- Hong Kong

- /

- Retail Distributors

- /

- SEHK:370

Promising Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets show signs of optimism with cooling U.S. inflation and strong bank earnings driving major indices higher, investors are exploring diverse opportunities. Penny stocks, often associated with smaller or newer companies, remain a relevant investment area despite the term's outdated connotations. These stocks can offer growth potential at lower price points when backed by strong financials and fundamentals, presenting underappreciated opportunities for those willing to explore beyond the well-known names.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.49B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.13B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.63 | HK$42.48B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.99 | HK$628.44M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.946 | £150.76M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.72 | MYR425.99M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.06 | £776.24M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.405 | £178.93M | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$142.2M | ★★★★☆☆ |

Click here to see the full list of 5,711 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

China Best Group Holding (SEHK:370)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Best Group Holding Limited is an investment holding company that trades in electronic appliances across the People’s Republic of China, Singapore, and Hong Kong, with a market cap of HK$585.62 million.

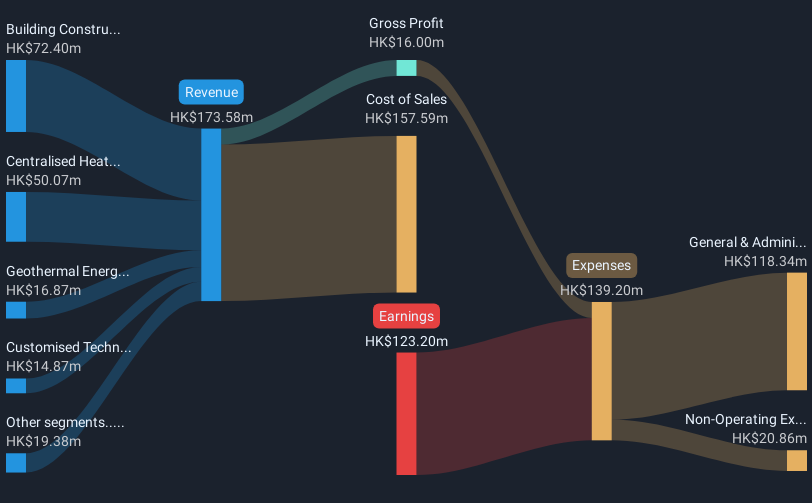

Operations: The company's revenue is primarily derived from building construction contracting (HK$72.40 million), centralised heating (HK$50.07 million), geothermal energy (HK$16.87 million), customised technical support (HK$14.87 million), property investment (HK$6.32 million), and money lending (HK$6.98 million).

Market Cap: HK$585.62M

China Best Group Holding faces challenges typical of its category, being currently unprofitable with a negative return on equity of -17.32%. Despite this, the company has a positive cash flow and a sufficient cash runway for over three years, supported by short-term assets exceeding both short-term and long-term liabilities. Recent board changes, including the appointment of Mr. Li Mengzhe as chairman, may bring fresh strategic direction given his background in high-tech investments. However, earnings have declined over the past five years at 19.5% annually, highlighting ongoing profitability issues amid volatile share prices in recent months.

- Take a closer look at China Best Group Holding's potential here in our financial health report.

- Understand China Best Group Holding's track record by examining our performance history report.

AEM Holdings (SGX:AWX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AEM Holdings Ltd. and its subsidiaries offer application-specific intelligent system tests and handling solutions for semiconductor and electronics companies, with a market capitalization of SGD482.05 million.

Operations: The company has not reported any revenue segments.

