Oversea-Chinese Banking (SGX:O39) Expands with New Singapore Subsidiaries to Enhance Investment Portfolio

Reviewed by Simply Wall St

Oversea-Chinese Banking (SGX:O39) is making strategic strides with the incorporation of new subsidiaries like Market Street Properties Private Limited in Singapore, aimed at expanding its investment portfolio. Despite impressive earnings growth and a strong net profit margin, OCBC faces challenges with its higher-than-average P/E ratio and modest forecasted earnings growth. The following discussion will delve into OCBC's financial performance, strategic initiatives, and potential risks, providing a comprehensive overview of the bank's current standing and future prospects.

Click here to discover the nuances of Oversea-Chinese Banking with our detailed analytical report.

Key Assets Propelling Oversea-Chinese Banking Forward

With a strong history of high-quality earnings, Oversea-Chinese Banking Corporation (OCBC) continues to demonstrate financial resilience. Over the past five years, earnings have grown at an impressive rate of 13.9% annually, underscoring the bank's strategic focus on sustainable growth. The current net profit margin of 55.1% reflects a slight improvement from the previous year, indicating effective cost management and operational efficiency. CEO Helen Wong highlighted a 15% year-over-year revenue growth, attributing it to an expanding customer base and enhanced service offerings. This growth is further supported by strong customer relationships, evidenced by long-term contracts that secure revenue streams.

Strategic Gaps That Could Affect Oversea-Chinese Banking

OCBC faces challenges with its Price-To-Earnings (P/E) Ratio, which stands at 9.8x, higher than both industry and peer averages. This suggests potential overvaluation concerns. Moreover, the forecasted earnings growth of 0.8% per year lags behind the Singapore market average of 11.2%, raising questions about future competitiveness. CFO Chin Yee Goh acknowledged increased operational costs impacting margins and noted the pressure from heightened competition in core markets. Additionally, the bank's return on equity, at 13.2%, is below the desired 20% benchmark, highlighting areas for improvement.

Future Prospects for Oversea-Chinese Banking in the Market

OCBC's strategic initiatives, such as technological investments in AI and machine learning, are expected to enhance product capabilities and customer experience. The bank is also exploring geographical expansion in Southeast Asia, tapping into emerging markets with significant growth potential. Recent incorporations of subsidiaries like Market Street Properties Private Limited in Singapore reflect OCBC's commitment to diversifying its investment portfolio. These moves, alongside targeted marketing campaigns aimed at younger demographics, position OCBC to capitalize on new opportunities.

Key Risks and Challenges That Could Impact Oversea-Chinese Banking's Success

Economic headwinds remain a concern, with potential downturns affecting consumer spending, as highlighted by Wong. Regulatory changes in operating regions could also pose challenges, requiring careful navigation to maintain compliance. Additionally, Helen Wong also pointed out supply chain disruptions, emphasizing the need for robust risk management strategies. The bank's unstable dividend track record could deter investors, necessitating a focus on stabilizing payouts to maintain investor confidence.

Conclusion

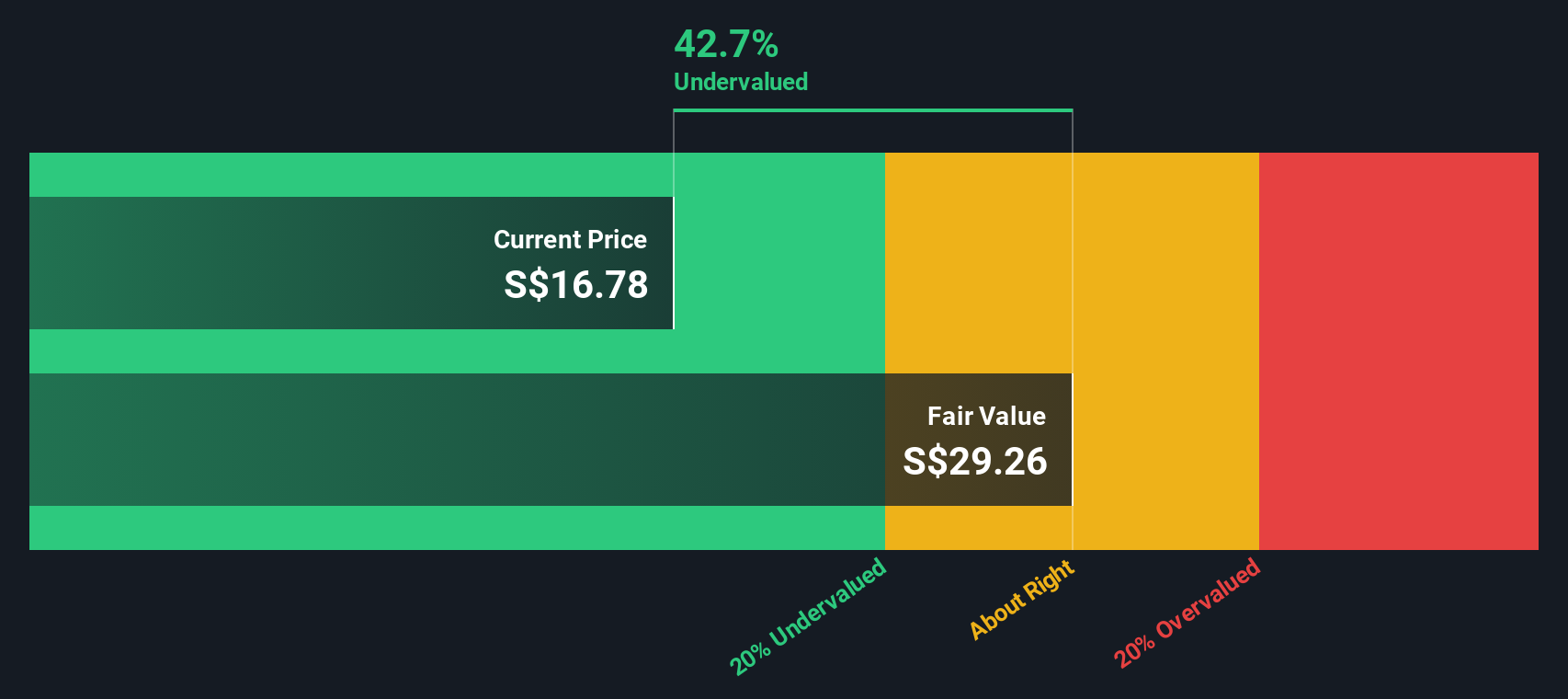

Oversea-Chinese Banking Corporation's impressive historical earnings growth and strong customer relationships underscore its strategic focus on sustainable expansion, yet its higher-than-average Price-To-Earnings Ratio suggests it may be trading at a premium compared to industry peers. While this could signal confidence in its future prospects, the bank's slower projected earnings growth of 0.8% per year compared to the Singapore market average of 11.2% raises concerns about its competitive positioning. Strategic initiatives like technological investments and geographical expansion into Southeast Asia are promising, but must be balanced against challenges such as increased operational costs and economic uncertainties. To enhance investor confidence and align with market expectations, OCBC must address its return on equity and dividend stability while leveraging its diversified investments to drive future growth.

Taking Advantage

- Shareholder in Oversea-Chinese Banking? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

- Find companies with promising cash flow potential yet trading below their fair value .

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About SGX:O39

Oversea-Chinese Banking

Engages in the provision of financial services in Singapore, Malaysia, Indonesia, Greater China, rest of the Asia Pacific, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives