- Sweden

- /

- Tech Hardware

- /

- OM:TOBII

Take Care Before Jumping Onto Tobii AB (publ) (STO:TOBII) Even Though It's 54% Cheaper

Unfortunately for some shareholders, the Tobii AB (publ) (STO:TOBII) share price has dived 54% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 24% in that time.

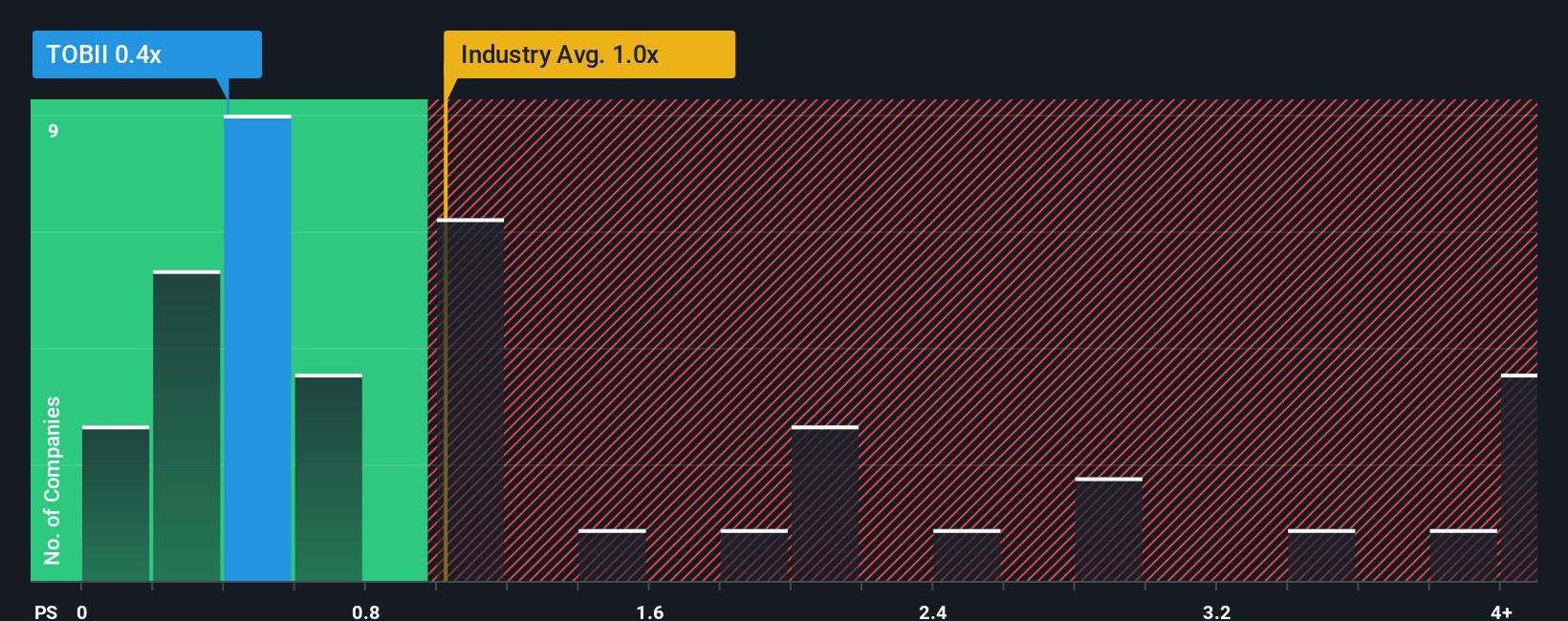

Following the heavy fall in price, when close to half the companies operating in Sweden's Tech industry have price-to-sales ratios (or "P/S") above 1.1x, you may consider Tobii as an enticing stock to check out with its 0.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Tobii

How Tobii Has Been Performing

Recent times haven't been great for Tobii as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Tobii's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Tobii?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Tobii's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. Pleasingly, revenue has also lifted 30% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 13% during the coming year according to the one analyst following the company. That's shaping up to be materially higher than the 9.7% growth forecast for the broader industry.

In light of this, it's peculiar that Tobii's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Tobii's P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A look at Tobii's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Tobii (of which 1 makes us a bit uncomfortable!) you should know about.

If these risks are making you reconsider your opinion on Tobii, explore our interactive list of high quality stocks to get an idea of what else is out there.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tobii might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:TOBII

Tobii

Develops and sells eye-tracking technology and solutions in Sweden, Europe, Middle East, Africa, the United States, and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026