Market Cap: SGD482.05M

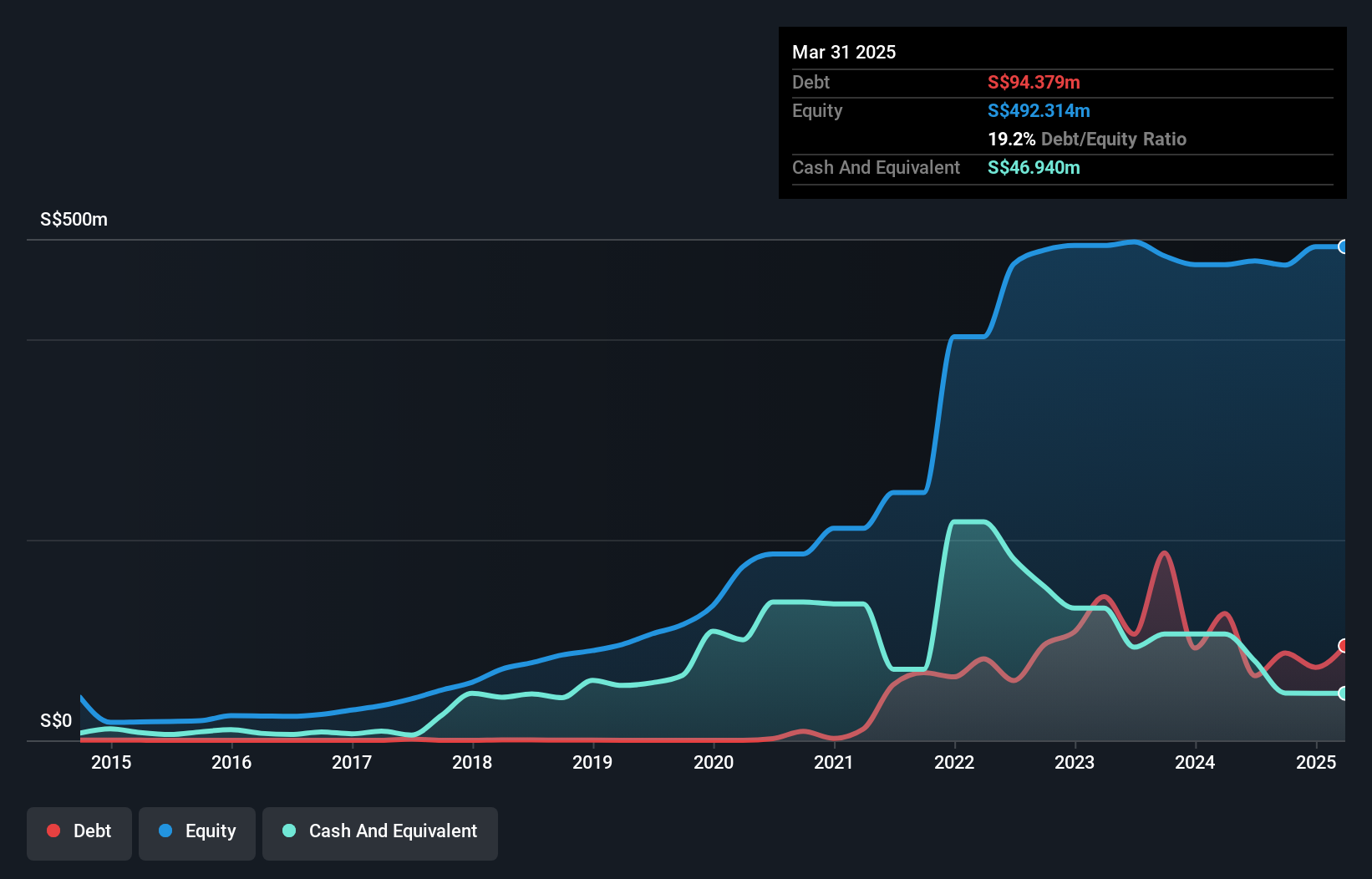

AEM Holdings Ltd. is navigating the complexities of its market with a strategic financial foundation, evidenced by short-term assets significantly surpassing both short-term and long-term liabilities. The company has maintained stable weekly volatility and satisfactory debt levels, with interest payments well-covered by EBIT. Despite being unprofitable and experiencing increased losses over five years, AEM's earnings are projected to grow substantially. Recent executive changes, including the appointment of an experienced CFO, aim to enhance financial strategy and operational efficiency. However, challenges persist in achieving profitability amidst these structural adjustments in the semiconductor sector.

- Navigate through the intricacies of AEM Holdings with our comprehensive balance sheet health report here.

- Evaluate AEM Holdings' prospects by accessing our earnings growth report.

Yangzijiang Shipbuilding (Holdings) (SGX:BS6)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yangzijiang Shipbuilding (Holdings) Ltd. is an investment holding company involved in shipbuilding activities across Greater China, Canada, Japan, Italy, Greece, other European countries, and internationally with a market cap of SGD11.42 billion.

Operations: The company generates revenue primarily from its shipbuilding segment, which accounts for CN¥24.53 billion, followed by its shipping operations contributing CN¥1.09 billion.

