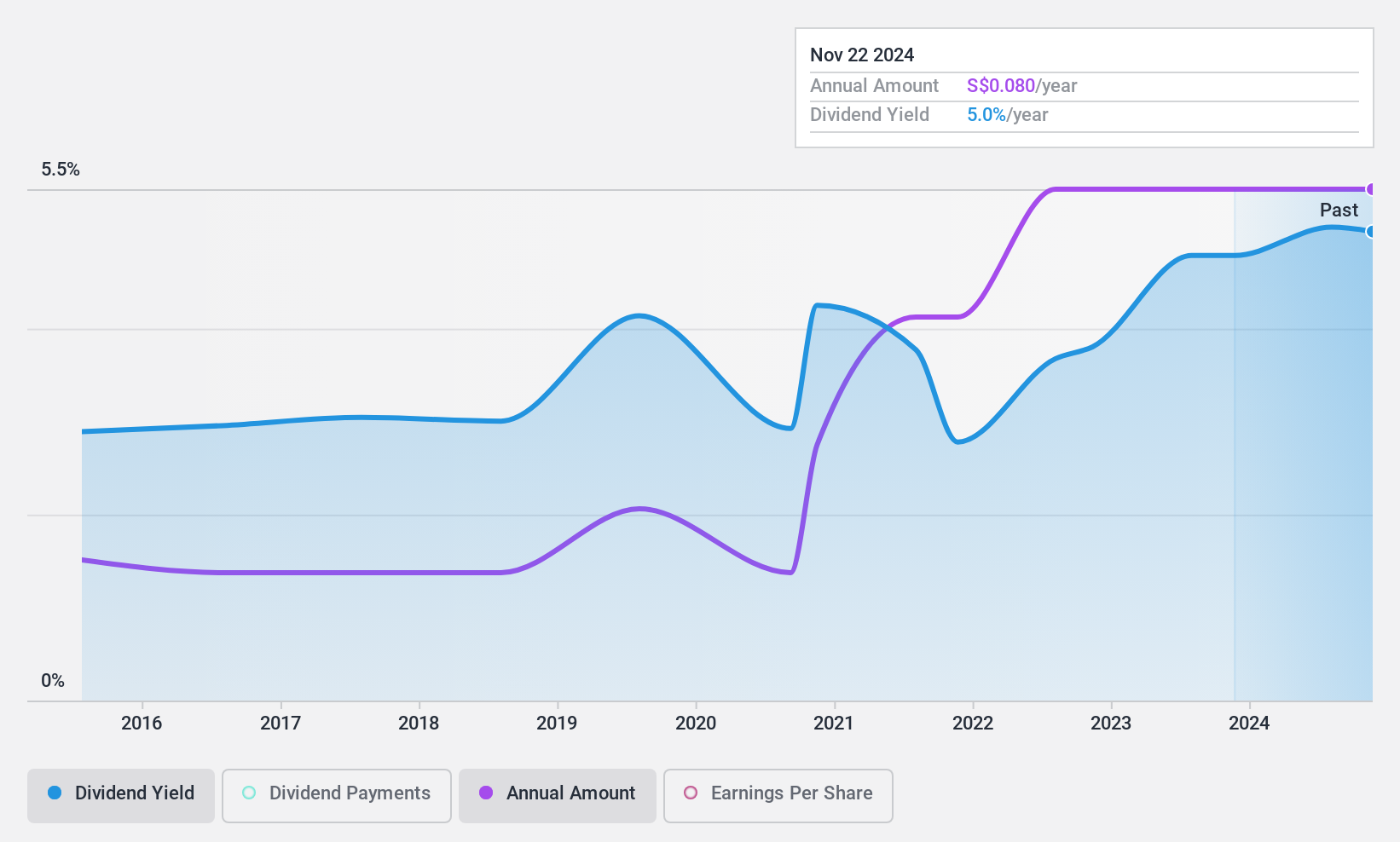

Dividend Yield: 5.2%

Hour Glass Limited's dividend payments are well-covered by earnings and cash flows, with a payout ratio of 33.5% and a cash payout ratio of 46.2%. However, the dividends have been volatile and unreliable over the past decade despite recent increases. The recent approval of a final dividend of S$0.06 per share for FY2024 underscores its commitment to shareholders, though its yield remains below top-tier levels in Singapore's market.

- Take a closer look at Hour Glass' potential here in our dividend report.

- Our expertly prepared valuation report Hour Glass implies its share price may be lower than expected.

Nordic Group (SGX:MR7)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nordic Group Limited (SGX:MR7) is an investment holding company providing global solutions in system integration, maintenance, repair, overhaul, trading, precision engineering, scaffolding, insulation, petrochemical and environmental engineering as well as cleanroom and air and water engineering with a market cap of SGD139.69 million.

Operations: Nordic Group Limited's revenue segments include Project Services generating SGD69.93 million and Maintenance Services contributing SGD83.13 million.

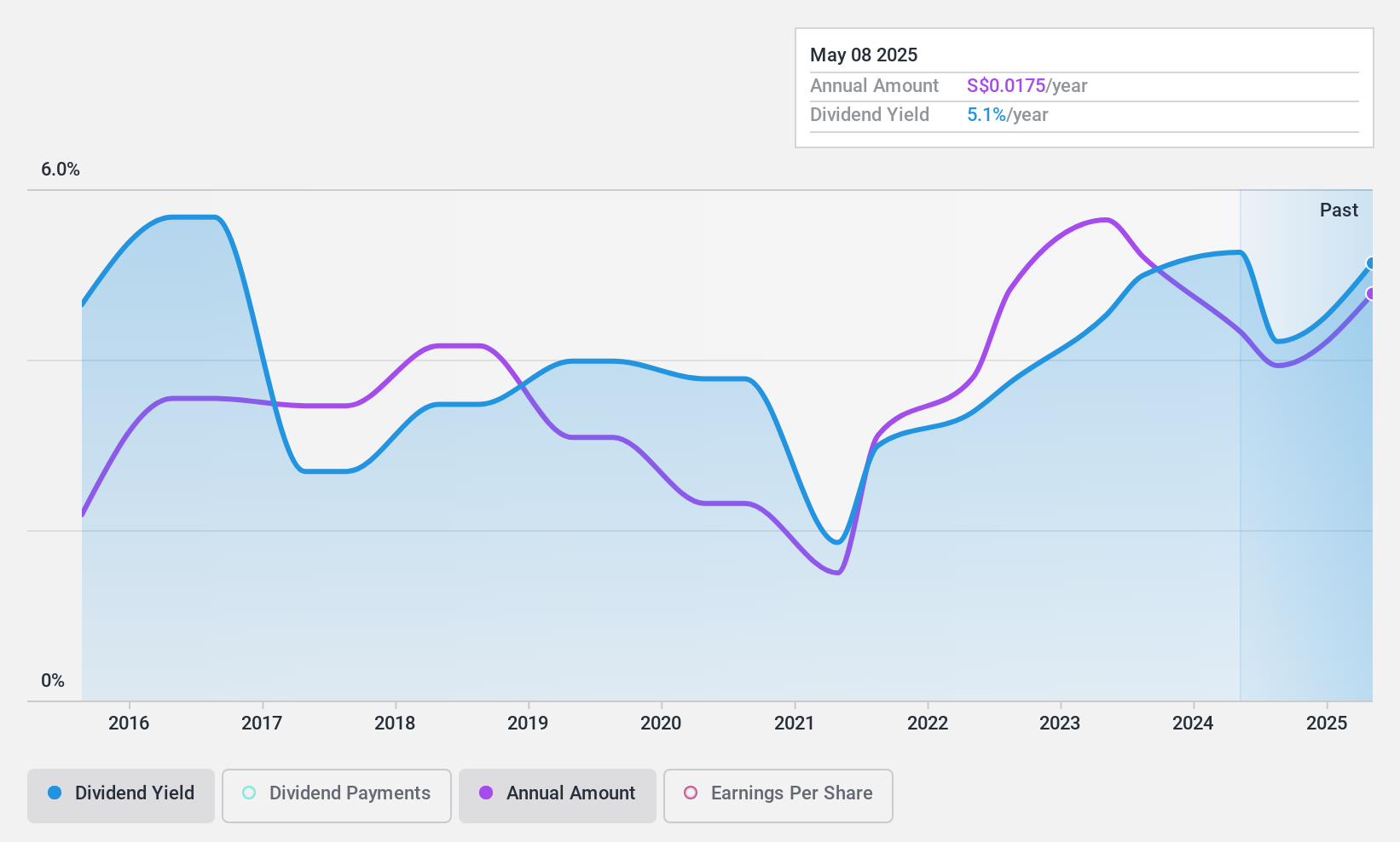

Dividend Yield: 4.5%

Nordic Group Limited's recent earnings report shows a decline in both sales and net income compared to last year, with sales at S$76.16 million and net income at S$8.53 million. The company declared an interim dividend of S$0.008526 per share, payable on 4 September 2024, though dividends have been volatile over the past decade. Despite a low payout ratio of 40%, indicating good coverage by earnings and cash flows, its dividend yield is lower than top-tier levels in Singapore's market.

- Click here and access our complete dividend analysis report to understand the dynamics of Nordic Group.

- Our valuation report unveils the possibility Nordic Group's shares may be trading at a premium.

Oversea-Chinese Banking (SGX:O39)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oversea-Chinese Banking Corporation Limited, with a market cap of SGD67.43 billion, provides financial services across Singapore, Malaysia, Indonesia, Greater China, the Asia Pacific region, and internationally.

Operations: Oversea-Chinese Banking Corporation Limited generates revenue primarily from Global Wholesale Banking (SGD5.23 billion), Global Consumer/Private Banking (SGD5.19 billion), Insurance (SGD1.27 billion), and Global Markets (SGD512 million).

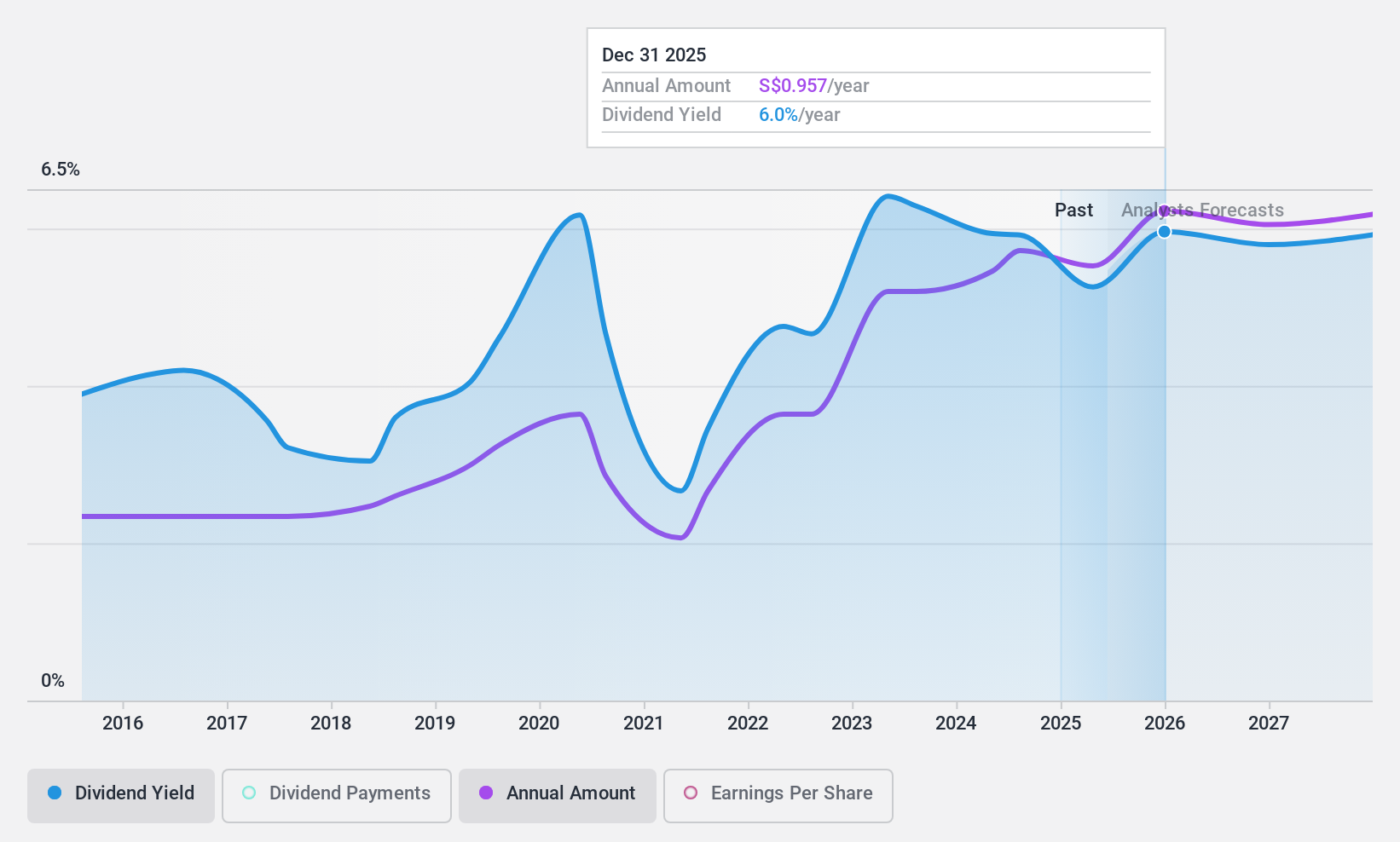

Dividend Yield: 5.9%

Oversea-Chinese Banking Corporation Limited reported a net income increase to S$3.93 billion for H1 2024, up from S$3.59 billion a year ago, supporting its recent interim dividend of S$0.44 per share paid on 23 August 2024. The bank's payout ratio stands at a reasonable 52.8%, indicating dividends are well-covered by earnings, though its dividend yield of 5.87% is slightly below the top quartile in Singapore's market and has shown volatility over the past decade.

- Navigate through the intricacies of Oversea-Chinese Banking with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Oversea-Chinese Banking's current price could be quite moderate.

Turning Ideas Into Actions

- Unlock more gems! Our Top SGX Dividend Stocks screener has unearthed 16 more companies for you to explore.Click here to unveil our expertly curated list of 19 Top SGX Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:O39

Oversea-Chinese Banking

Engages in the provision of financial services in Singapore, Malaysia, Indonesia, Greater China, rest of the Asia Pacific, and internationally.

Flawless balance sheet average dividend payer.