Market Cap: SGD11.42B

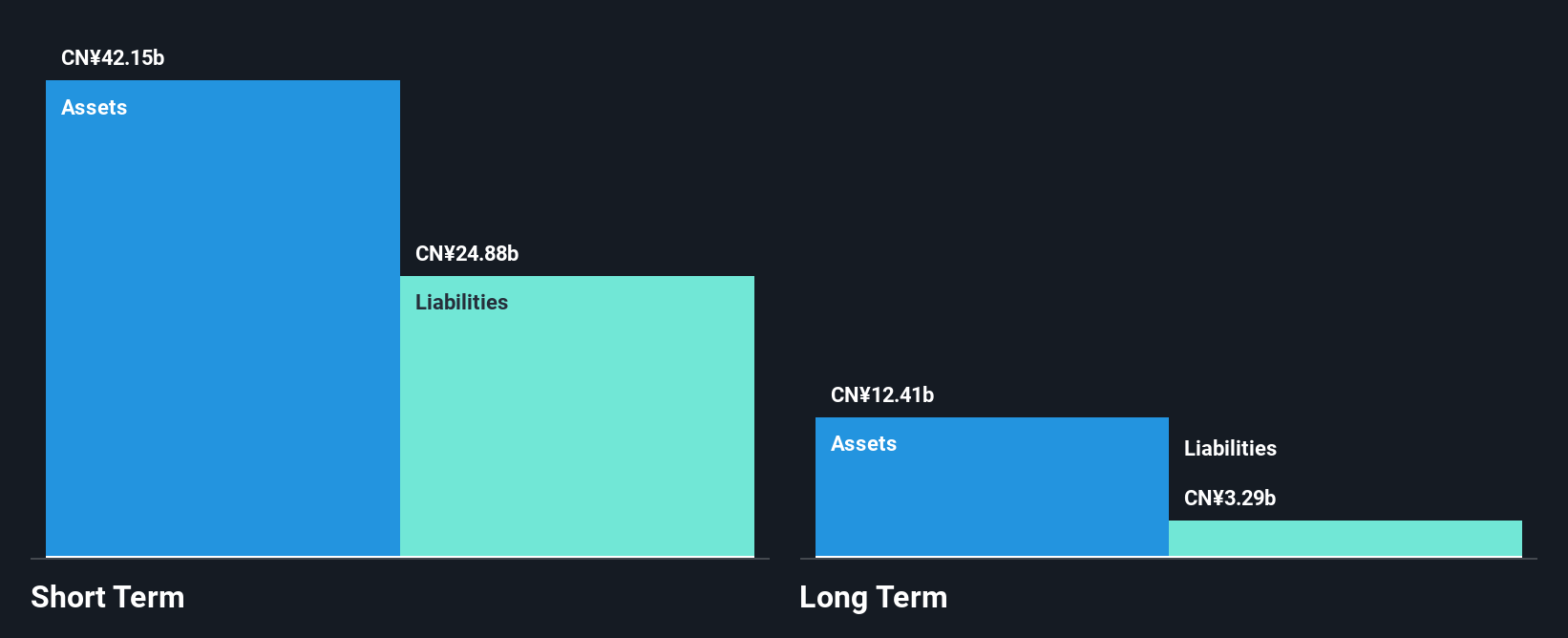

Yangzijiang Shipbuilding (Holdings) Ltd. demonstrates robust financial health with short-term assets of CN¥33.6 billion exceeding both short-term and long-term liabilities, and cash reserves surpassing total debt. The company has achieved significant earnings growth of 71.5% over the past year, outpacing its historical average and the broader machinery industry decline. Its high return on equity at 23.8% and stable weekly volatility reflect strong operational performance. Despite a recent increase in the debt-to-equity ratio to 26.6%, operating cash flow covers debt well, mitigating risk concerns while recent contracts worth US$14.27 billion bolster future prospects without impacting current earnings significantly.

- Unlock comprehensive insights into our analysis of Yangzijiang Shipbuilding (Holdings) stock in this financial health report.

- Understand Yangzijiang Shipbuilding (Holdings)'s earnings outlook by examining our growth report.

Make It Happen

- Jump into our full catalog of 5,711 Penny Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:370

China Best Group Holding

An investment holding company, trades in electronic appliances in the People’s Republic of China, Singapore, and Hong Kong.

Excellent balance sheet very low.

Similar Companies

Market Insights

Community Narratives